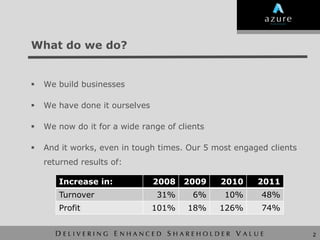

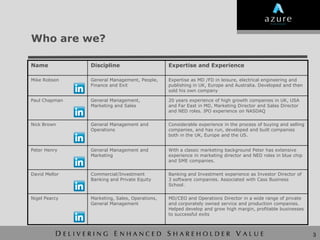

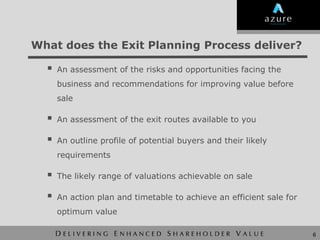

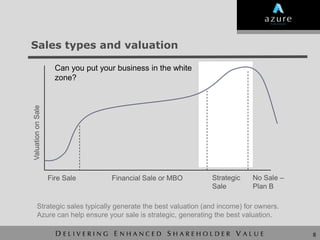

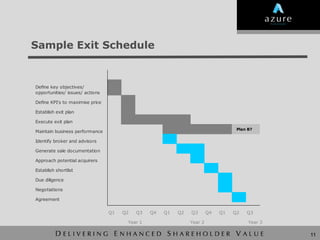

Azure Partners provides business advisory services to help clients build and exit businesses successfully. They have experience implementing strategies that increased client turnover by 31-48% and profits by 18-126% annually. Azure's team of advisors have extensive management experience across industries. Their exit planning process assesses a business, identifies optimal exit routes, and creates an action plan to achieve the best valuation possible for owners within 1-3 years.