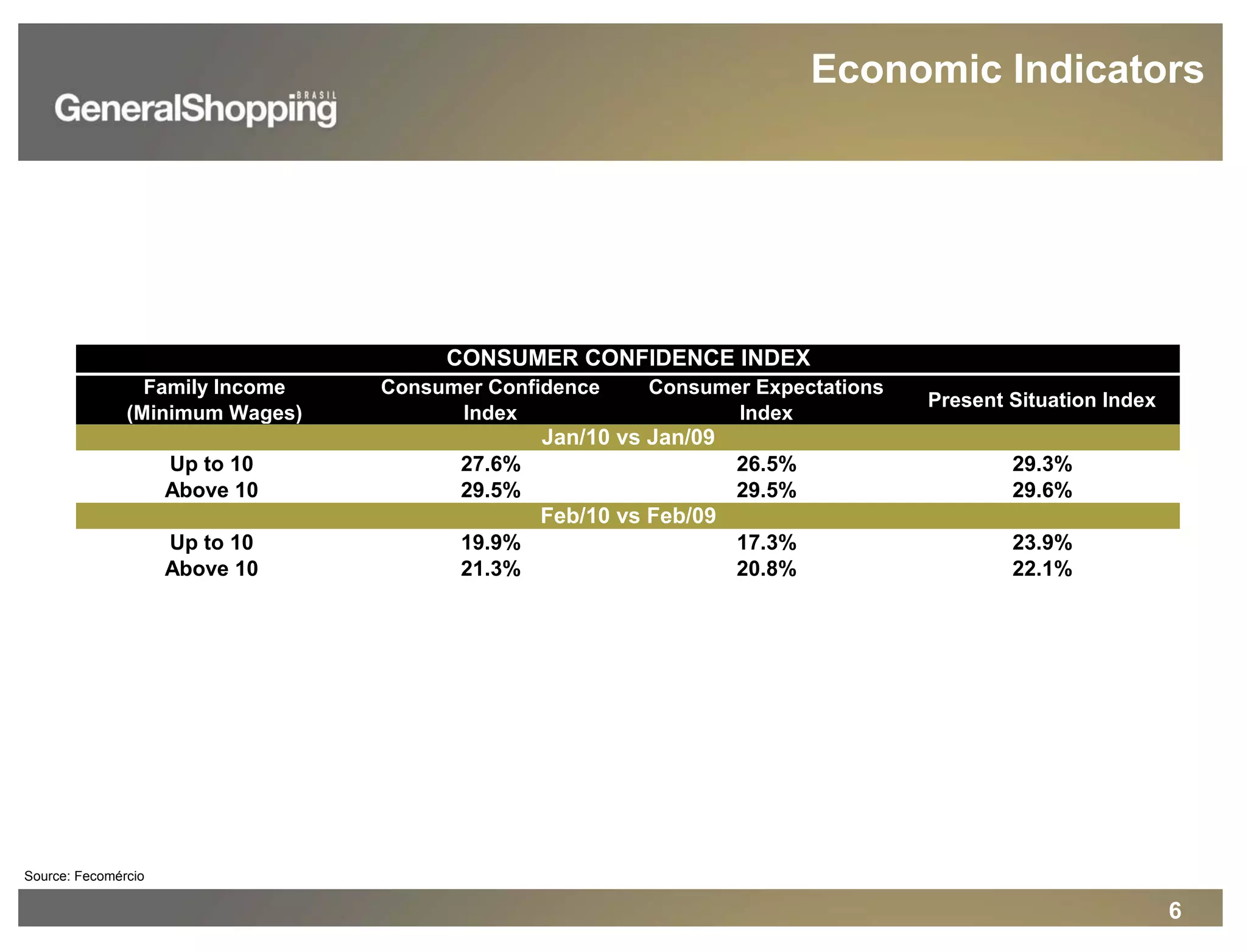

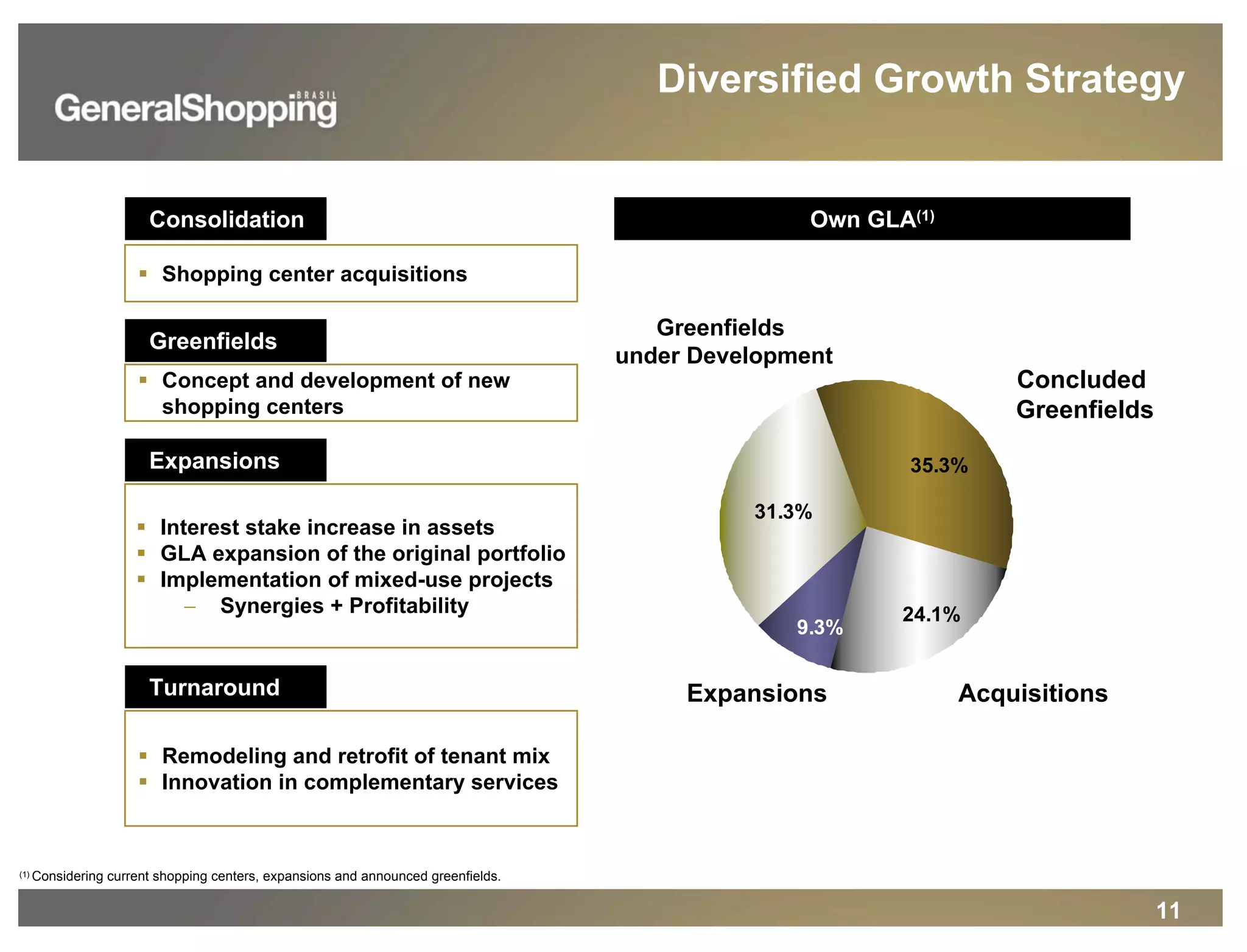

