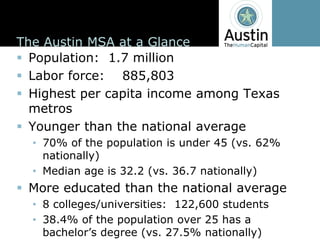

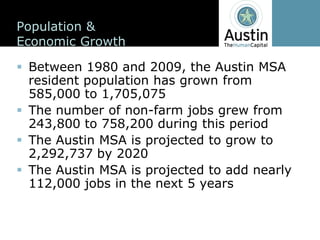

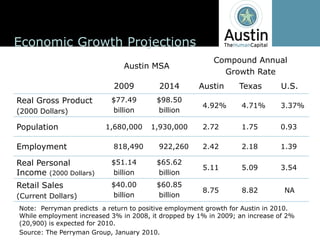

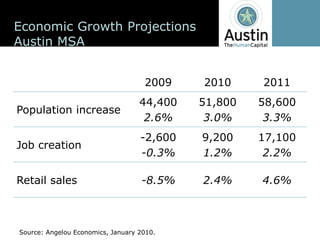

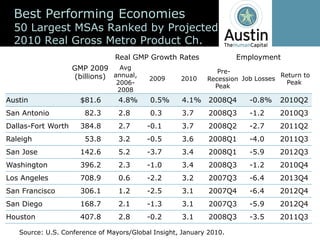

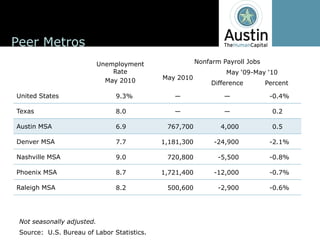

The document provides an overview of population, economic, and employment trends in the Austin metropolitan statistical area (MSA). Some key points:

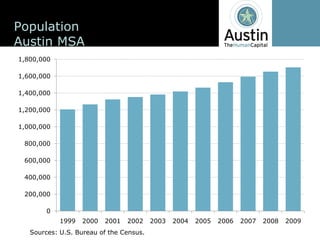

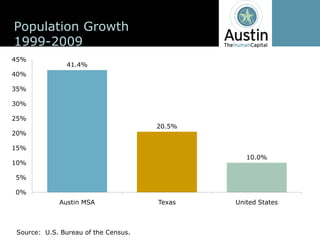

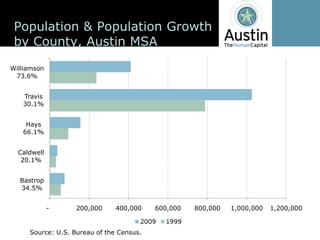

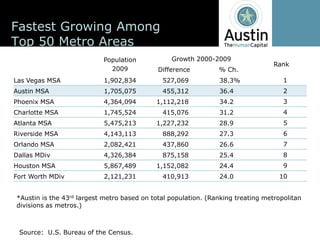

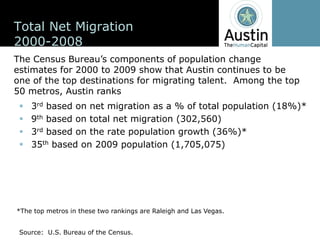

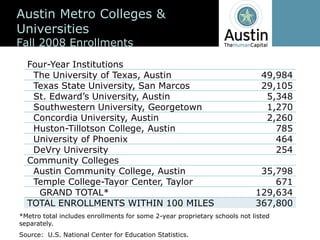

- The Austin MSA population grew 41.4% between 1999-2009, among the fastest growing of major US metro areas.

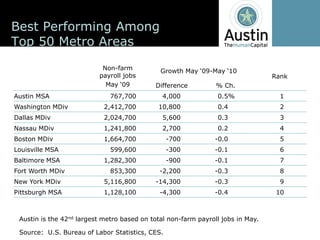

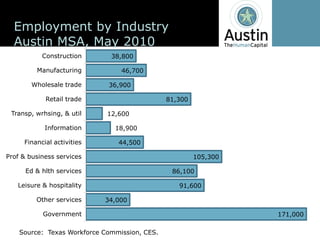

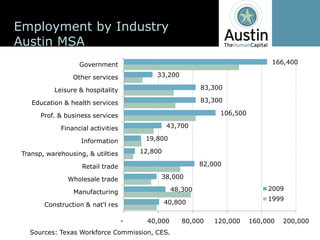

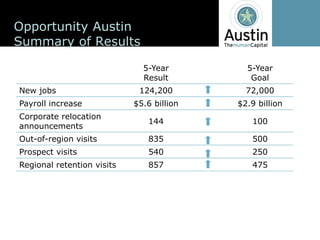

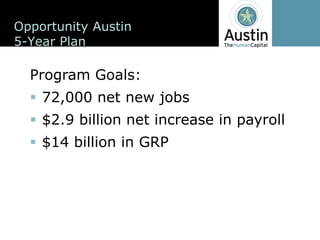

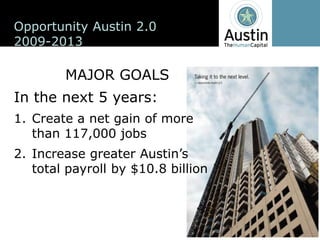

- The region is projected to add over 112,000 new jobs in the next 5 years and see continued strong economic and population growth.

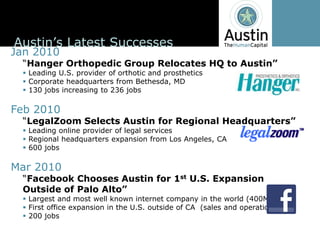

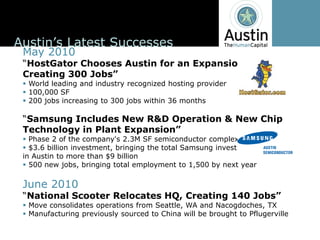

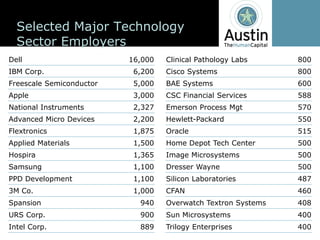

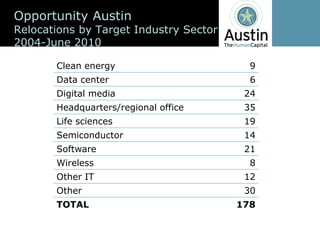

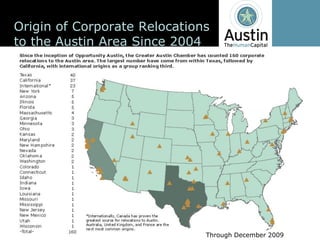

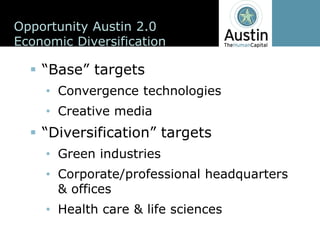

- Major employers in the Austin area include Dell, IBM, Seton Healthcare, St. David's Healthcare, Apple, National Instruments, and Whole Foods Market. The area has attracted many new and expanded operations from companies like Oracle, Samsung, and PayPal.