Amresh management accounting

•Download as PPT, PDF•

0 likes•953 views

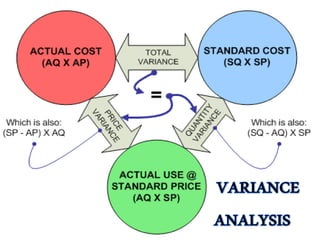

The document classifies variances into material cost, price, usage, mix, and yield variances. It also discusses labor cost, rate, efficiency, idle time, mix, and yield variances. Finally, it covers variable and fixed overhead variances. Material and labor variances are calculated using standard quantities/rates and actual quantities/rates. Variable overhead variances have expenditure/budget and efficiency components. Fixed overhead variance is the difference between standard overhead recovered and actual overhead incurred.

Report

Share

Report

Share

Recommended

Standard cost, labor & material variance

Standards are benchmarks used to measure performance. In managerial accounting, standards relate to the quantity and cost of inputs used in production. Quantity standards specify the amount of inputs needed, while cost standards specify the price paid per input unit. Variance analysis involves comparing actual performance to standards, analyzing differences, and taking corrective actions. Manufacturing companies develop detailed standard costing systems with standards for materials, labor, and overhead for each product. Standards are set through collaboration between different departments and by reviewing past production records. Material, labor, and overhead variances are calculated by comparing actual inputs and costs to standards. Variances identify where costs differ from standards so issues can be addressed.

Standard costing and Variance Analysis

Standard costing is a technique used to measure differences between actual and expected costs. A variance is the difference between standards and actual performance. Material, labor, and overhead variances can be classified by function, measurement, or result. Material variances include price, usage, mix, and yield variances. Labor variances include rate, efficiency, idle time, mix, and yield variances. Variances are either favorable if actual is lower than standard or adverse if actual exceeds standard. Examples show how to calculate variances for a manufacturing company.

Variance Analysis

The document defines variances as differences between standard and actual costs. It discusses computing variances for material costs, including material cost, price, usage, mix, and yield variances. It also discusses labor cost and rate variances. Variances are classified and examples are provided to demonstrate how to calculate different types of variances based on standard and actual data. The key information is on defining and calculating different types of variances to identify reasons for deviations between actual and standard performance.

Standard costing short tutorial

This document provides a tutorial on standard costing and variance analysis techniques. It defines key terms like actual cost, standard cost, quantity and price variances. Formulas are provided for calculating variances for materials, labor, variable overhead and fixed overhead. A sample problem demonstrates calculating variances for materials and labor. Another sample problem demonstrates calculating variances for variable and fixed overhead.

Variance analysis

Variance analysis involves computing the differences between actual and standard costs. It has two phases - computation of individual variances and determining the causes of variances. Variances are classified as material, labor, and overhead. Material variance is caused by differences in actual and standard quantities and prices of materials. Labor variances can be due to mix of labor grades or wage rates. Overhead variances arise from differences between actual and standard overhead amounts. Variance analysis helps identify reasons for deviations from standards and improve performance.

Variance Analysis

The document defines various types of variances that can occur in cost accounting, including material, labor, and overhead variances. It provides formulas to calculate variance amounts and examples showing how to compute variances based on standard and actual costs. Variances are classified into price, usage/efficiency, and mix categories and can be favorable or unfavorable depending on whether actual costs are lower or higher than standards.

Stdcostingppt

This document provides an overview of standard costing and variance analysis techniques. It defines key terms like standard costing, variances, and variance analysis. It then explains how to calculate variances for materials, labor, sales, and overhead costs. Specific formulas are provided to derive price, quantity, mix, and other variances. Causes of variances like volume, price, efficiency are discussed. The purpose of variance analysis is to identify reasons for deviations from standards and take corrective actions.

Akaun Chapter 11

The document summarizes standard costing and variance analysis.

Standard costing involves setting standard costs for direct materials, direct labor, and factory overhead based on expected efficiencies. Variances measure the difference between actual and standard costs. There are variances for direct material price and usage, direct labor rate and efficiency, and factory overhead which includes a controllable variance and volume variance. Variance analysis identifies reasons for differences to improve performance.

Recommended

Standard cost, labor & material variance

Standards are benchmarks used to measure performance. In managerial accounting, standards relate to the quantity and cost of inputs used in production. Quantity standards specify the amount of inputs needed, while cost standards specify the price paid per input unit. Variance analysis involves comparing actual performance to standards, analyzing differences, and taking corrective actions. Manufacturing companies develop detailed standard costing systems with standards for materials, labor, and overhead for each product. Standards are set through collaboration between different departments and by reviewing past production records. Material, labor, and overhead variances are calculated by comparing actual inputs and costs to standards. Variances identify where costs differ from standards so issues can be addressed.