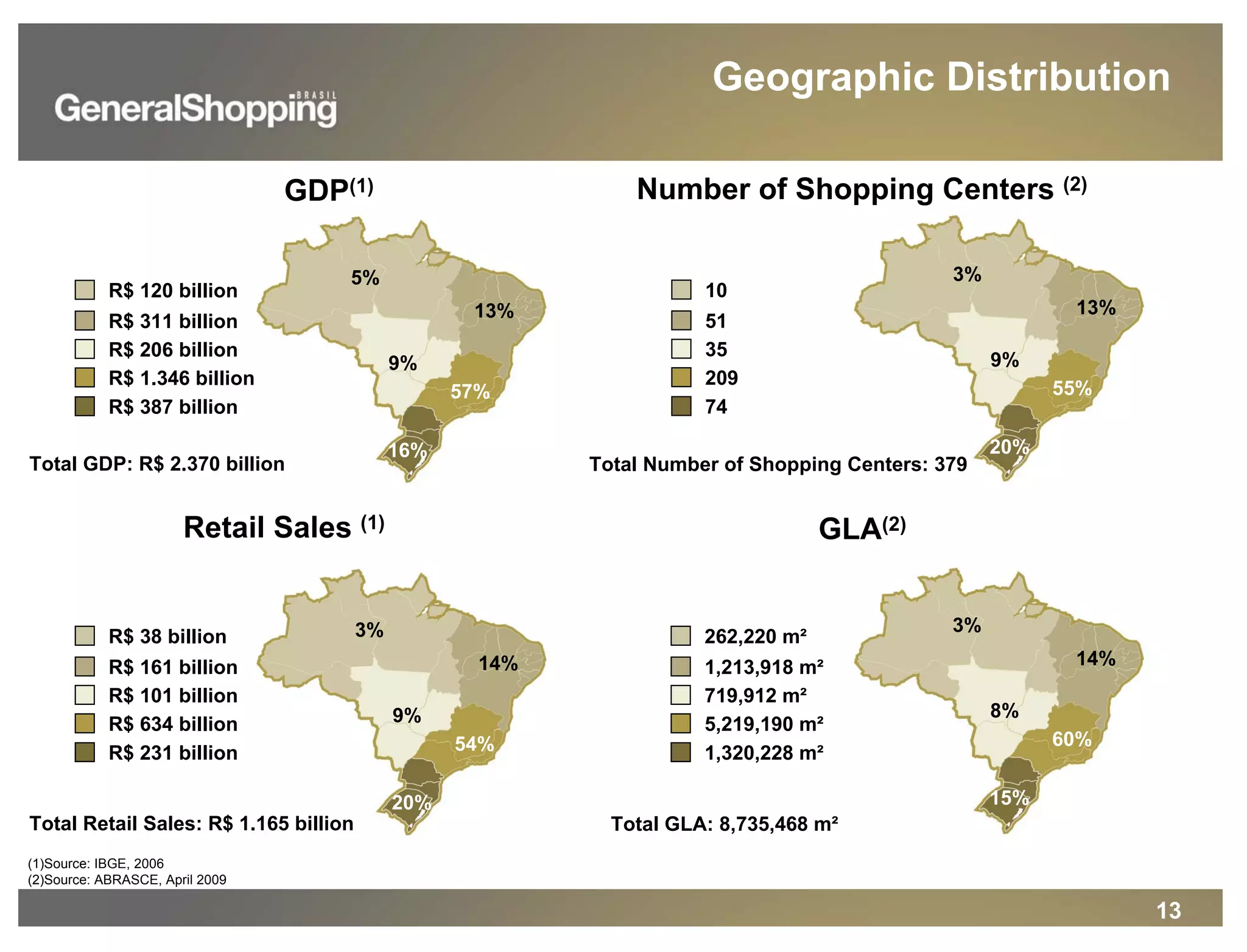

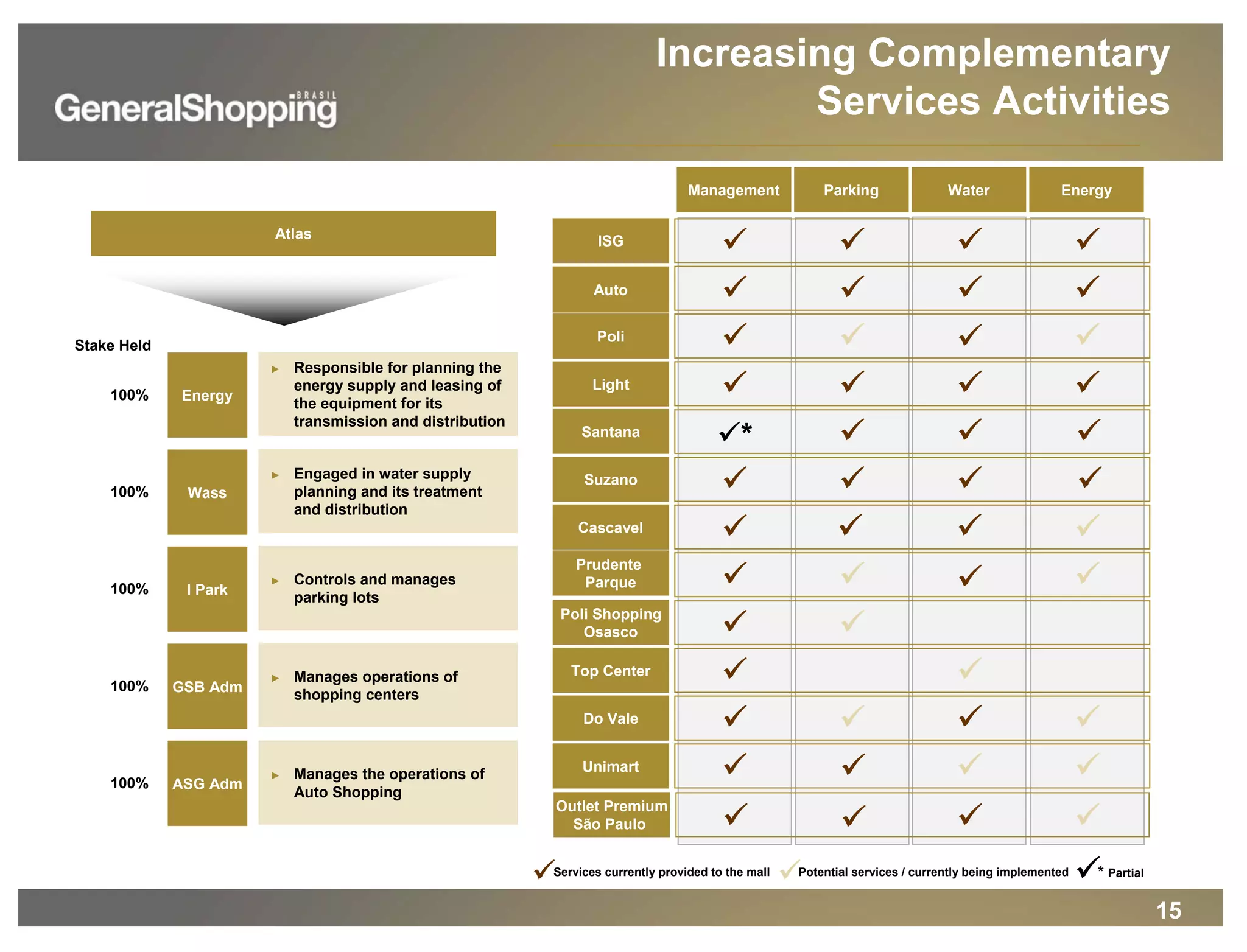

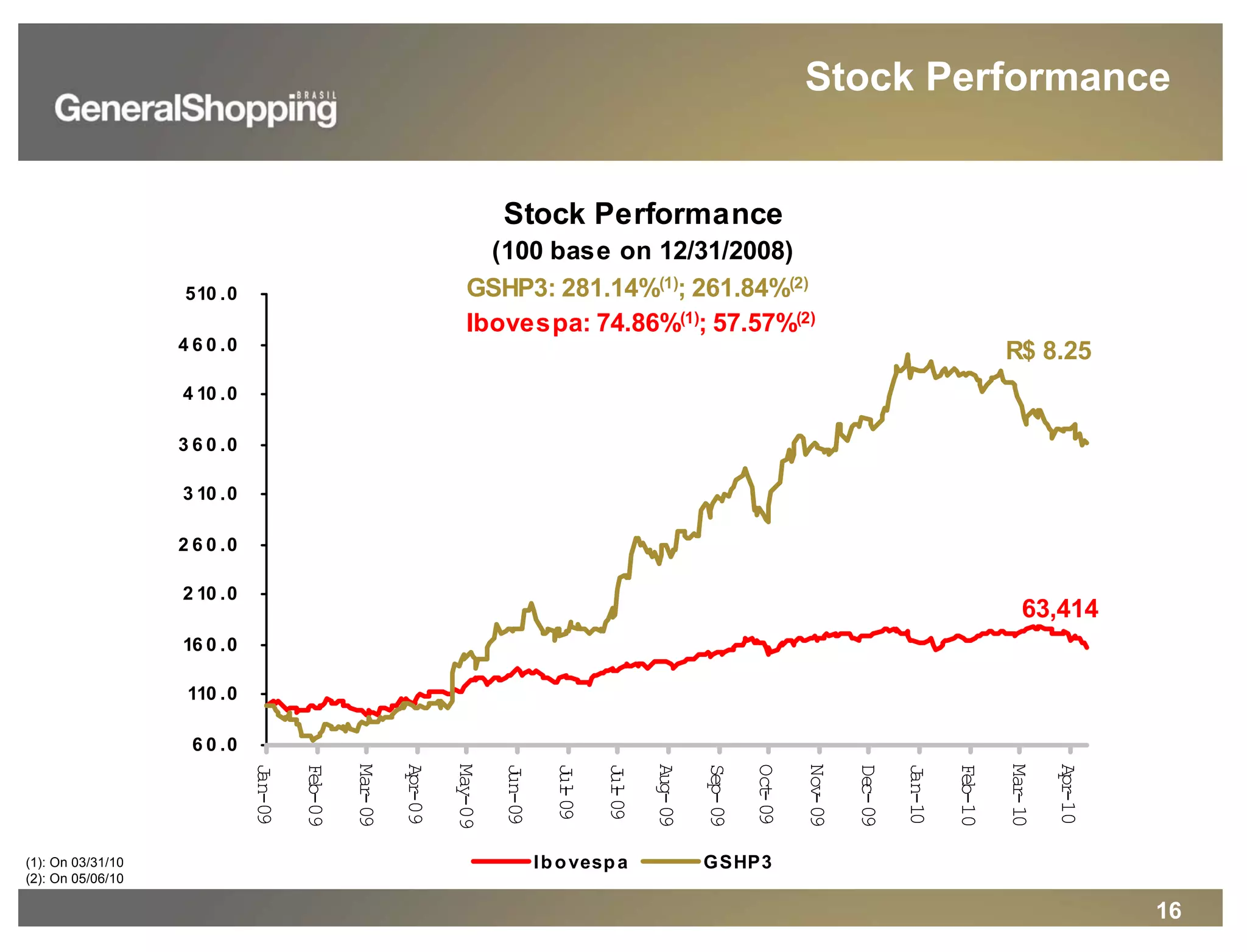

