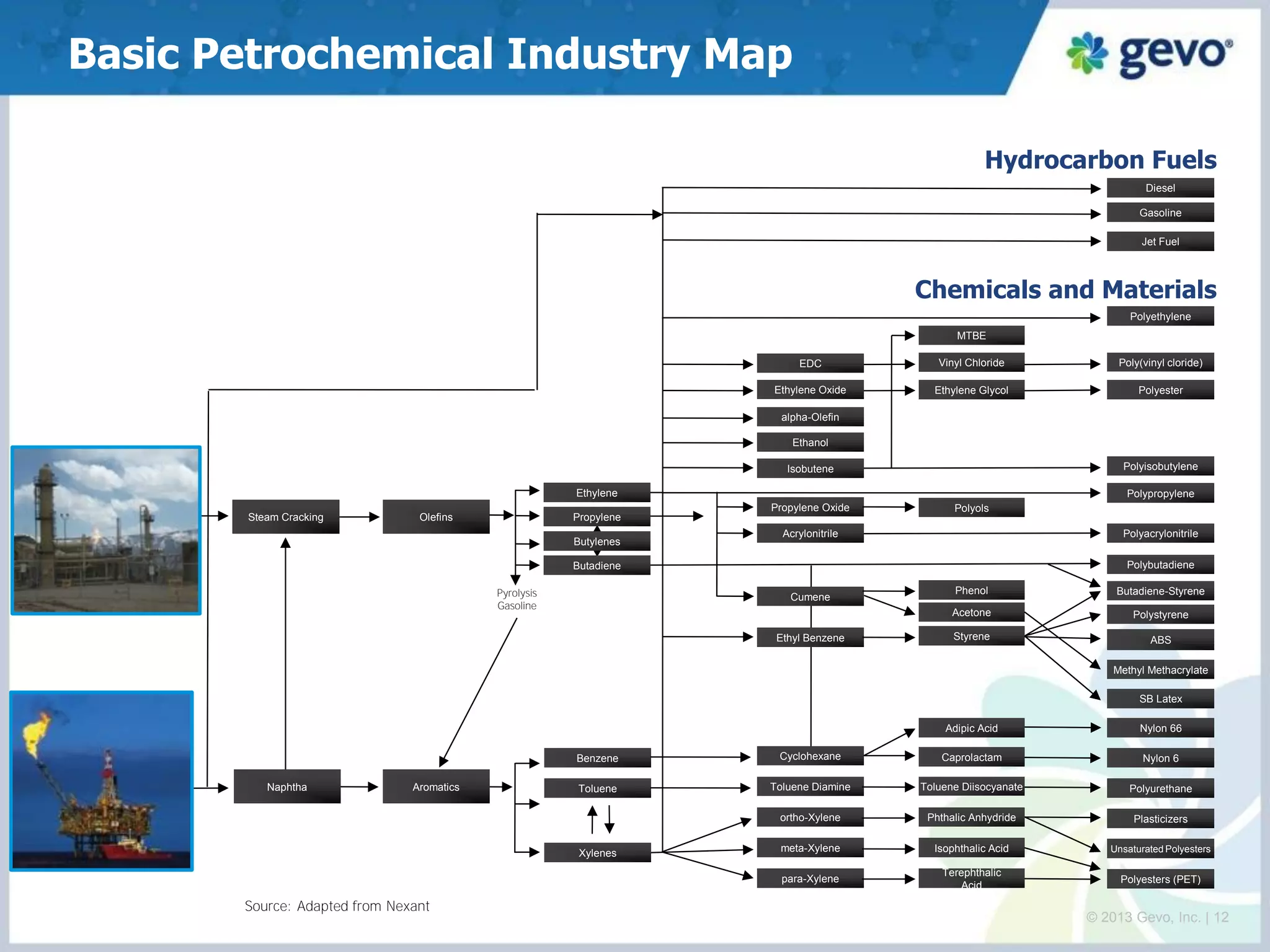

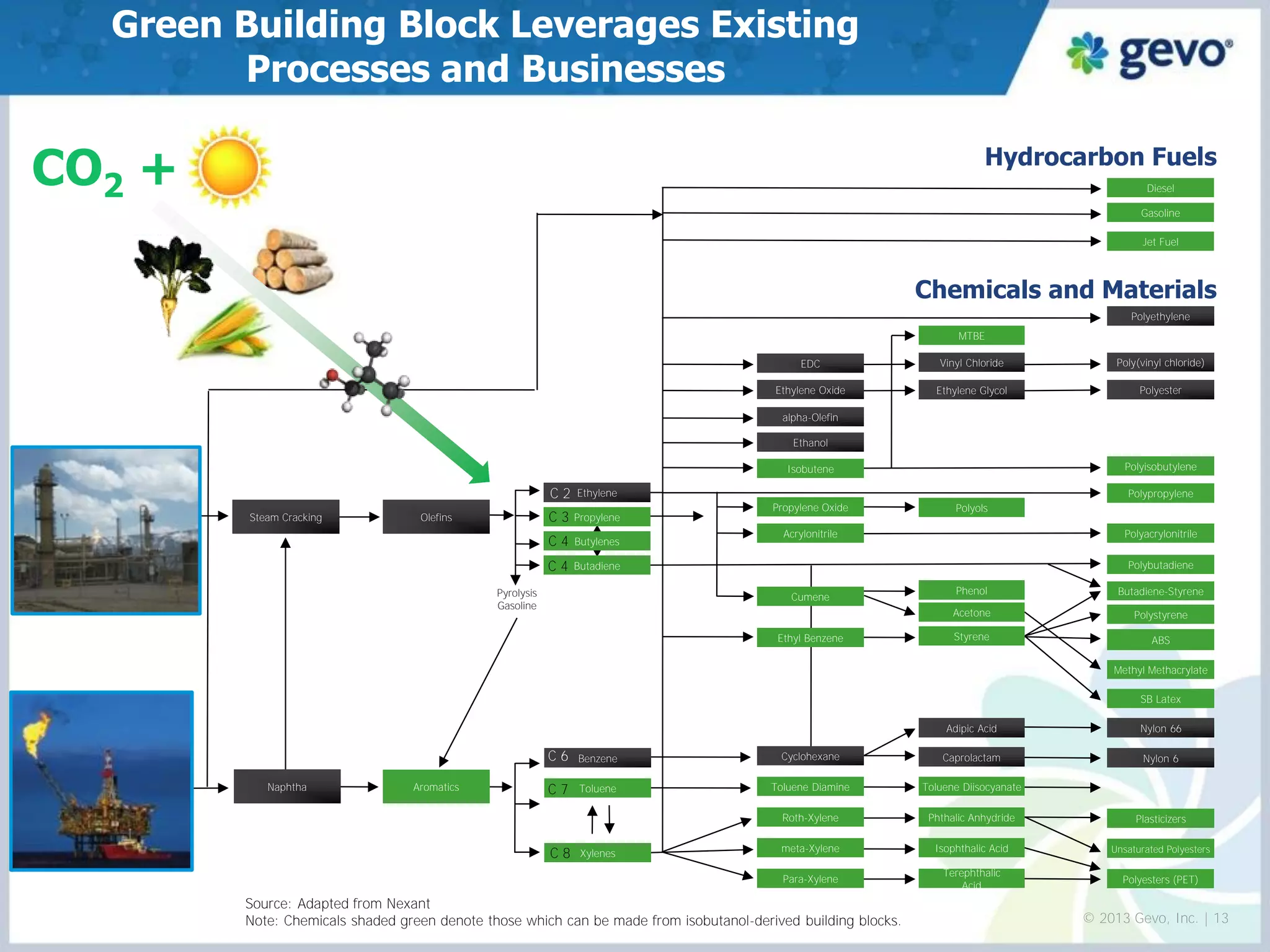

This document provides an overview of Gevo, Inc., a company that produces renewable chemicals and biofuels using proprietary technology. Key points:

