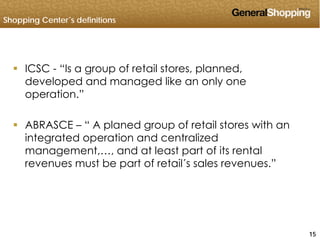

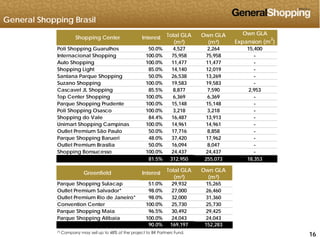

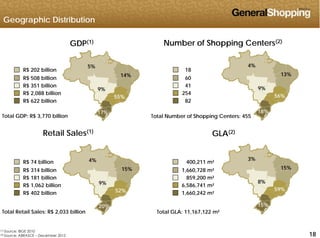

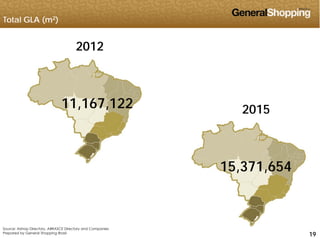

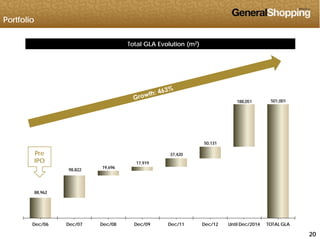

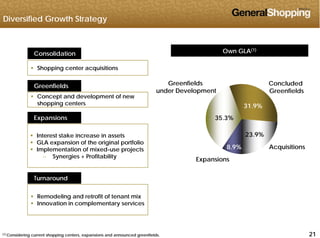

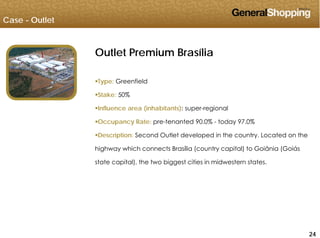

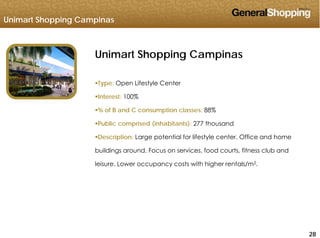

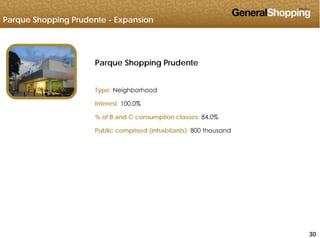

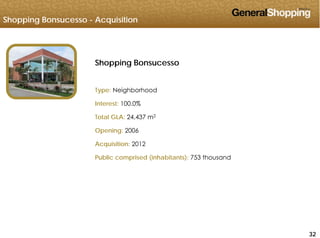

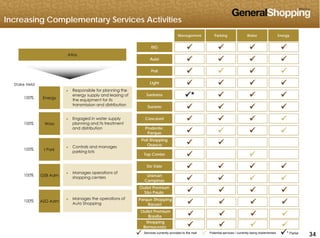

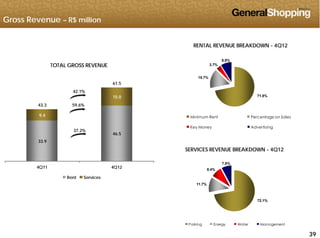

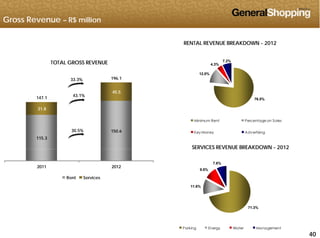

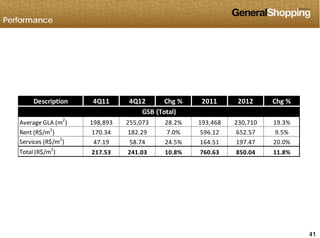

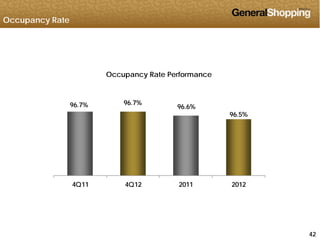

This document provides an overview of General Shopping Brasil, a Brazilian shopping center company. It owns interests in 20 shopping centers across Brazil with over 255,000 square meters of owned GLA and plans to develop 5 new shopping centers with over 152,000 square meters of GLA. The company has a geographic focus in the more economically developed South and Southeast regions of Brazil which represent over 70% of the country's GDP and retail market. Financial and operating metrics are presented for the company and the shopping center industry in Brazil.