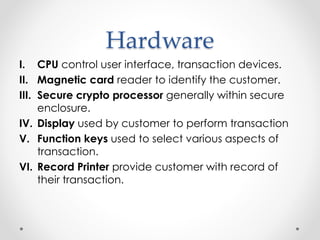

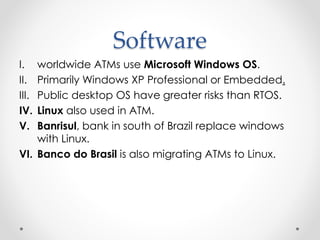

ATM stands for Automated Teller Machine. It allows customers to access their bank accounts and perform financial transactions electronically without visiting a bank. Some key transactions include withdrawing cash, checking balances, and making deposits. The first ATM was introduced by HSBC bank in India in 1987. ATMs have since evolved from early machines that only performed basic transactions to modern networked machines that provide enhanced functionality. An ATM consists of components like a card reader, keypad, display screen, receipt printer, cash dispenser, and hardware/software to facilitate secure financial transactions for customers remotely. While convenient, ATMs also present some security risks and potential for technical errors.