Standard costing and Variance Analysis

Standard costing is a technique used to measure differences between actual and expected costs. A variance is the difference between standards and actual performance. Material, labor, and overhead variances can be classified by function, measurement, or result. Material variances include price, usage, mix, and yield variances. Labor variances include rate, efficiency, idle time, mix, and yield variances. Variances are either favorable if actual is lower than standard or adverse if actual exceeds standard. Examples show how to calculate variances for a manufacturing company.

Variance Analysis

The document defines variances as differences between standard and actual costs. It discusses computing variances for material costs, including material cost, price, usage, mix, and yield variances. It also discusses labor cost and rate variances. Variances are classified and examples are provided to demonstrate how to calculate different types of variances based on standard and actual data. The key information is on defining and calculating different types of variances to identify reasons for deviations between actual and standard performance.

Standard costing short tutorial

This document provides a tutorial on standard costing and variance analysis techniques. It defines key terms like actual cost, standard cost, quantity and price variances. Formulas are provided for calculating variances for materials, labor, variable overhead and fixed overhead. A sample problem demonstrates calculating variances for materials and labor. Another sample problem demonstrates calculating variances for variable and fixed overhead.

Variance analysis

Variance analysis involves computing the differences between actual and standard costs. It has two phases - computation of individual variances and determining the causes of variances. Variances are classified as material, labor, and overhead. Material variance is caused by differences in actual and standard quantities and prices of materials. Labor variances can be due to mix of labor grades or wage rates. Overhead variances arise from differences between actual and standard overhead amounts. Variance analysis helps identify reasons for deviations from standards and improve performance.

Variance Analysis

The document defines various types of variances that can occur in cost accounting, including material, labor, and overhead variances. It provides formulas to calculate variance amounts and examples showing how to compute variances based on standard and actual costs. Variances are classified into price, usage/efficiency, and mix categories and can be favorable or unfavorable depending on whether actual costs are lower or higher than standards.

Stdcostingppt

This document provides an overview of standard costing and variance analysis techniques. It defines key terms like standard costing, variances, and variance analysis. It then explains how to calculate variances for materials, labor, sales, and overhead costs. Specific formulas are provided to derive price, quantity, mix, and other variances. Causes of variances like volume, price, efficiency are discussed. The purpose of variance analysis is to identify reasons for deviations from standards and take corrective actions.

Akaun Chapter 11

The document summarizes standard costing and variance analysis.

Standard costing involves setting standard costs for direct materials, direct labor, and factory overhead based on expected efficiencies. Variances measure the difference between actual and standard costs. There are variances for direct material price and usage, direct labor rate and efficiency, and factory overhead which includes a controllable variance and volume variance. Variance analysis identifies reasons for differences to improve performance.

Standrad costing

Here are the steps to calculate direct labor variances for Hanson Inc:

1. Standard hours to produce 1,000 Zippies = 1,000 x 1.5 = 1,500 hours

2. Standard direct labor cost = Standard hours x Standard rate

= 1,500 hours x $10/hour = $15,000

3. Actual direct labor hours worked last week = 1,550 hours

4. Actual direct labor cost = Actual hours x Actual rate

= Let's assume the actual rate is $10/hour

= 1,550 hours x $10/hour = $15,500

5. Labor efficiency variance = Standard hours - Actual hours

= 1,500 -

Standard costing

- Standard costing involves determining standard costs for materials, labor, and overhead and comparing them to actual costs incurred. Variances between standard and actual costs are calculated and analyzed.

- The key aspects of standard costing include establishing standard costs, tracking actual costs, calculating variances between the two, and analyzing significant variances to improve efficiency. Standard costs are predetermined estimates for direct materials, direct labor, and factory overhead to manufacture a product.

- Variances are measured for direct materials, direct labor, and overhead and can be favorable or unfavorable depending on whether actual costs were lower or higher than standards. Material variances include price, quantity, mix, and yield variances while labor variances include rate and

Standard Costing

Standard costing involves setting predetermined expected costs for cost components like direct materials, direct labor, and factory overhead. Variances are calculated as the difference between actual and standard costs. This includes direct material, direct labor, and factory overhead variances. The direct material variance has a price and usage component. The factory overhead variance separates variable from fixed costs, with the controllable variance measuring variable cost efficiency and volume variance measuring fixed cost utilization.

