1) The document discusses a study on individual investors' perspectives in Durg, Bhilai, and Raipur, Chhattisgarh regarding investment in shares, with a focus on India Infoline.

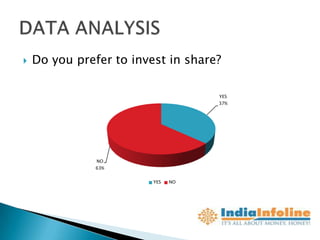

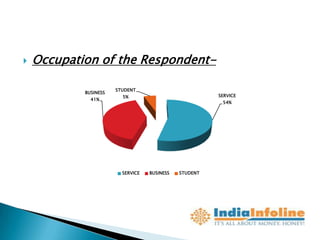

2) A questionnaire was used to collect primary data from 100 respondents regarding their awareness of share markets, preferences for investment avenues, and perceptions of brokerage firms like India Infoline.

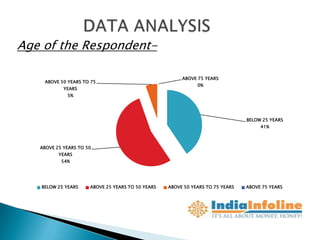

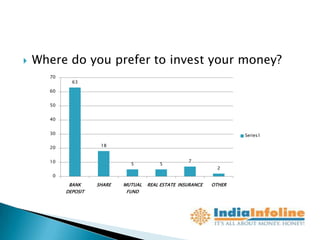

3) The results found that over 50% of respondents were between 25-50 years old, most preferred investing in bank deposits over shares, and India Infoline was the most preferred brokerage among options like ICICI Securities and Sharekhan.