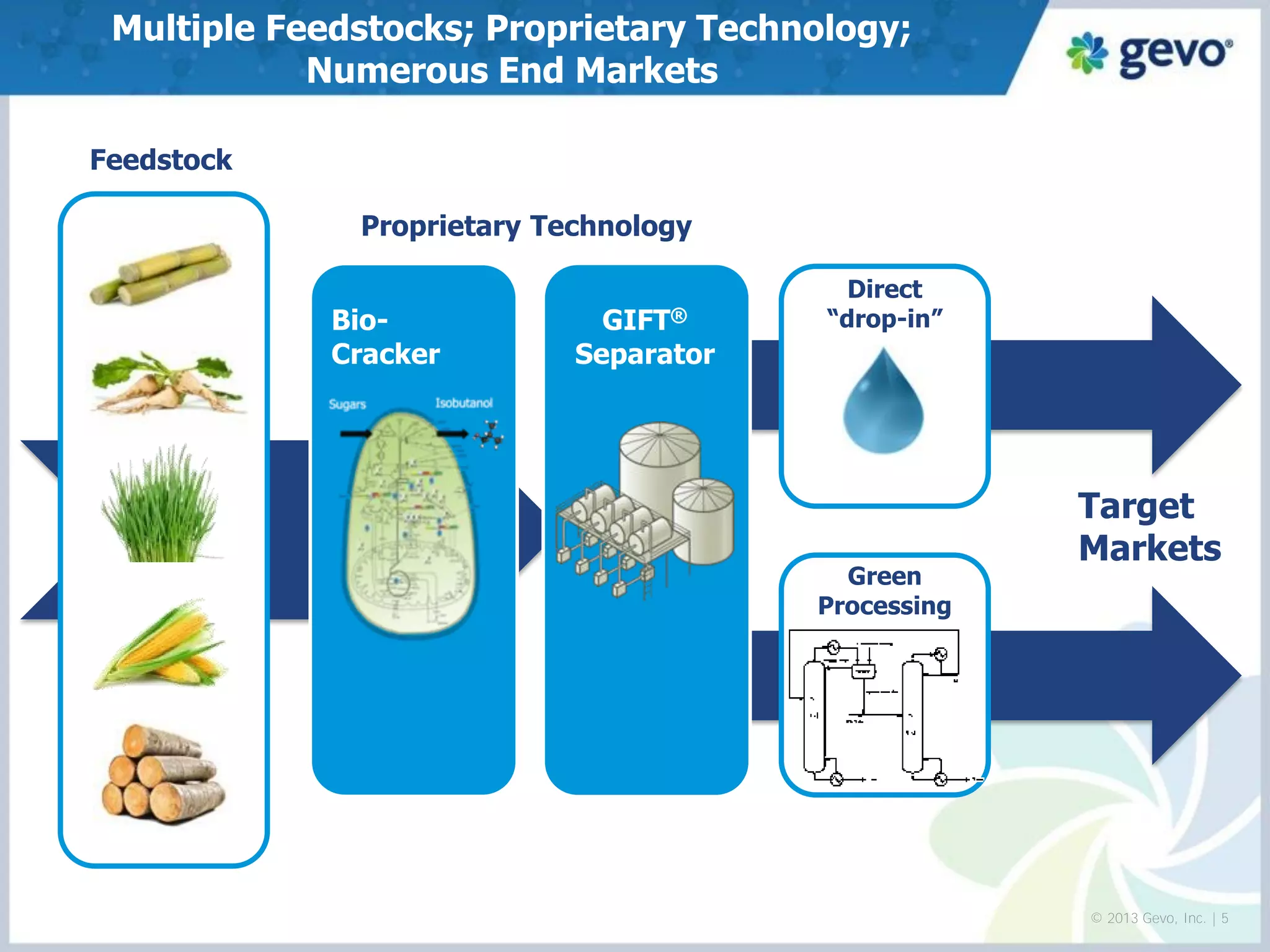

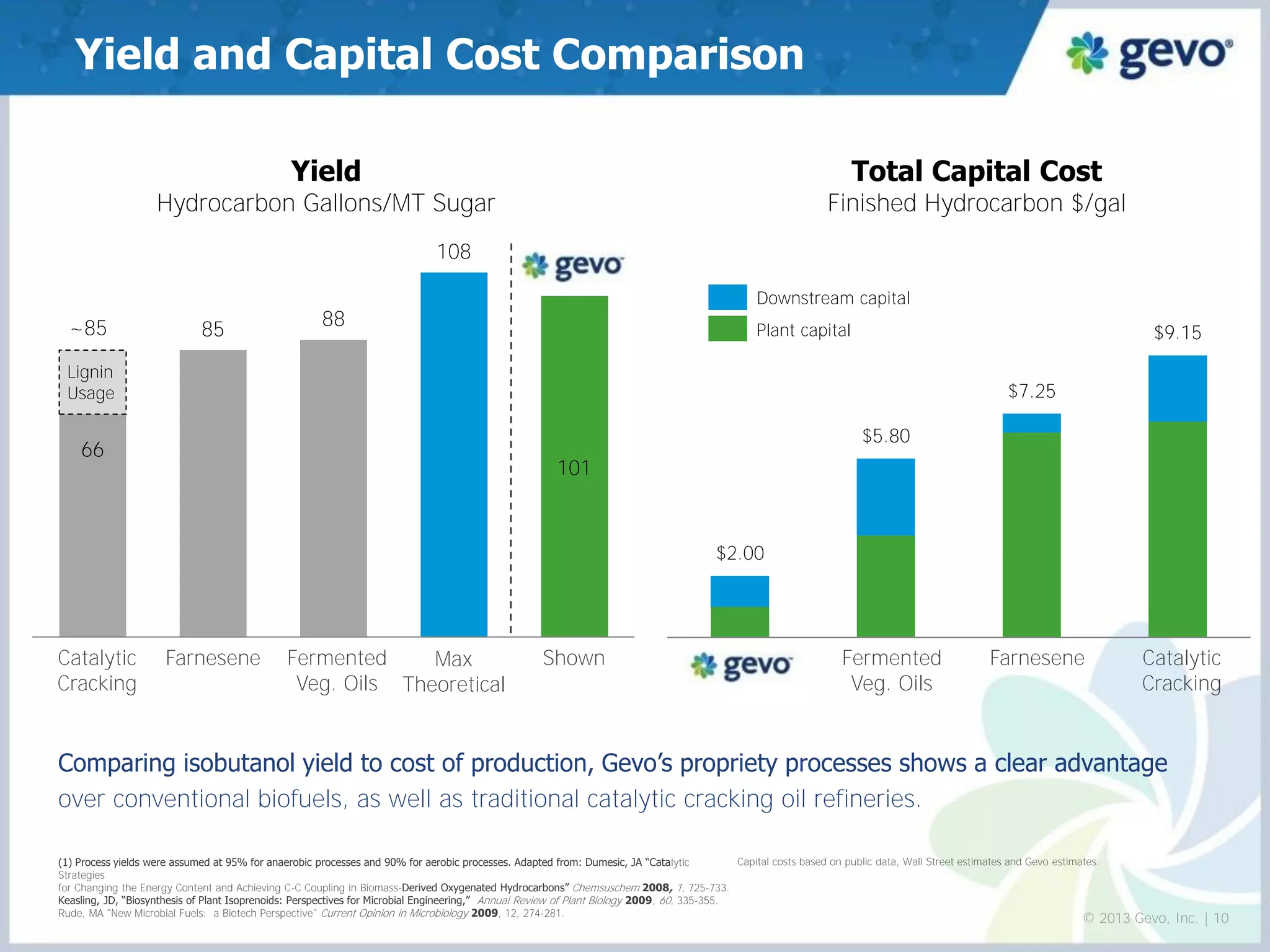

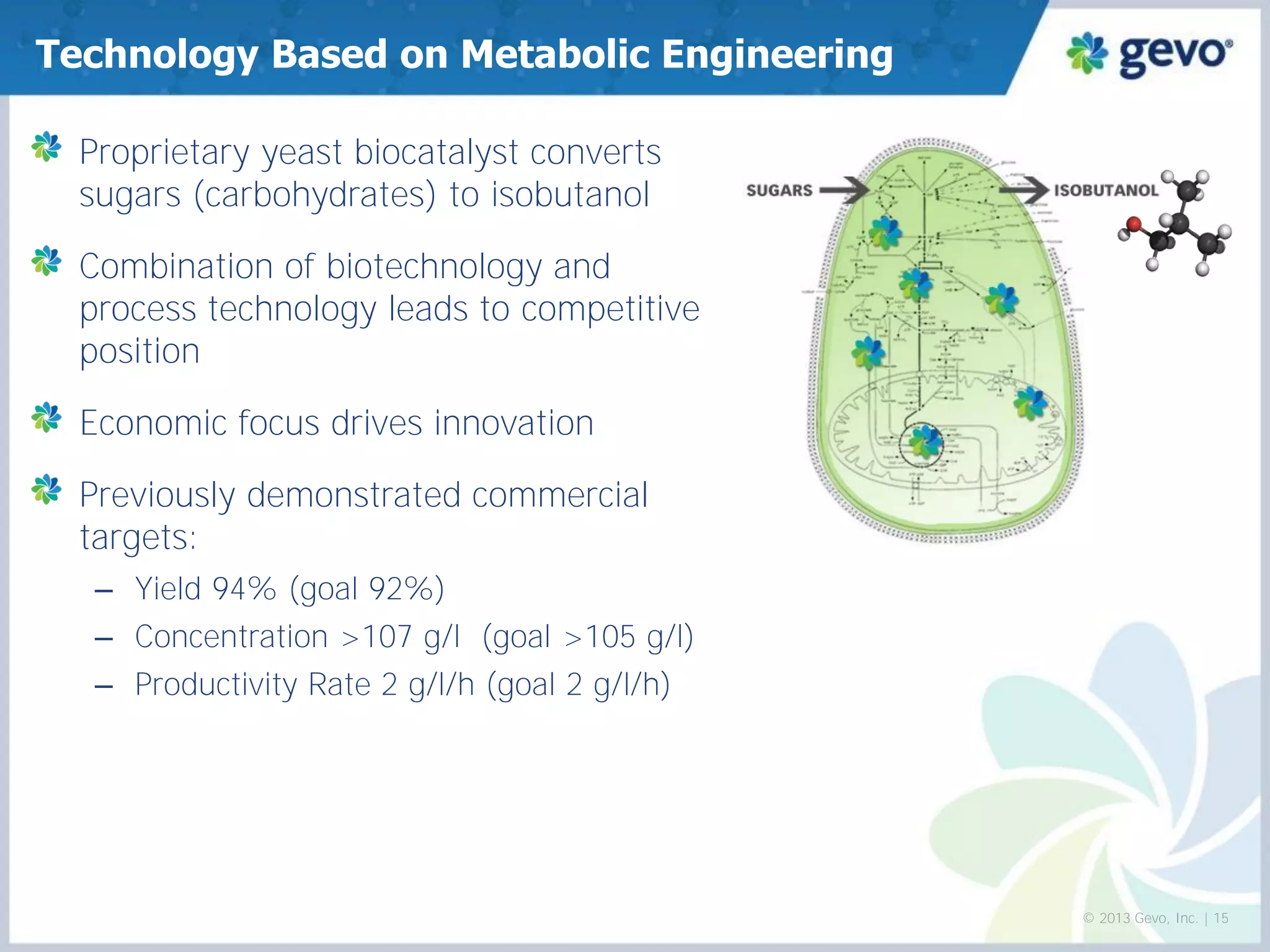

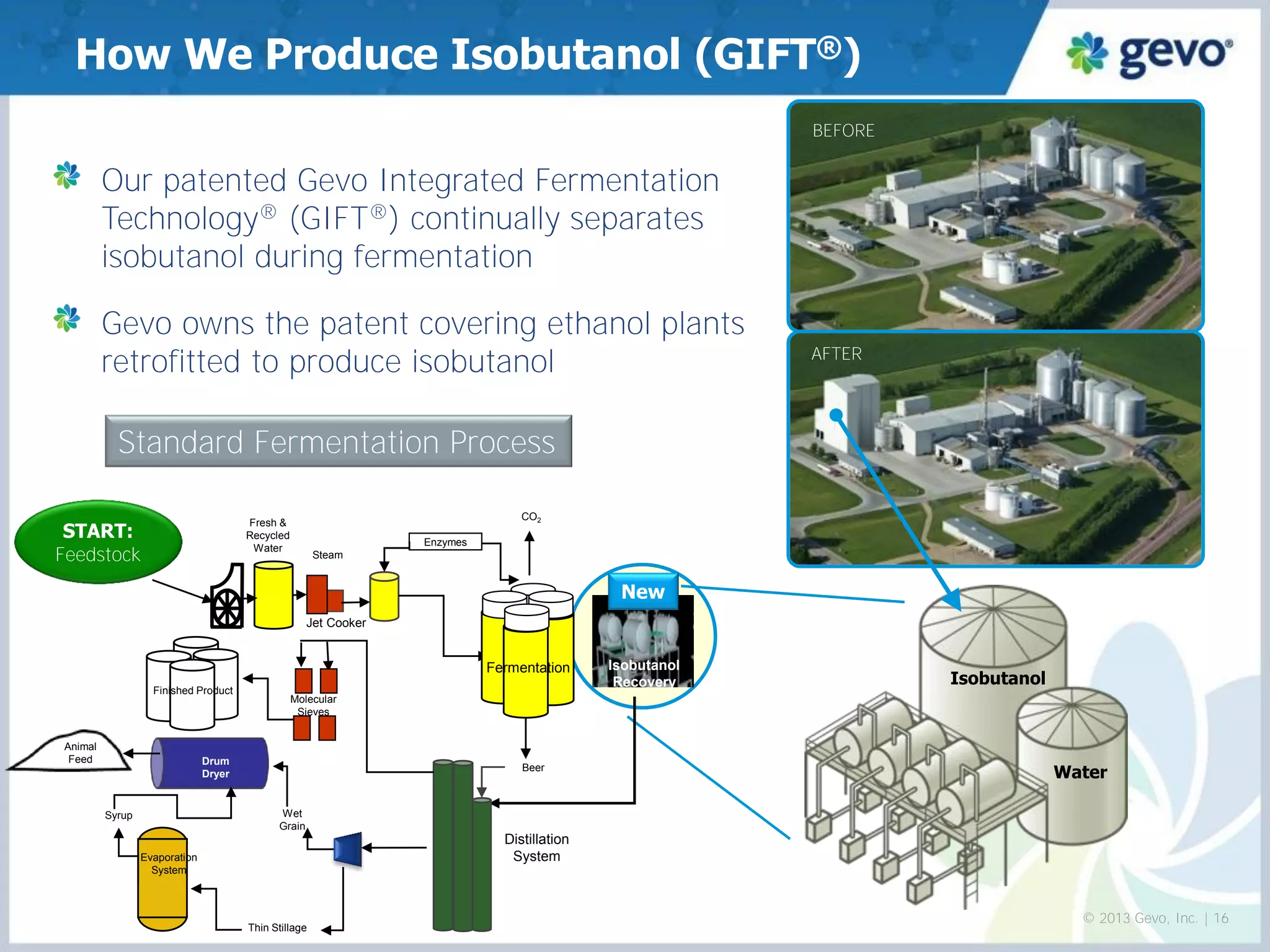

