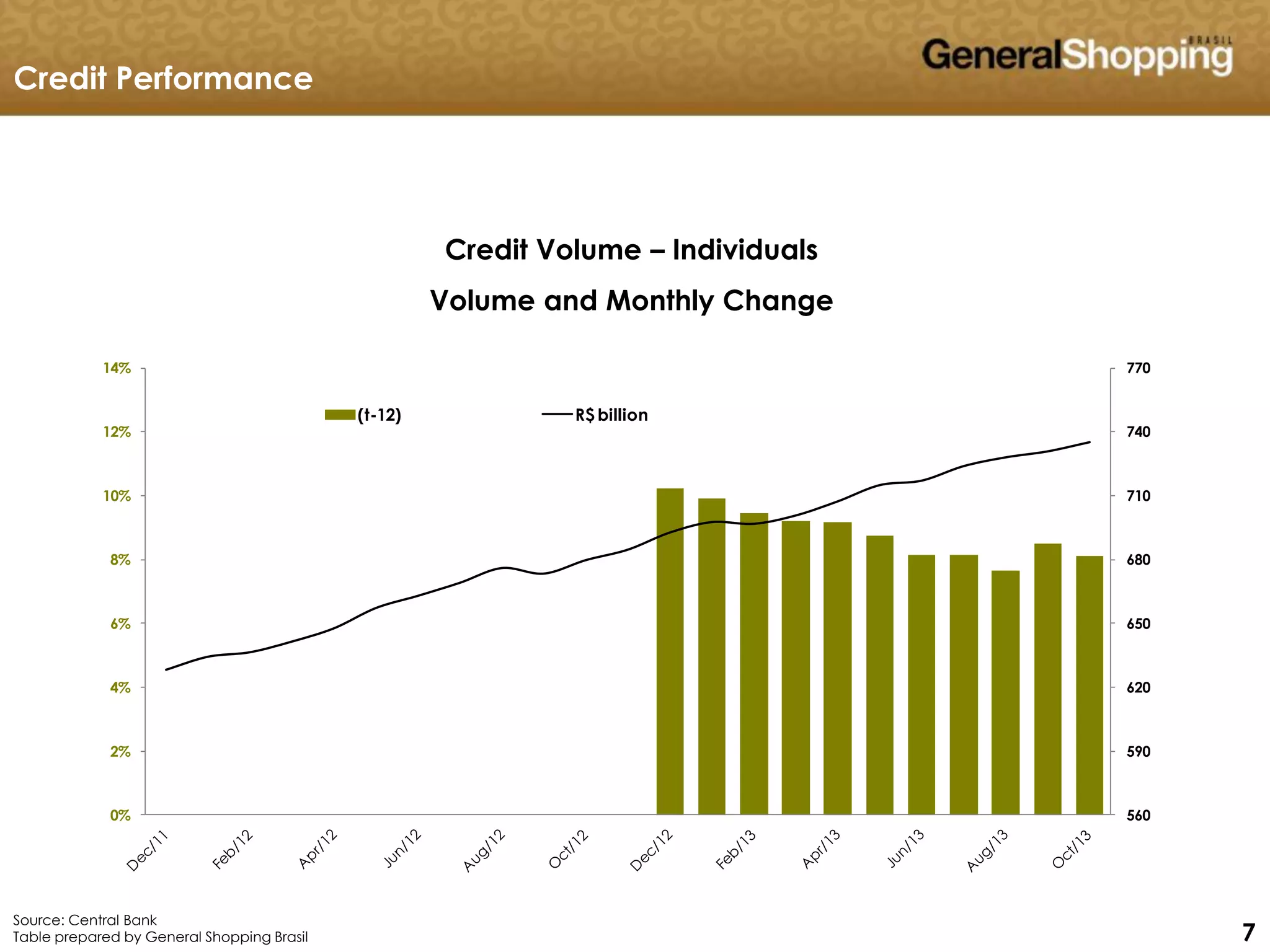

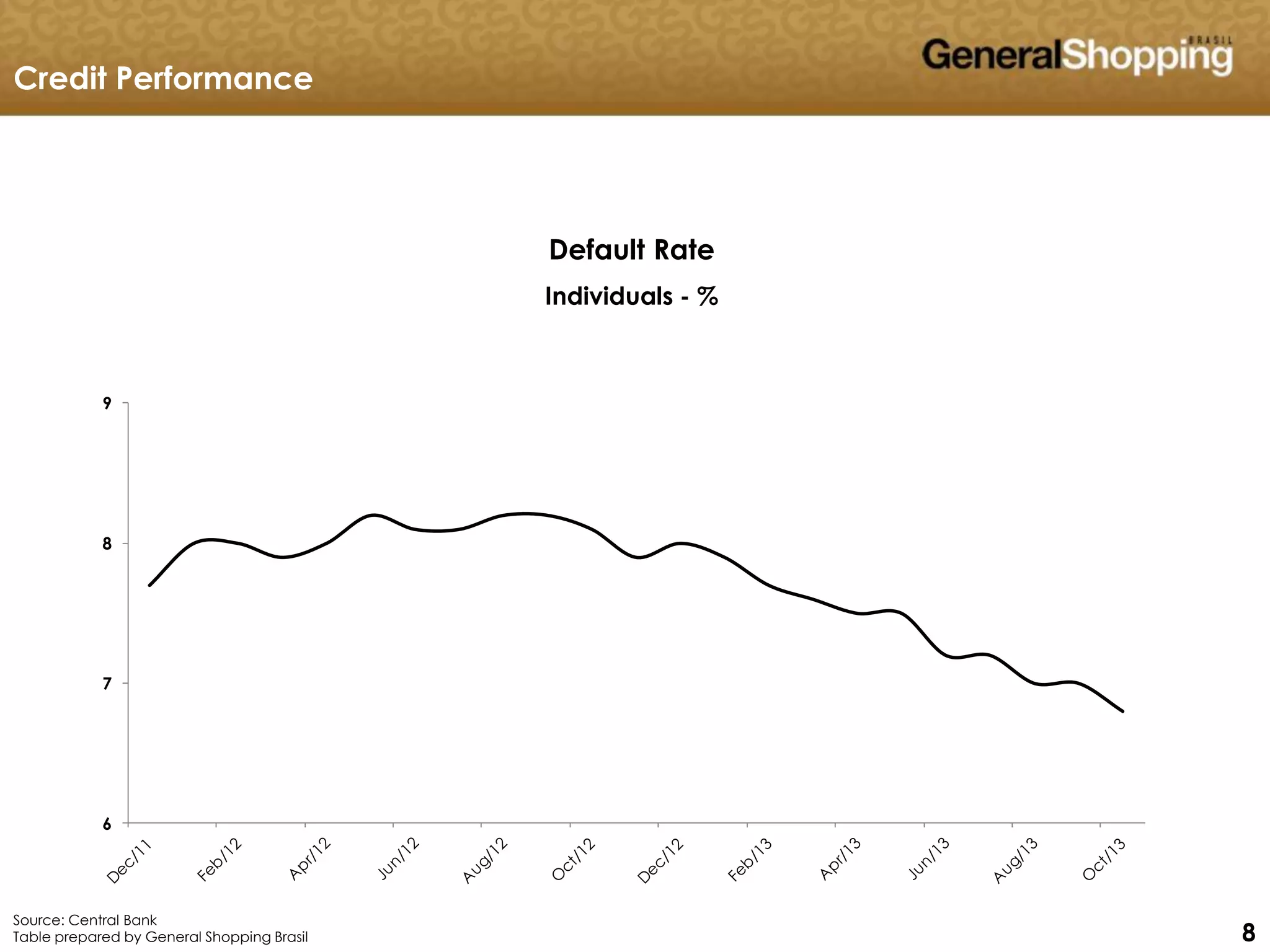

