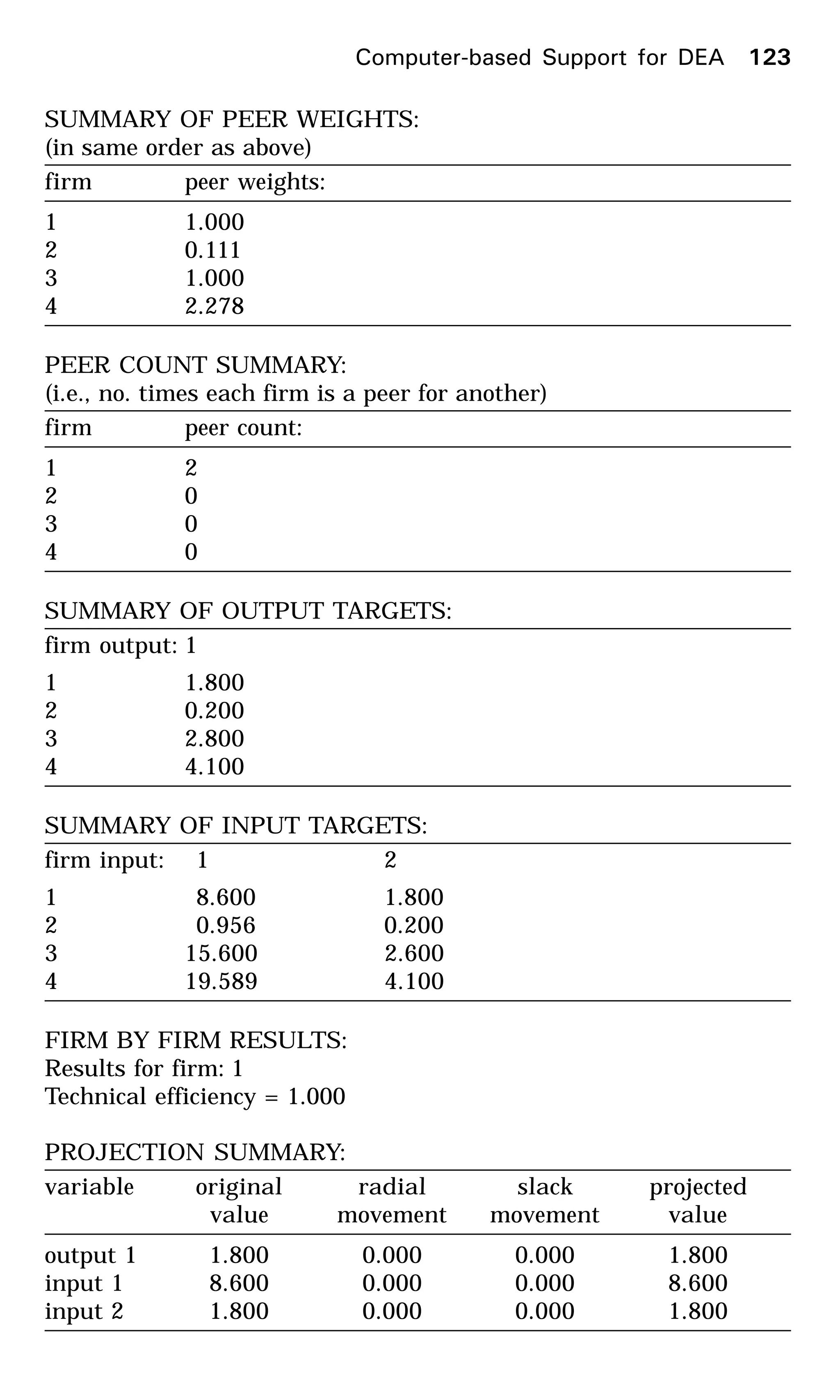

This document provides an introduction to data envelopment analysis (DEA). It begins with basic concepts of efficiency measurement using DEA, including graphical frontier analysis. It then discusses the mathematical programming aspects of DEA, including both primal and dual formulations. It also covers extensions to DEA such as variable returns to scale and window analysis. The document concludes with a discussion of DEA software, applications of DEA in various fields, and strengths and limitations of the approach.

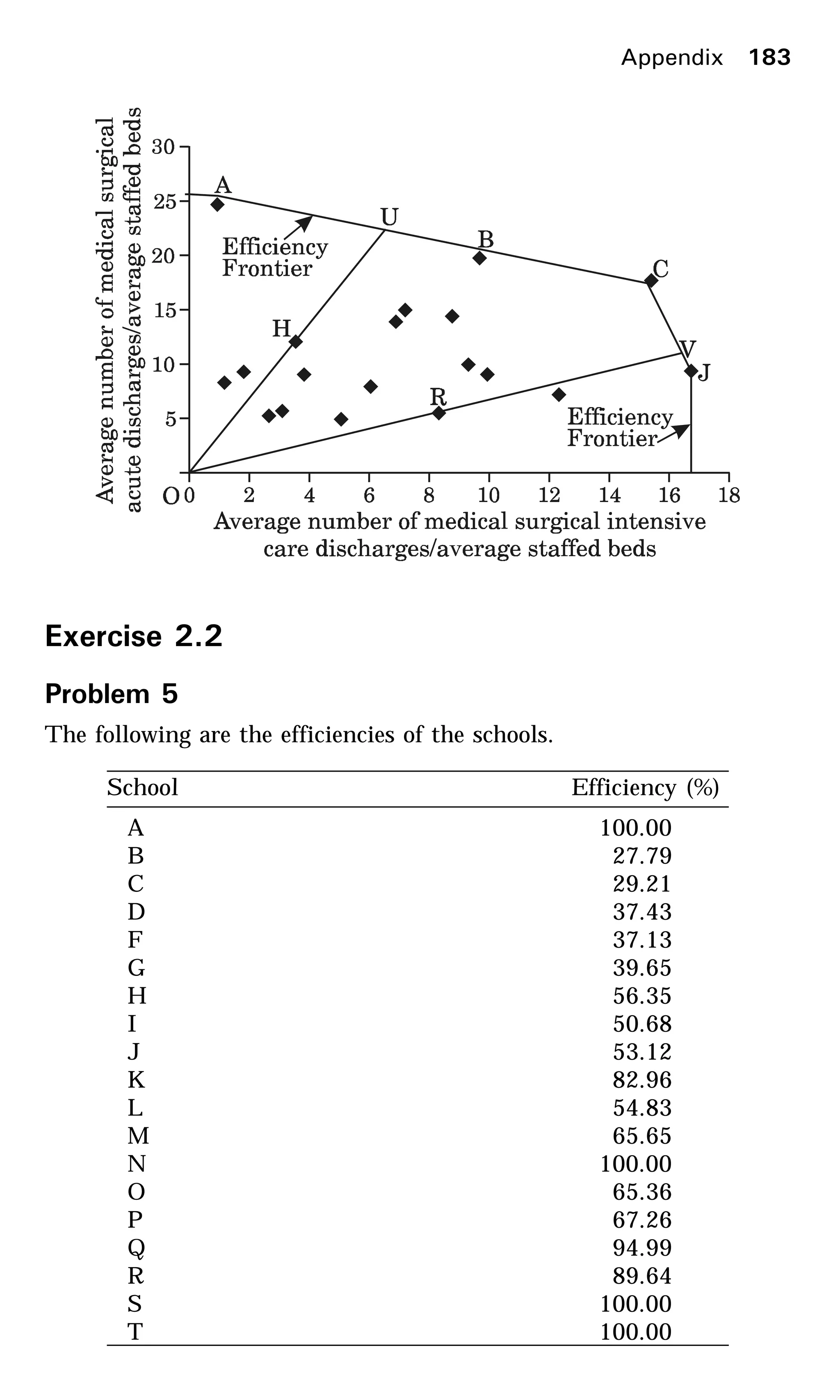

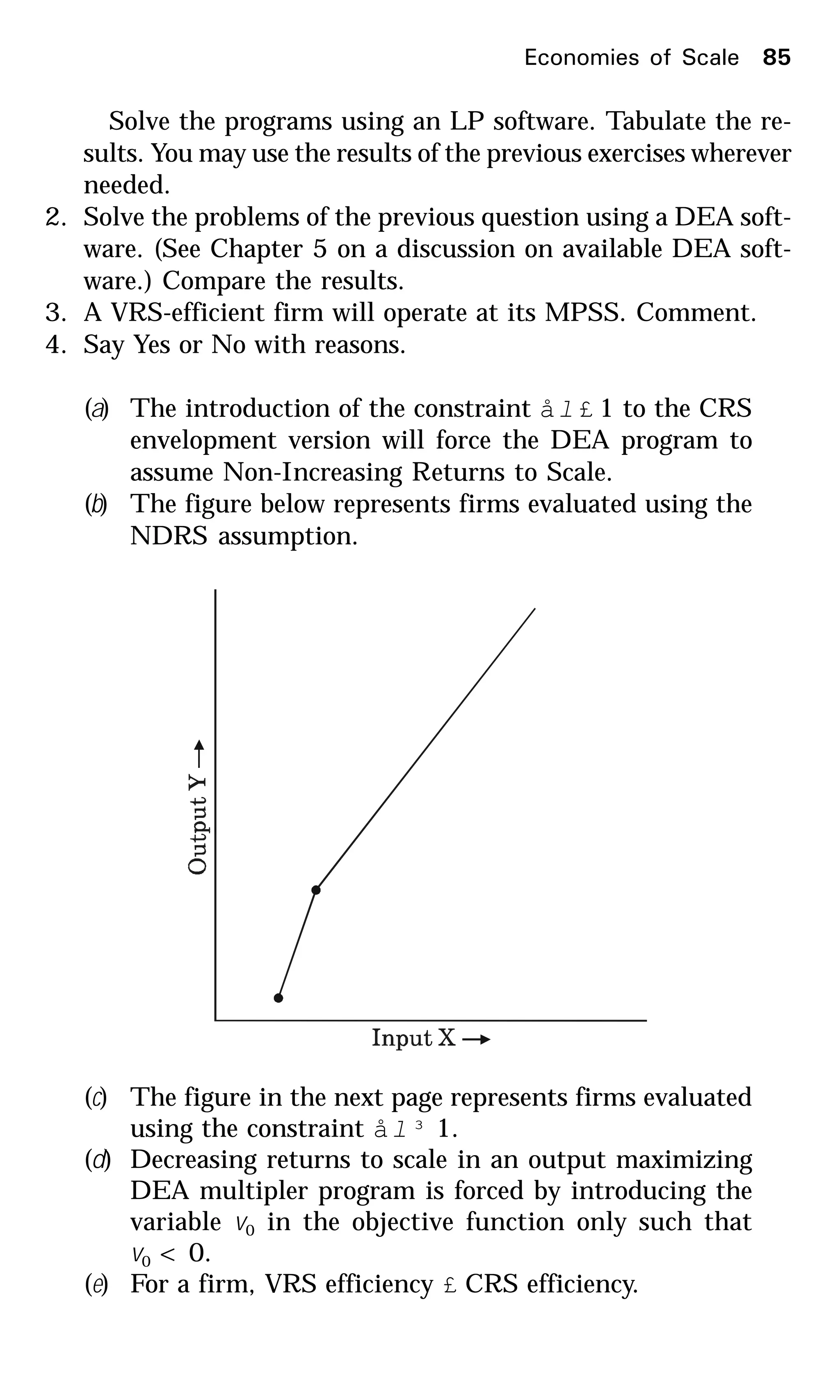

![(d) M operates at its MPSS.