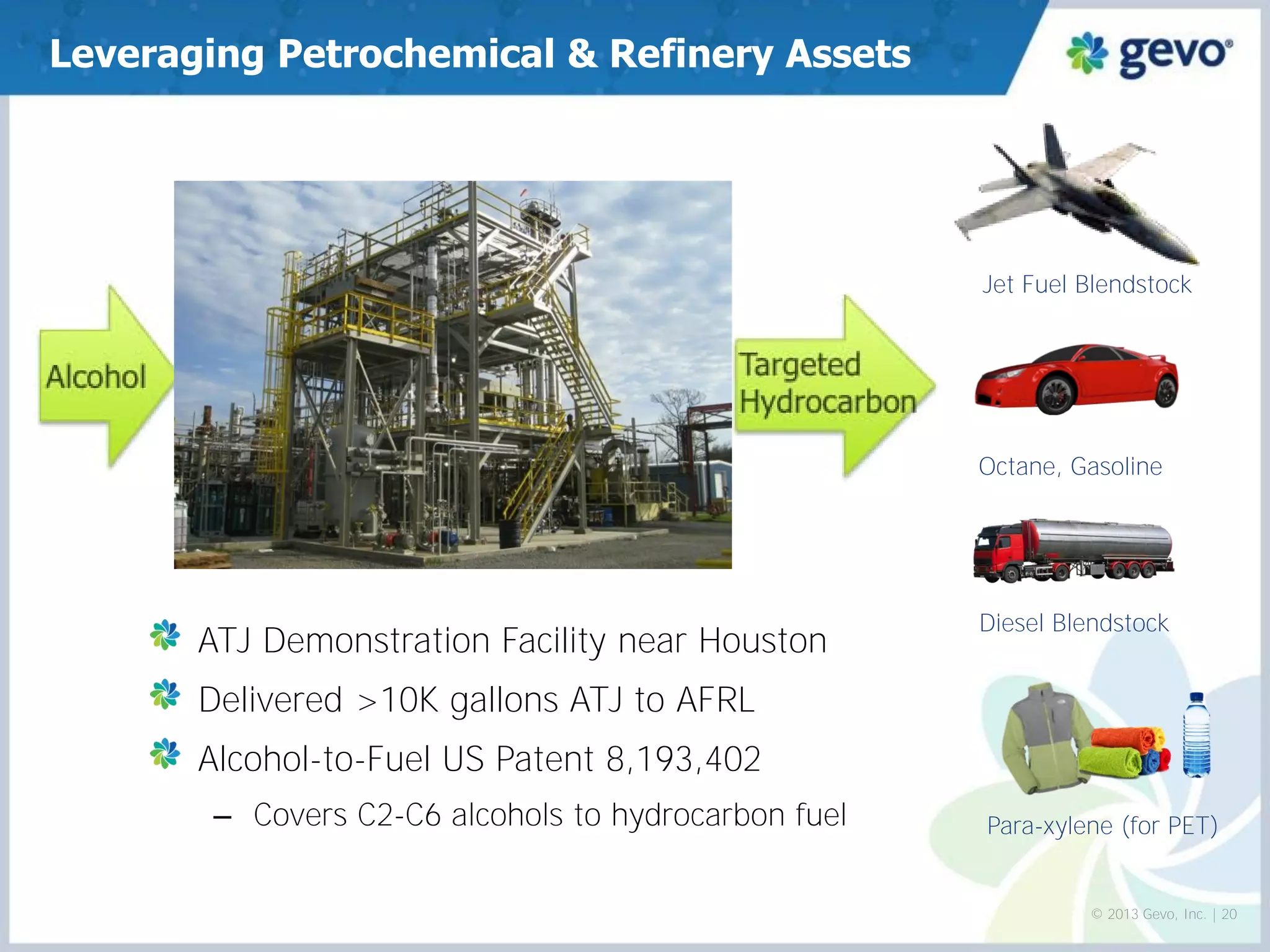

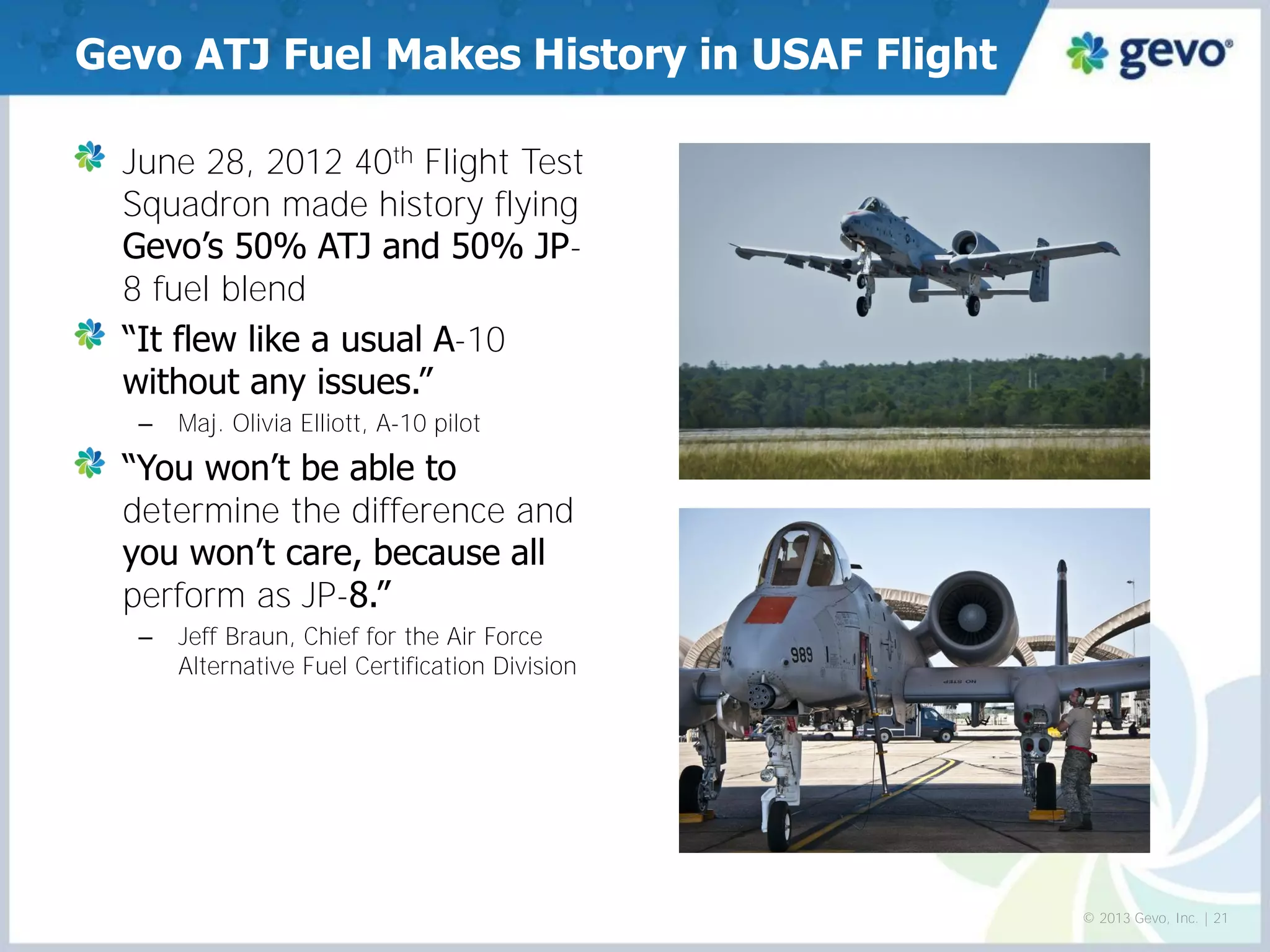

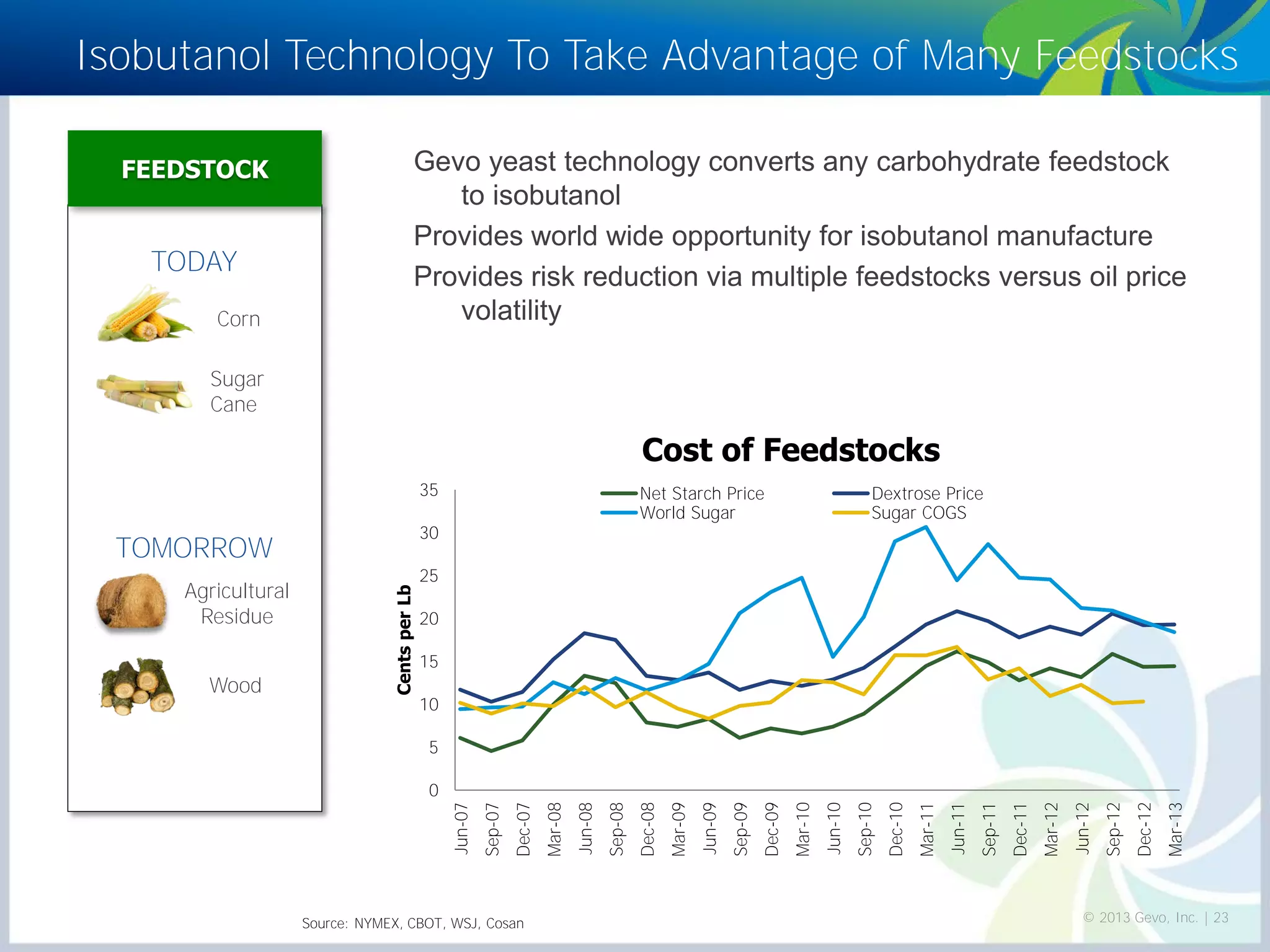

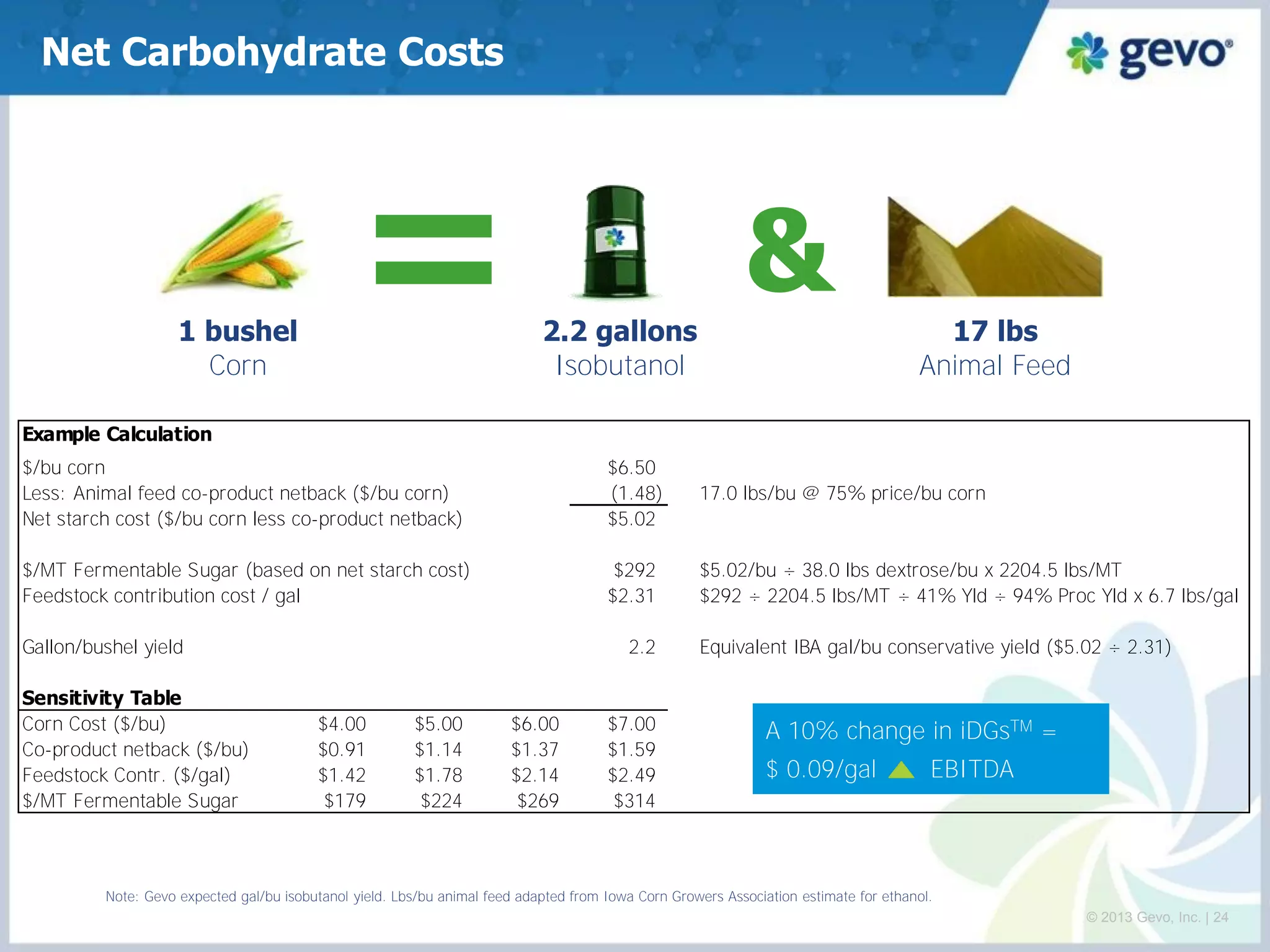

