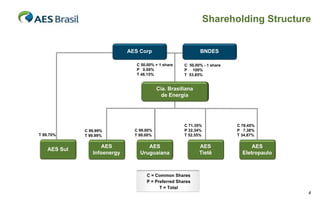

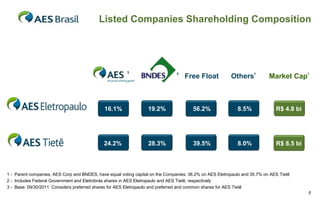

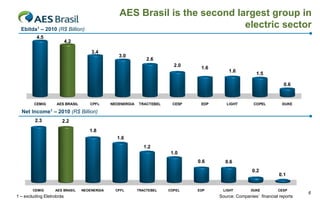

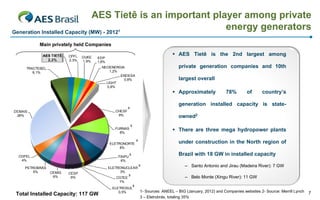

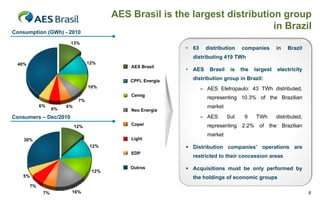

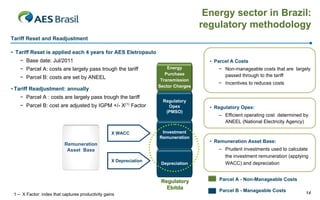

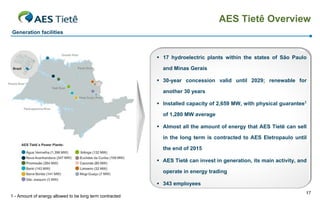

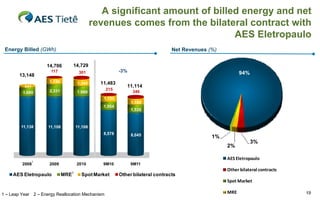

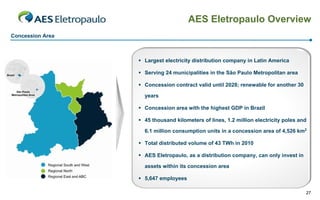

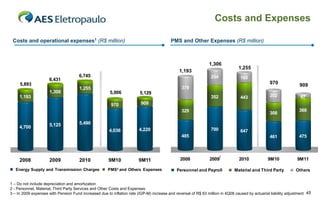

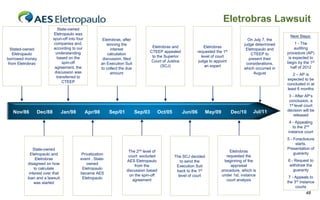

AES Brasil Group is a large energy company in Brazil comprised of four companies in the sectors of energy generation and distribution. It has been operating in Brazil since 1997, and has invested $6.9 billion from 1998-2010. It employs over 7,400 people and has good corporate governance and sustainability practices. A significant portion of AES Tietê's billed energy and net revenues comes from its long-term bilateral contract to supply energy to AES Eletropaulo, Brazil's largest electricity distribution company.