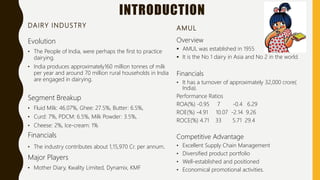

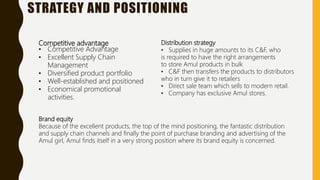

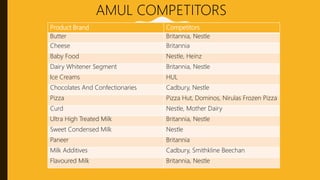

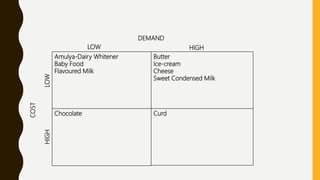

The dairy industry in India produces approximately 160 million tonnes of milk per year. The top segments are fluid milk at 46.07% and ghee at 27.5%. Major players include Amul, Mother Dairy, and Kwality. Amul was established in 1955 and is the number 1 dairy in Asia and number 2 in the world with a turnover of approximately 32,000 crore rupees. Amul has a competitive advantage through excellent supply chain management, a diversified product portfolio, and economical promotional activities. Its main competitors are Britannia, Nestle, and other large companies.