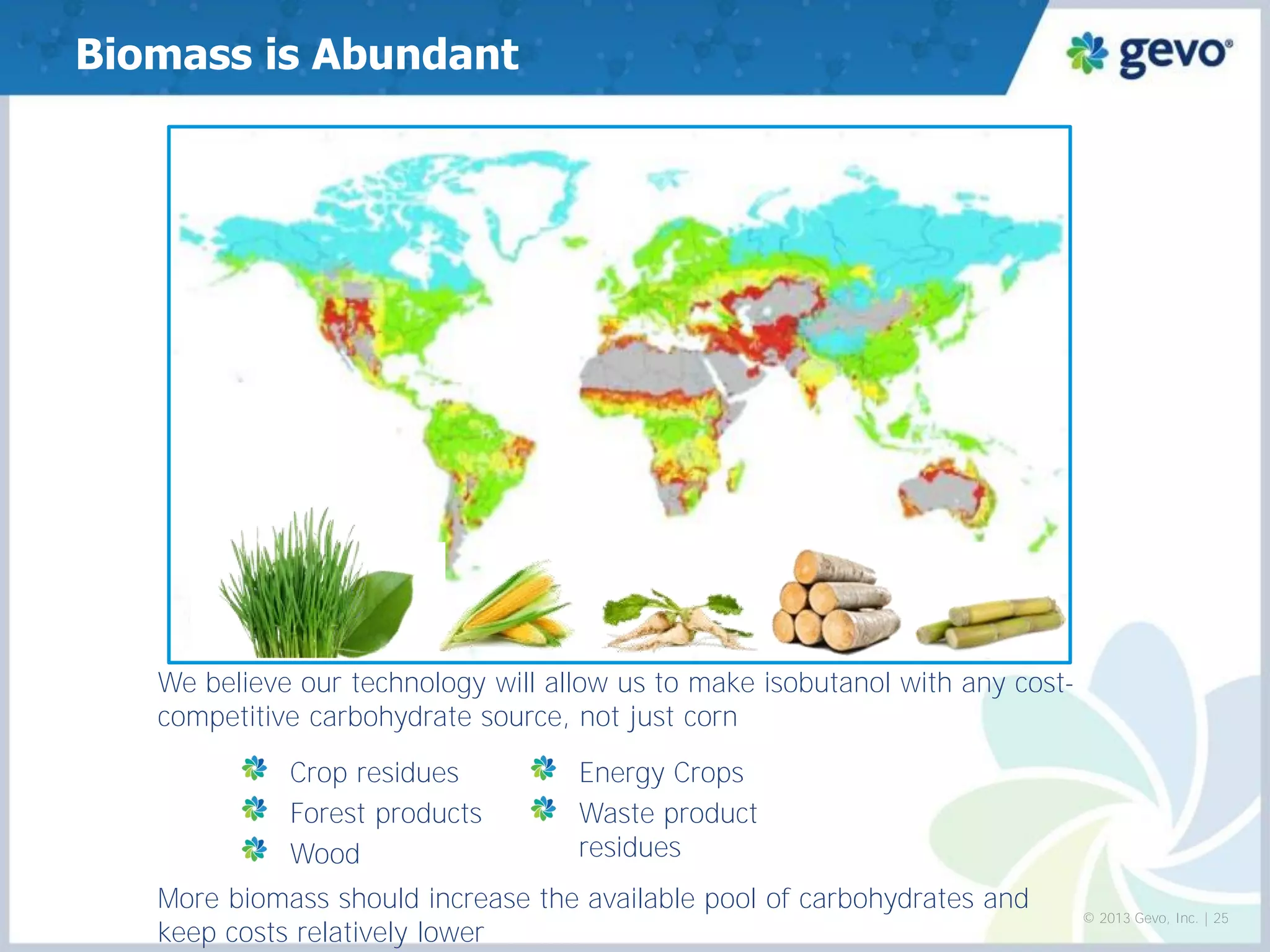

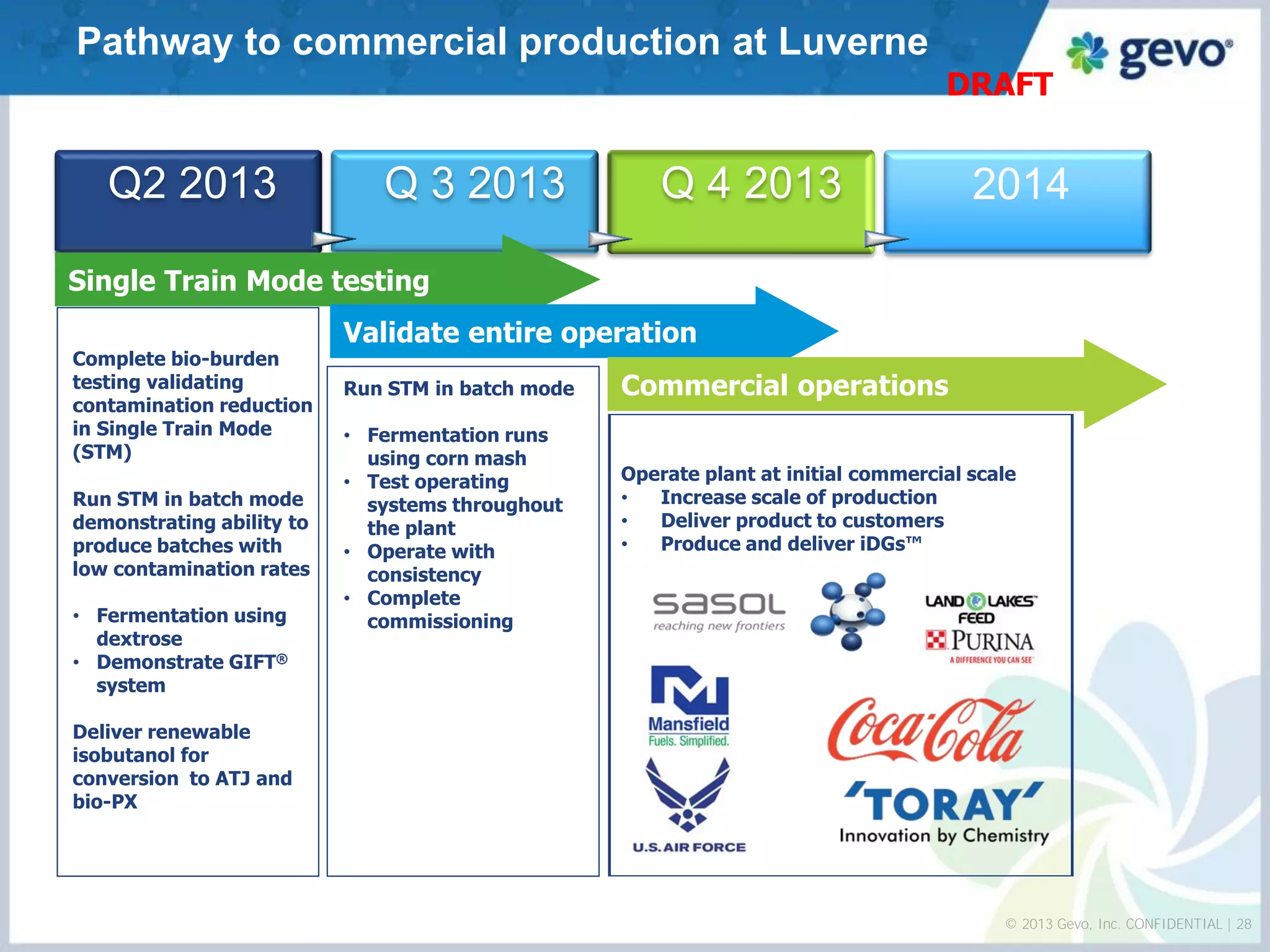

- Gevo has developed a patented process called GIFT that uses yeast fermentation to convert plant-based sugars into isobutanol, which can then be used to produce chemicals, fuels and other products as a drop-in replacement for petroleum.