(e) Firm P is 100 per cent scale efficient.

( f ) If one introduces the constraint ål ³ 1 to the CCR

envelopment model, Firm M will be considered effi-

cient.

(g) Write the ratios for the CRS, VRS and scale efficiencies

of Firm A.

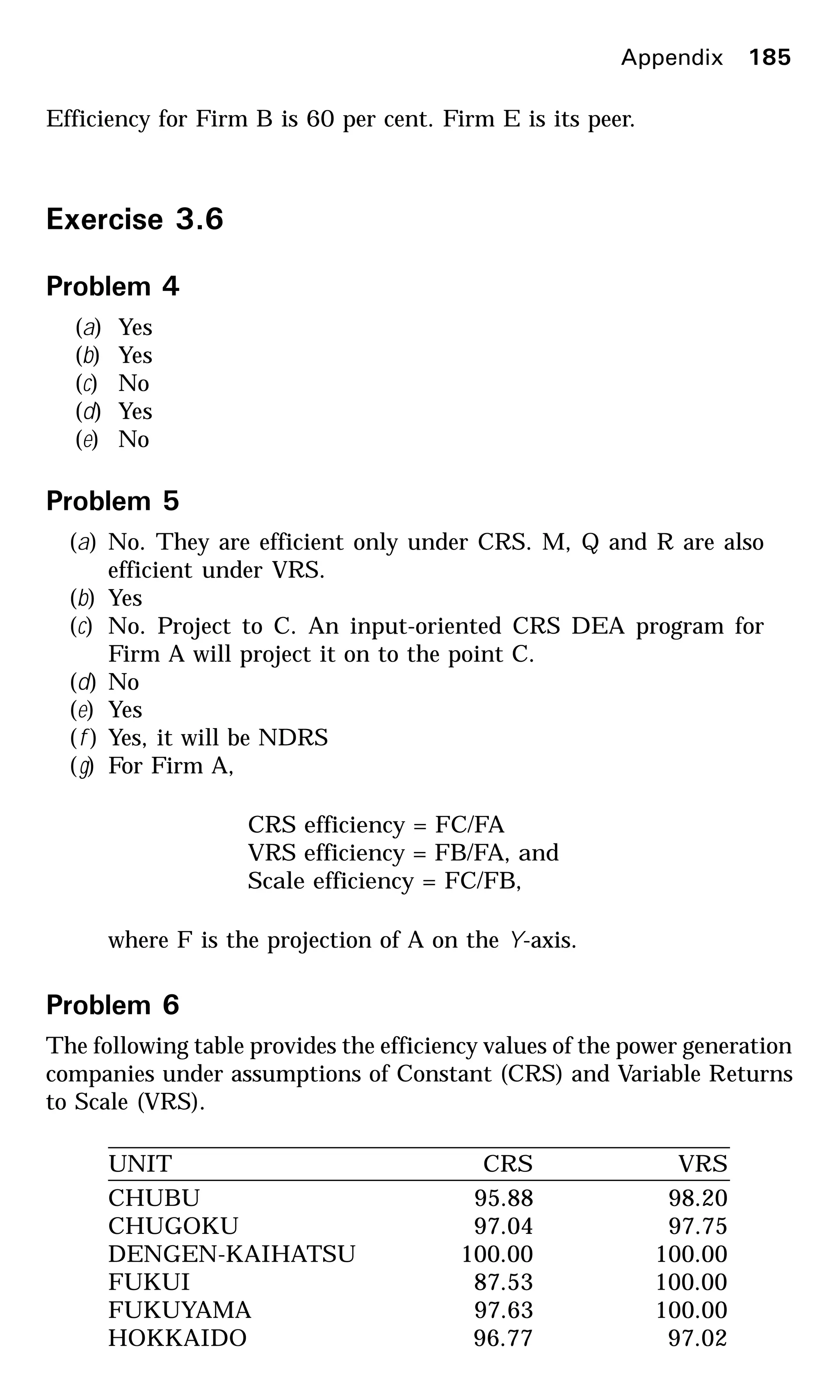

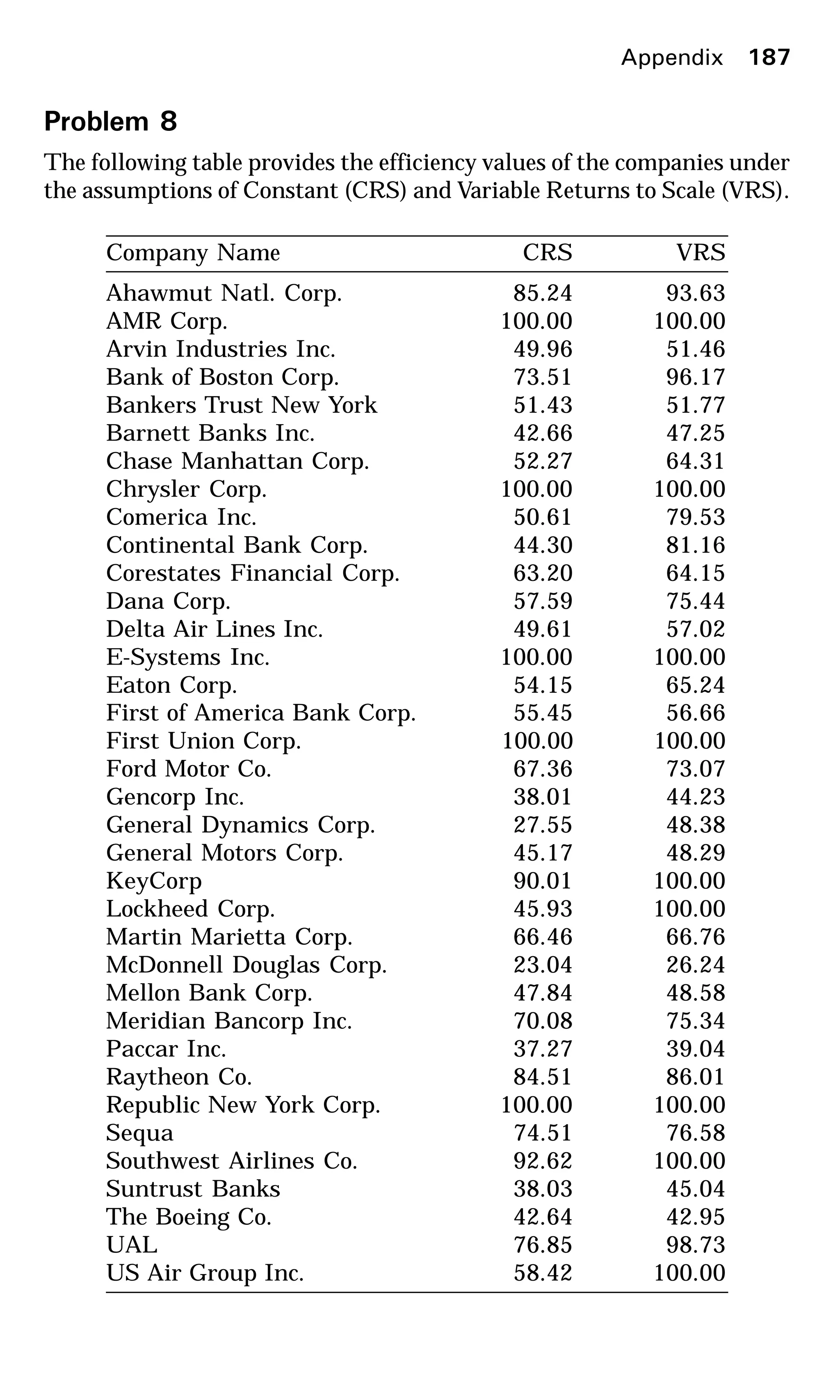

