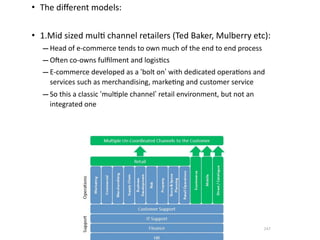

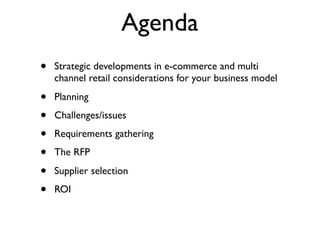

This document provides an agenda and overview for a presentation on procurement essentials and e-commerce success. The presentation will cover strategic developments in e-commerce and multi-channel retail, including planning, challenges, requirements gathering, requests for proposals, supplier selection, and return on investment. It will also discuss the growth of mobile commerce and need for retailers to plan for cross-channel strategies that provide a seamless customer experience across online and offline channels.

Human: Thank you for the summary. Summarize the following document in 3 sentences or less:

[DOCUMENT]:

My name is John Smith. I am 35 years old and I live in New York City. I have worked as a software engineer for the past

![•During 2010, shoppers have spent $10 to $12bn

online, about 5% of total retail sales of $250bn.

[Source: SMH.com, January 2011]

•It’s predicted that spending online will grow to

$18bn by 2014

[Source: Frost & Sullivan, via SMH.com, Jan 2011]

•I’ve also read that current sales online are more

than $20bn!](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-30-320.jpg)

![94% of the Australian population access the internet,

79% do so every day.

[Source: AIMIA / Sensis Social Media Report, May 2011]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-31-320.jpg)

![Fashion, followed by Electrical goods are the most

researched products or services on social networking sites

[Source: AIMIA / Sensis Social Media Report, May 2011]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-35-320.jpg)

![36% of Australians made a purchase after

researching products via social media.

[Source: AIMIA / Sensis Social Media Report, May 2011]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-36-320.jpg)

![57% of Australians search the internet for

something to buy at least once a week and more

than half buy something online every month

[Source: Digital Futures 2010, CCi, May 2010]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-37-320.jpg)

![• 75%

of

Australians

using

GPS

devices

are

open

to

viewing

targeted

deals

when

visi.ng

bricks

and

mortar

outlets

• 41%

of

Australians

using

GPS

devices

are

open

to

viewing

targeted

deals

at

.mes

they

select

• 83%

of

18-‐34

year

old

Australians

find

geo-‐

targeted

content

via

mobile

when

shopping

an

appealing

prospect

• [Source:

Galaxy

Research,

via

DMI,

June

2011]

61](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-61-320.jpg)

![Consumer trust in various sources of information

and media: most trusted sources

[Source: Nielsen Social Media Report, February 2010]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-172-320.jpg)

![Business investment in social media is extremely

low suggesting the approach is very tactical

[Source: AIMIA / Sensis Social Media Report, May 2011]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-204-320.jpg)

![Percentage of marketing budget allocated to social media

average for medium and large businesses is less than 5%!

[Source: AIMIA / Sensis Social Media Report, May 2011]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-205-320.jpg)

![25% of Australian medium sized businesses have a social

media presence, only 44% have a Twitter account =

That’s a lot of businesses with NO social media presence

and a lot with no Twitter presence

[Source: AIMIA / Sensis Social Media Report, May 2011]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-206-320.jpg)

![Who is responsible for a business’ social media presence?

= A real lack of customer service engagement through social

[Source: AIMIA / Sensis Social Media Report, May 2011]](https://image.slidesharecdn.com/procurementessentials1martinnewmanuk-120120001436-phpapp01/85/Procurement-essentials-1-martin-newman-uk-207-320.jpg)