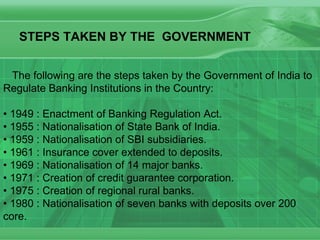

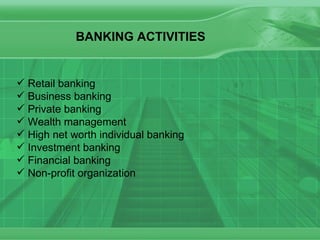

The document summarizes the history and recent trends in Indian banking. It discusses the nationalization of banks in 1969 and other key steps taken by the government to regulate the banking sector. These include establishing the Banking Regulation Act in 1949 and nationalizing several major banks. The document also outlines the wider commercial role played by banks and their functions such as accepting deposits, lending money, and transferring funds.