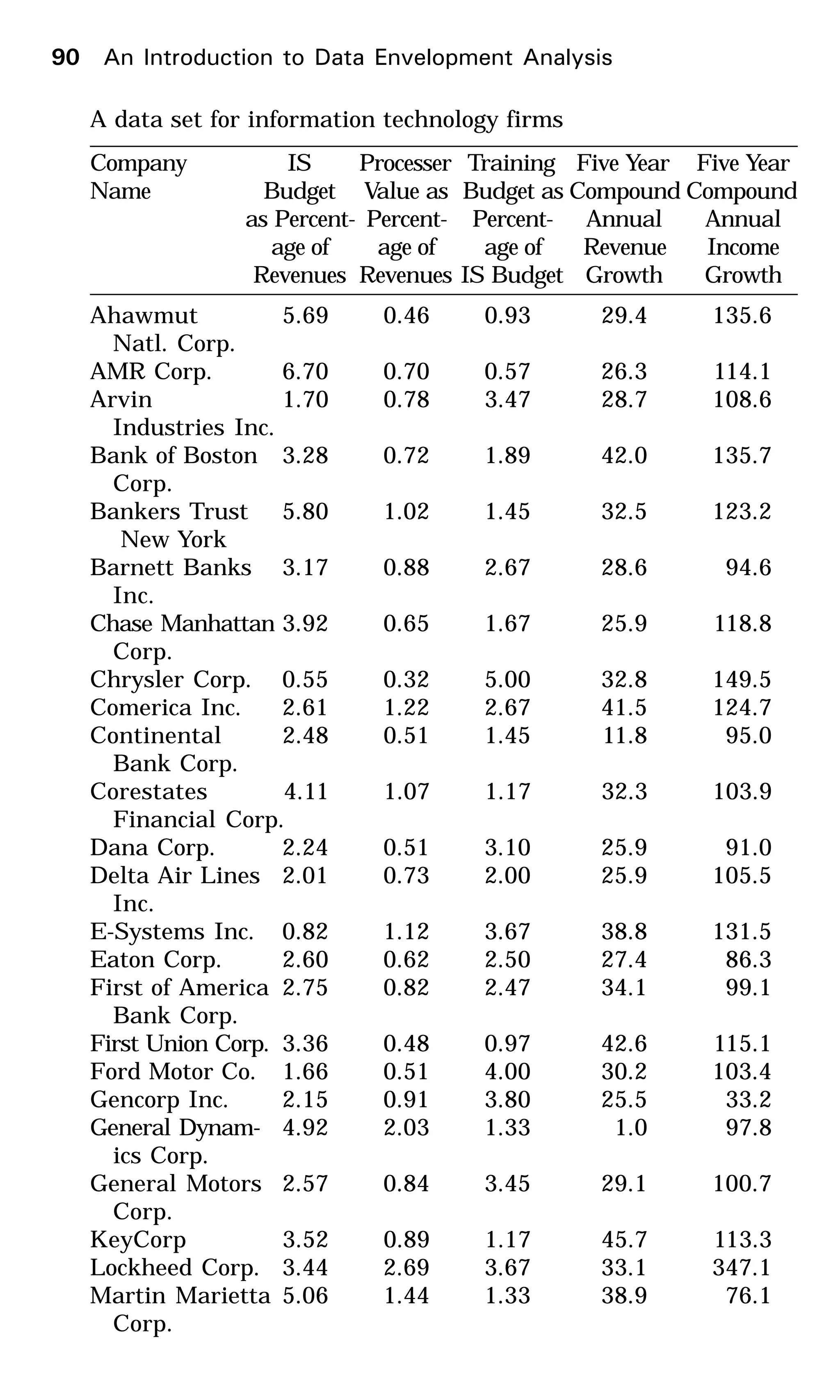

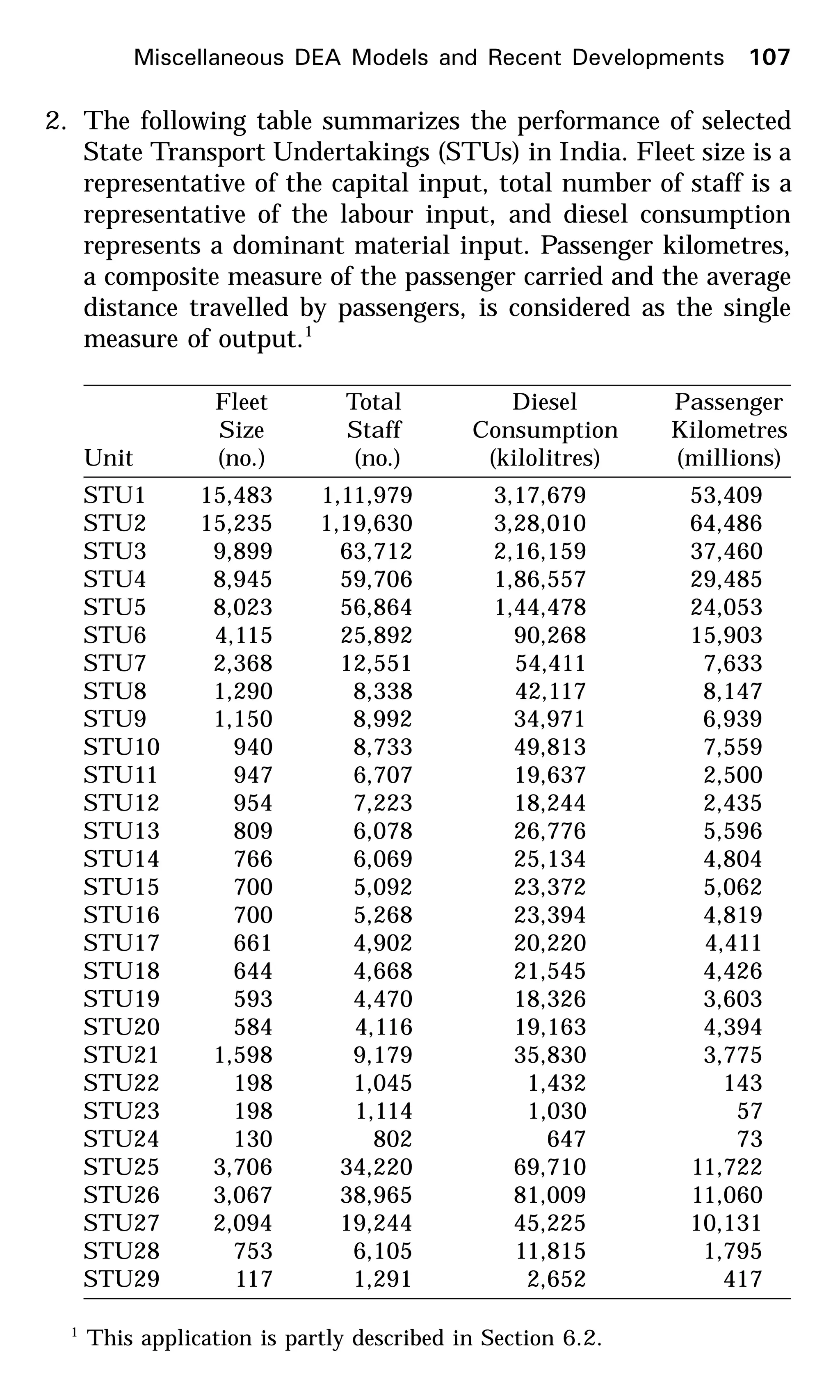

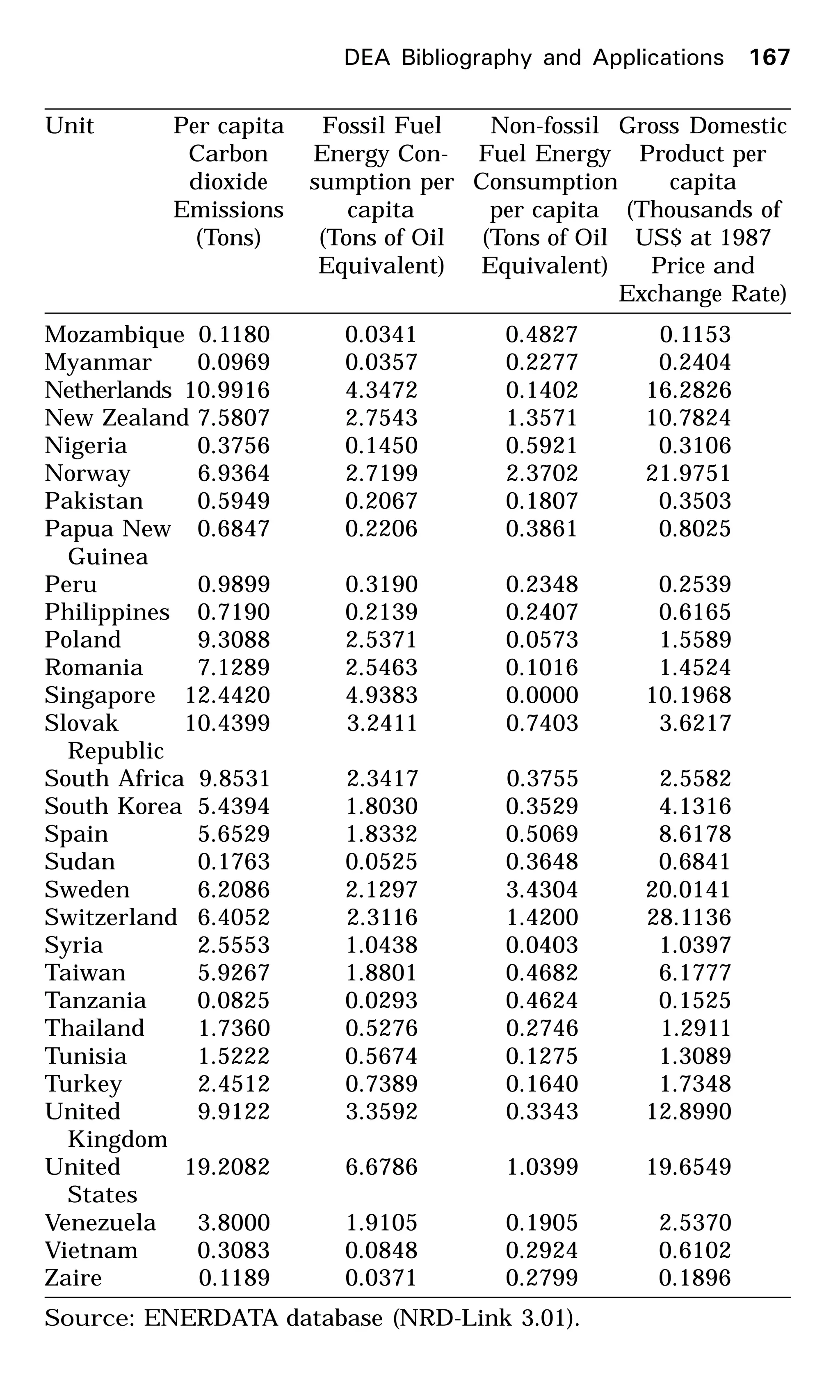

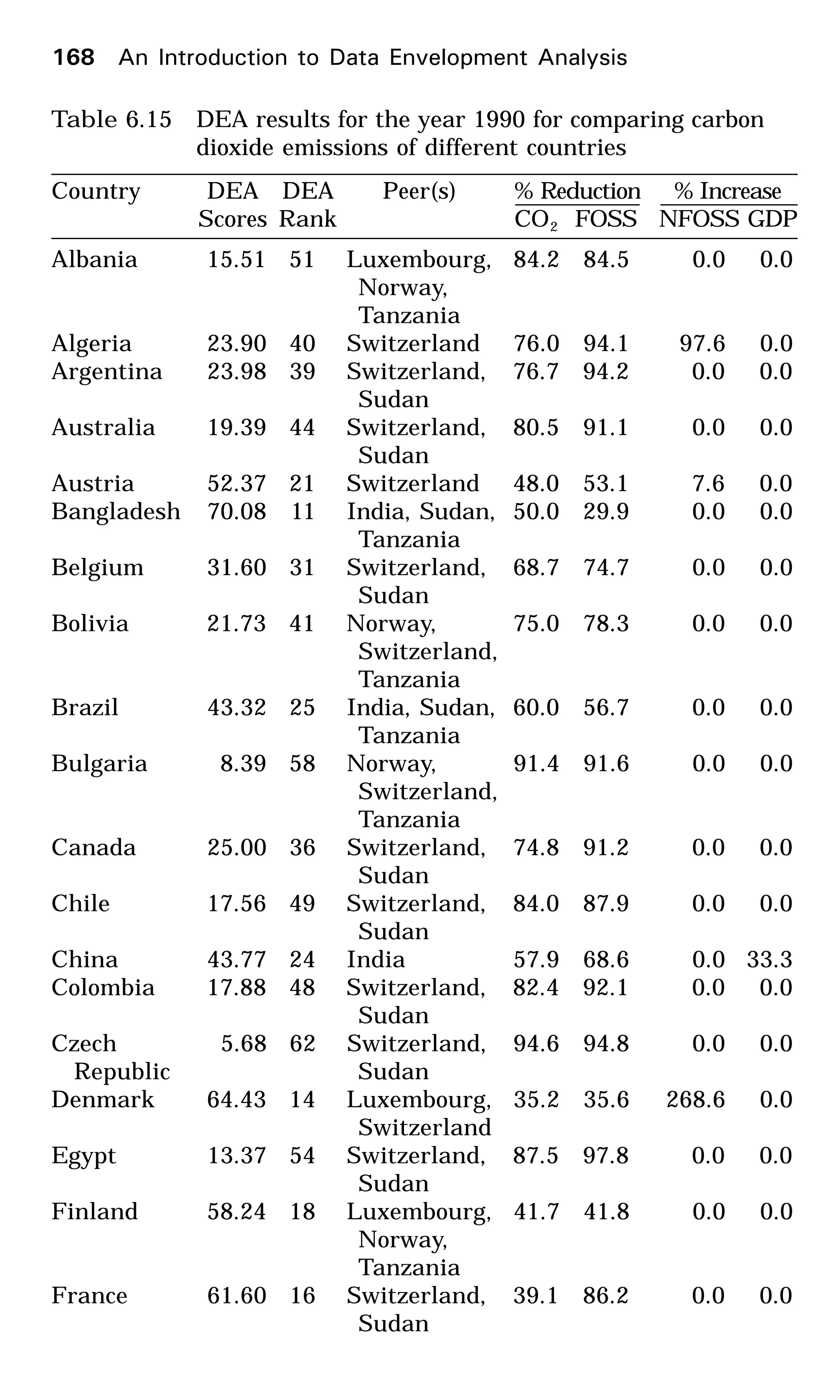

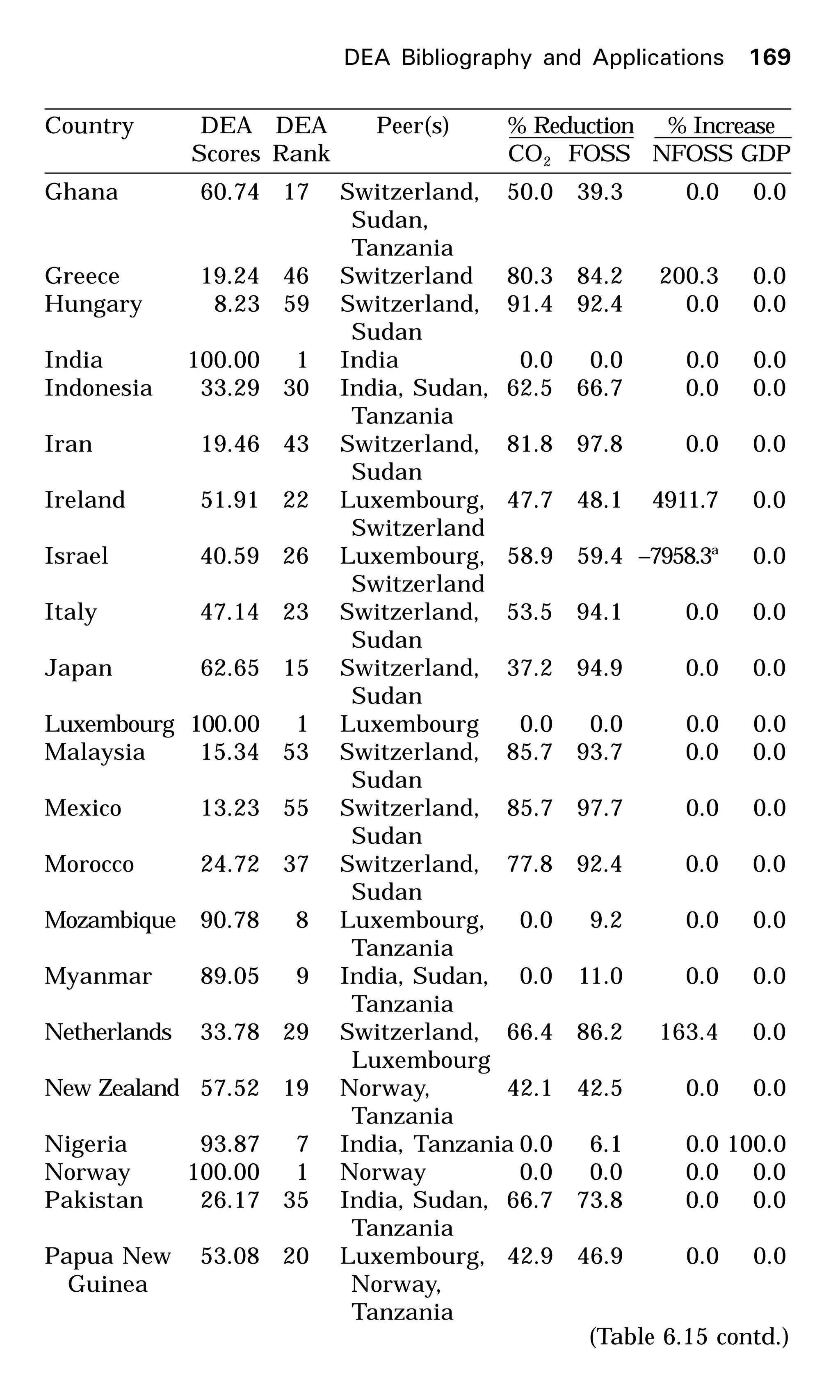

The following questions have been included as practice prob-

lems for demonstrating the variety of applications of DEA.

Several applications of DEA have been described in Chap-

ter 6, each for of which the data and the DEA results have

been presented. Students should consider them also as practice

problems. In addition, several data sets for practicing DEA

are available on the Internet. See Chapter 5 for more details.

