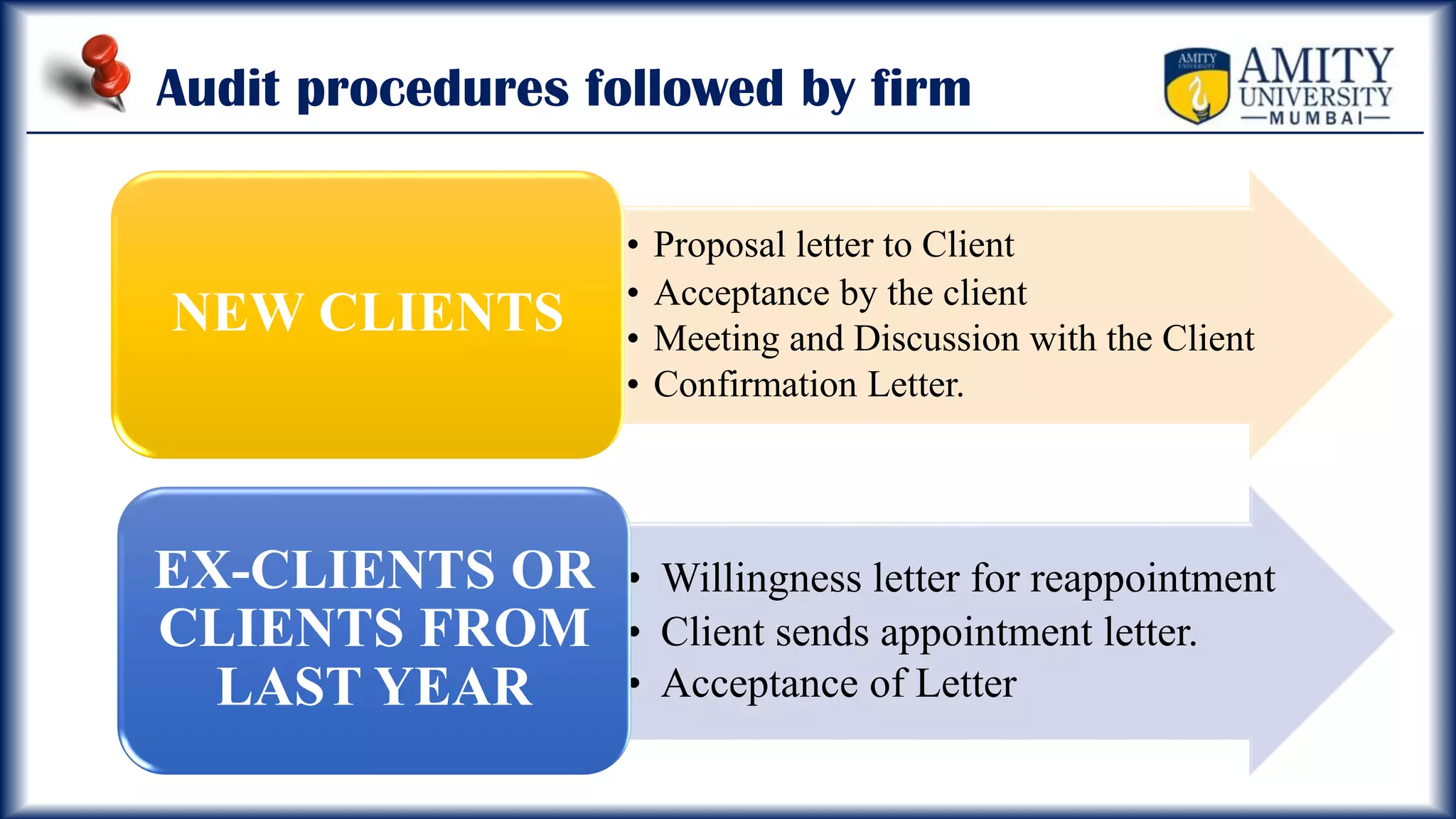

Sunita Jaiswar presented on her summer internship project at ECOVIS R. Kabra Corporate Advisors Ltd, an audit and accounting firm. She outlined the company's services, her objectives of gaining practical audit knowledge and experience, and her methodology of using primary and secondary sources.