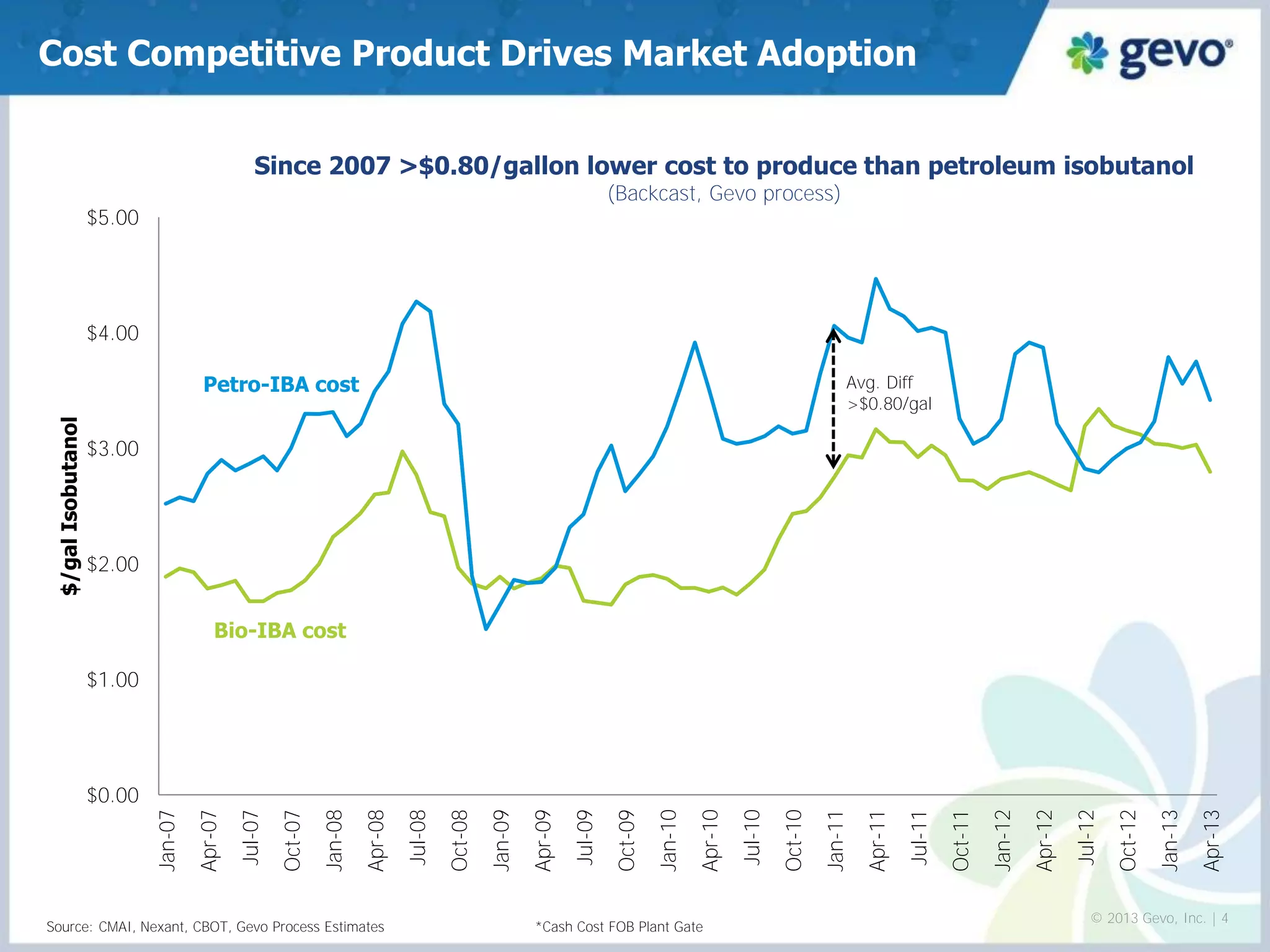

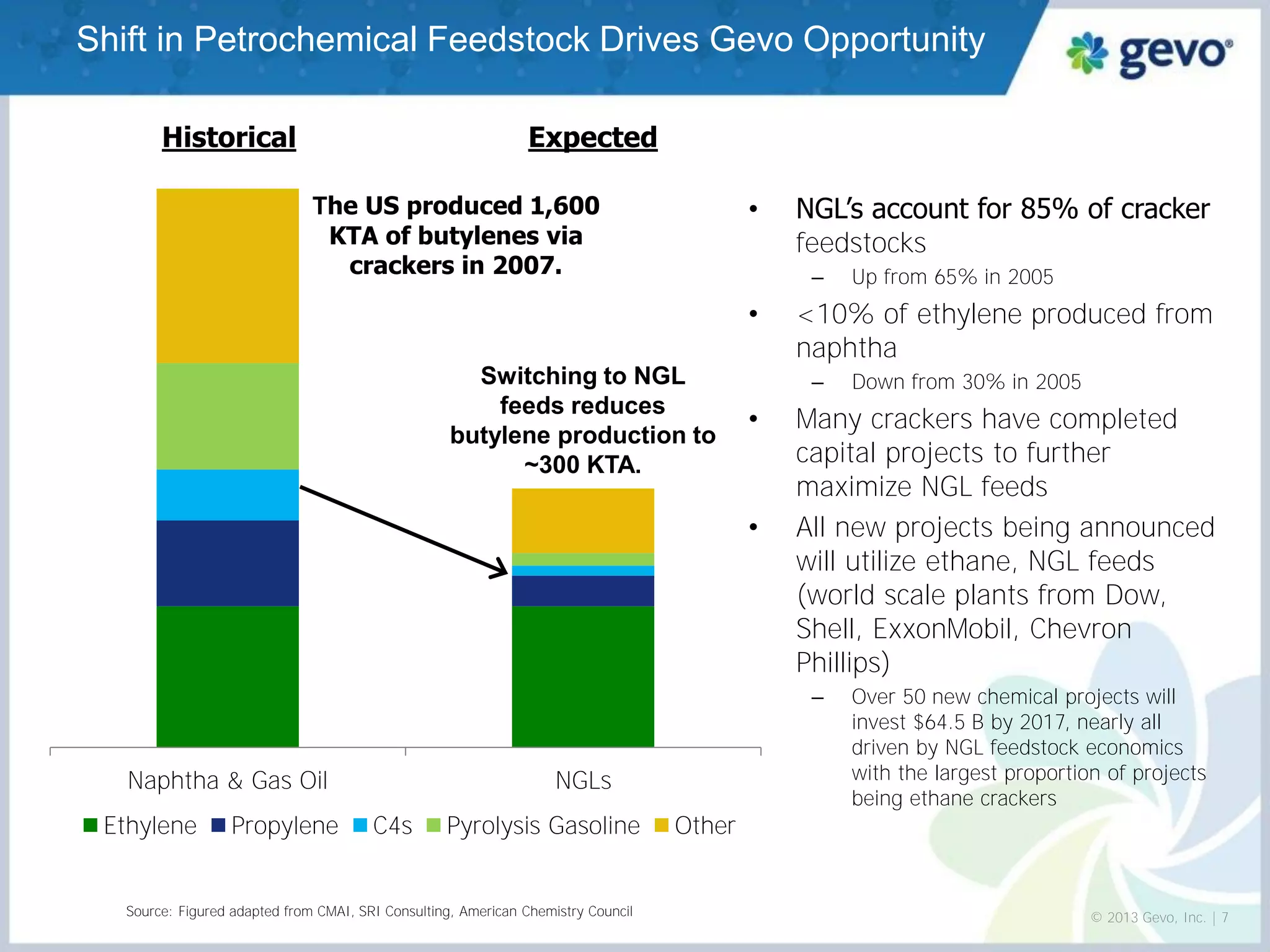

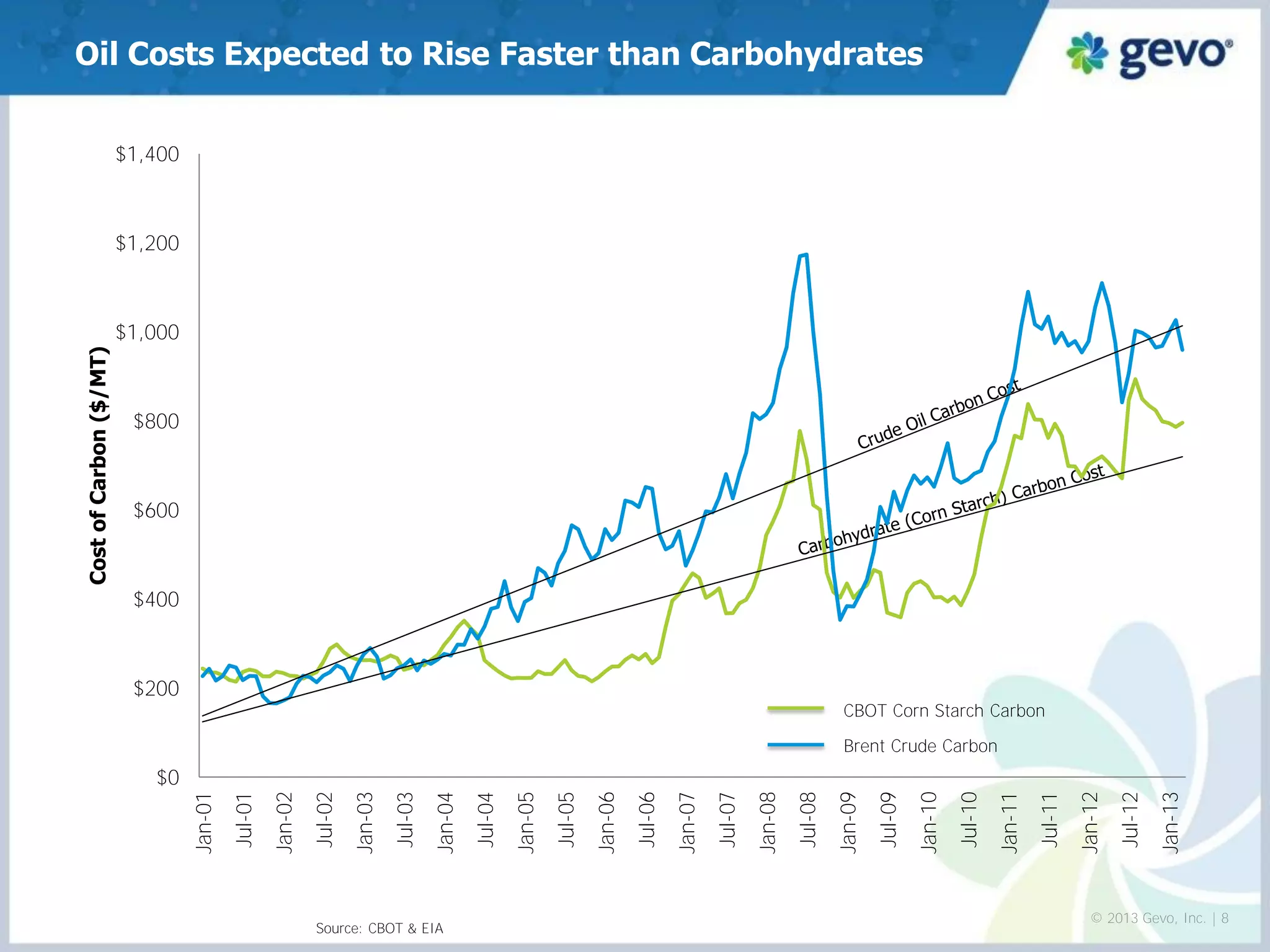

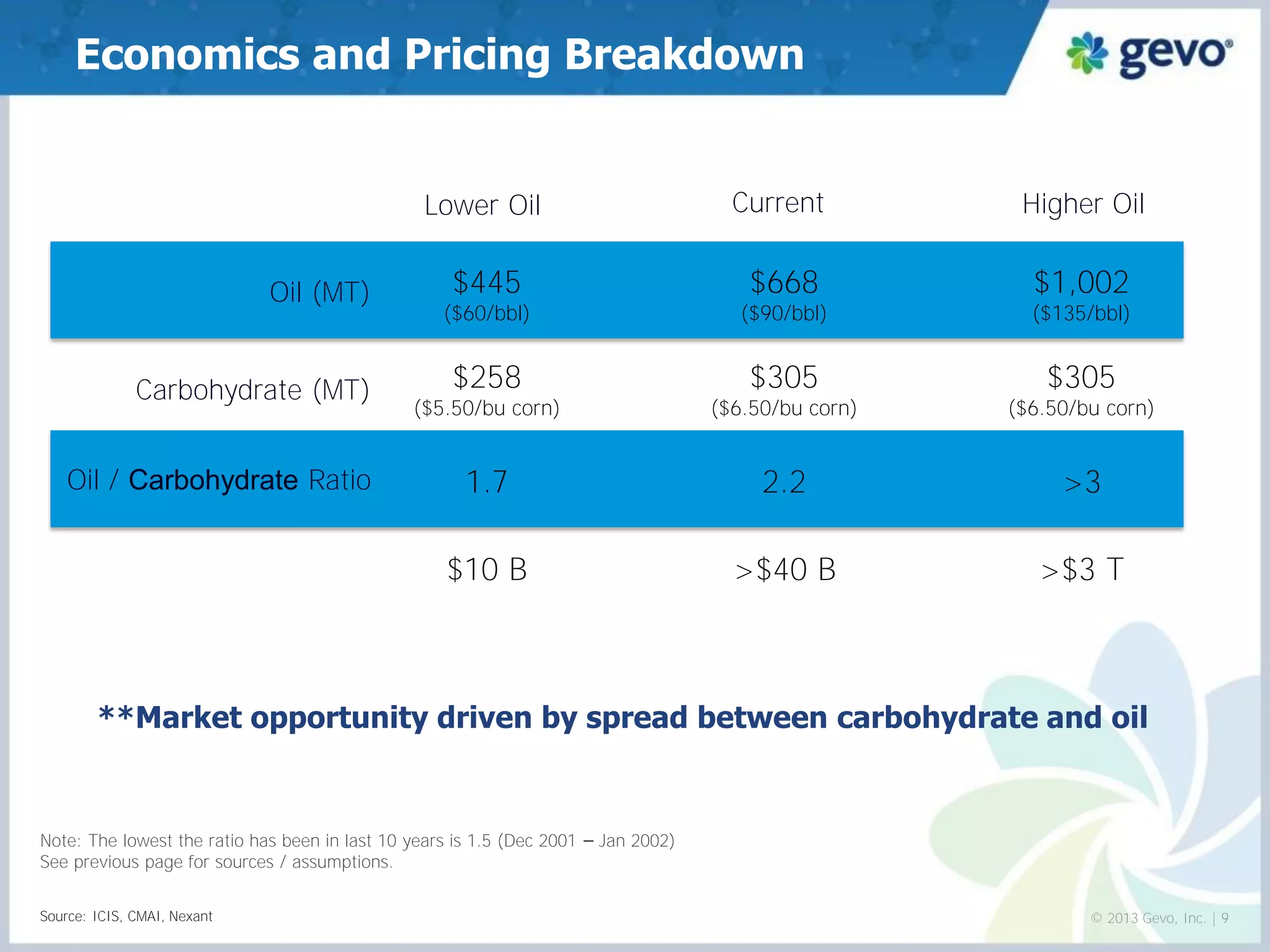

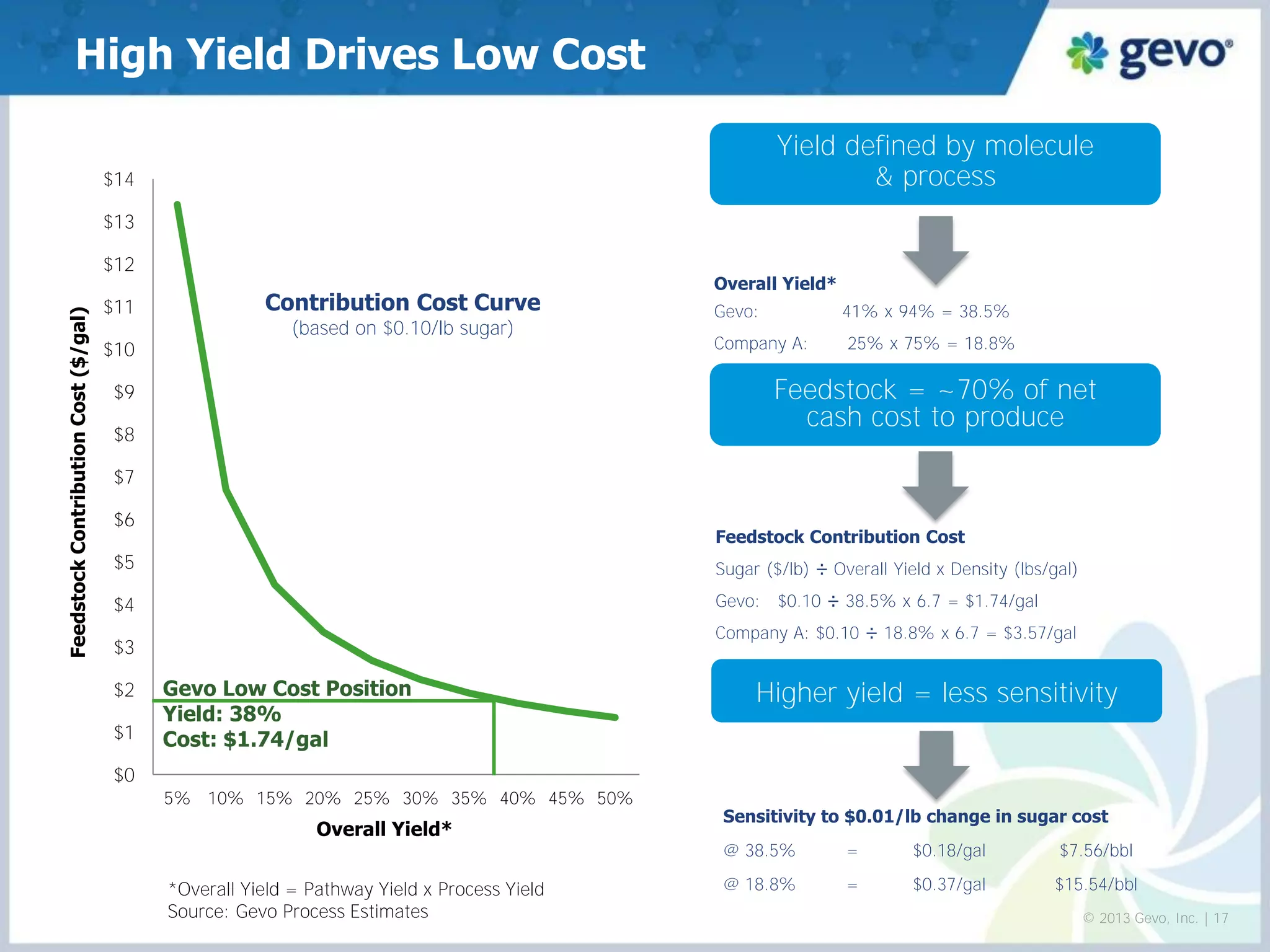

