The Q2 2012 Appcelerator/IDC Mobile Developer Survey Report found:

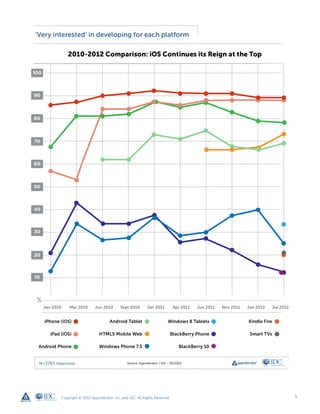

1) Apple's iOS opened a 16% lead over Google's Android among developers who said which platform would win in the enterprise, at 53% to 37%.

2) Interest in developing for Android stabilized after declining in previous surveys, with 78% of developers saying they were very interested in Android phones and 69% in tablets.

3) Developers were cautiously optimistic about Windows 8 tablets, seeing opportunity for Microsoft to displace Android as the number two platform, though interest in Windows phones dropped sharply.