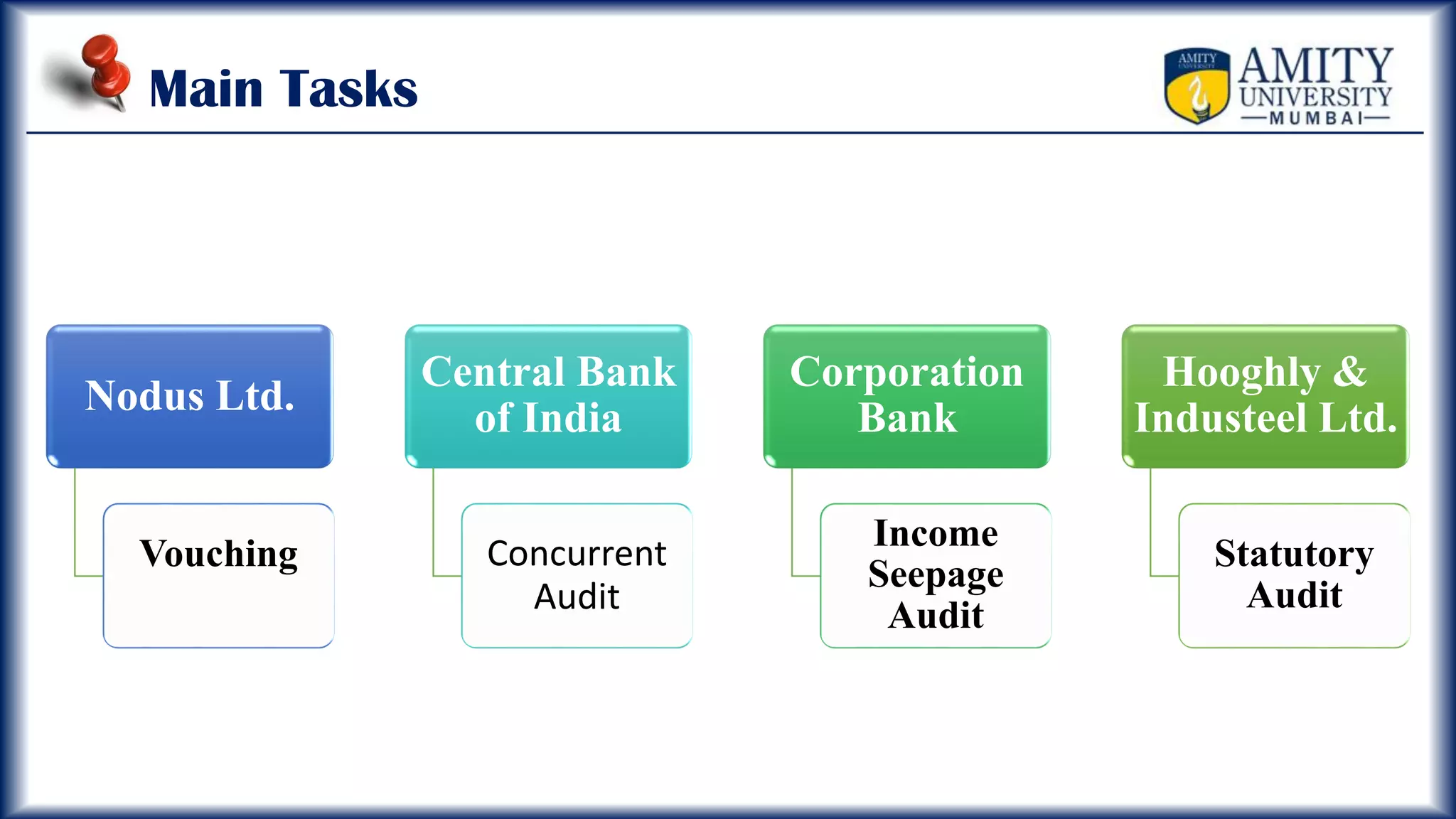

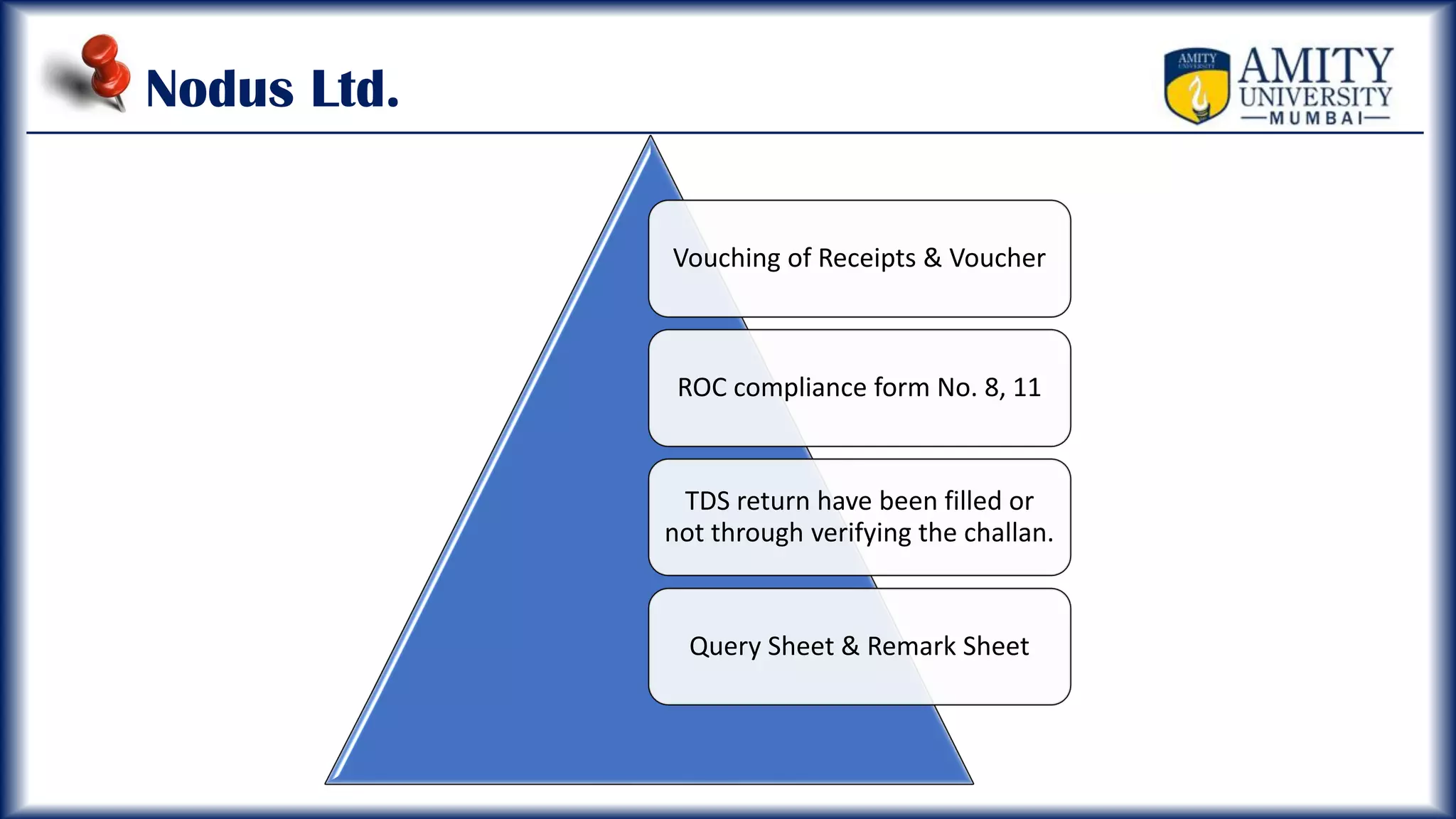

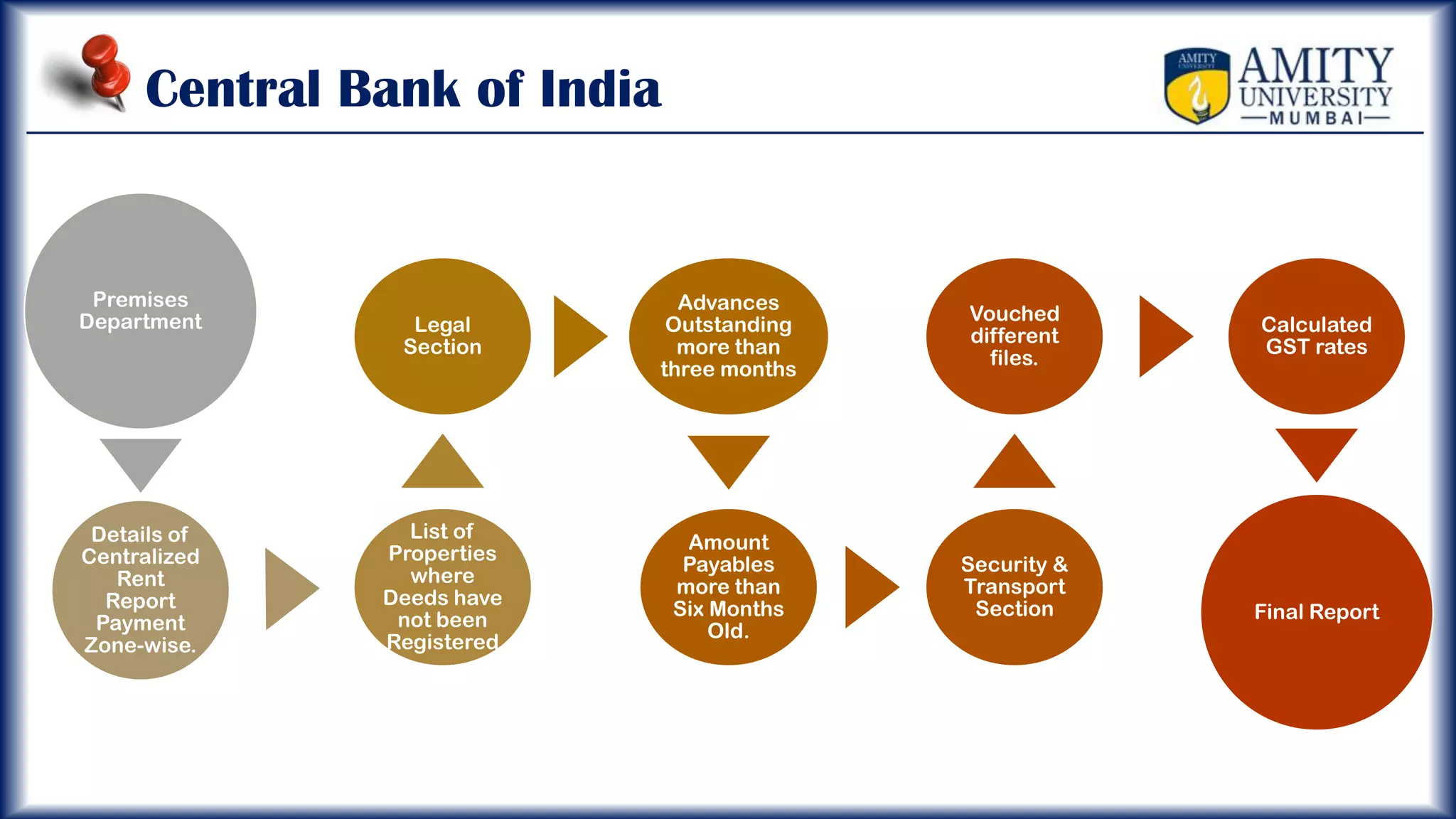

