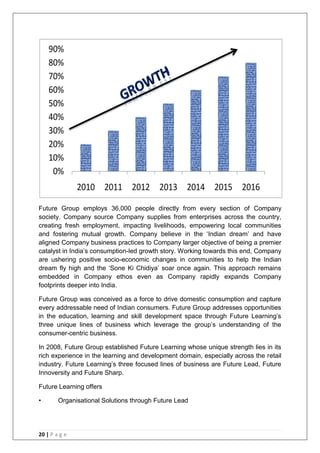

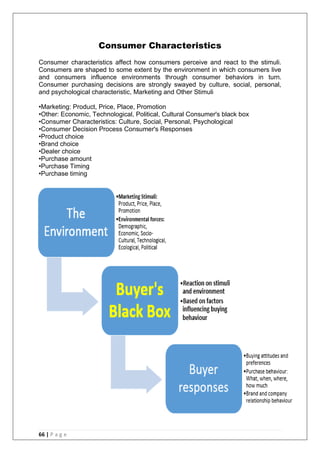

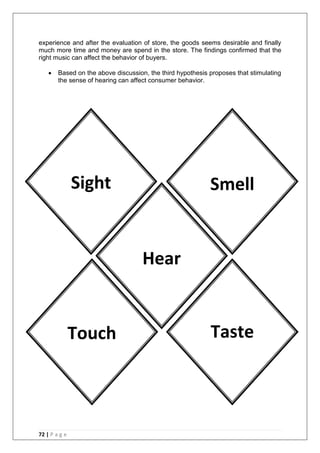

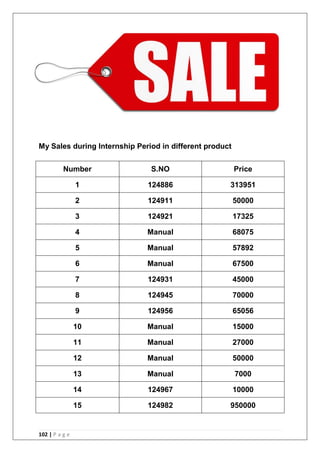

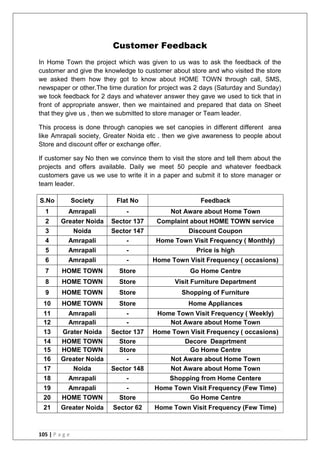

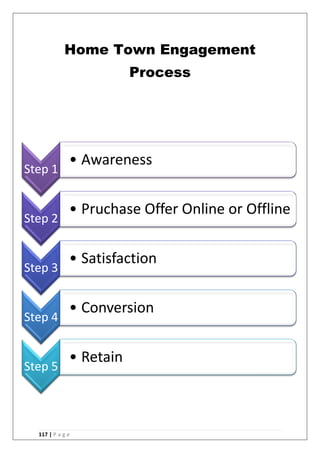

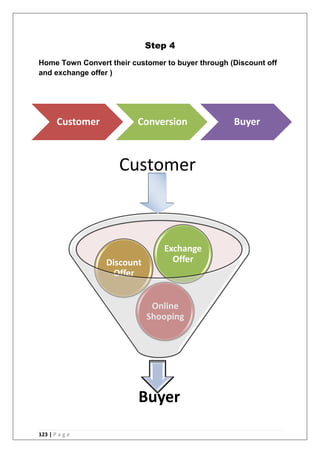

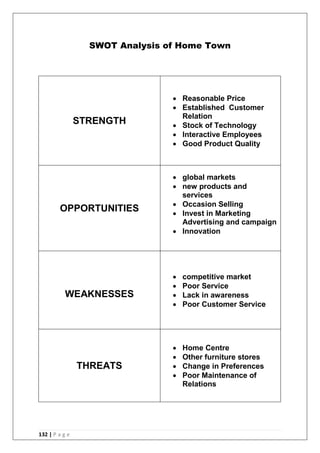

This document is a project report submitted by Amrita Srivastava for her internship at Future Retail's Hometown outlet. The report discusses consumer behaviour and customer engagement at Hometown. It includes an introduction to management, marketing, retail, Future Group and Future Retail. It also describes the research methodology used and analyses the consumer behaviour and customer engagement practices at Hometown. The report concludes with recommendations and limitations.