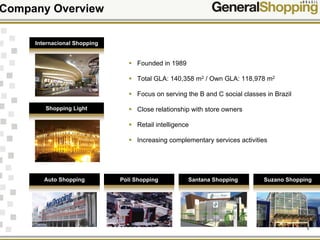

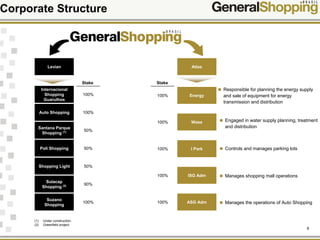

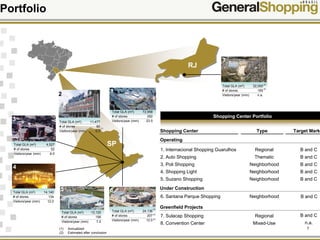

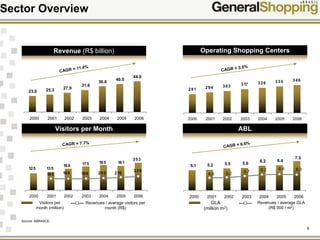

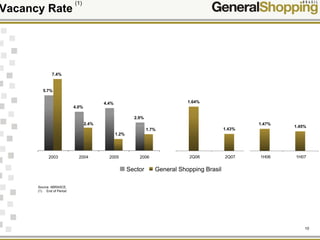

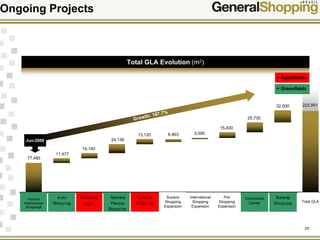

General Shopping Brasil is a Brazilian shopping center company that owns and operates 7 shopping centers with over 140,000 square meters of GLA. The company has a growth strategy of acquiring additional shopping centers, expanding existing malls, and developing new projects. Some key ongoing projects include expansions of the Suzano and Internacional Shopping centers, as well as developing the new Sulacap Shopping regional mall. The company focuses on serving Brazil's B and C social classes and has close relationships with store owners to understand retail trends.