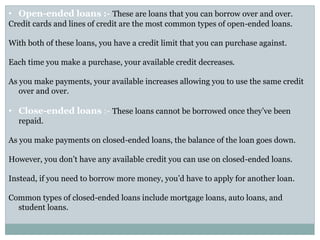

The document discusses various types of loans and lending principles. It describes secured and unsecured loans, open-ended and close-ended loans, and various forms of advances like cash credits, overdrafts, and bills discounted. The lending process involves filling a loan application, submitting documents, sanctioning the loan, executing an agreement, and arranging security. Basic lending principles for banks are safety, liquidity, profitability, and risk diversification.