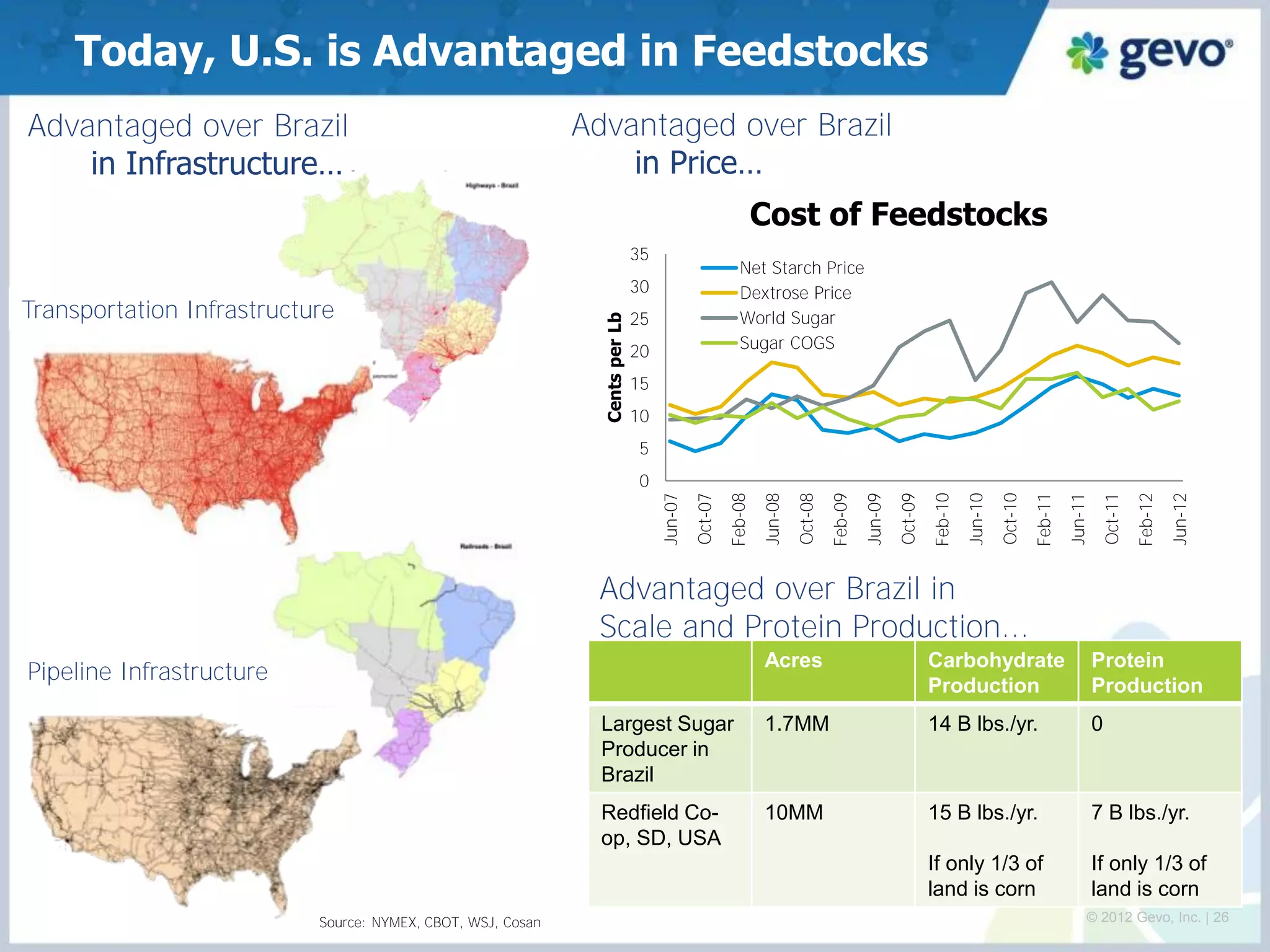

- Isobutanol production is cost competitive with petroleum-based production due to high yields from GIFT and the increasing price differential between oil and plant-based feedstocks.

