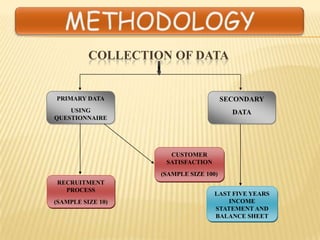

1) The document analyzes the recruitment process, customer satisfaction, and financial performance of Bajaj Allianz Life Insurance.

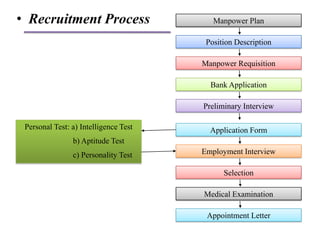

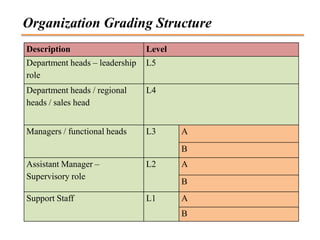

2) It finds that the recruitment process is centralized but could be improved by decentralizing and training new hires.

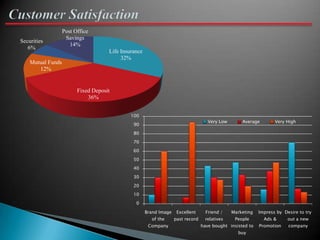

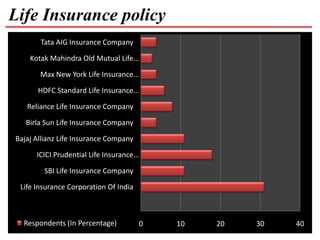

3) Customers primarily seek risk coverage, returns, and brand reputation when purchasing policies.

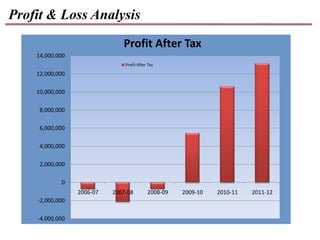

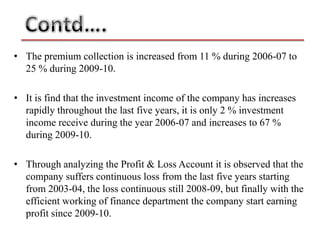

4) While Bajaj Allianz has grown premium collections and investment incomes, it previously suffered losses but is now profitable.

5) Suggestions include improving awareness, returns, and investing profits more effectively.