Embed presentation

Download as PDF, PPTX

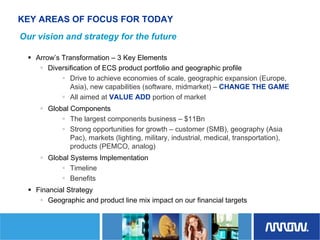

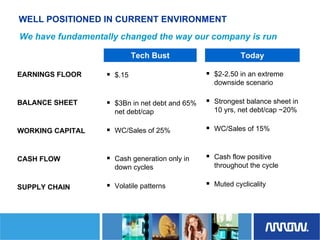

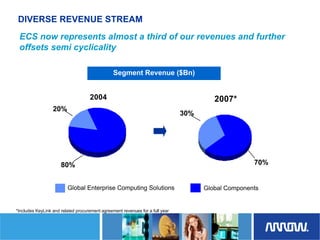

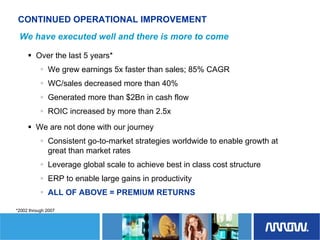

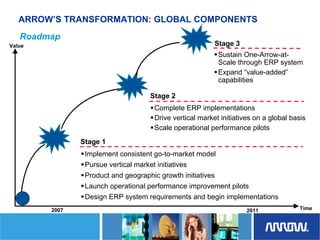

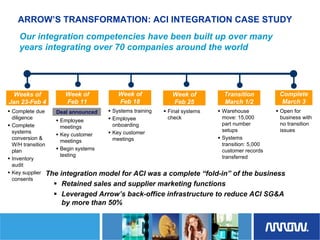

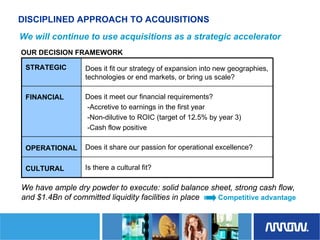

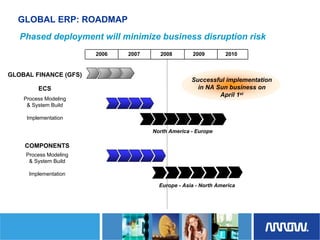

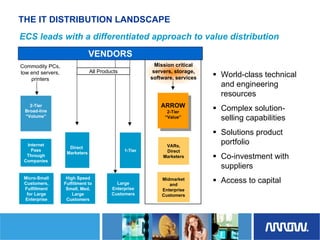

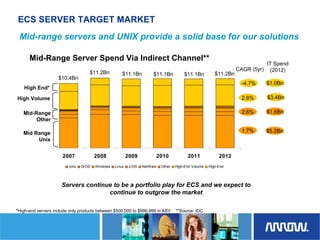

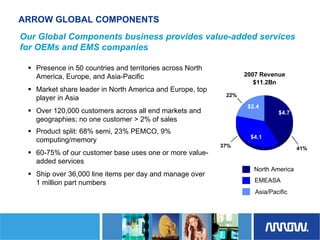

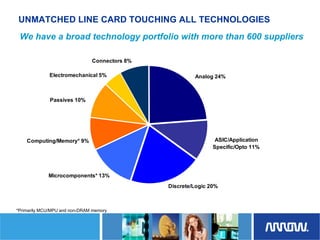

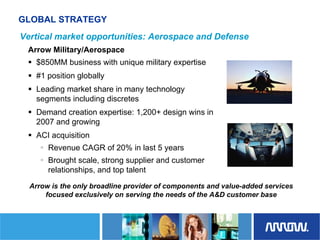

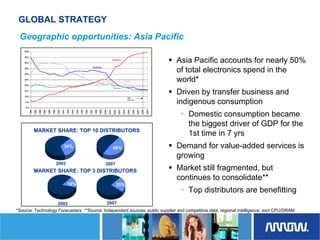

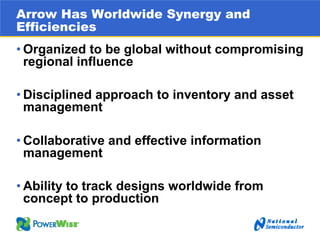

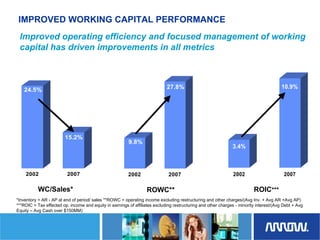

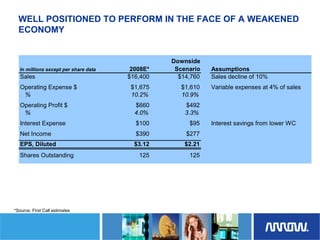

