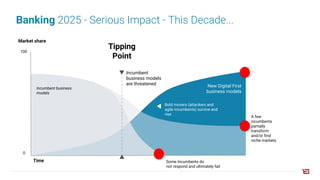

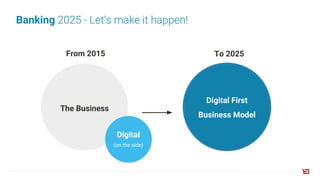

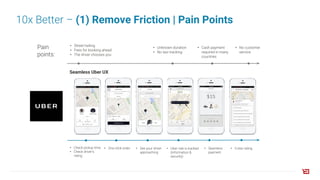

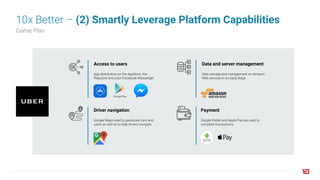

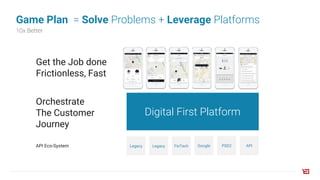

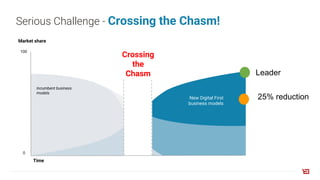

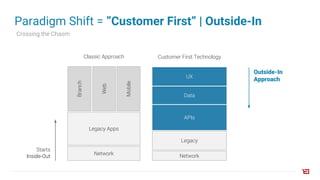

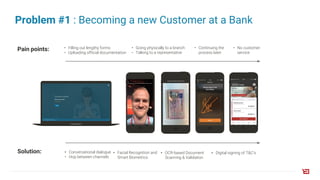

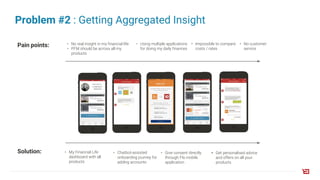

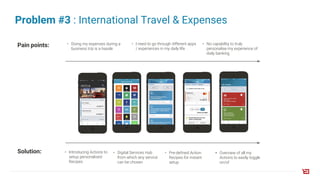

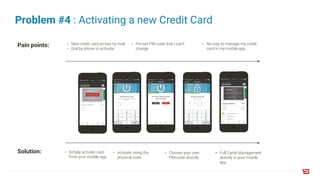

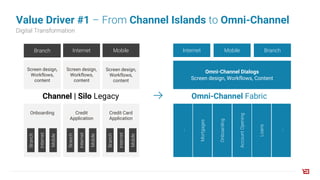

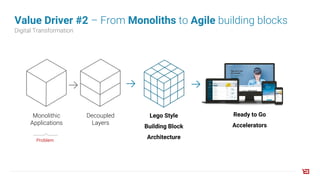

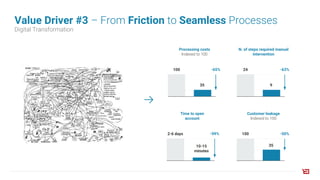

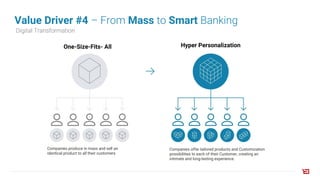

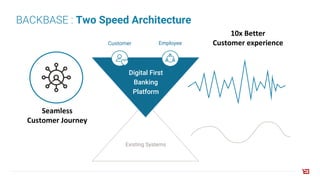

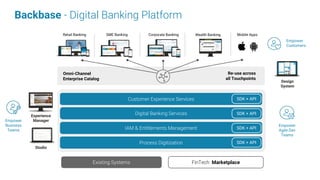

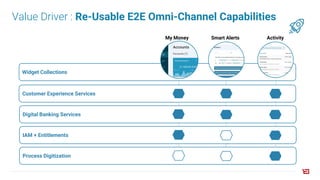

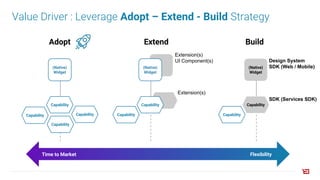

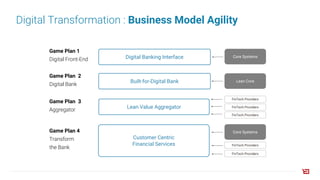

The webinar discusses the shifts in banking towards a digital-first model by 2025, highlighting the impact of digital disruption across various industries. It emphasizes the need for banks to innovate customer experiences by removing friction, leveraging technology, and personalizing services to remain competitive against agile market entrants. Key strategies include adopting an outside-in approach, enhancing omni-channel capabilities, and utilizing data to optimize customer journeys.