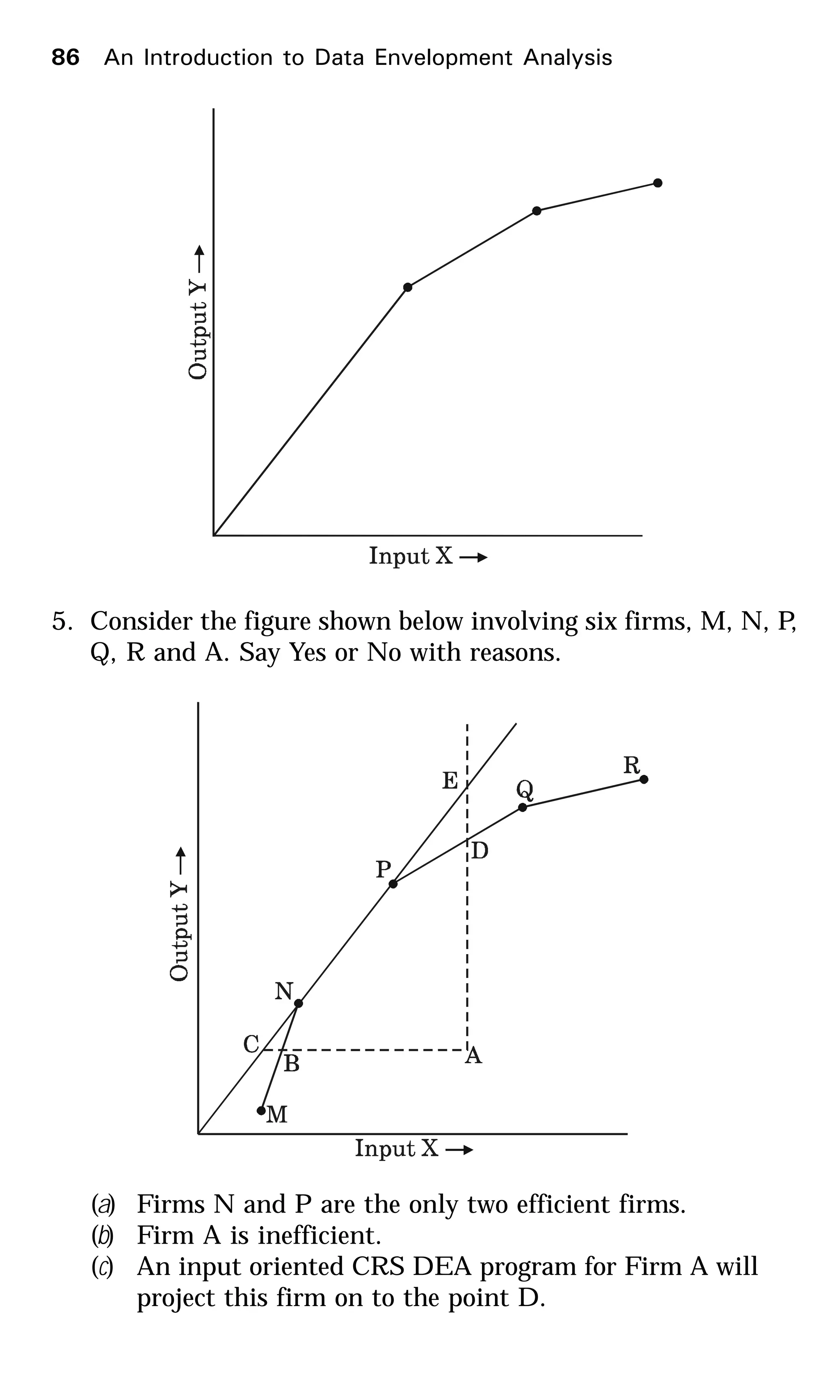

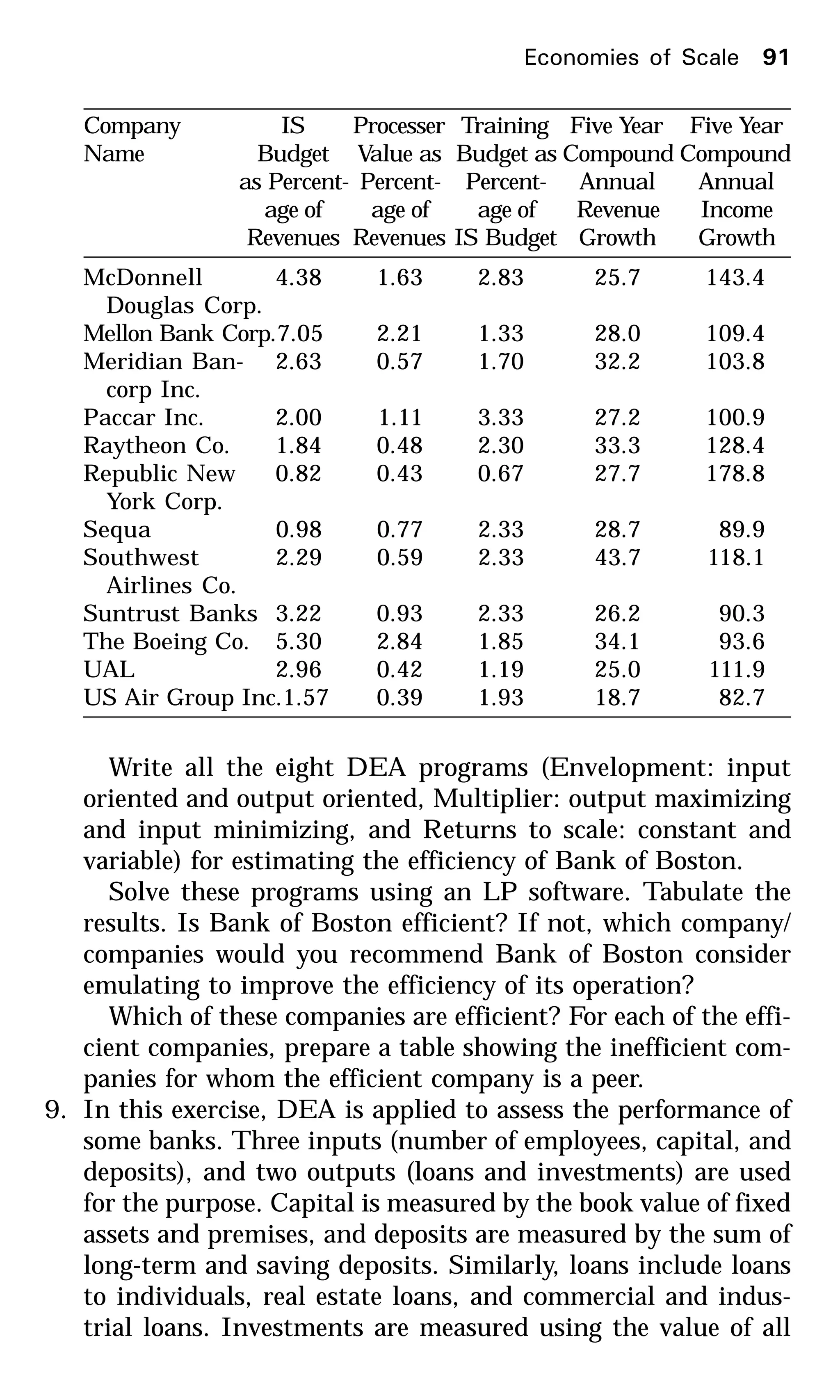

6. The data, choice of inputs and choice of output in this exercise

are based on the article, Sueyoshi and Goto (2001). The fol-

lowing data represents, for the year 1993, three inputs (the

amount of total fossil fuel generation capacity in Mega Watts

(MW); the amount of total fuel consumption in 109

kilocalories

(kcal); and the number of total employees in fossil fuel plants)

and one output (the amount of total generation in Giga Watt-

hour [GWh]) pertaining to electric power generation companies

in Japan.

Write all the eight DEA programs (Envelopment: input

oriented and output oriented, Multiplier: output maximizing

and input minimizing, and Returns to scale: constant and

variable) for estimating the efficiency of the power generation

company located in Hokkaido.

Solve the programs using an LP software. Tabulate the re-

sults. Is the Hokkaido power generation company efficient?

If not, which power generation companies would you recom-

mend the Hokkaido company consider emulating to improve

the efficiency of its operation? What are the CRS, VRS and

scale efficiencies of this company? What is its most productive

scale size?

Which are the efficient power generation companies in this

data set? For each of them, prepare a table showing the ineffi-

cient companies for whom the efficient company is a peer.

Economies of Scale 87](https://image.slidesharecdn.com/anintroductiontodea-180619020626/75/An-introduction-to-dea-88-2048.jpg)