Standard cost

The document discusses standard costing and variance analysis techniques. It defines standard cost as a predetermined cost computed in advance based on cost factors. It explains that standard costing compares standard and actual costs to determine efficiency and take corrective action. Variances are the differences between standard and actual costs and are computed for materials, labor, and overhead. Variance analysis involves subdividing total variances to assign responsibility for performance differences. Formulas are provided for calculating different type of variances.

Budgetory Control System and Cost Control

Budgeting and Budgetary control – Standard costing and variance analysis: Cost control and cost reduction:

Introduction to cost control – cost reduction- fields covered by cost reduction- tools and techniques for cost reduction

Standard Costing Operational Performance Measures And

A cost management system measures the costs of activities, identifies unnecessary costs, and finds ways to improve performance. It has three parts: predetermined standards of performance, actual performance measures, and comparisons of standards to actuals with corrective actions. Managers focus on significant cost variances to determine their causes and reduce problems. Standards can be set through historical analysis, task analysis, or a combined approach. Direct material and labor variances are calculated to measure differences between actual and standard quantities and prices used and costs.

Management accounting overhead variance

This document discusses the calculation and analysis of variances in overhead costs. It begins with an introduction to variance analysis and classification of variances as favorable or unfavorable. It then describes the different types of overhead variances including variable overhead variances, fixed overhead variances, and combined overhead variances. Specific formulas are provided for calculating the variable overhead cost variance, variable overhead expenditure variance, fixed overhead cost variance, and other overhead variances. An example is also shown to illustrate the calculation of a variable overhead expenditure variance.

Ca chap 13 standard costing&variance analysis(2)

This document discusses standard costing and variance analysis techniques. Standard costing involves setting predetermined standard costs that products should attain under given conditions. Variances measure the difference between actual and standard costs/results and can be classified in various ways, including functionally, based on measurement, results, and controllability. Key variances include material, labor, variable and fixed overhead variances. Standard costing is used for cost control, pricing, performance evaluation, and management objectives.

Standard Costing

Definition of standard cost, target costing, kaizen costing and some mathematical problem with requirements.

Variance Formulae

Consolidated Variance Formula sheet which you easily understand and learn all the variance formula like, Material Labor OR FOH.

Standard costs and variance analysis

Standard costs are developed using formulas, supplier lists, or time studies and compared to actual costs to calculate variances which should be investigated if significant, with variances for direct materials including price, quantity, mix and yield and variances for direct labor including rate, efficiency, mix, yield and idle time.

Mbaptscv ijuly2009 s

This document contains 10 questions related to standard costing and calculation of material and labor variances. The questions provide standard and actual costs for materials and labor along with production quantities. Sample solutions are provided that calculate variances for material yield, mix, usage, price and cost as well as labor efficiency, mix, usage, price and cost. Calculations are set up in a standard variance formula format comparing standard planned quantities and costs to actual quantities and costs.

Financial%20&%20 management%20accounting%20 %20chapter%2022%20(standard%20cos...

This document provides an overview of standard costing and variance analysis. It defines standard costs as realistic estimates of costs used to set performance targets. Standard costs are developed for direct materials, direct labor, and manufacturing overhead. Variance analysis compares standard costs to actual costs to identify differences known as variances. Managers use variance analysis to control costs by investigating significant variances and taking corrective actions. The document demonstrates how to calculate variances for direct materials costs.

Standard costing

Standard costs are predetermined costs that are used for planning, control, and performance evaluation. Actual costs are compared to standard costs to calculate variances. This document provides an example of calculating variances for material, labor, overhead and other expenses based on standard and actual data for a company. It determines cost, revenue, and profit variances and reconciles the actual profit to the standard profit through a variance analysis. The variances are then analyzed to identify reasons for differences in order to take corrective actions and improve operations.

Standard Costing Day2

The document discusses standard costing, which is a management accounting technique used to analyze variances. It outlines the steps in standard costing as setting standard costs, studying actual costs, comparing actuals to standards, analyzing variances, fixing responsibilities, and taking corrective action. The document also compares budgetary control to standard costing, noting their similarities like basing them on standards, and differences like standard costing focusing more on root causes of variances. It defines types of standards and provides examples of calculating material, labor, and overhead variances.

standard costing & variances analysis

The document discusses standard costing and variance analysis in manufacturing. It defines different types of production costs like direct material, direct labor, indirect costs. It explains how to calculate variances for material, labor, and overhead costs based on standard and actual quantities, prices, and hours. Variances indicate whether the difference between standard and actual costs is favorable or adverse. The document provides formulas to calculate variances for material usage, price, labor rate and efficiency, variable and fixed overhead rates and expenditures.

