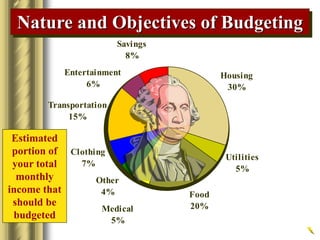

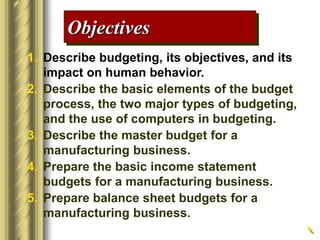

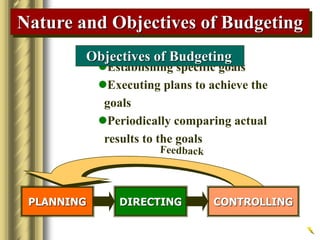

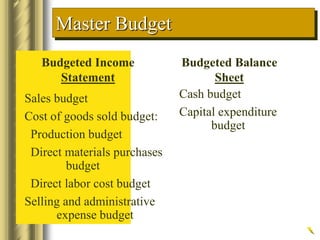

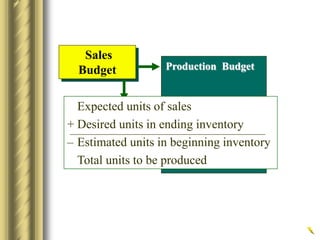

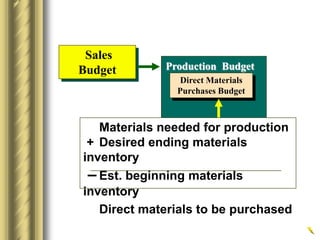

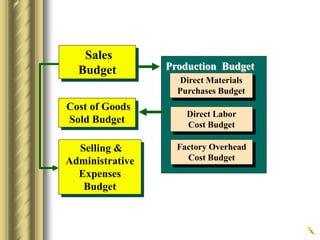

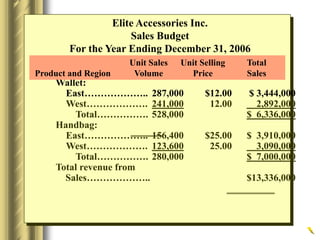

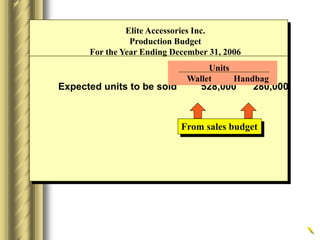

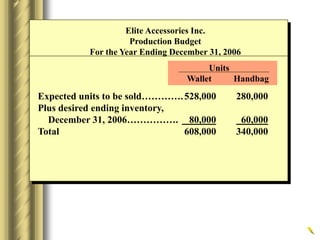

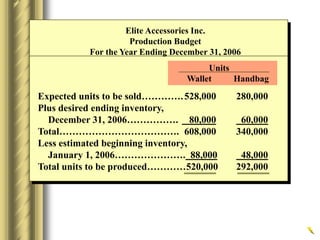

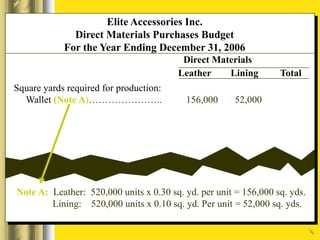

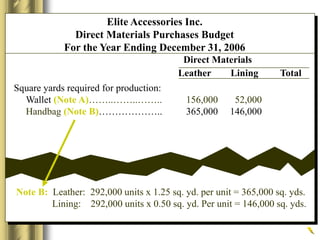

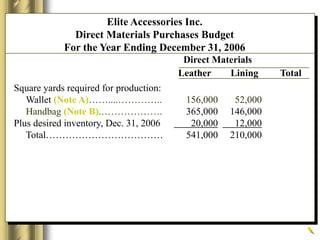

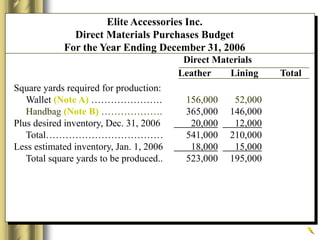

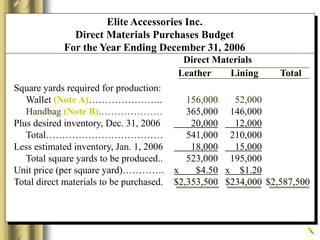

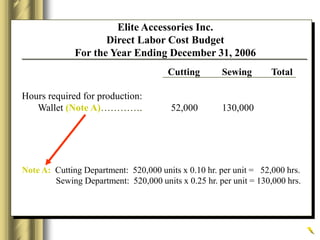

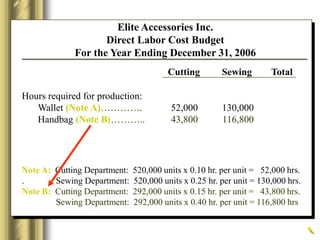

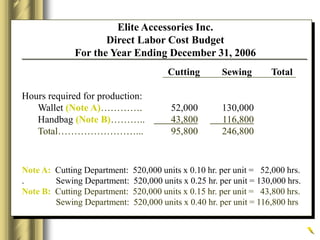

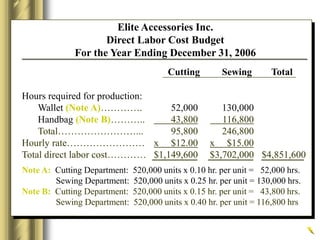

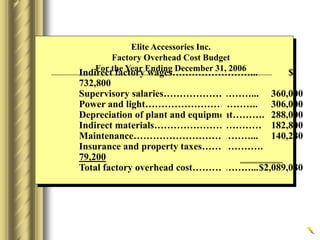

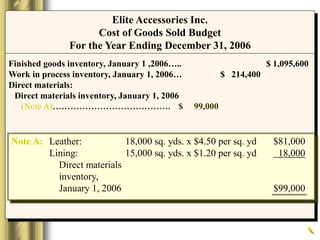

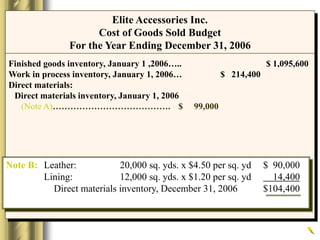

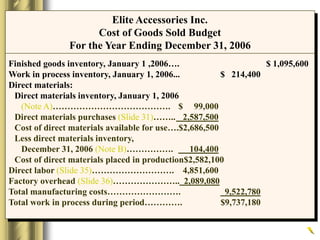

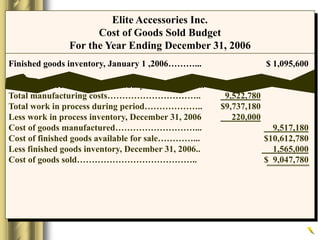

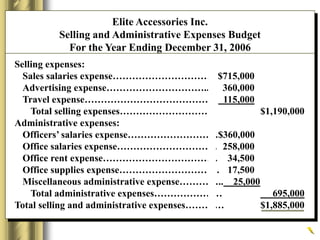

