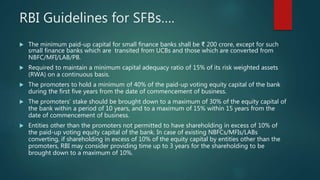

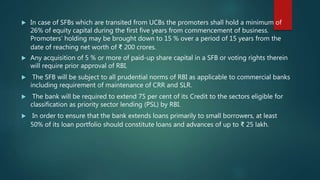

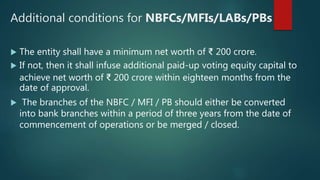

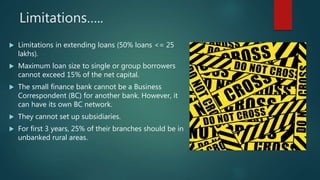

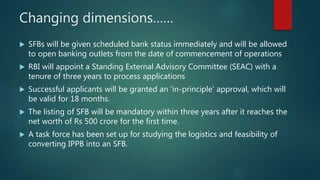

Small finance banks (SFBs) were introduced in India to increase access to banking in rural and underserved areas. Before SFBs, 35% of adults lacked bank accounts, with many low-income households having unmet credit demands. SFBs aim to deepen financial inclusion by serving small businesses and low-income communities through low-cost operations. The Reserve Bank of India issued guidelines in 2014 allowing certain qualified non-banking financial institutions to transition into SFBs. SFBs must meet requirements around capital, ownership, lending priorities, and financial inclusion. Currently there are 10 SFBs operating in India to expand access to banking and credit for underserved populations.