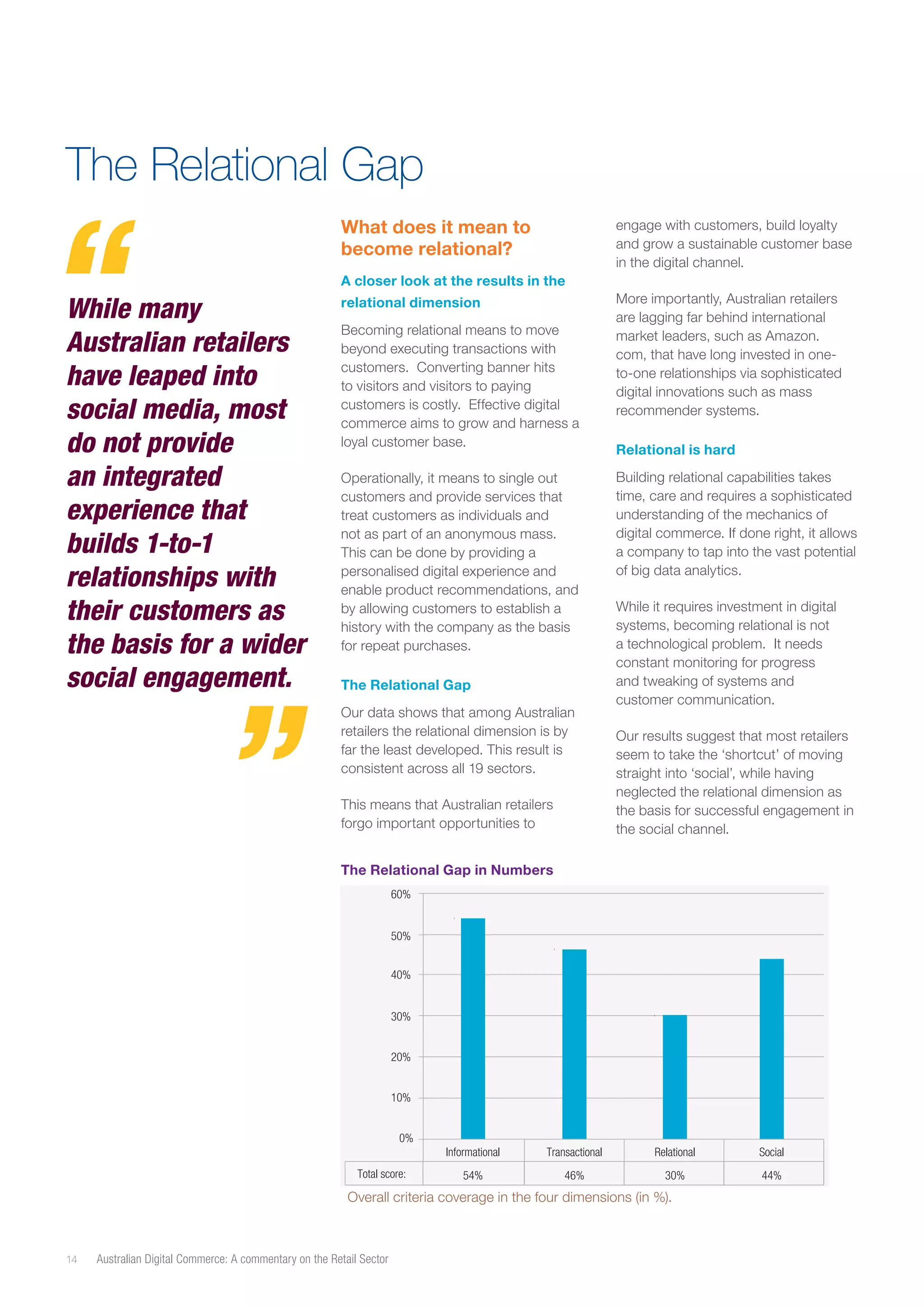

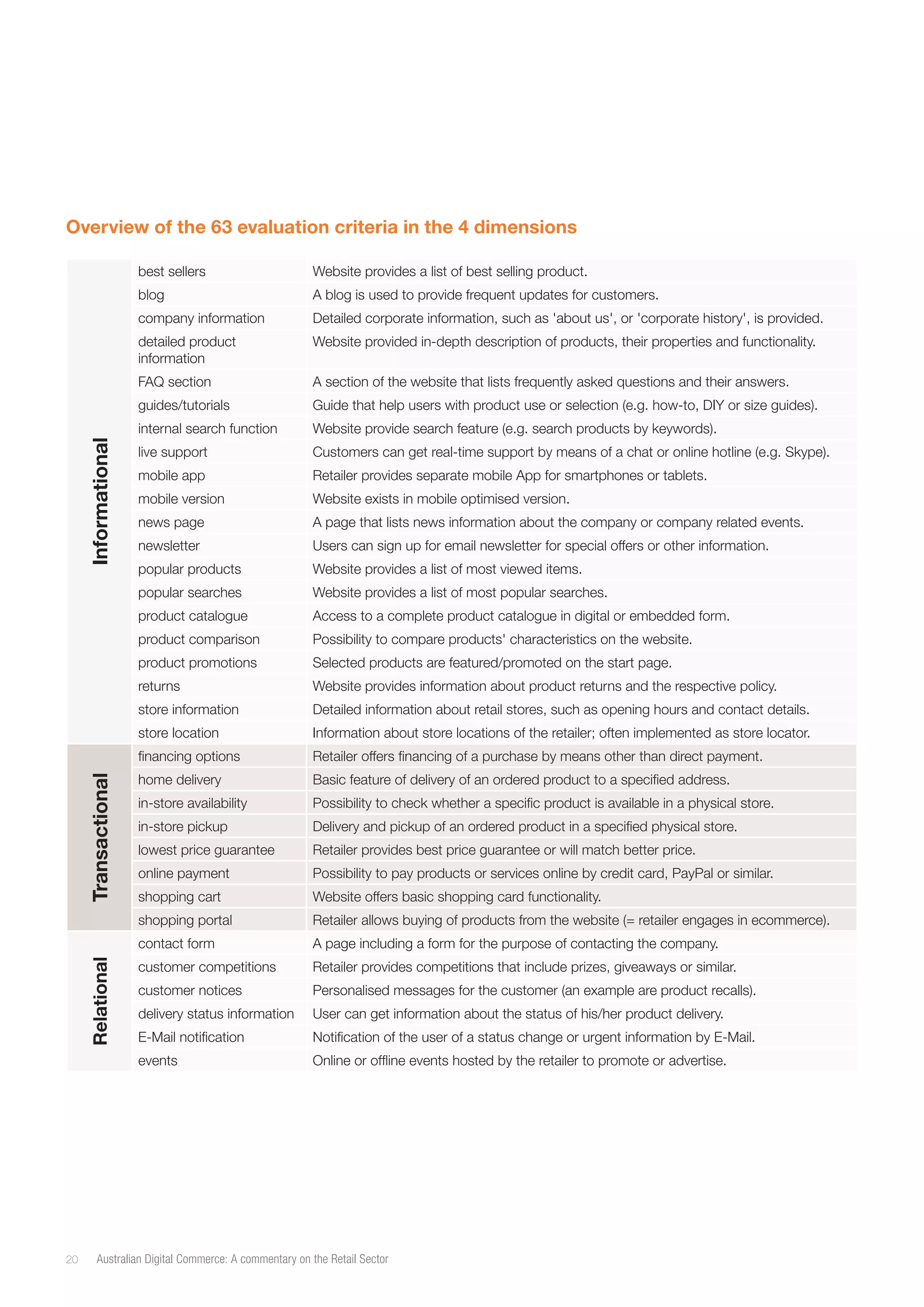

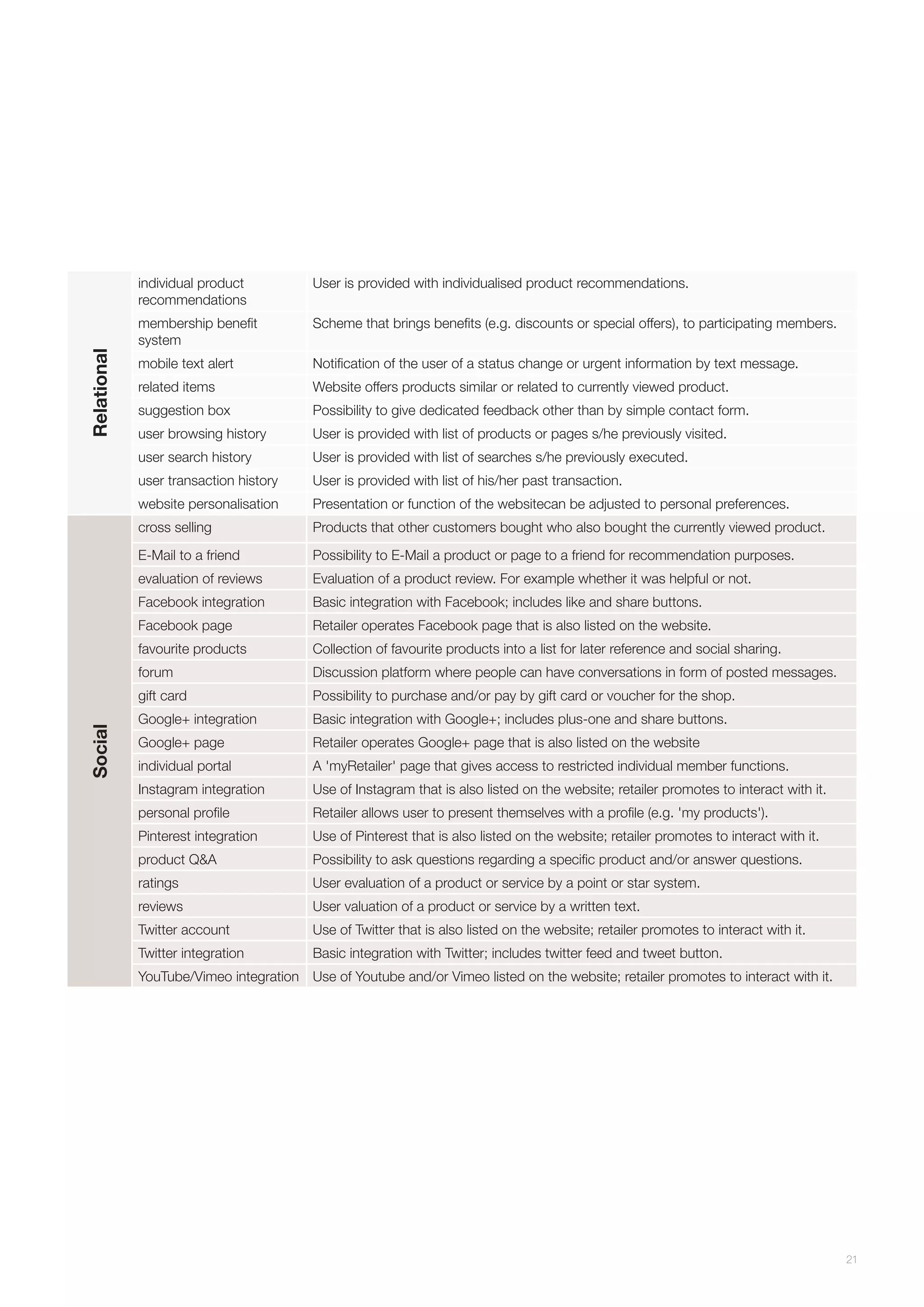

The document discusses the state of digital commerce within Australian retail, highlighting that while retailers have made progress in providing online transactional services, they largely underutilize relational and social features that could enhance customer loyalty and engagement. It identifies a significant 'relational gap' where retailers fail to build meaningful relationships with customers, which is crucial for sustainable success in the digital economy. The commentary suggests that closing this gap through investment in relational digital commerce features is essential for Australian retailers to thrive in an increasingly competitive landscape.