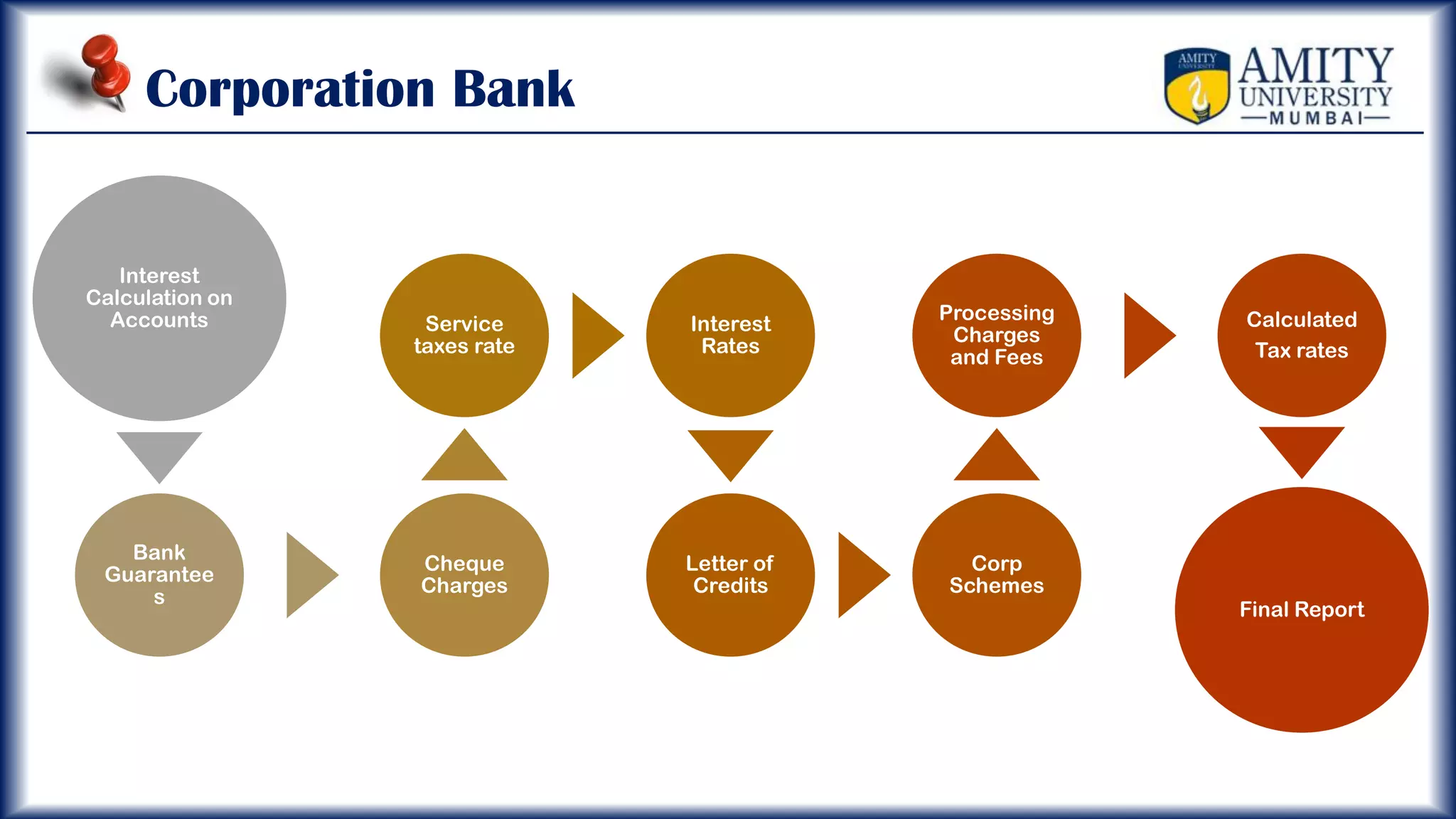

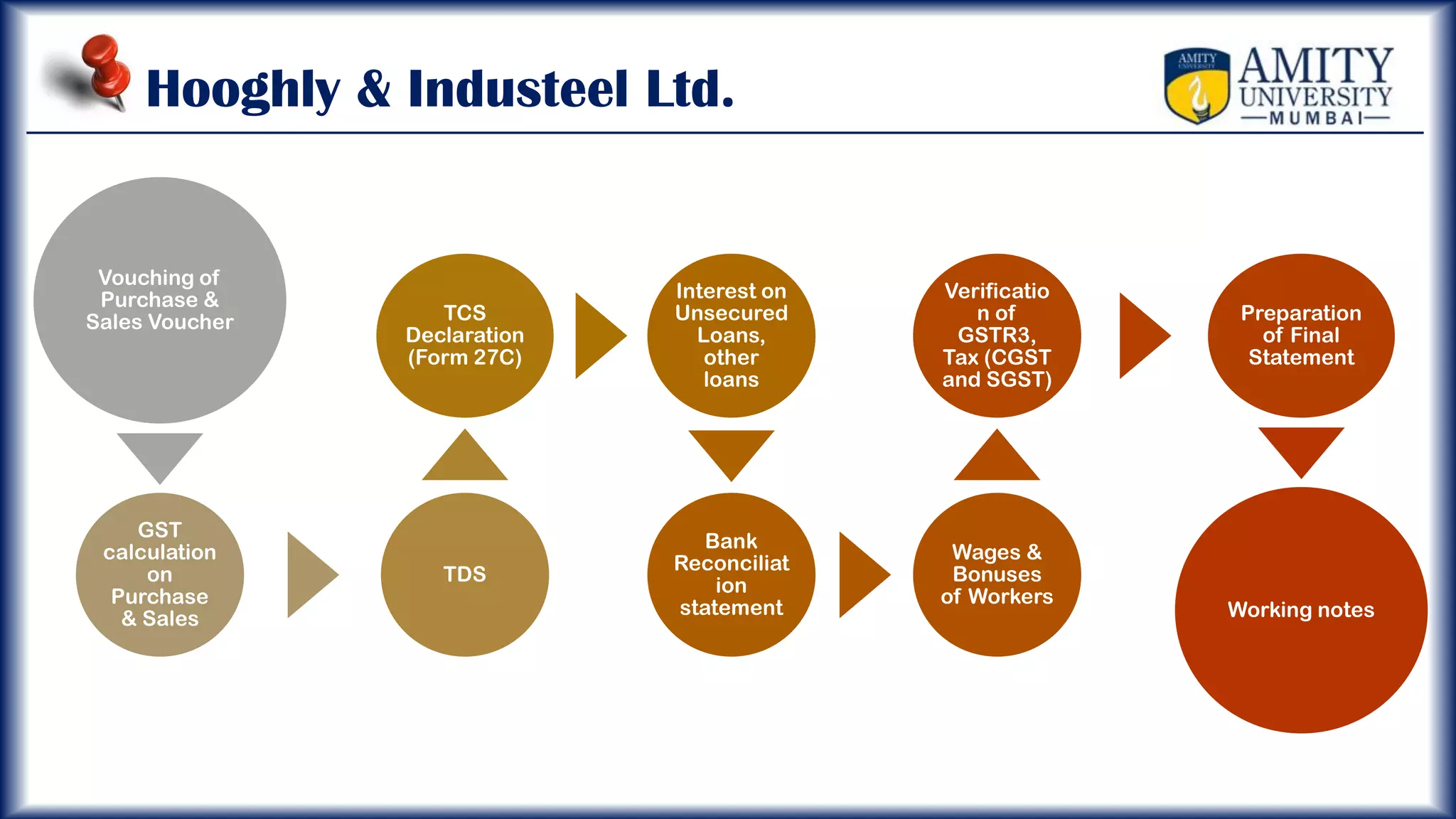

Some of her main tasks included vouching receipts and vouchers for Nodus Ltd, reviewing premises details and outstanding advances for Central Bank of India, calculating interest and fees for Corporation Bank, and verifying GST calculations, TDS, wages, and final statements for Hooghly & Industeel Ltd.

Overall, she concluded it was a great opportunity to grow, develop extensively about audits