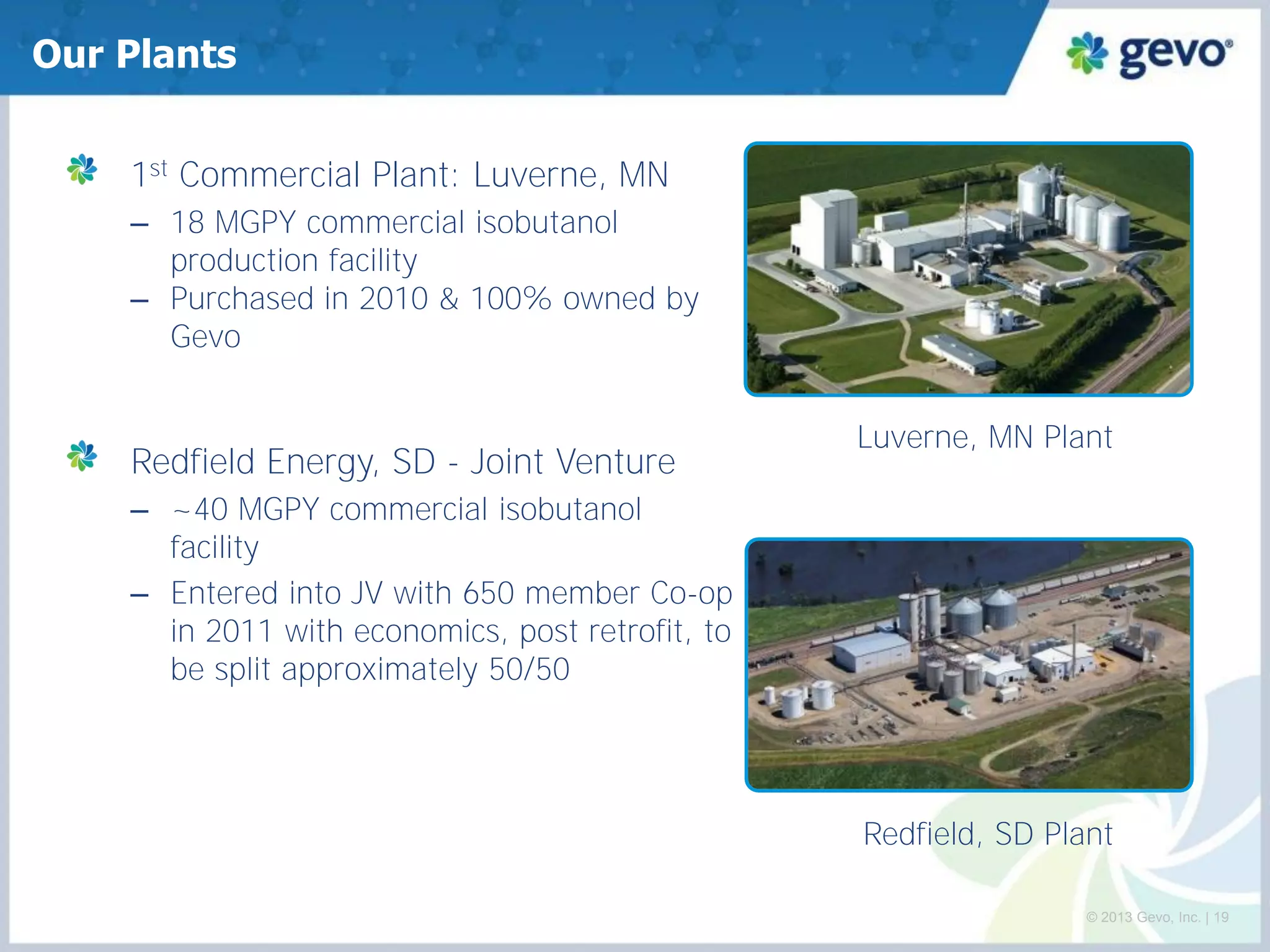

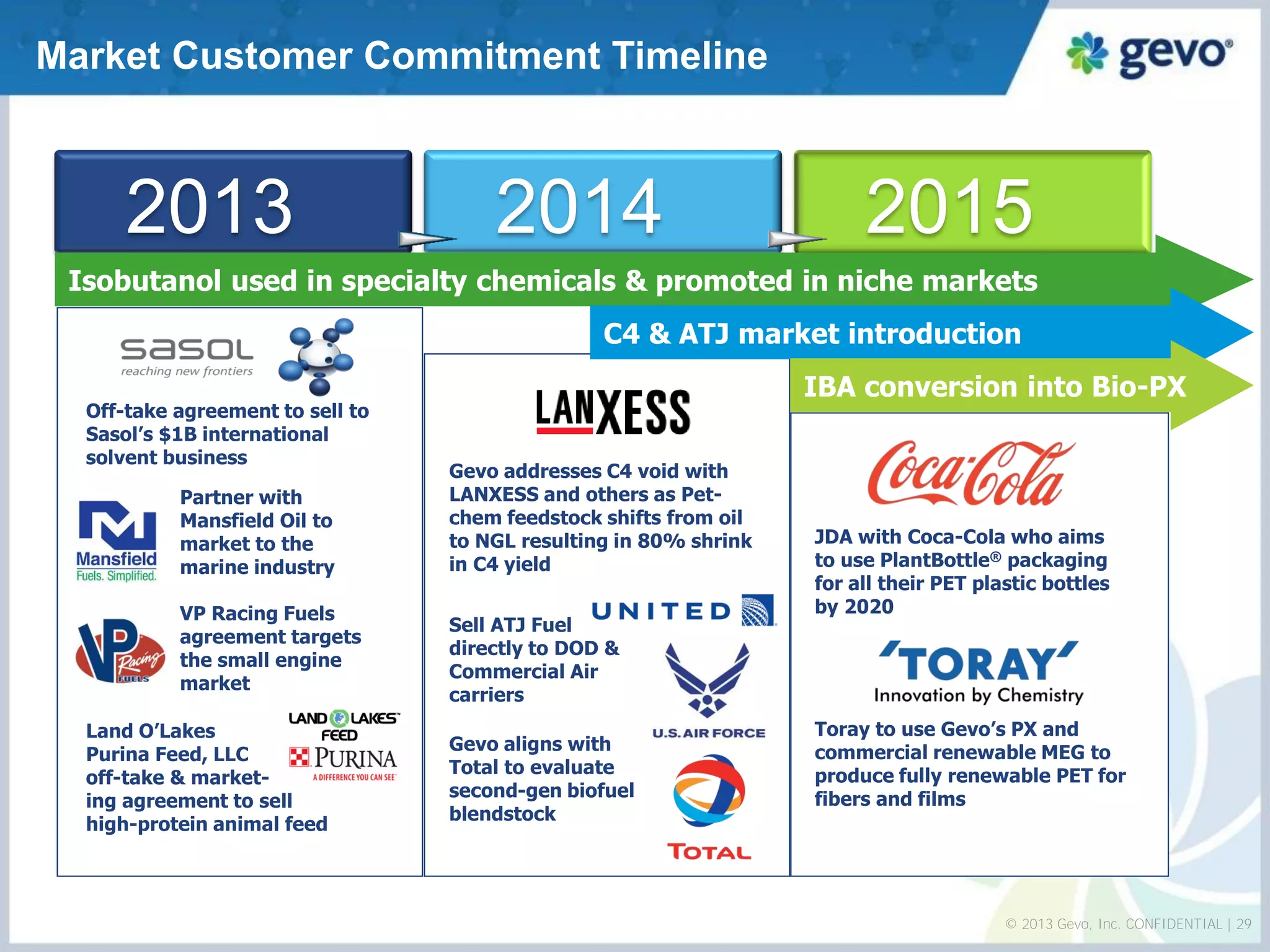

- Gevo has two commercial production facilities, one wholly owned and one in a joint venture, and is focused on multiple end