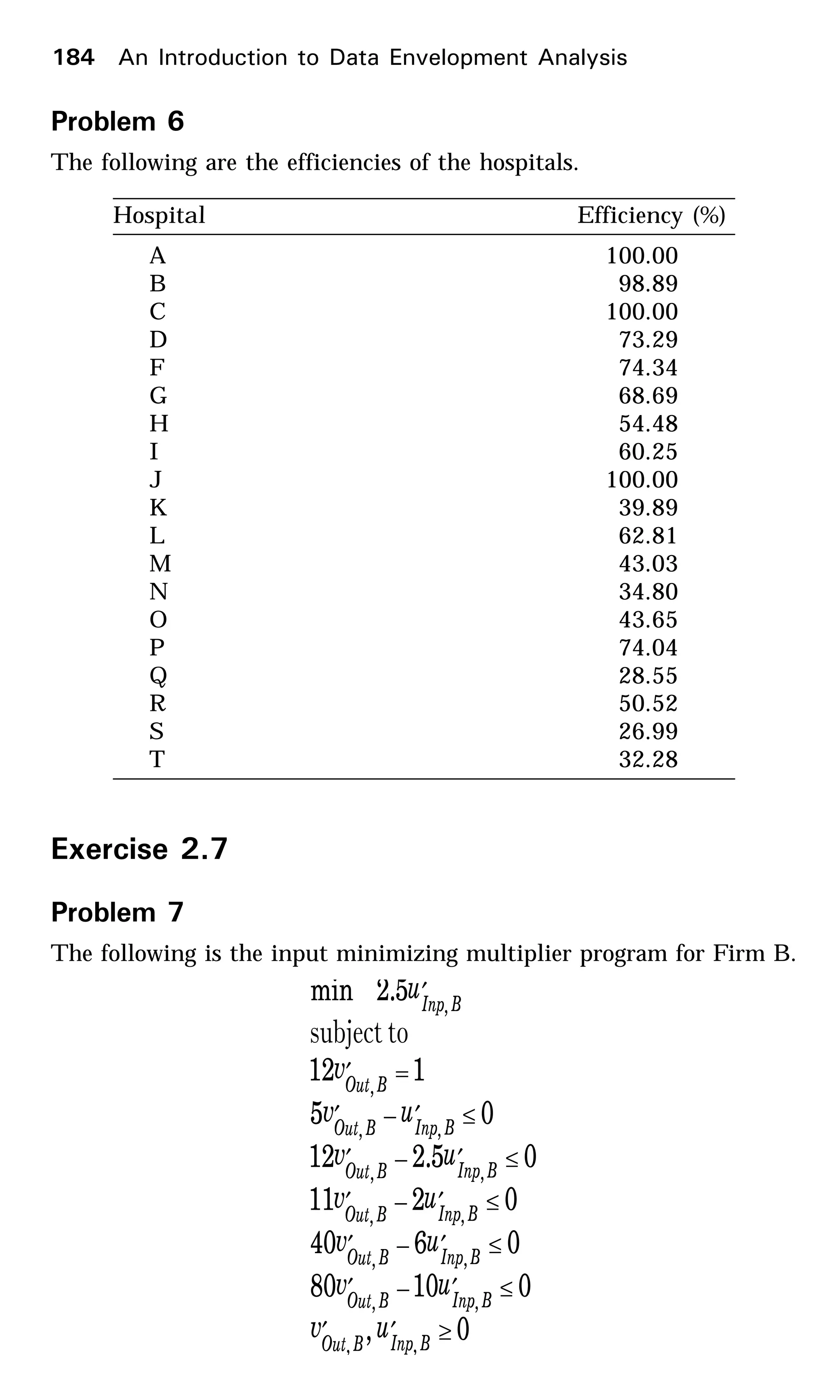

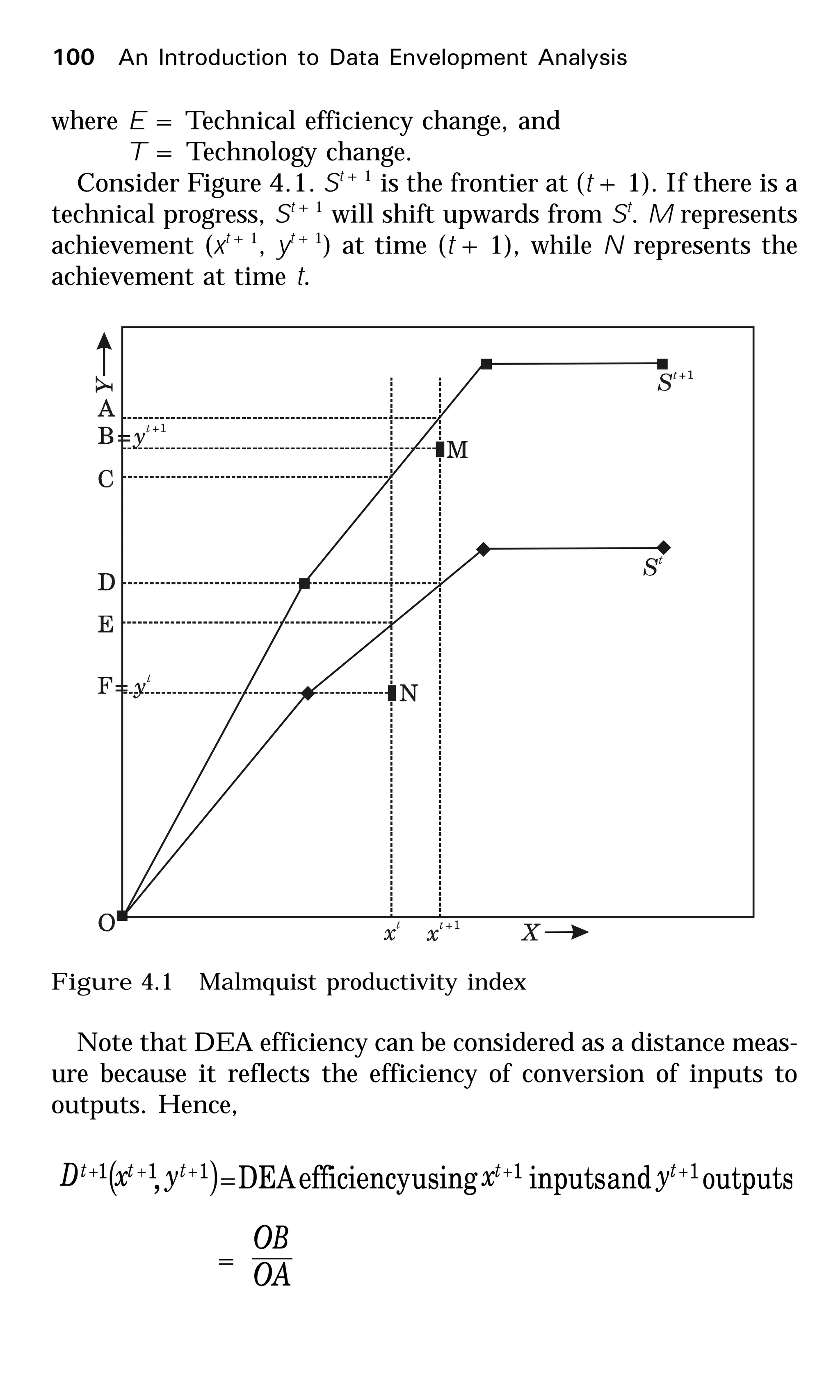

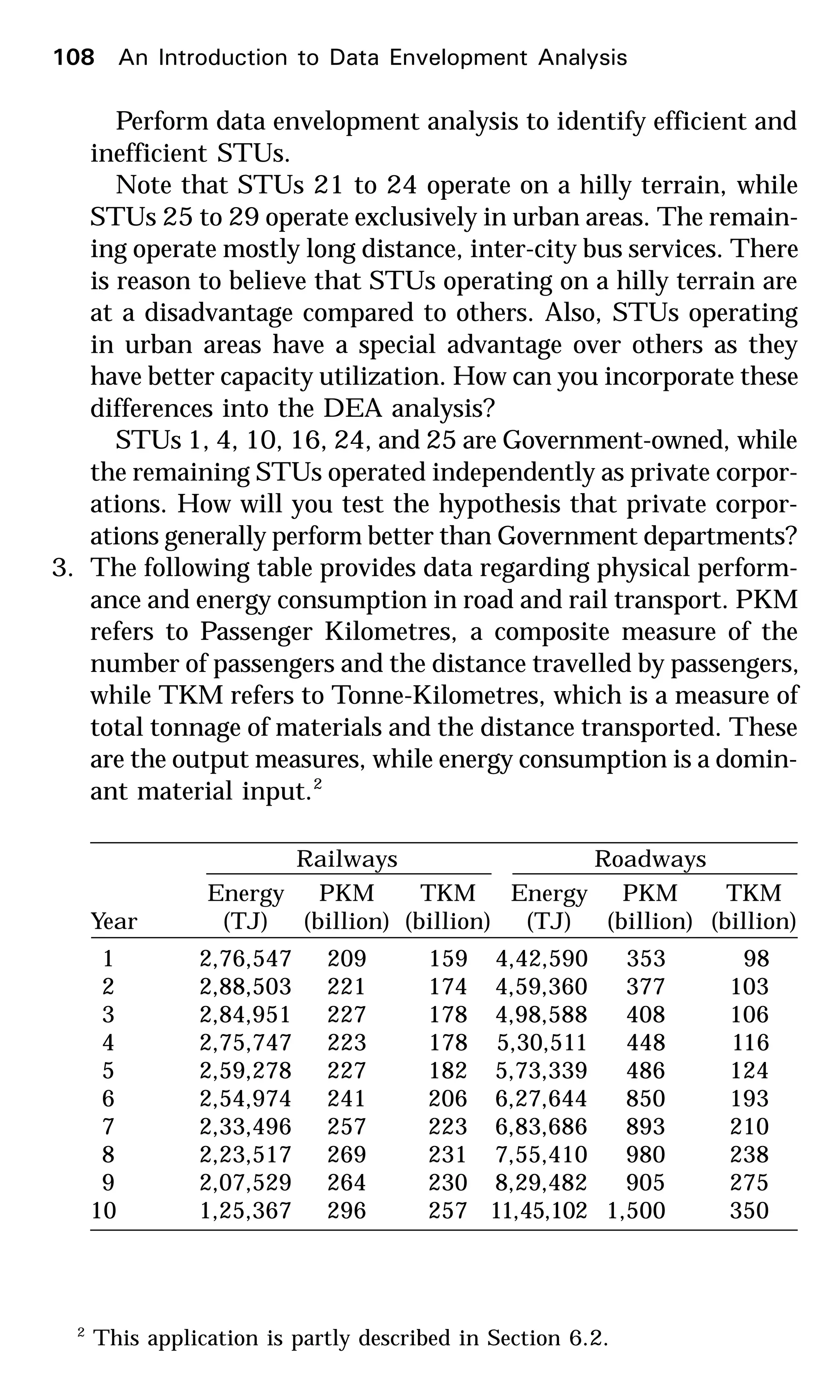

![Similarly,

( )

OE

OF

yxD ttt =,

Hence,

( )

( )

( )

( )OEOF

OAOB

yxD

yxD

E

ttt

ttt

/

/

,

,

changeefficiencyTechnical

111

=

=

=

+++

(4.11)

If E > 1, then there is an increase in the technical efficiency of

converting inputs to outputs.

What does ( )[ ]ttt yxD , ( )[ ]ttt yxD ,1+

in Equation 4.10 mean?

Because of a technical change, the same input xt

can produce a

higher output when used during the period (t+1). Input xt

can

produce only OE as its best ouput in time t, but can produce a

higher output OC in time (t+1). Hence, the ratio (OC/OE)

represents a measure of technology change. If this ratio is greater

than unity, then there is proof of technological improvement.

( )

( )

OC

OFyxD

OE

OF

yxD

ttt

ttt

=

=

+

,

,

1

HHence,

( )

( ) OE

OC

yxD

yxD

ttt

ttt

=+

,

,

1

For technological progress, this ratio should be greater than

unity. Similarly,

( )

( )

1

,

,

111

11

>=

+++

++

OD

OA

yxD

yxD

ttt

ttt

for technological progress.

Miscellaneous DEA Models and Recent Developments 101](https://image.slidesharecdn.com/anintroductiontodea-180619020626/75/An-introduction-to-dea-102-2048.jpg)