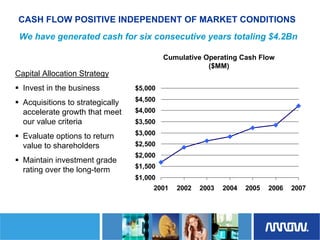

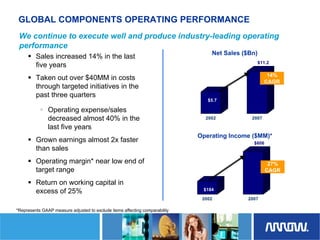

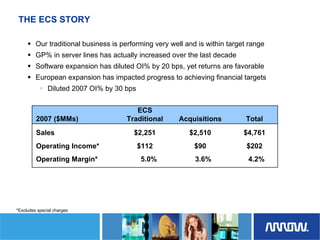

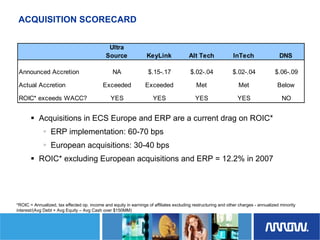

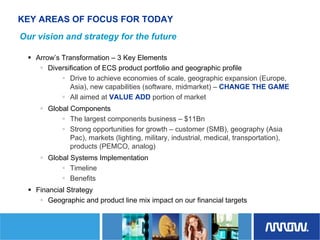

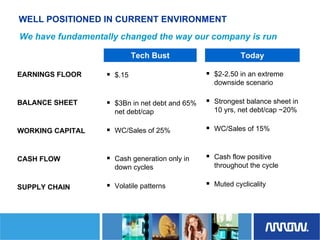

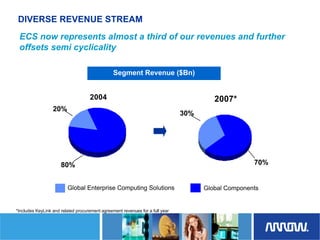

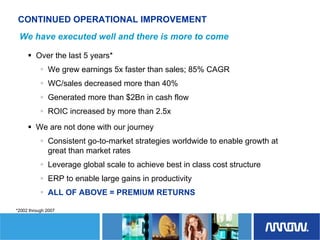

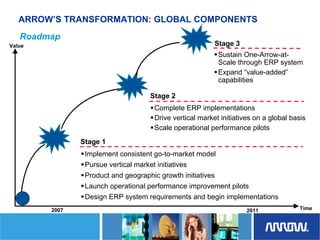

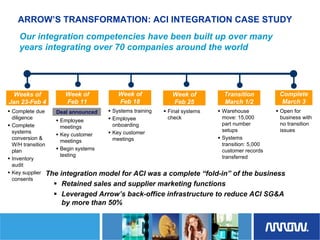

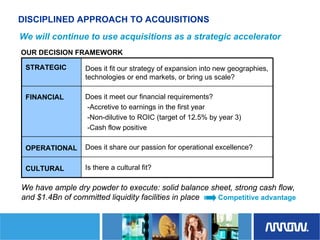

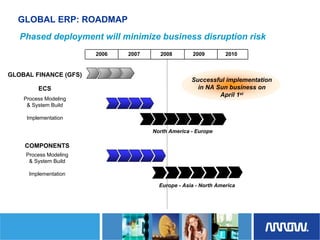

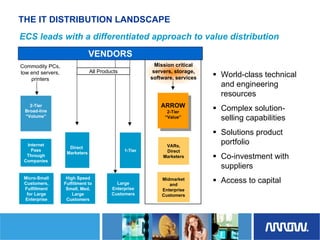

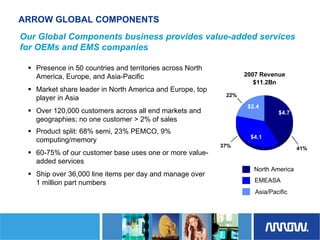

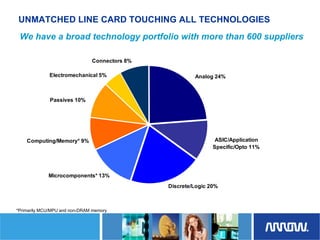

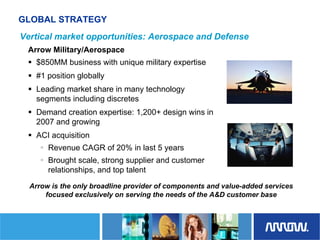

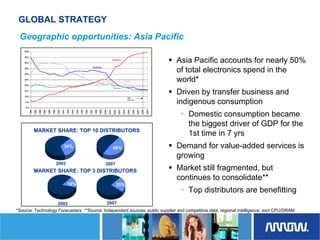

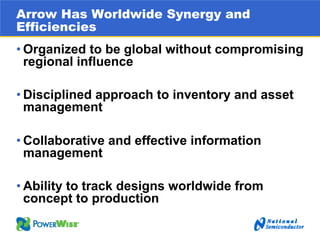