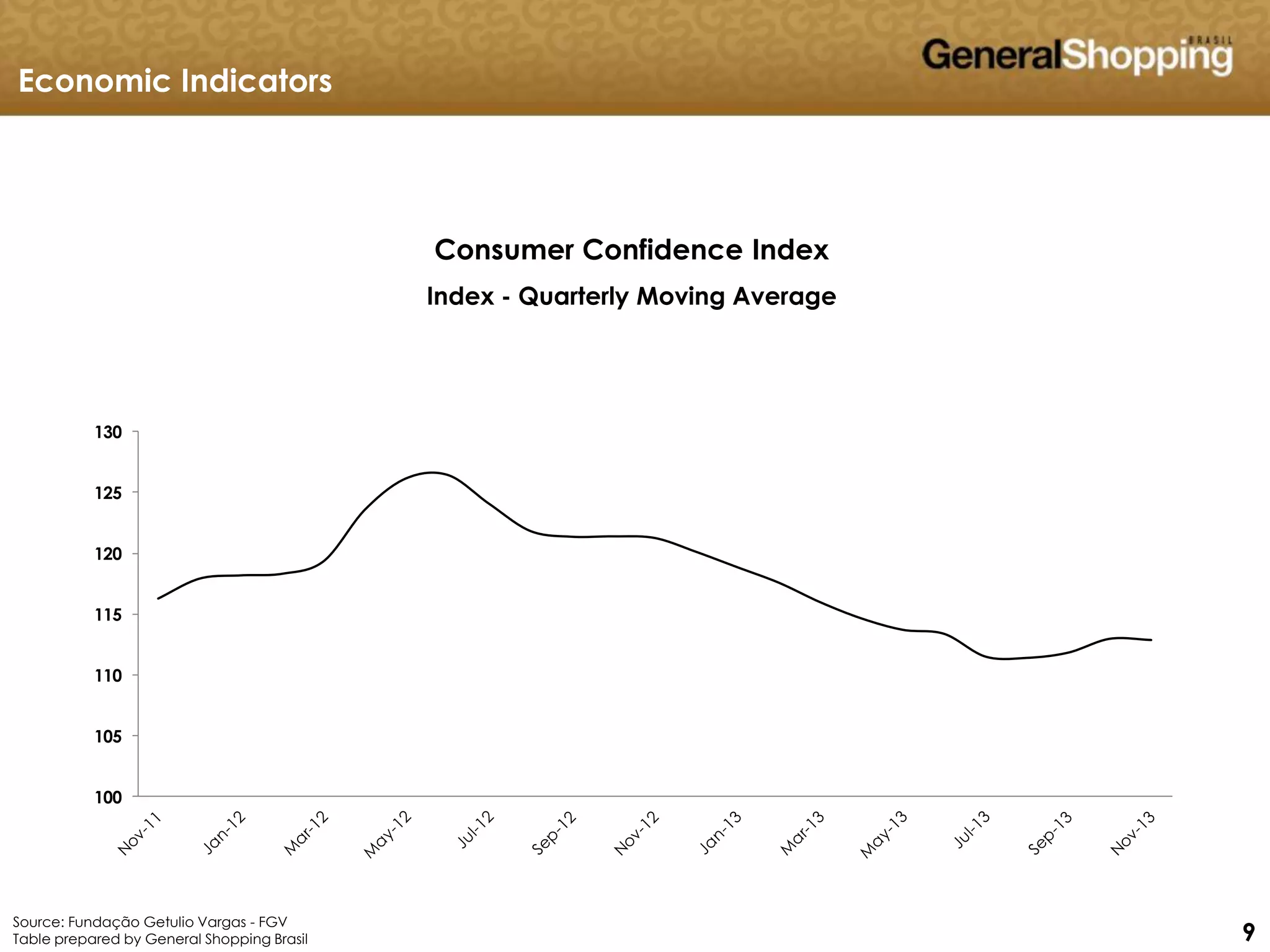

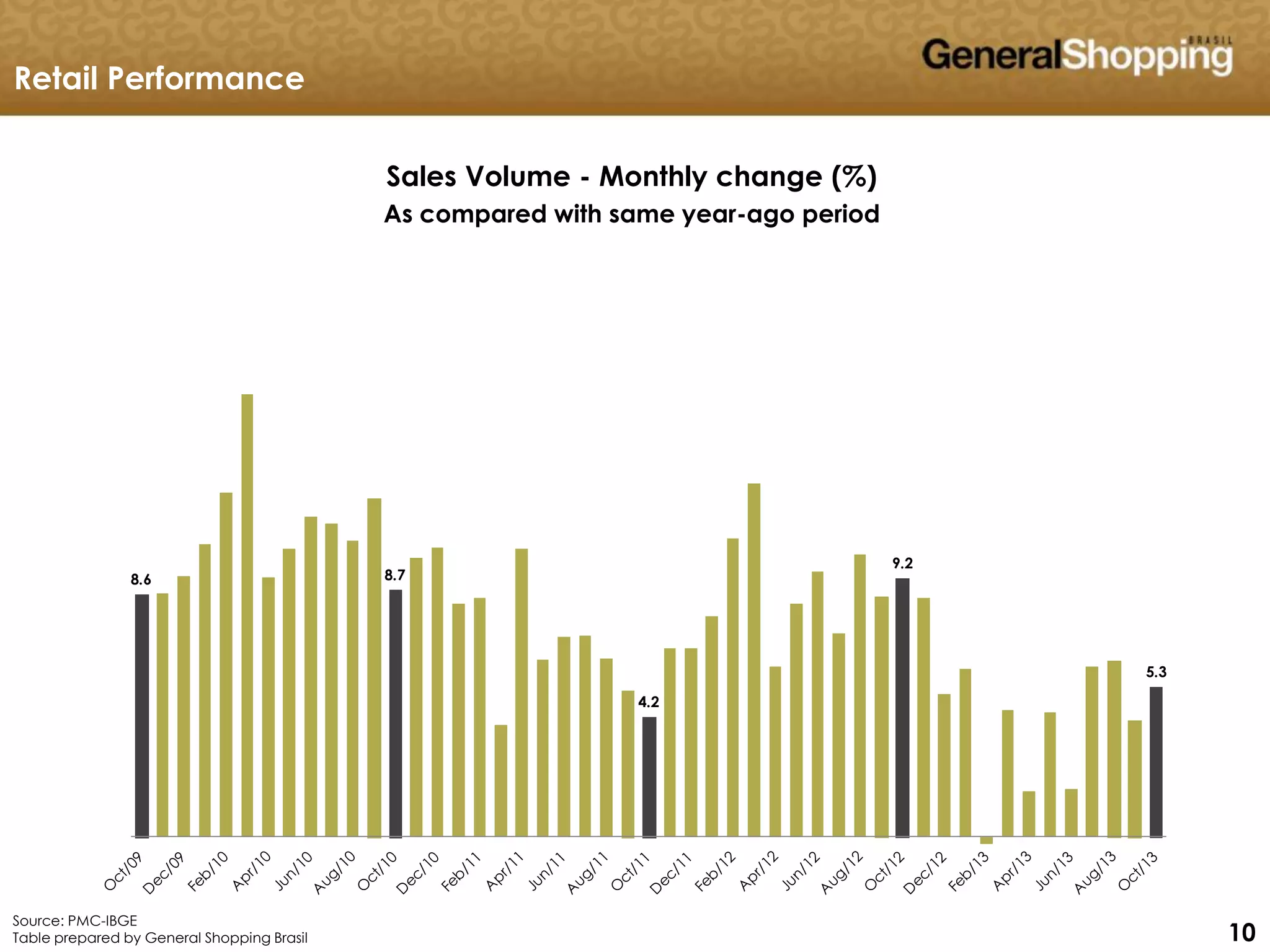

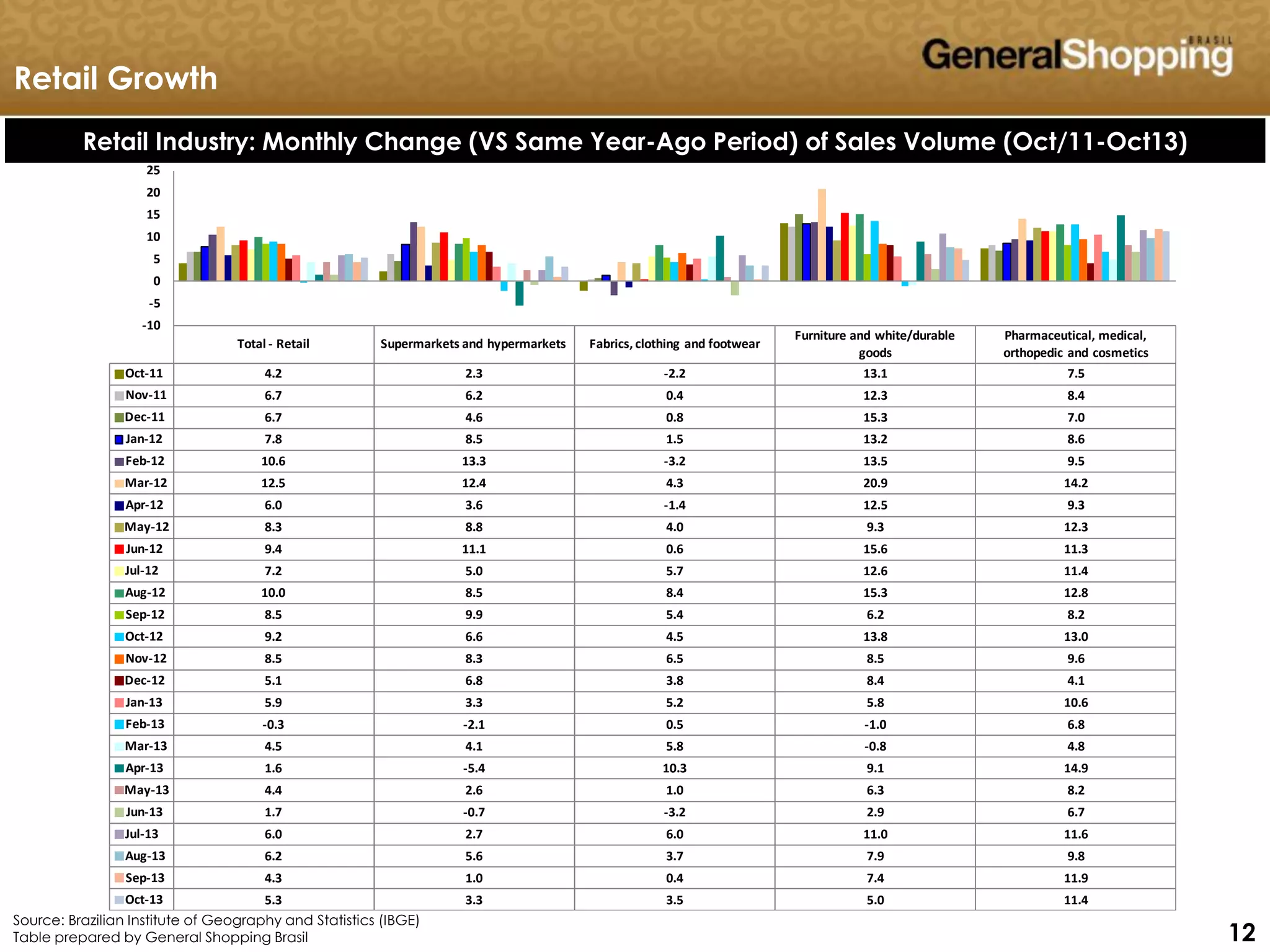