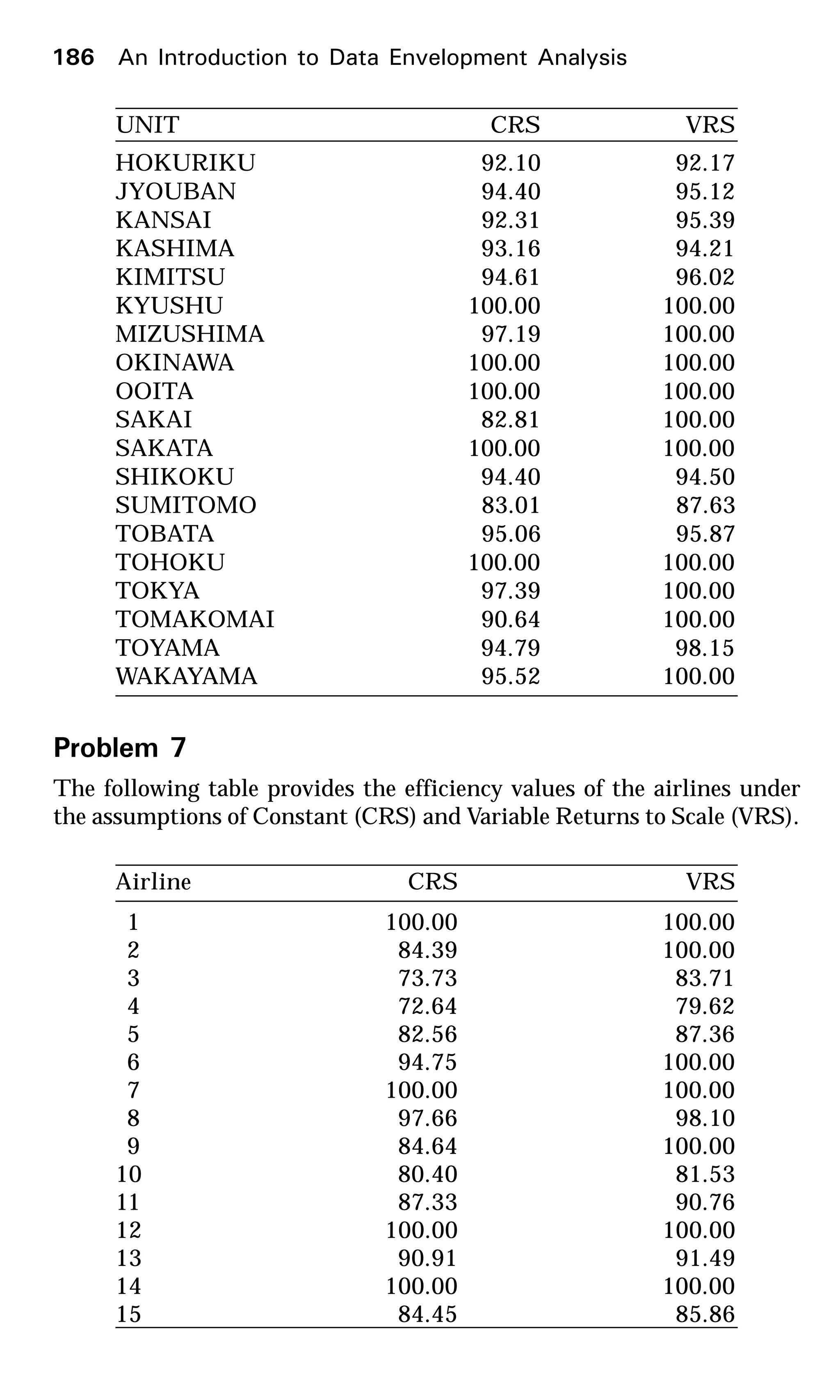

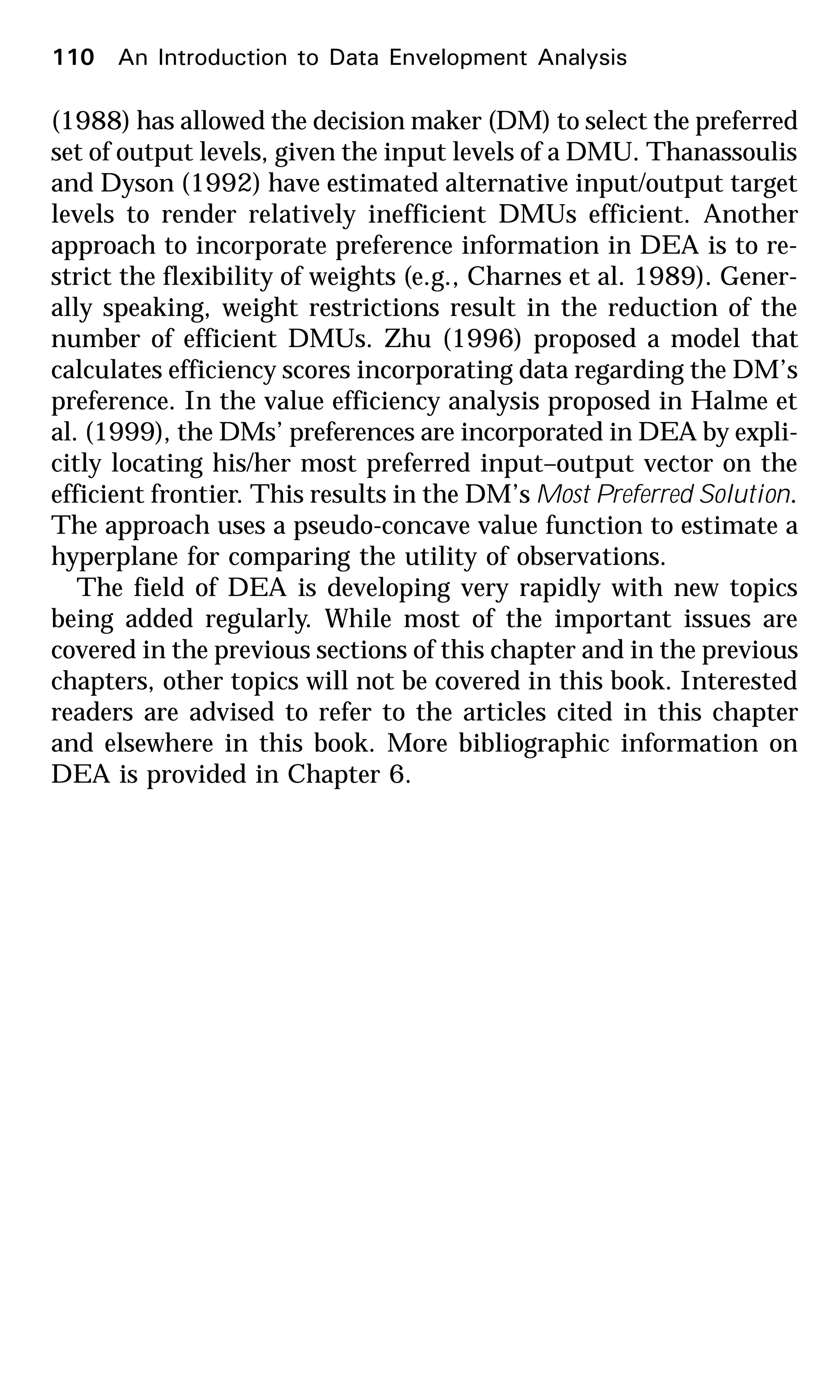

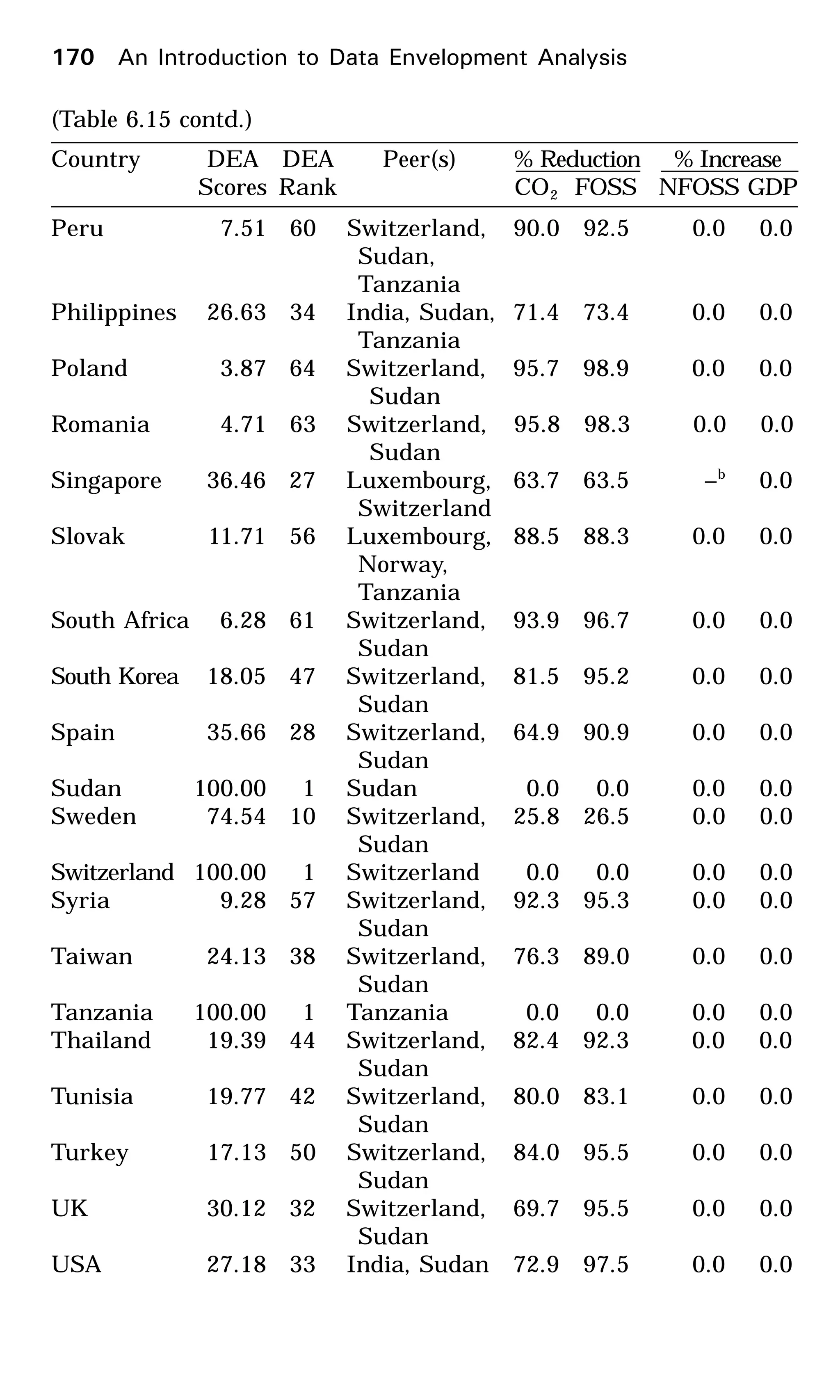

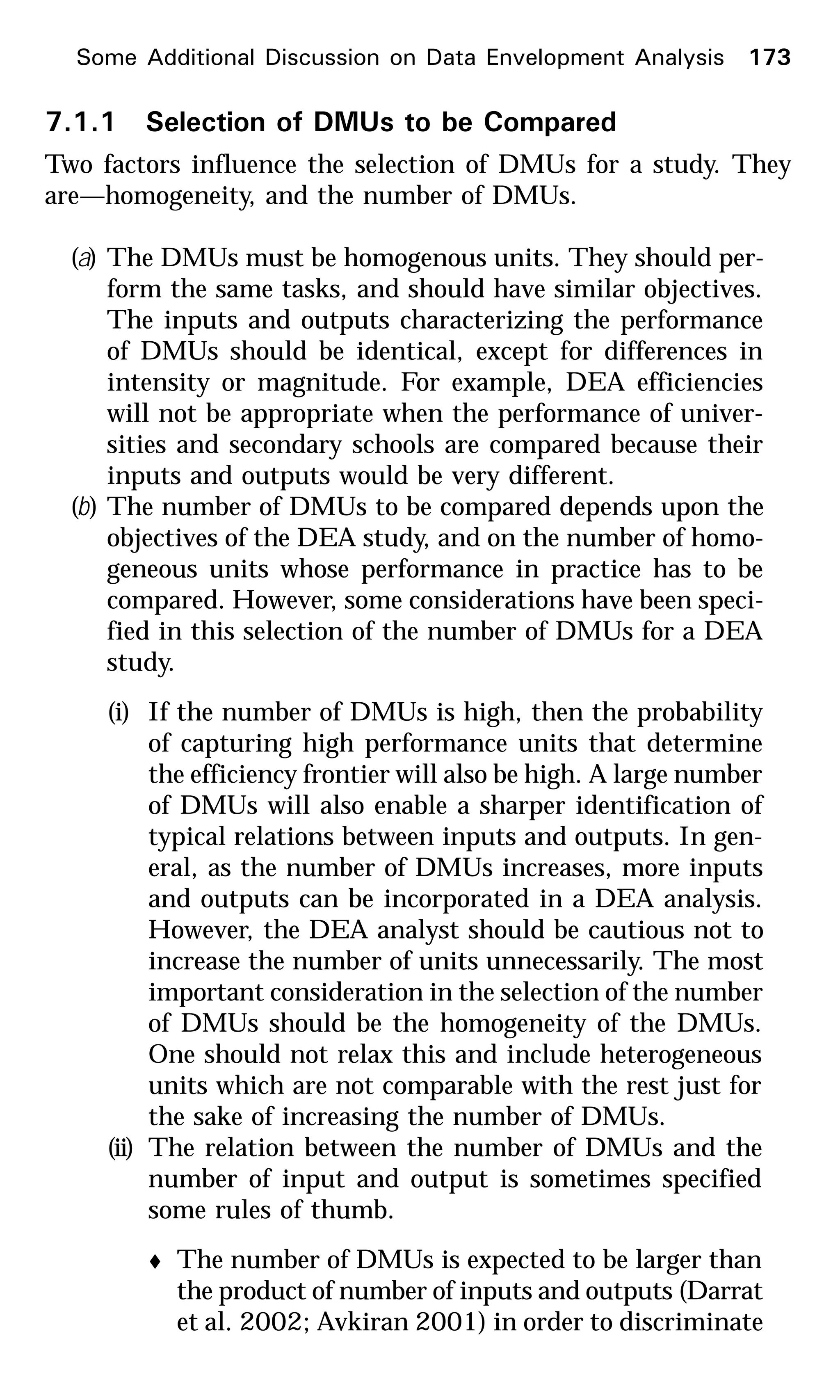

![174 An Introduction to Data Envelopment Analysis

effectively between efficient and inefficient DMUs.

