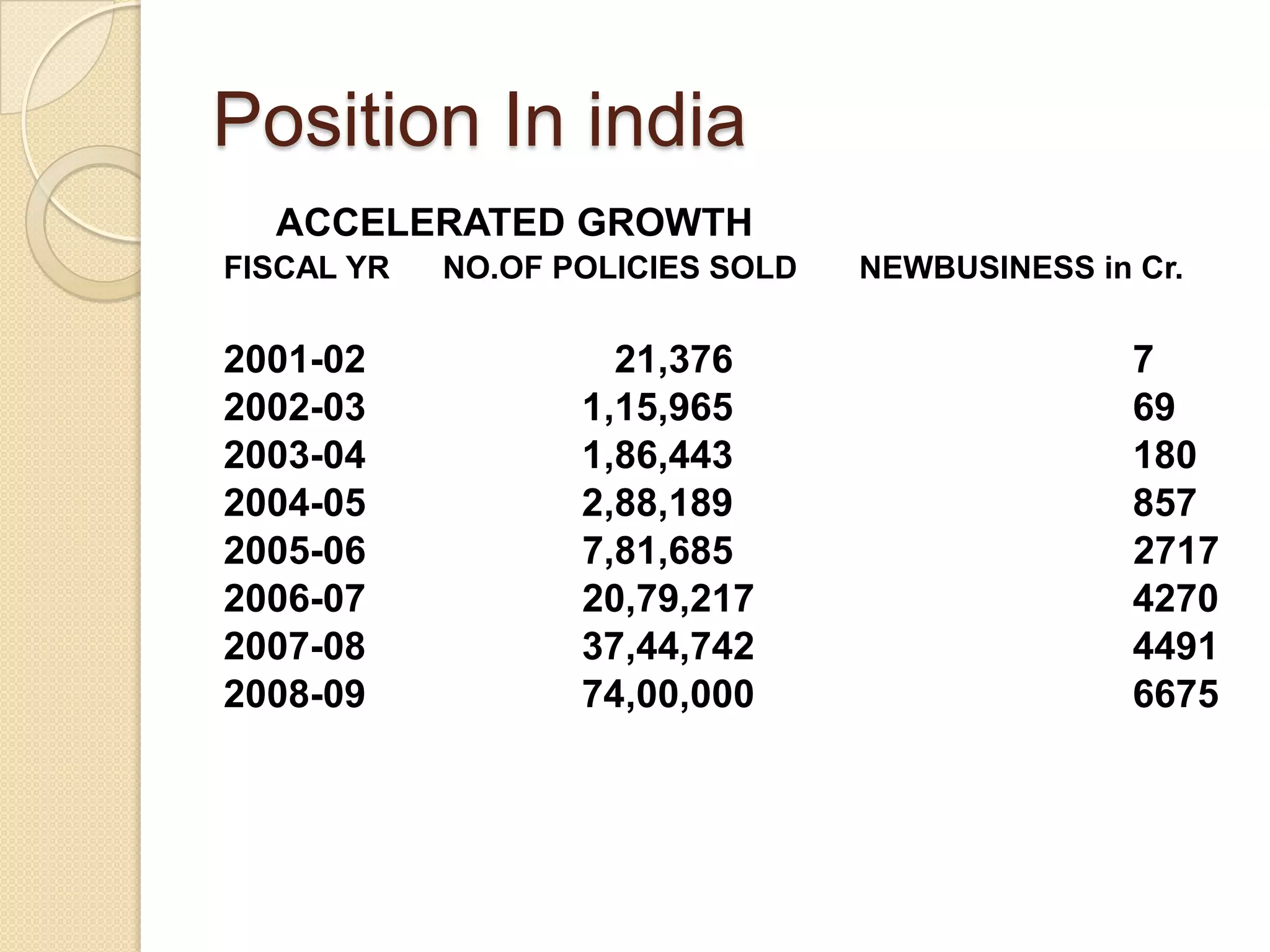

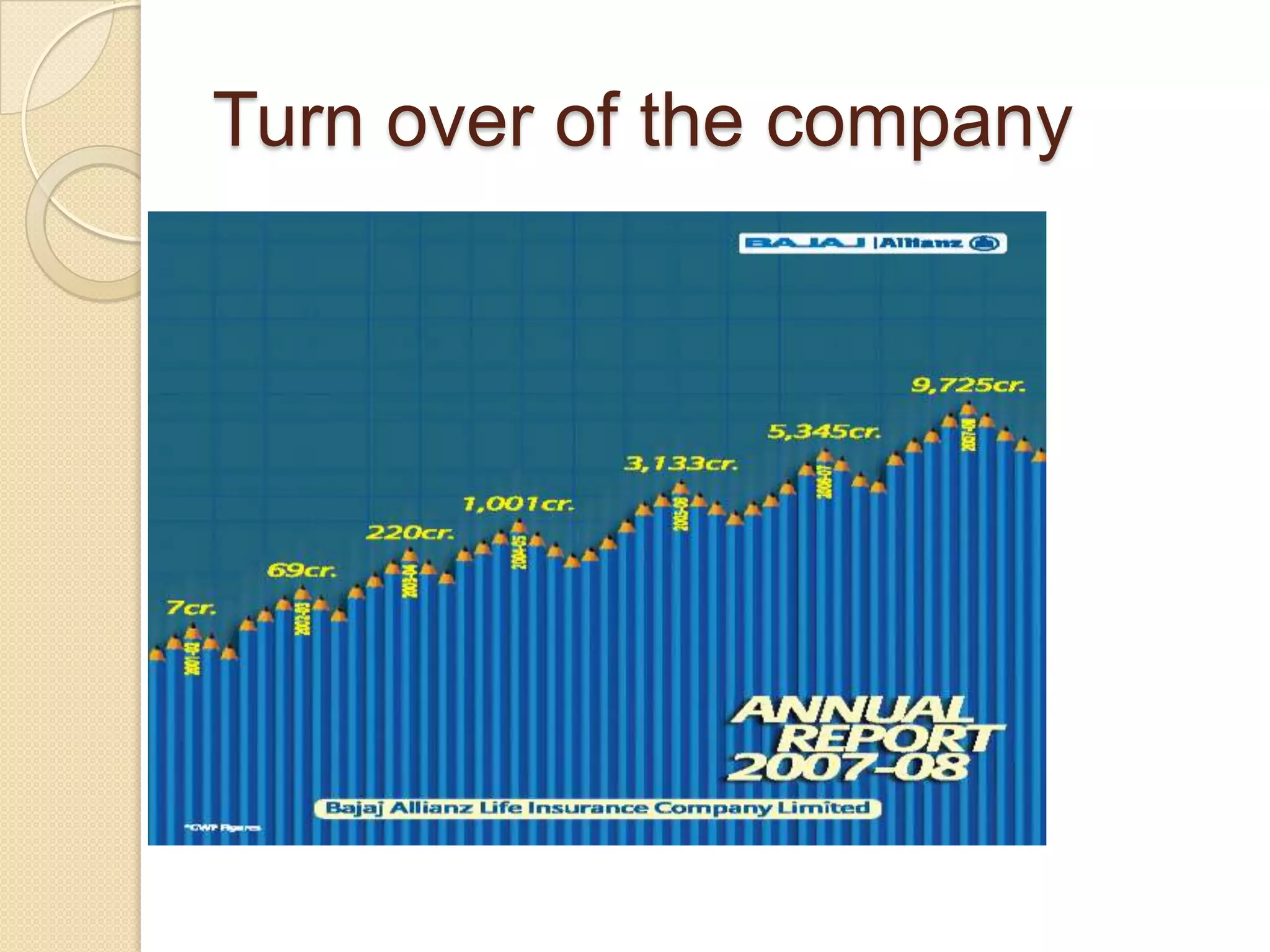

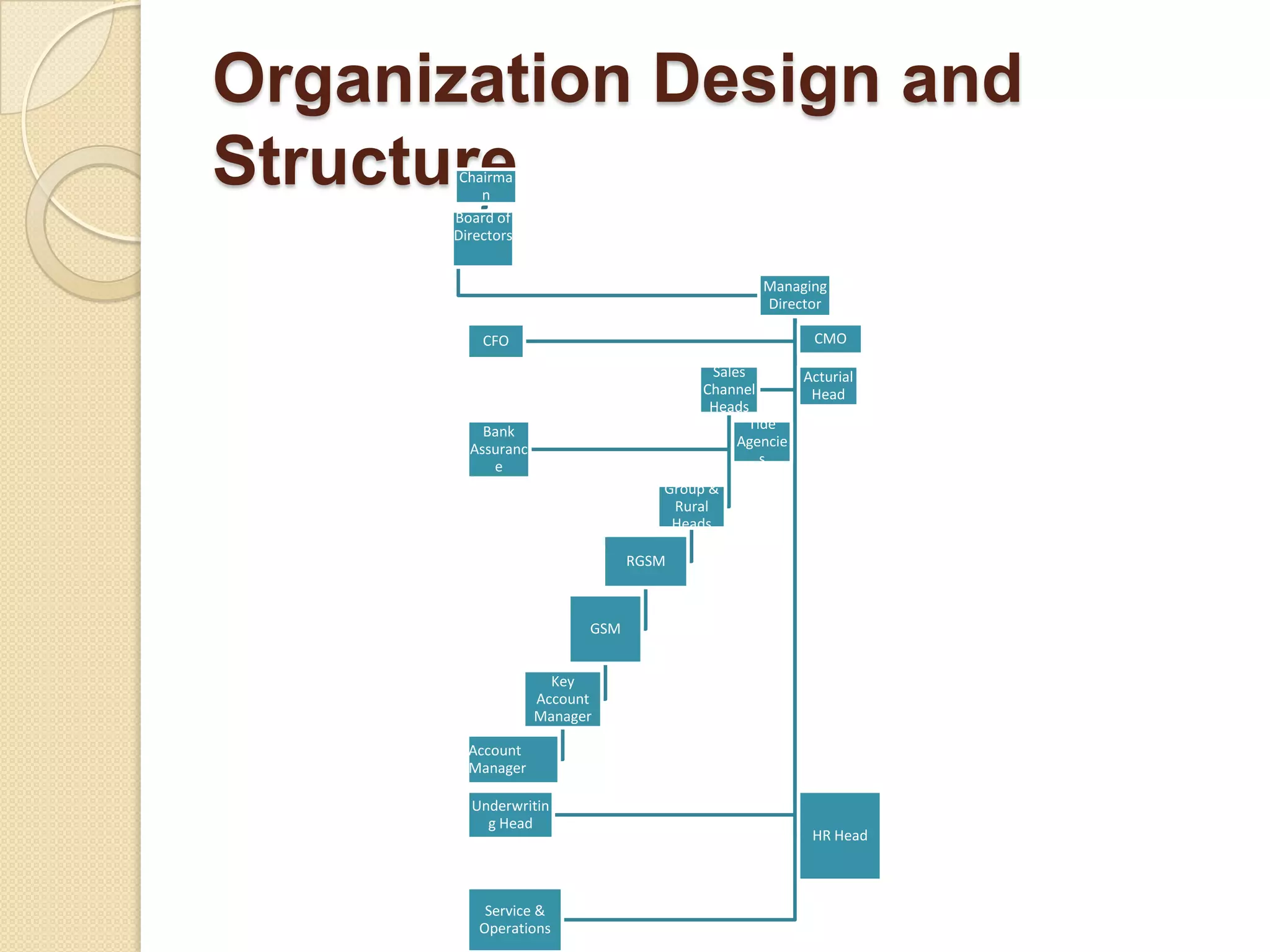

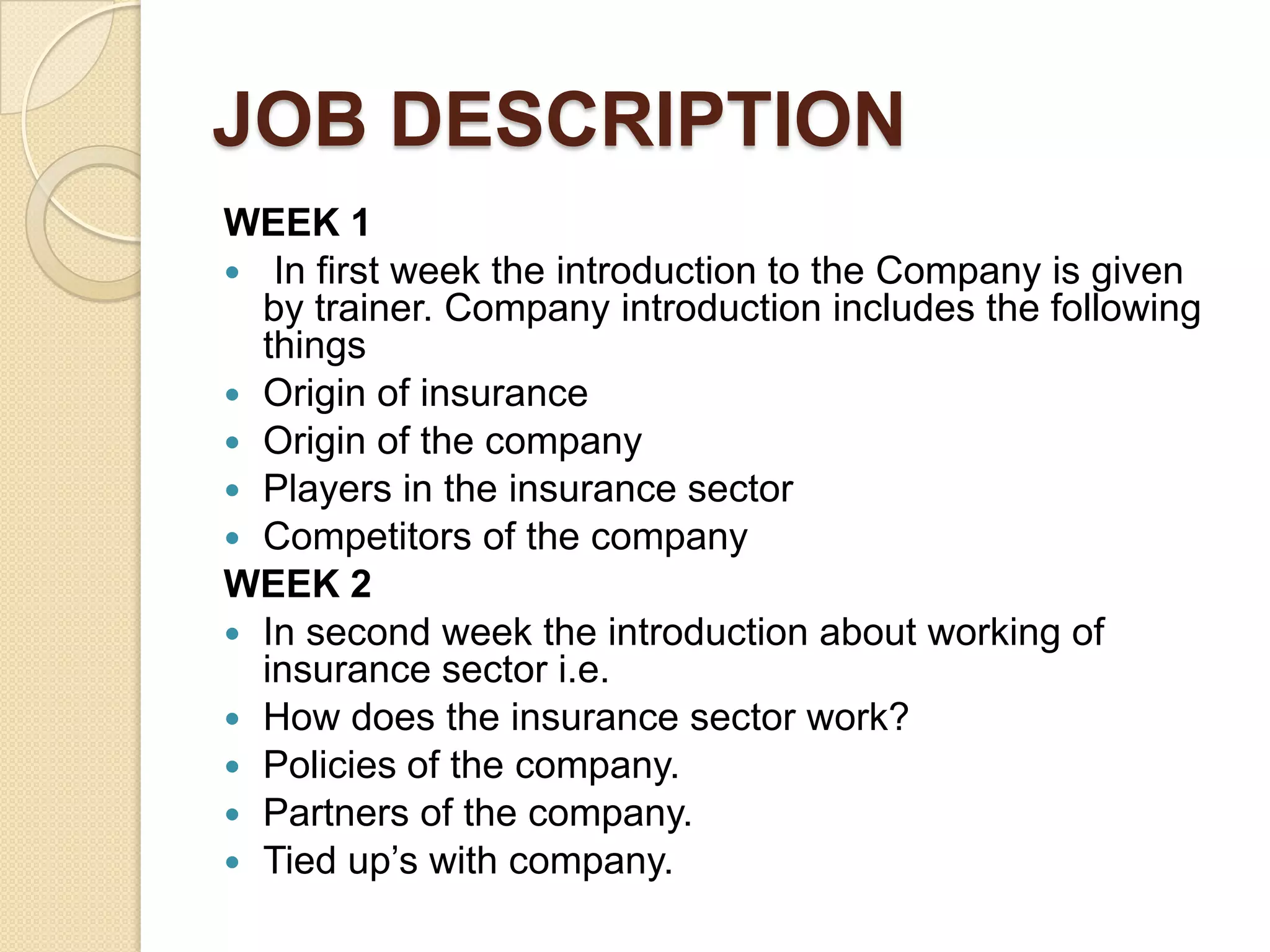

Bajaj Allianz Life Insurance is a joint venture between Bajaj Auto and Allianz AG. It has over 74 lakh customers served through 1164 customer care centers. The presentation discusses the establishment and growth of the company, profiles of its parent companies (Bajaj Group and Allianz Group), its products, policies, organizational structure, SWOT analysis and strategies for recruitment. It aims to be the preferred insurer and employer in India.