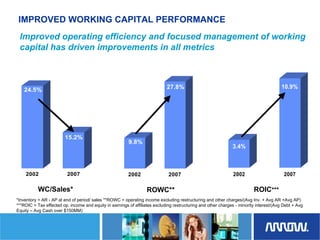

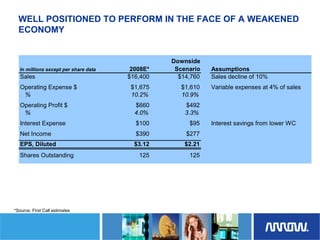

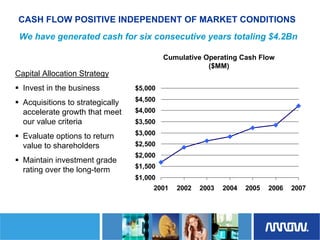

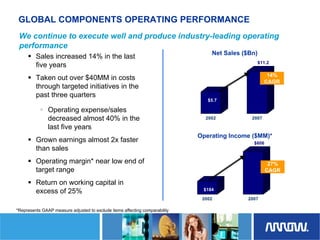

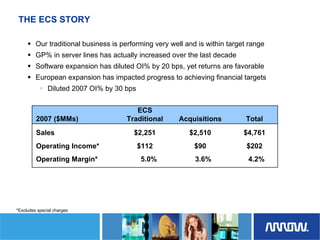

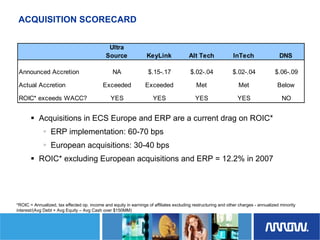

The document summarizes Arrow's 2008 Investor Day presentation. It includes an agenda for the day-long event covering Arrow's strategic overview, transformation, global business segments, and financial review. The document discusses Arrow's strategy to diversify its product portfolio and geographic presence in enterprise computing solutions and components. It also reviews Arrow's operational improvements, financial targets, and priorities to pursue organic and acquisition growth opportunities globally.