However, there are many examples in the literature

where DEA has been used with small sample sizes.

t The sample size should be at least 2 or 3 times

larger than the sum of the number of inputs and

outputs.

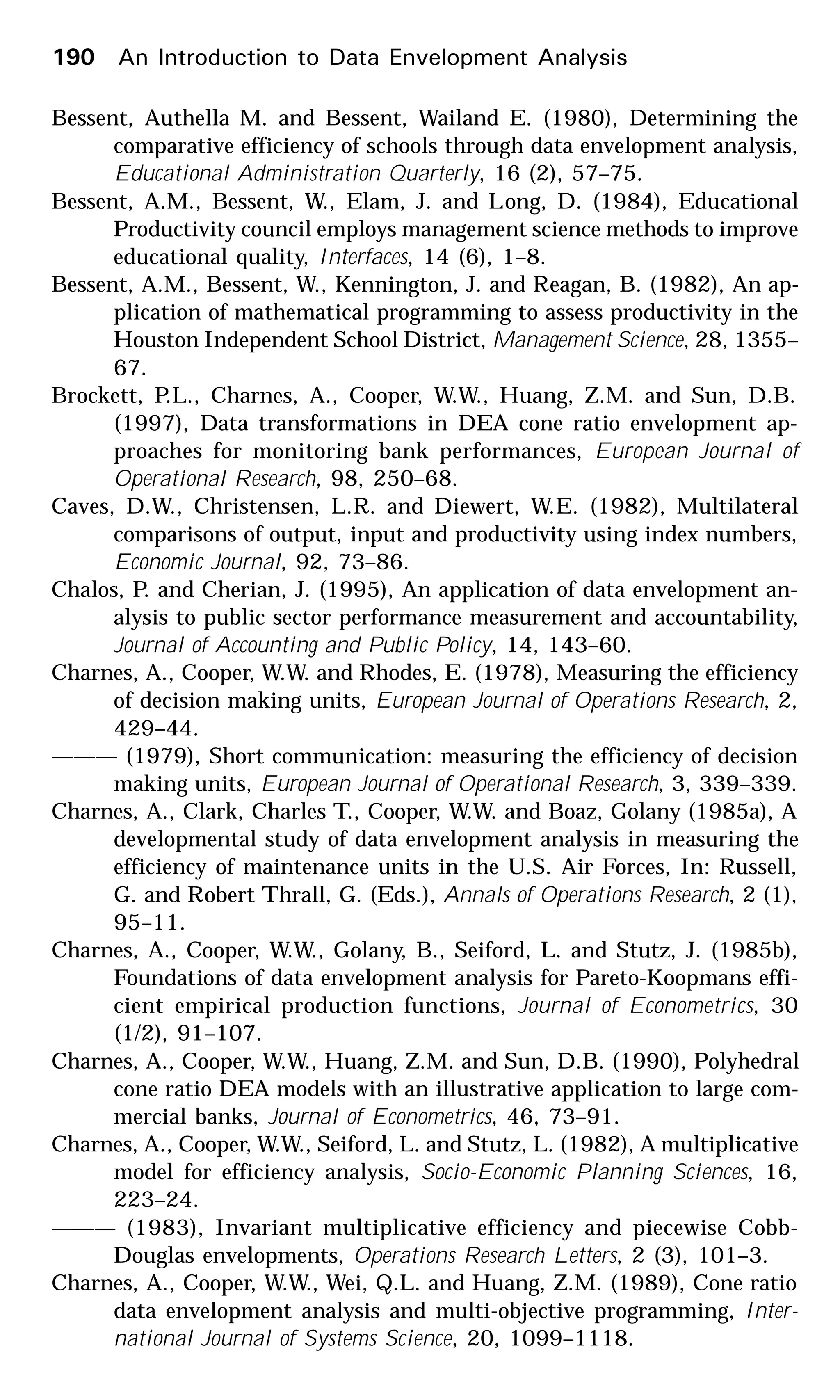

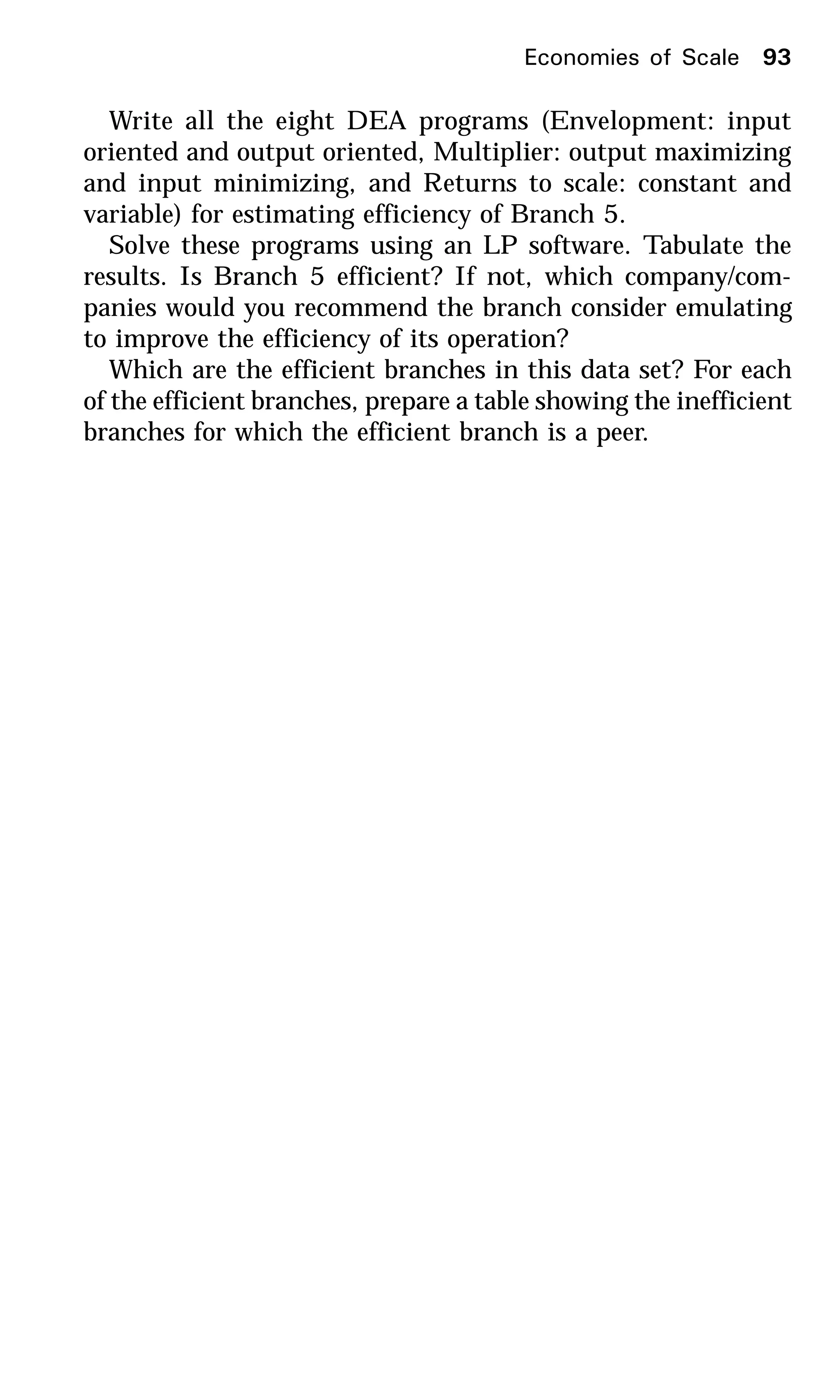

7.1.2 Selection of Inputs and Outputs

A main difficulty in any application of DEA is in the selection of

inputs and outputs. The criteria of selection of these inputs and

outputs are quite subjective. There is no specific rule in deter-

mining the procedure for selection of inputs and outputs. However,

some guidelines may be suggested, and are discussed below.

A DEA study should start with an exhaustive, initial list of

inputs and outputs that are considered relevant for the study. At

this stage, all the inputs and outputs that have a bearing on the

performance of the DMUs to be analyzed should be listed. Screen-

ing procedures, which may be quantitative (e.g., statistical) or

qualitative (simply judgemental, using expert advice or using

methods such as the Analytic Hierarchy Process [Saaty 1980]),

may be used to pick up the most important inputs and outputs

and, therefore reducing the total number to a reasonable level.

For the purpose of this filtering, questions such as the following

may help:

(a) Is the input or output related to one or more of the objec-

tives of the DEA study?

(b) Does the input or output identify the characteristics of

the DMUs that are not captured by other inputs or out-

puts?

Normally, inputs are defined as resources utilized by the DMUs

or conditions affecting the performance of DMUs, while outputs

are the benefits generated as a result of the operation of the DMUs.

However, sometimes it may become difficult to classify a particular

factor as input or output, especially when the factor can be inter-

preted either as input or as output. In such cases, one way of

classifying the factor to check whether DMUs recording higher

performance in terms of that factor is considered more efficient](https://image.slidesharecdn.com/anintroductiontodea-180619020626/75/An-introduction-to-dea-175-2048.jpg)