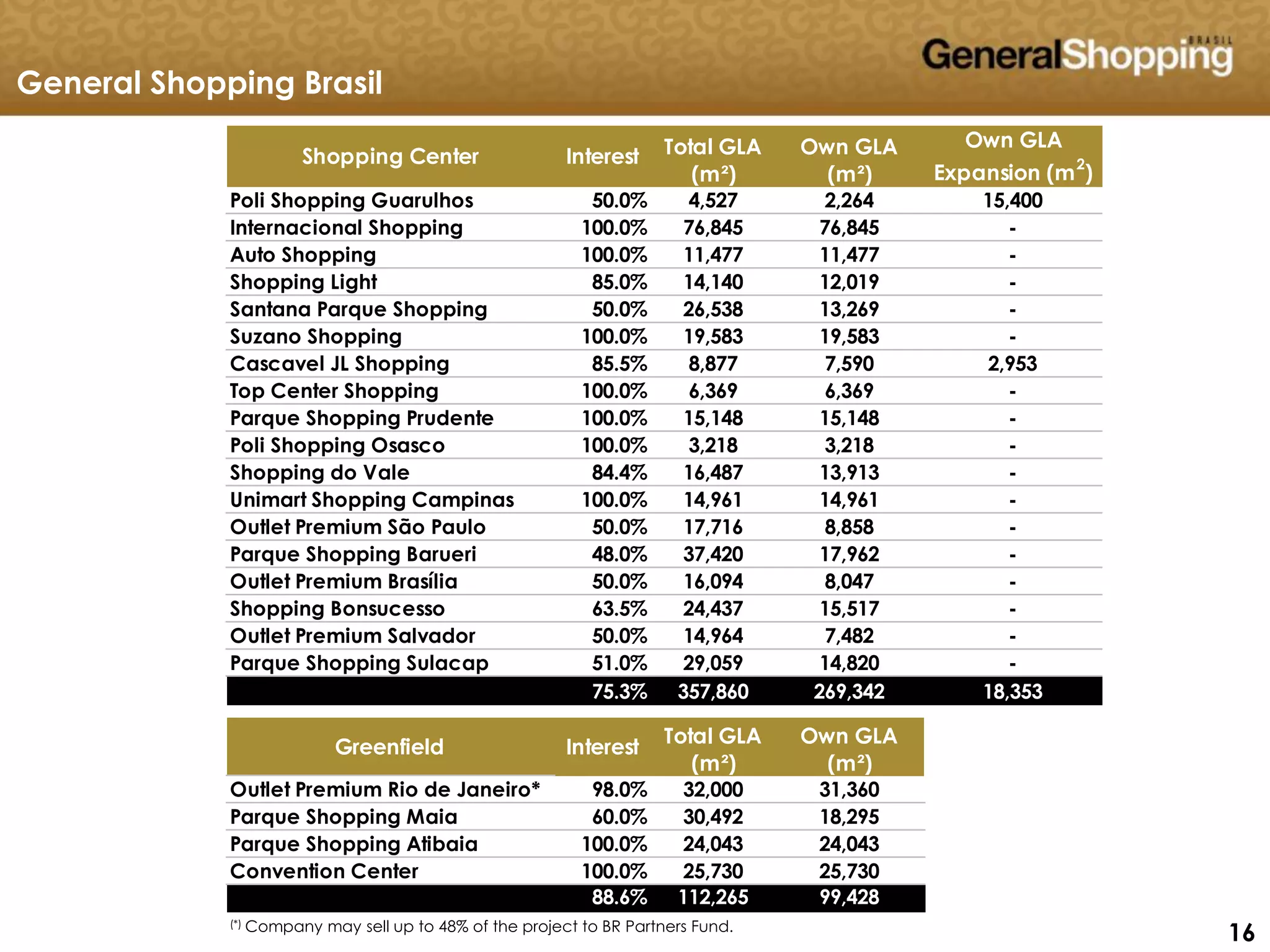

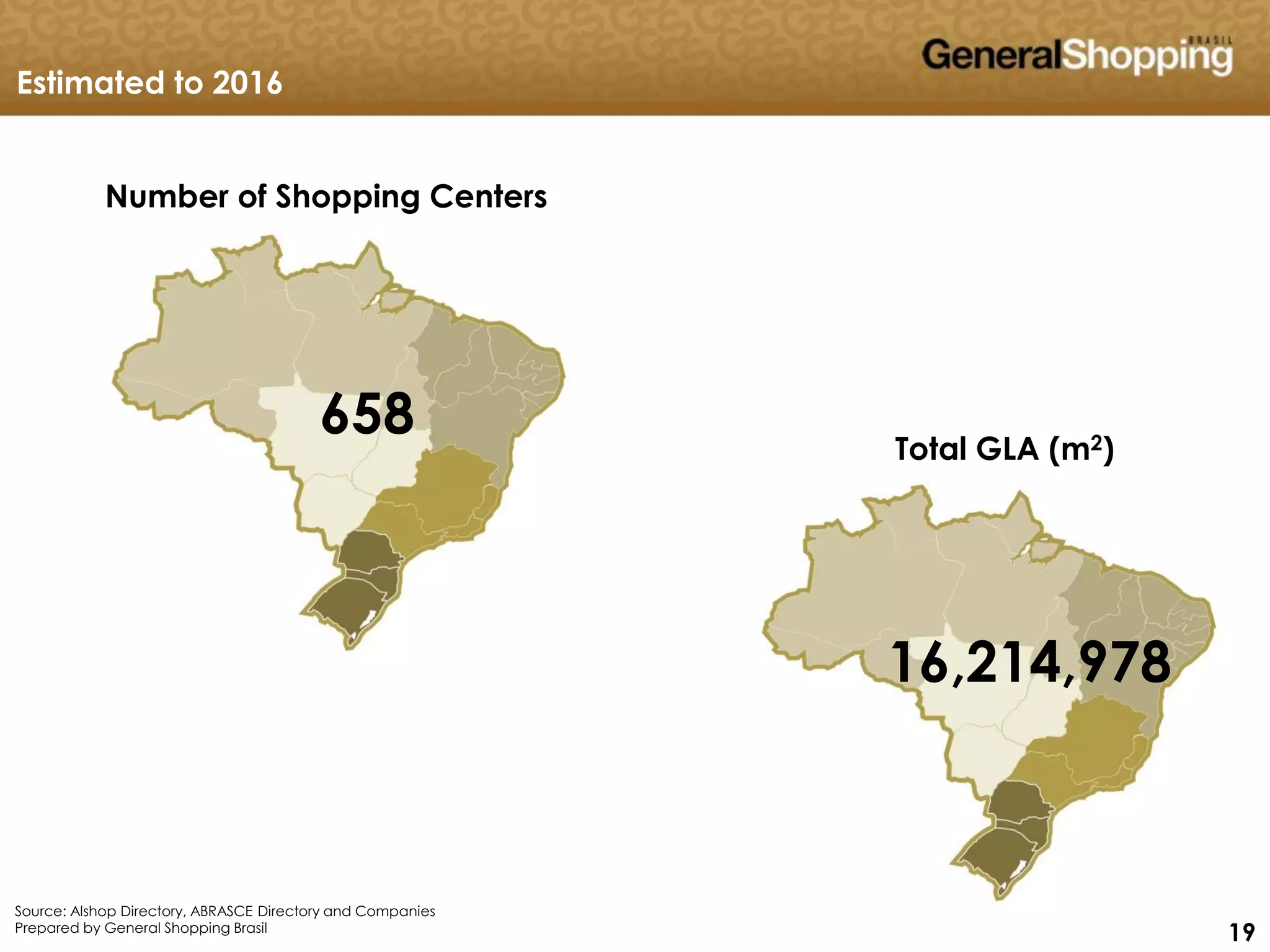

