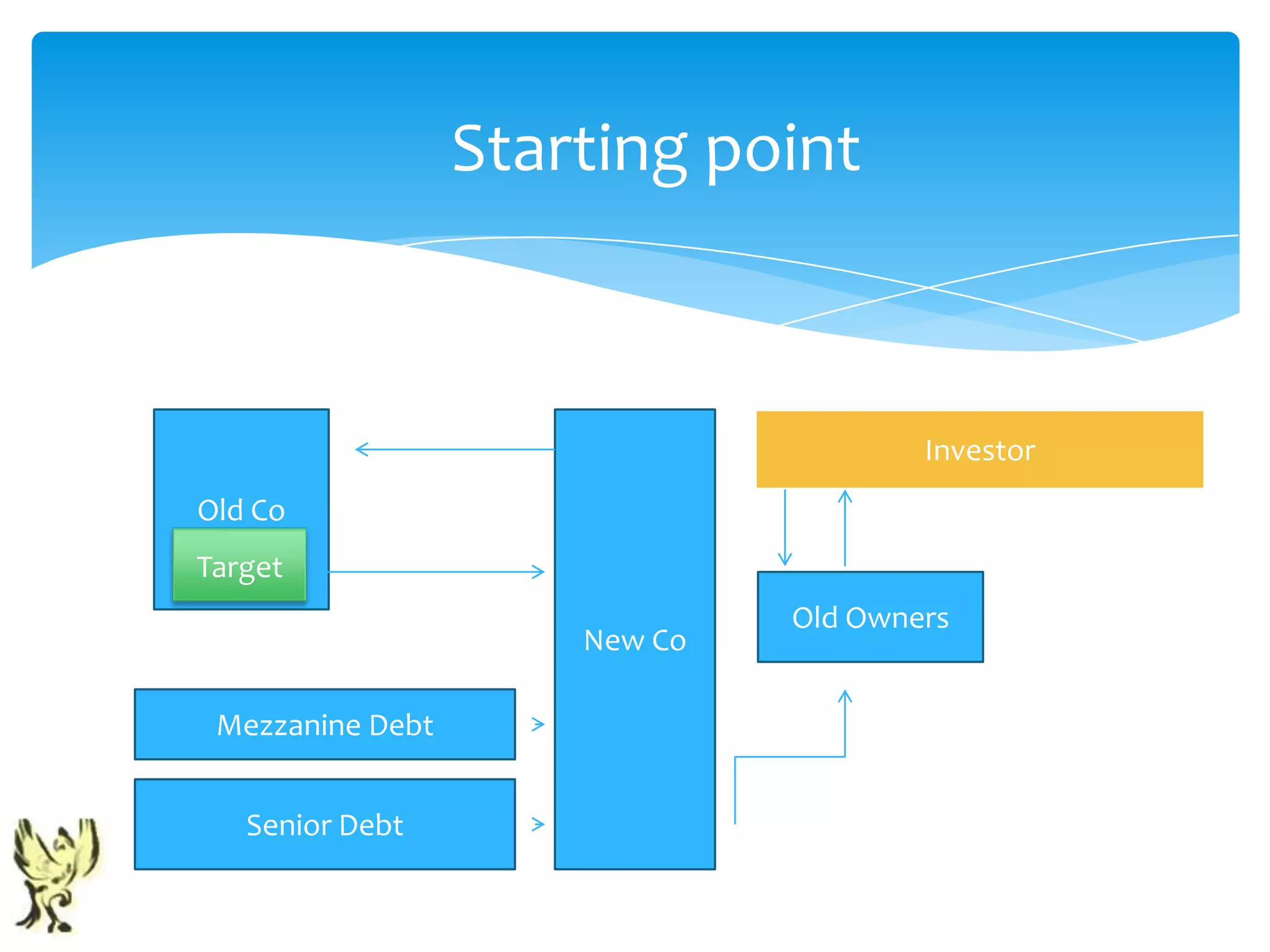

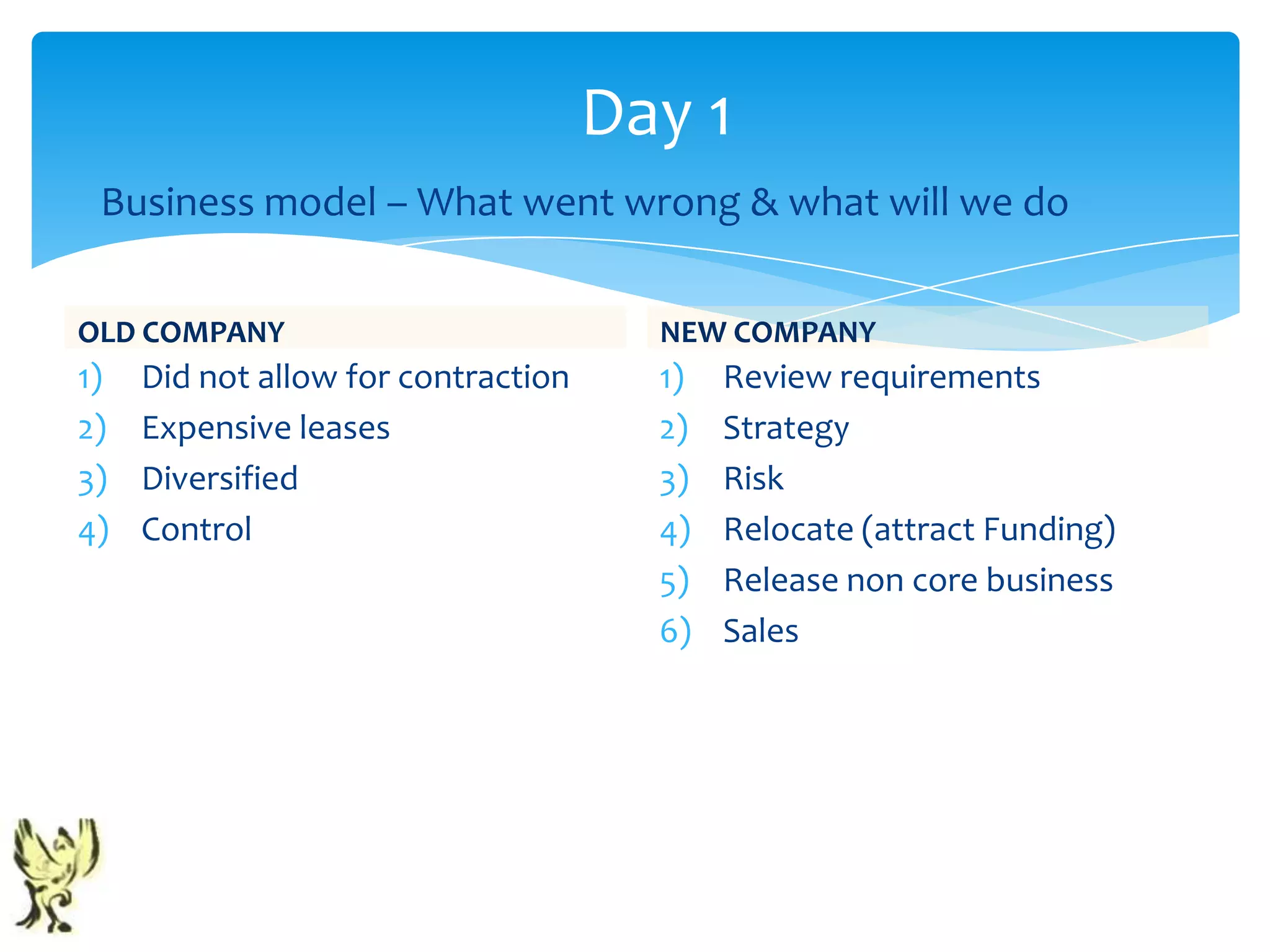

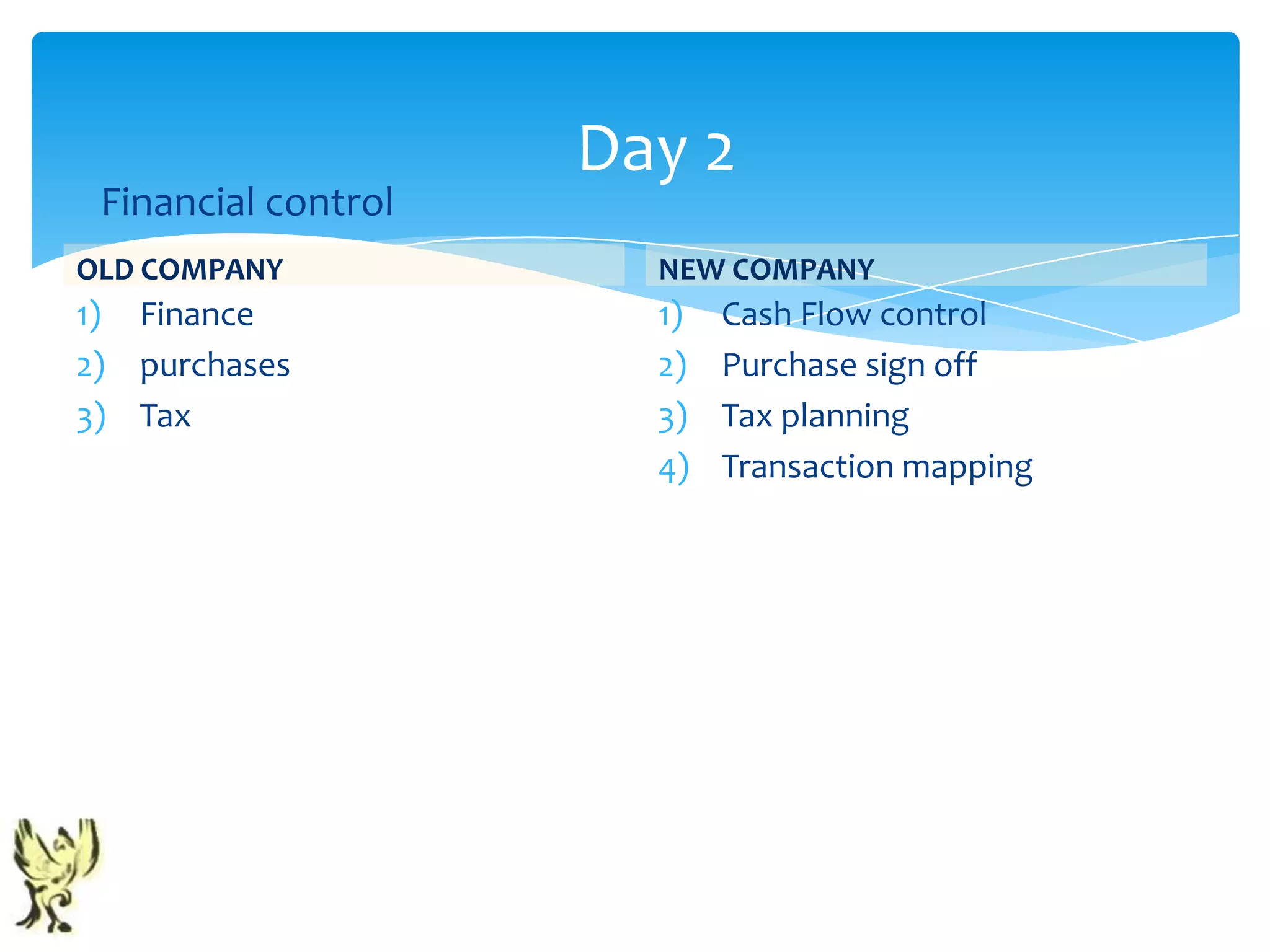

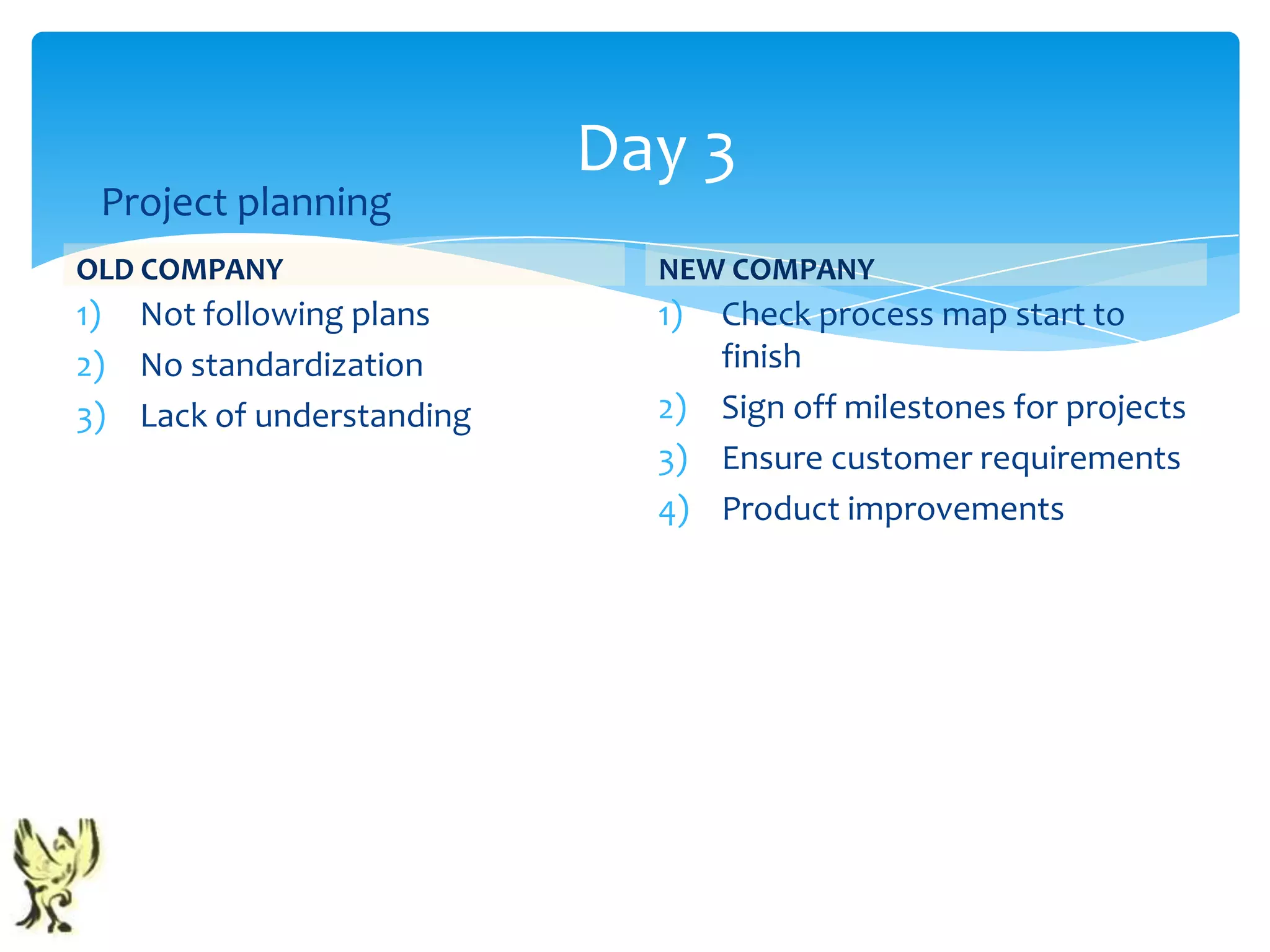

This document discusses Core Business Rescue, a team that helps companies in distress. It outlines their approach over several days to stabilize a business and set it up for longer term success. They focus on improving the business model, financial controls, project planning, sales, taxes, metrics, and continuous improvements. Their goal is to restructure the business, get it profitable again, and eventually facilitate its sale so investors can realize returns and previous owners can realize value from the distressed company. The document provides details on their team and the process they use to rescue struggling businesses.