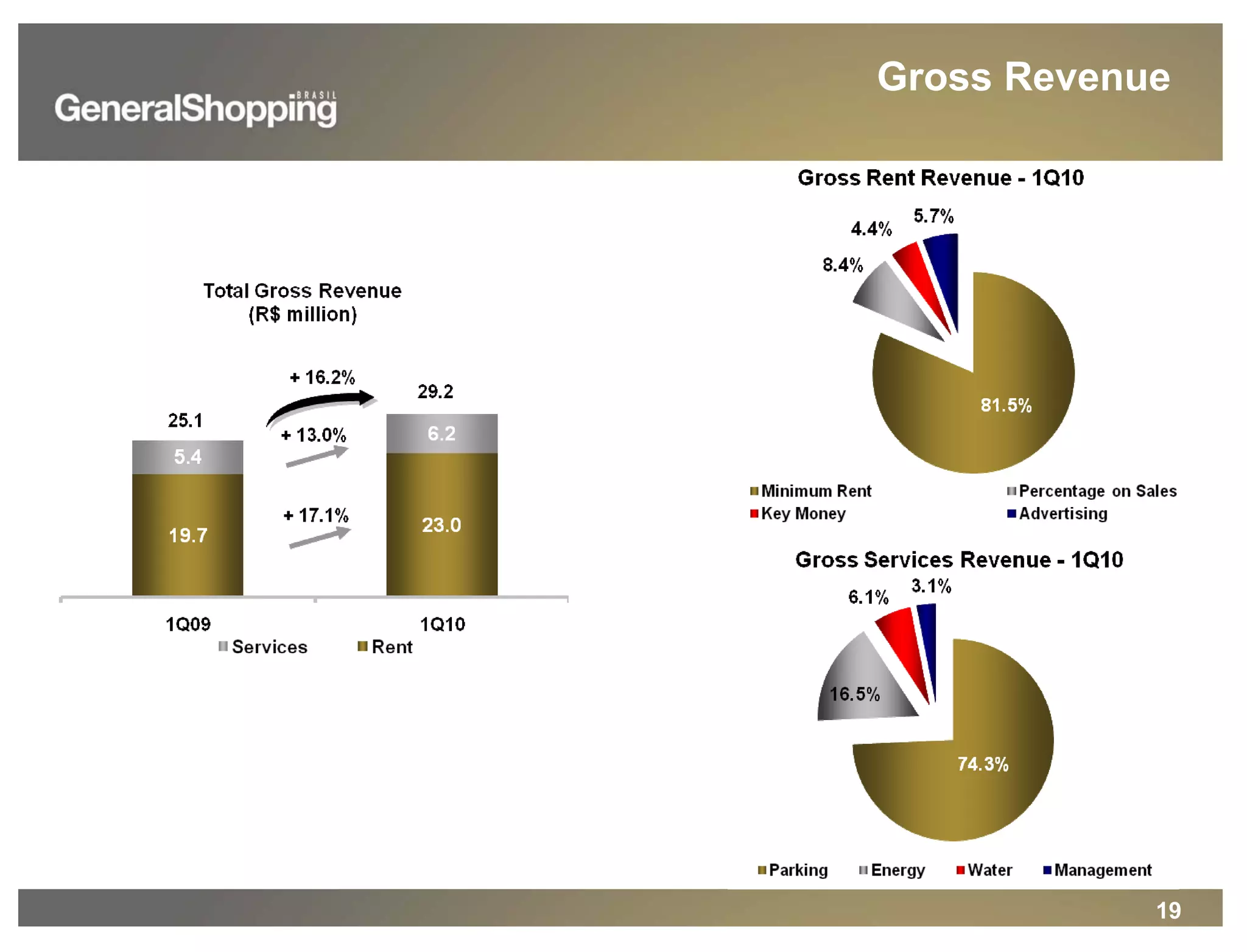

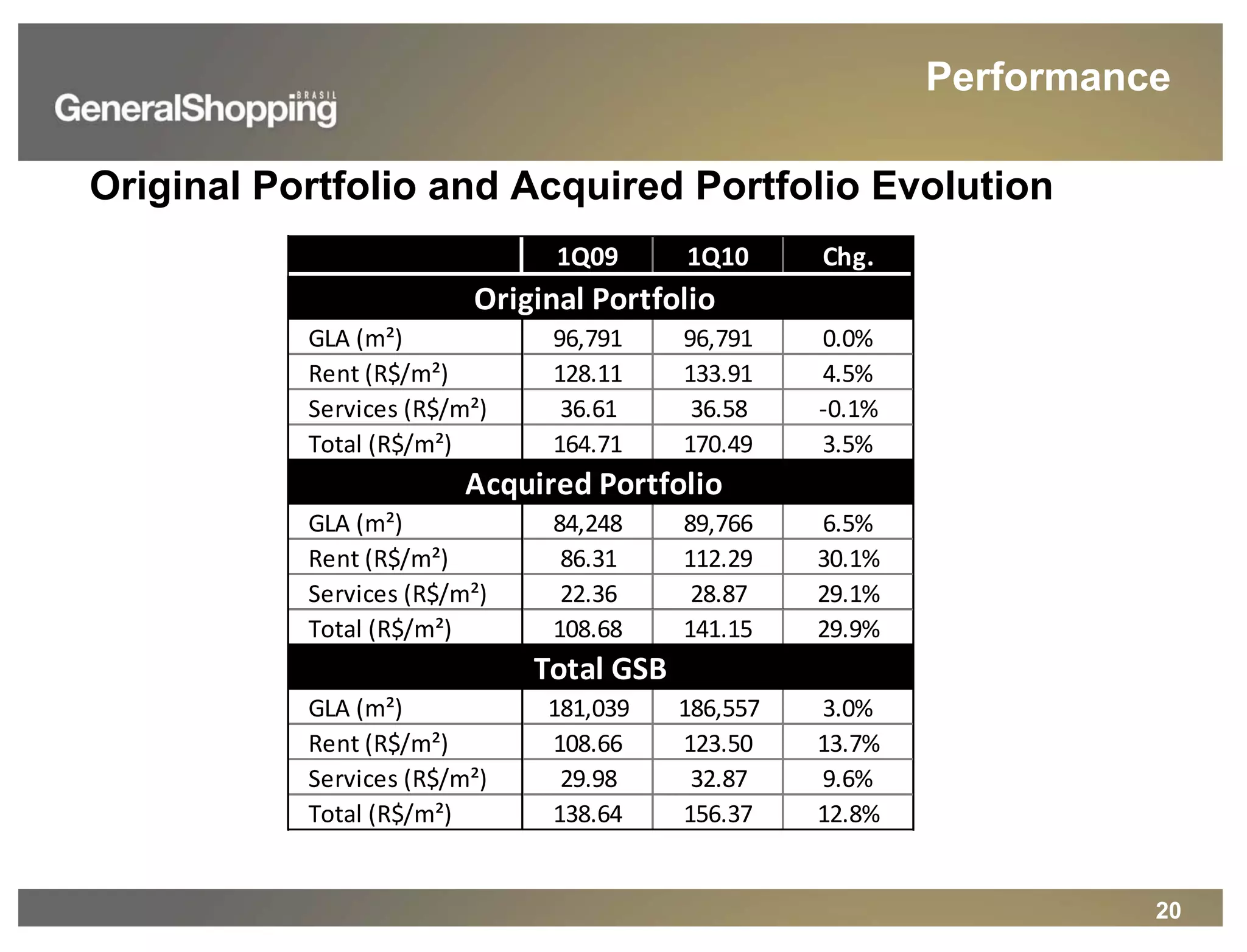

