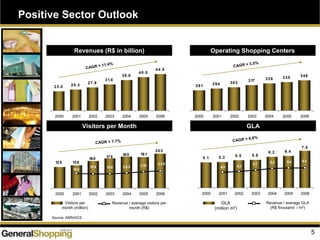

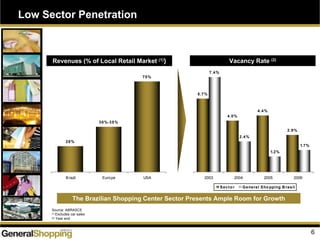

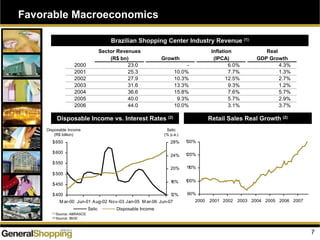

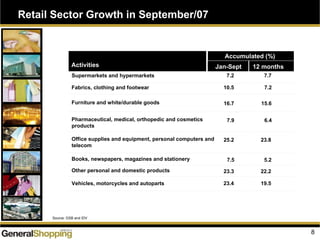

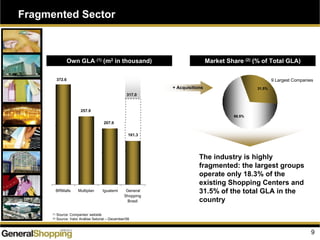

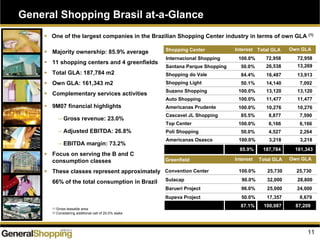

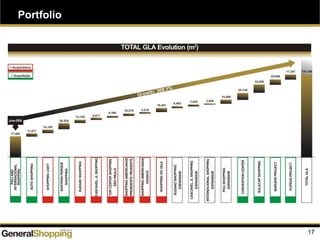

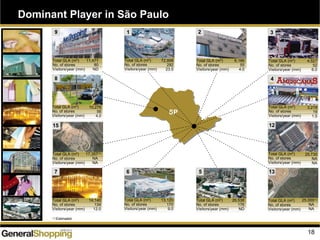

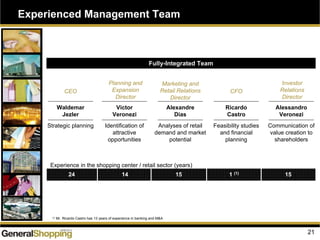

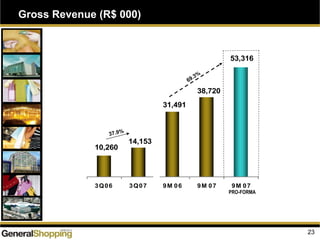

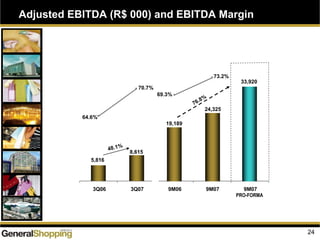

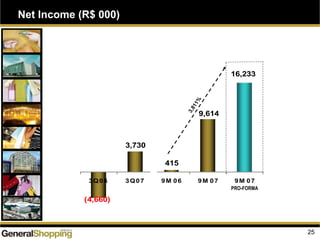

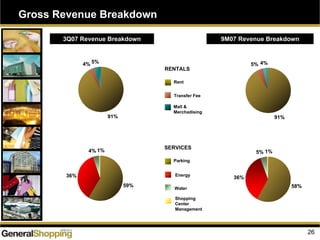

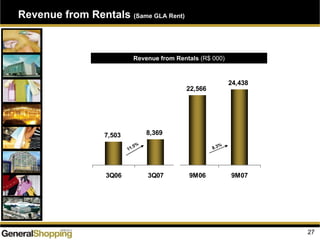

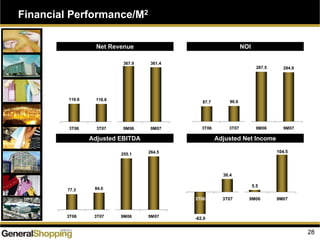

This presentation summarizes General Shopping Brasil's analyst and investor meeting that took place on December 17, 2007. It highlights the company's growth in gross revenues and adjusted EBITDA through both greenfield projects and acquisitions. General Shopping Brasil owns and operates 11 shopping centers in Brazil with plans for expansion. The presentation also provides an overview of the positive outlook for Brazil's shopping center sector and General Shopping Brasil's competitive advantages, including its experienced management team.