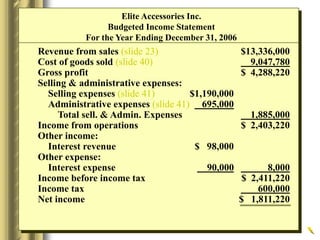

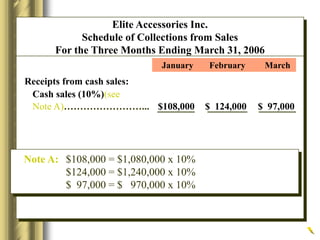

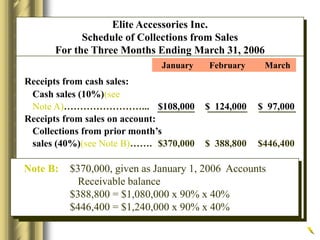

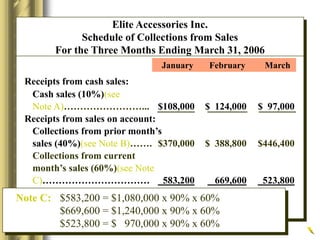

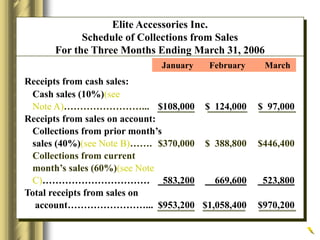

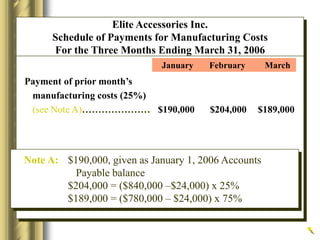

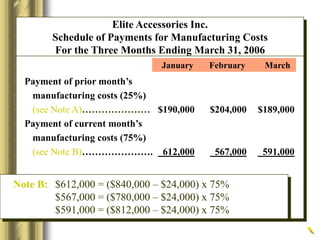

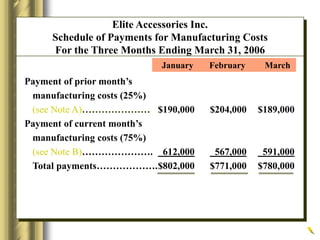

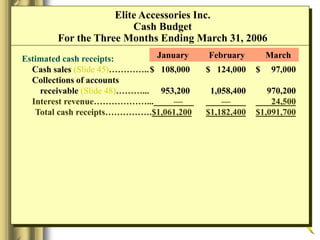

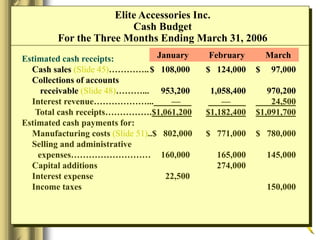

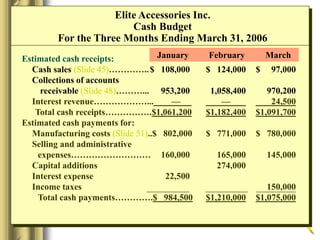

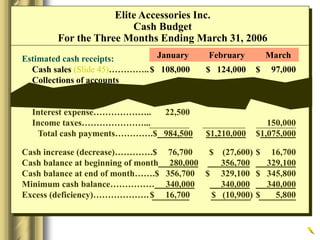

Budgeting involves planning, directing, and controlling finances to achieve goals. A budget allocates estimated income and expenses over a set period of time. This document provides an example budget for a manufacturing company called Elite Accessories. The master budget includes sales, production, materials purchases, labor, and factory overhead budgets. It also includes income statement and balance sheet budgets such as cost of goods sold. The production budget estimates materials, labor hours, and costs needed to produce the estimated units to be sold. The budgets allow the company to plan and control its finances.