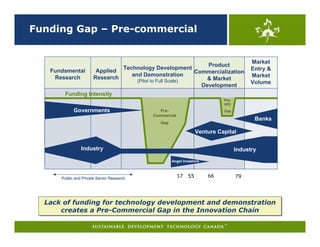

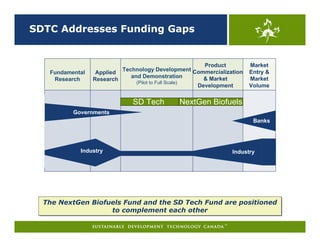

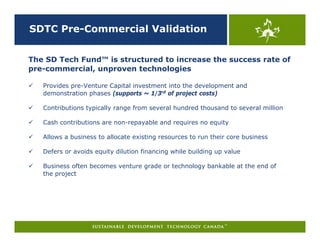

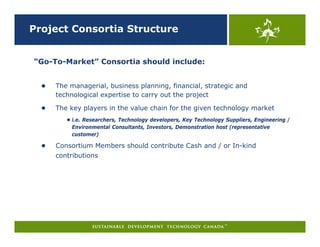

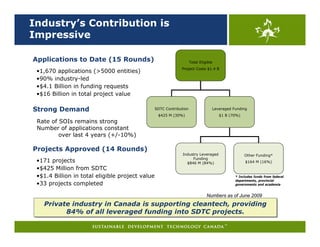

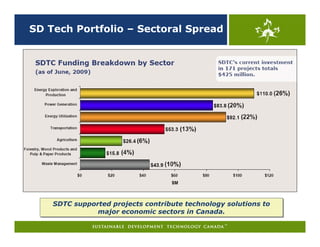

Susan McLean's presentation outlines the operations and funding mechanisms of Sustainable Development Technology Canada (SDTC), established in 2001 to support clean technology innovations with a total funding allocation of $1.05 billion. The SD Tech Fund and NextGen Biofuels Fund address critical gaps in pre-commercial technology development and leverage significant private sector investment. The presentation highlights the strong demand for SDTC support, the extensive involvement of private industry in funding projects, and the organization's role in fostering a sustainable development technology infrastructure in Canada.