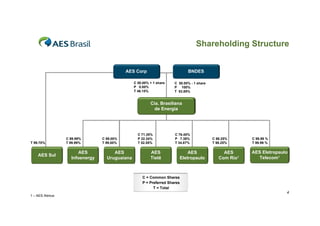

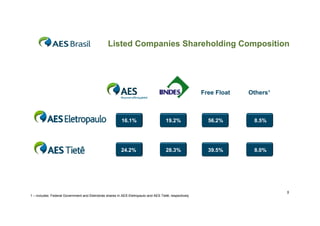

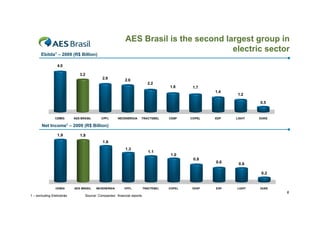

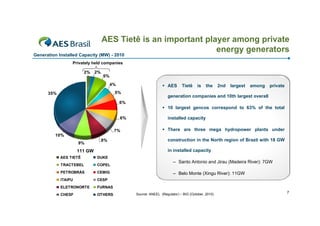

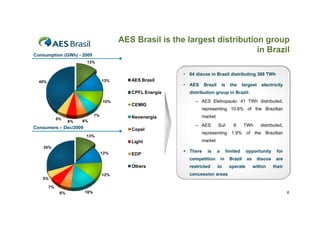

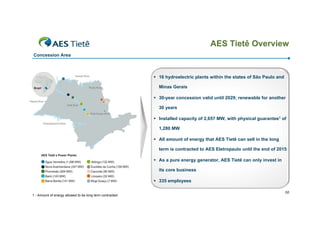

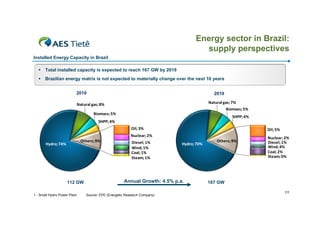

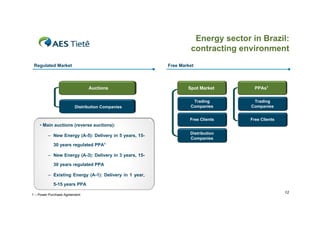

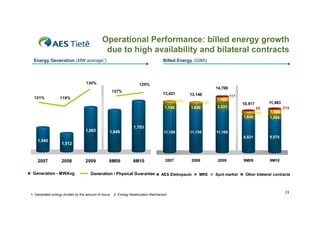

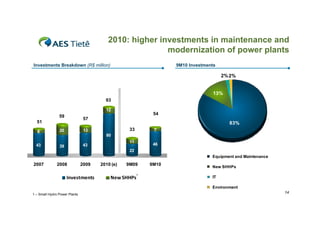

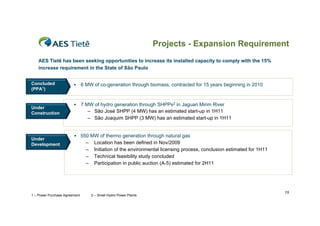

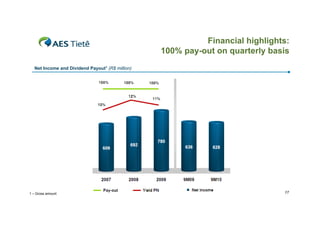

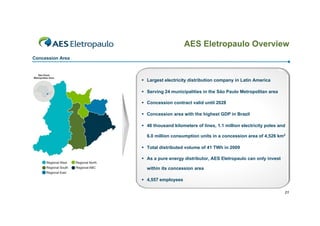

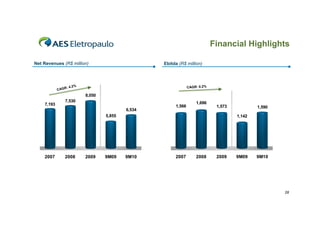

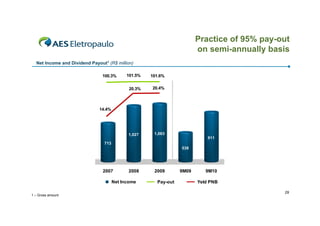

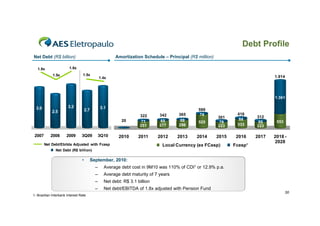

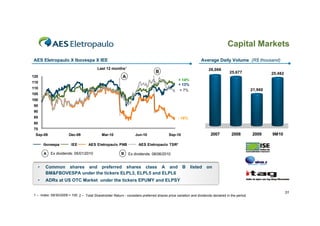

The document provides an overview of AES Brasil Group, which has a presence in Brazil since 1997 and is comprised of seven companies in the energy, distribution, trade and telecommunications sectors. It invests billions in Brazil and has over 7,000 employees. AES Brasil has strong corporate governance and sustainability practices. It has a differentiated dividend policy among its companies. The document also outlines AES Brasil's recognition for quality, safety, management excellence and environmental concern. It provides shareholding structures and lists AES Brasil as the second largest group in the Brazilian electric sector based on EBITDA and net income.