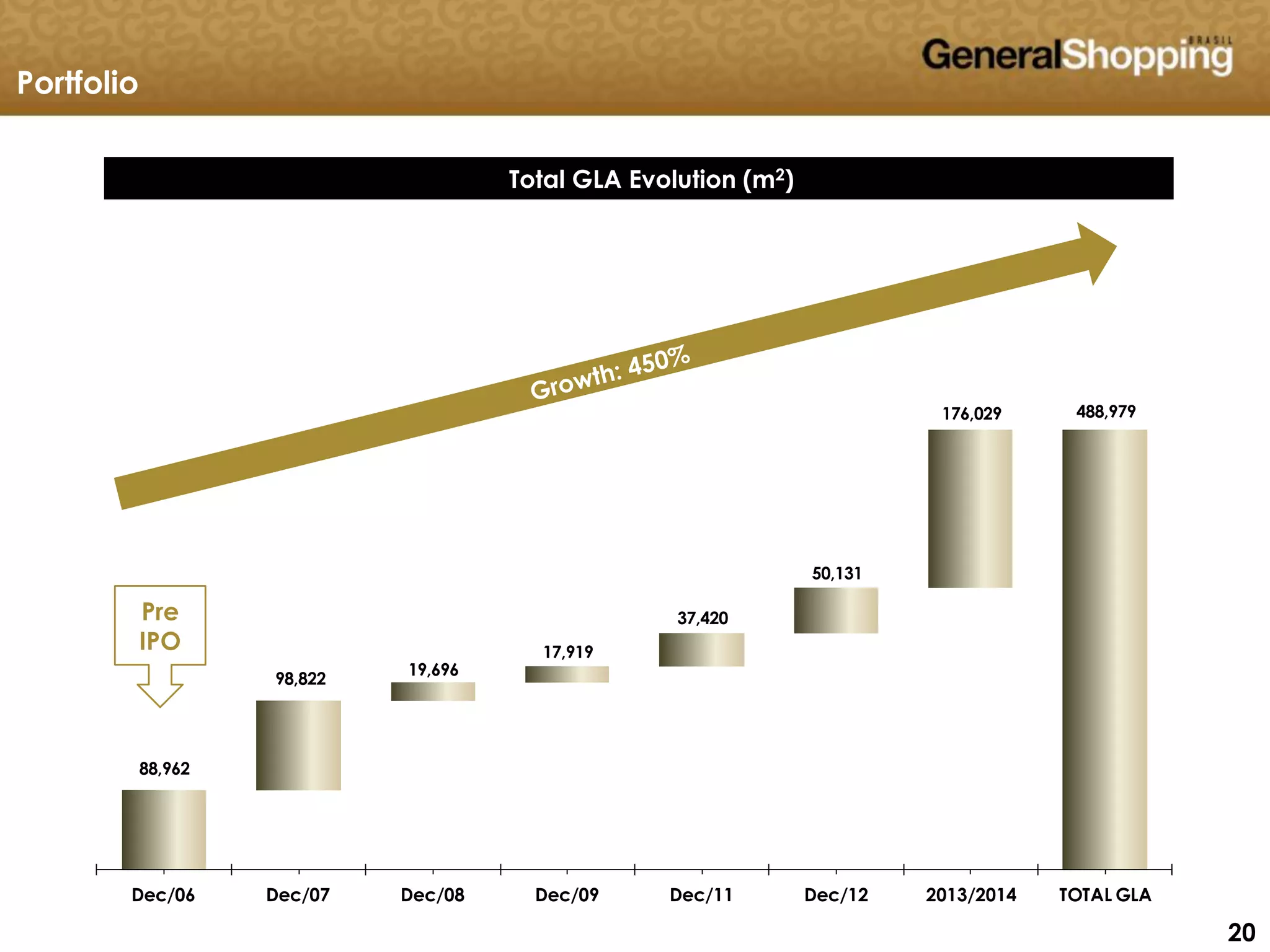

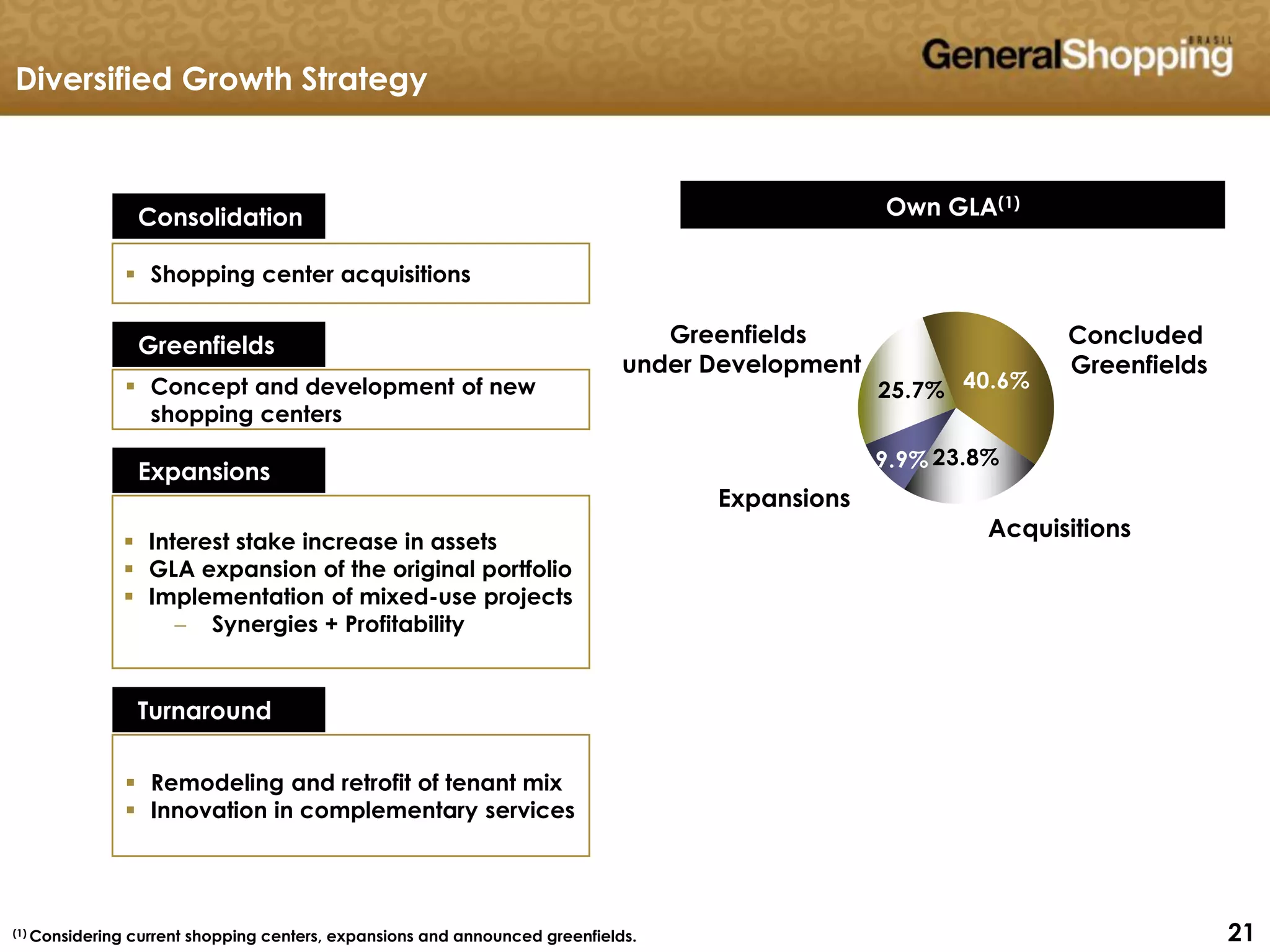

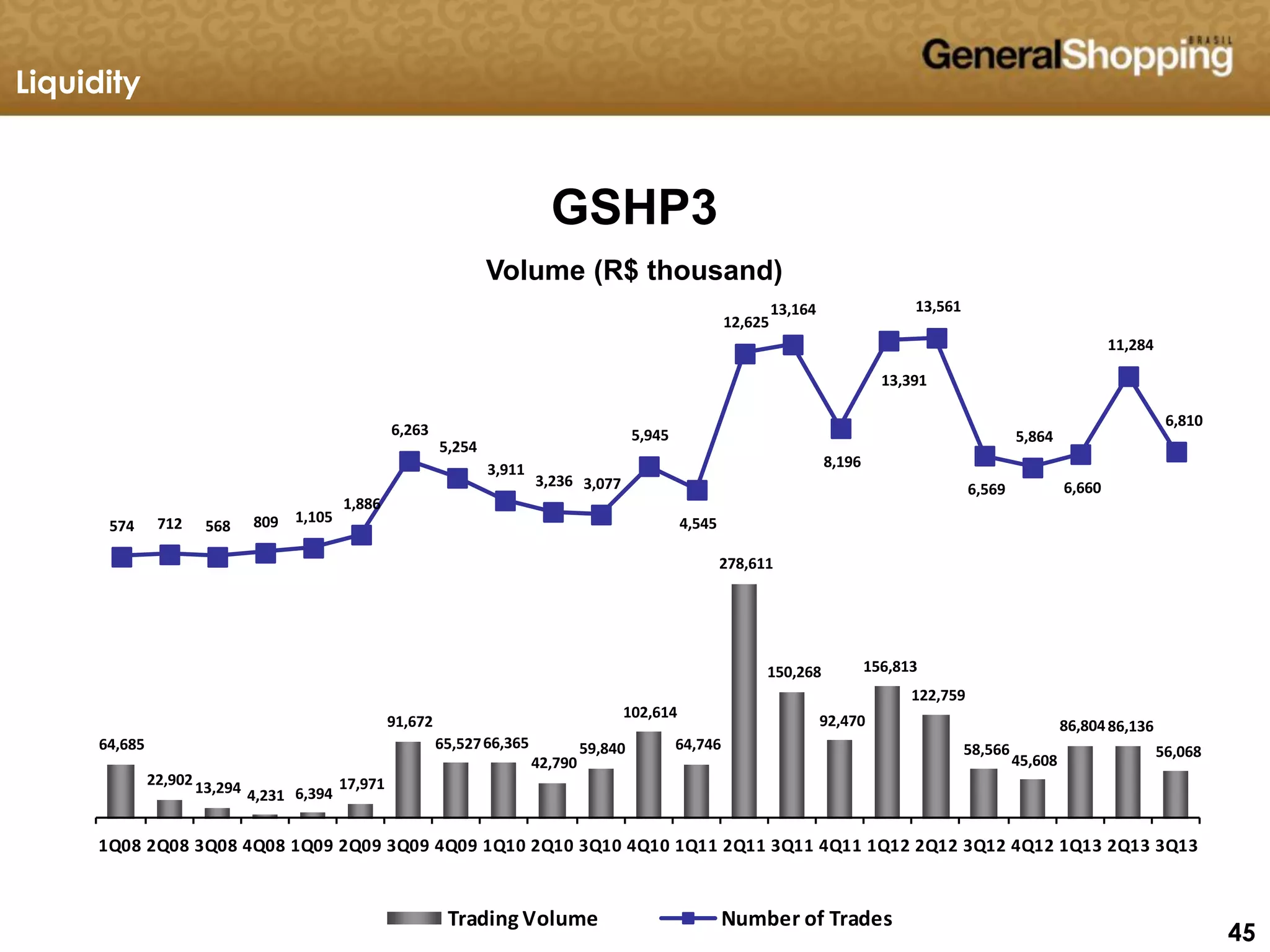

This presentation discusses forward-looking statements and disclaimers. It then outlines General Shopping's sector overview, including economic indicators and retail performance data. It provides an overview of General Shopping, describing its differentials, portfolio of shopping centers, geographic distribution, and growth strategy of acquisitions, greenfields, expansions, and turnarounds.