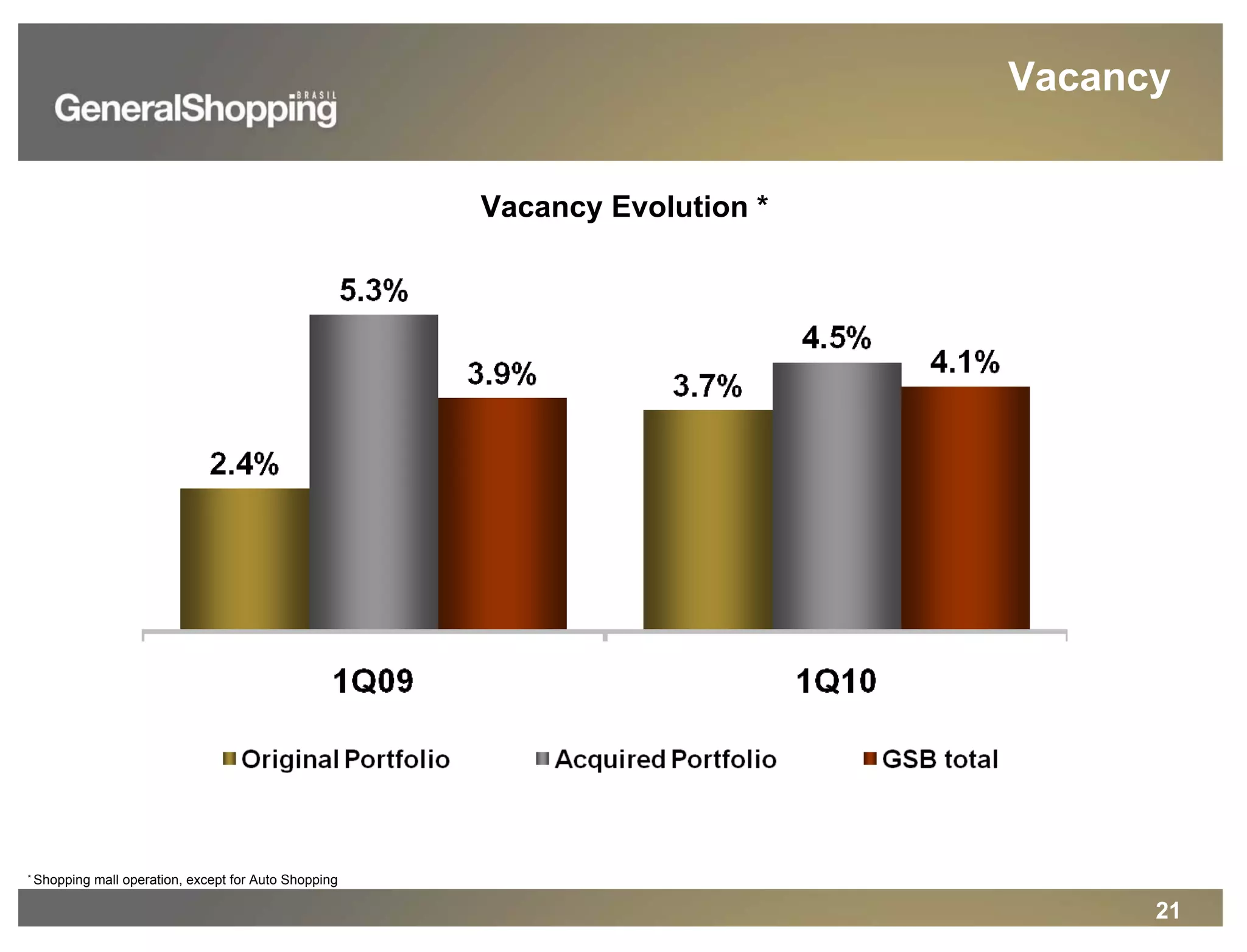

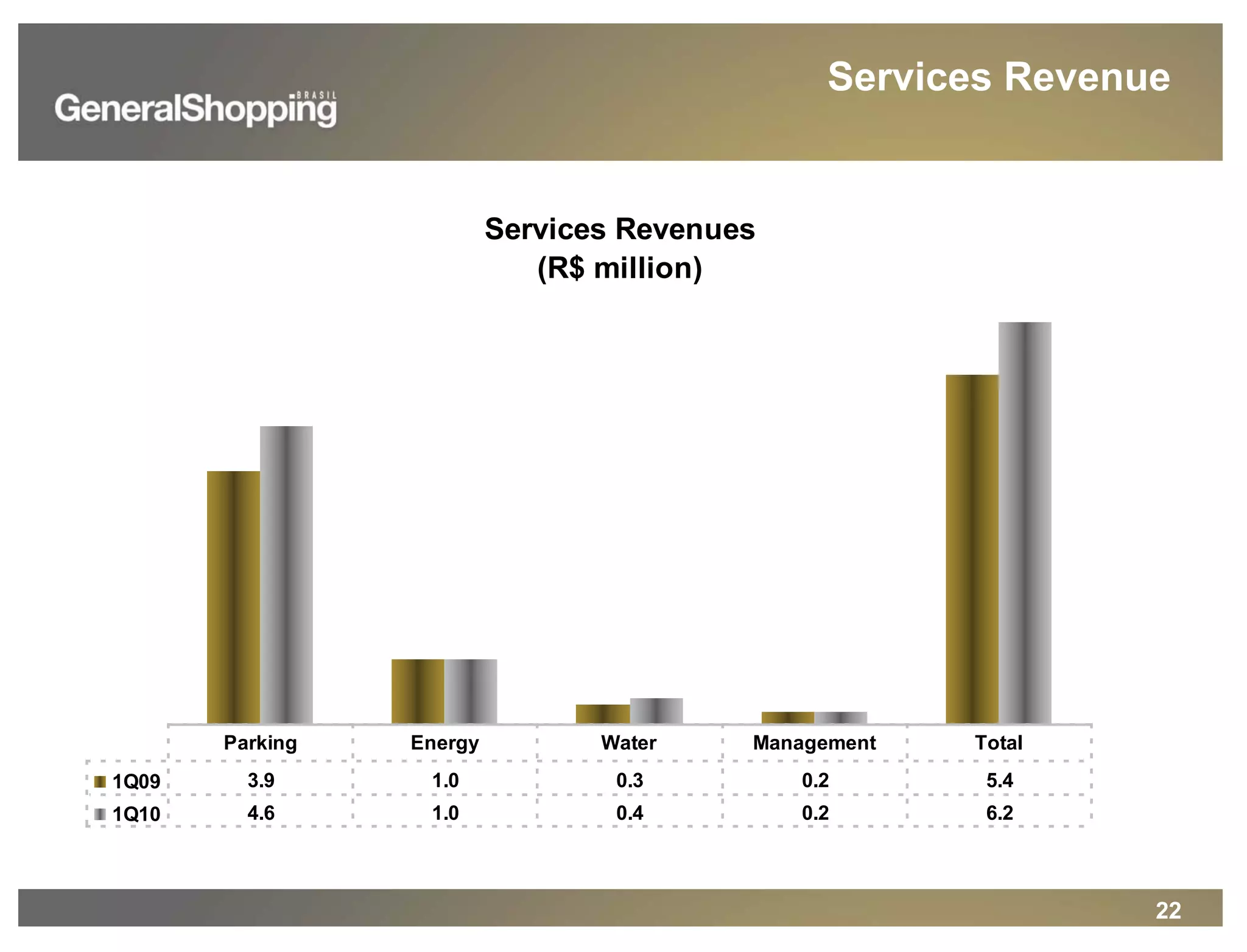

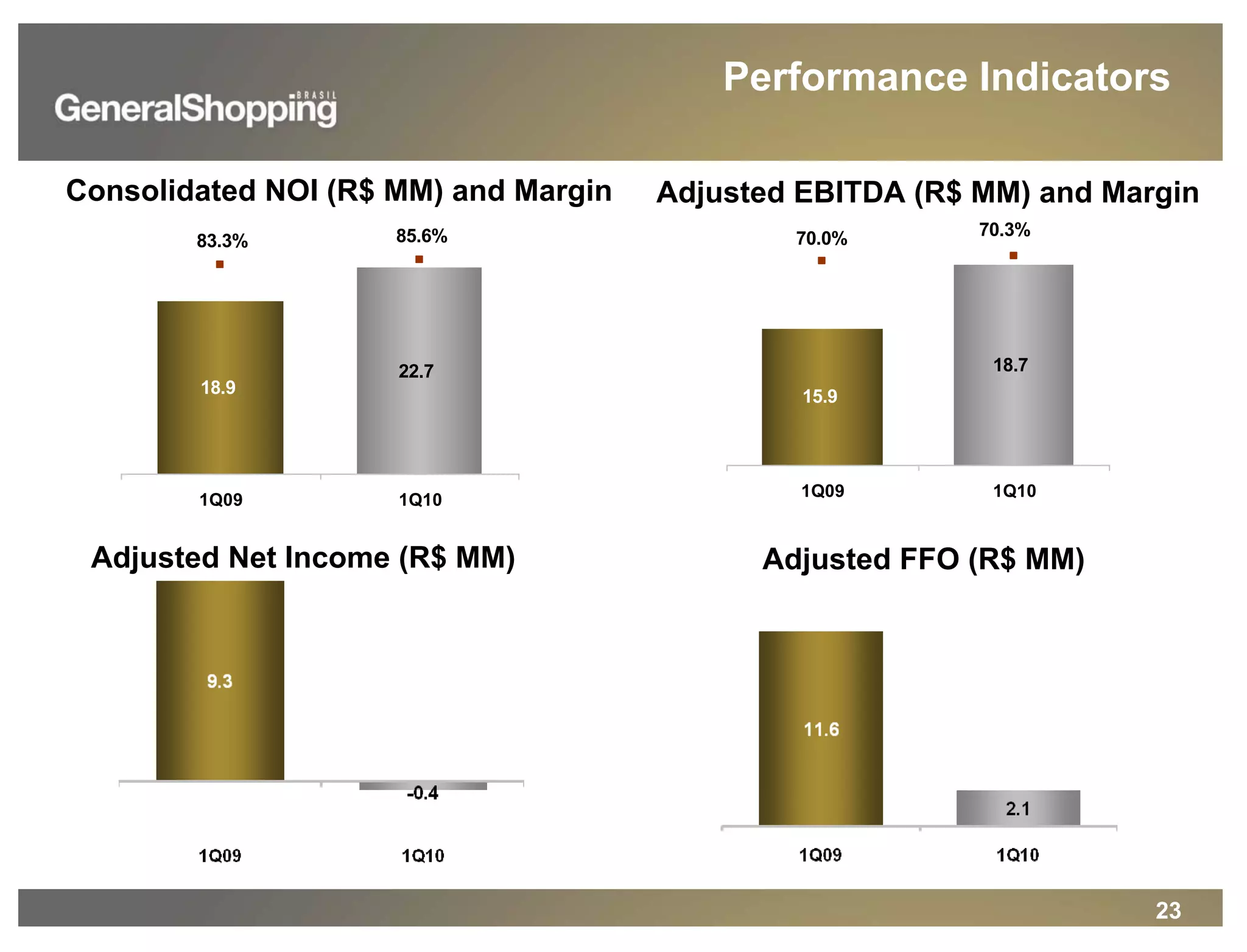

General Shopping Brasil reported its financial results for the first quarter of 2010. The company saw increases in key metrics such as gross revenue, net operating income, and adjusted EBITDA compared to the first quarter of 2009. Occupancy rates remained stable and the company continued its strategy of diversifying growth through acquisitions, greenfield developments, and expanding existing shopping centers.