Variance Analysis

The document discusses material and labor cost variances. It provides examples to show how to calculate material cost variance (MCV), which is the difference between total standard material costs and total actual material costs. MCV can be further broken down into material price variance and material usage variance. The document similarly discusses how to calculate labor cost variance (LCV) and how it can be further broken down. It also discusses how material usage variance and labor efficiency variance can each be broken down into mix and yield sub variances.

Standard costing presentation

Standard costing is a technique that involves setting predetermined standards for costs and comparing them to actual costs. Standards are set for materials, labor, overhead and sales prices/margins. Variances between standards and actuals are analyzed to identify reasons for differences and take corrective actions. It helps management evaluate performance, control costs, set budgets and motivate staff. Some key advantages include cost control, delegation, efficiency improvements, and anticipating future costs and profits. Limitations include requiring technical skills and difficulty separating controllable vs. uncontrollable variances.

Standard Costing

Standard costing involves establishing standard costs, comparing them to actual costs, and analyzing variances. It provides several benefits including aiding management, measuring efficiency, and promoting cost consciousness. Variance analysis examines differences between standard and actual material and labor costs. Material variances include material cost, price, usage, mix, and yield variances. Labor variances include labor cost, rate, efficiency, mix, and yield variances.

Standard Costing & Variances

Standard costing is a system that uses predetermined costs to evaluate actual costs and operational performance. It sets standards for direct materials, direct labor, and factory overheads and calculates variances between actual and standard costs. Variance analysis identifies reasons for differences from standards and helps improve operations, reduce costs through error corrections, and deploy resources effectively. Standard costing provides rules and guidelines for production, allows performance comparisons, and assists with budgeting, financial reporting, and cost management to increase efficiency and productivity. However, setting accurate standards is technical and not easy, and meeting standards should not be the only target.

Bca i fma u 4.4 varience analysis

This document discusses various types of cost and sales variances that can occur in standard costing. It defines direct material, direct labor, and overhead variances, explaining how to calculate variances for material price and usage, labor rate and efficiency, and fixed and variable overhead costs. Sales variances are also covered, including calculations for price, volume, mix, and quantity variances based on both turnover and profit. Formulas are provided for computing each variance.

Mca i fma u 4.4 varience analysis

This document discusses various types of cost and sales variances that can occur in standard costing. It defines direct material, direct labor, and overhead variances, explaining how to calculate variances for material price and usage, labor rate and efficiency, and fixed and variable overhead costs. Sales variances are also covered, distinguishing between variances calculated based on turnover versus profit, and how price, volume, mix, and quantity variances are derived in each case. Formulas are provided for computing each variance.

More Related Content

What's hot

Standrad costing

Here are the steps to calculate direct labor variances for Hanson Inc:

1. Standard hours to produce 1,000 Zippies = 1,000 x 1.5 = 1,500 hours

2. Standard direct labor cost = Standard hours x Standard rate

= 1,500 hours x $10/hour = $15,000

3. Actual direct labor hours worked last week = 1,550 hours

4. Actual direct labor cost = Actual hours x Actual rate

= Let's assume the actual rate is $10/hour

= 1,550 hours x $10/hour = $15,500

5. Labor efficiency variance = Standard hours - Actual hours

= 1,500 -

Standard costing

- Standard costing involves determining standard costs for materials, labor, and overhead and comparing them to actual costs incurred. Variances between standard and actual costs are calculated and analyzed.

- The key aspects of standard costing include establishing standard costs, tracking actual costs, calculating variances between the two, and analyzing significant variances to improve efficiency. Standard costs are predetermined estimates for direct materials, direct labor, and factory overhead to manufacture a product.

- Variances are measured for direct materials, direct labor, and overhead and can be favorable or unfavorable depending on whether actual costs were lower or higher than standards. Material variances include price, quantity, mix, and yield variances while labor variances include rate and

Standard Costing

Standard costing involves setting predetermined expected costs for cost components like direct materials, direct labor, and factory overhead. Variances are calculated as the difference between actual and standard costs. This includes direct material, direct labor, and factory overhead variances. The direct material variance has a price and usage component. The factory overhead variance separates variable from fixed costs, with the controllable variance measuring variable cost efficiency and volume variance measuring fixed cost utilization.

Standard cost

The document discusses standard costing and variance analysis techniques. It defines standard cost as a predetermined cost computed in advance based on cost factors. It explains that standard costing compares standard and actual costs to determine efficiency and take corrective action. Variances are the differences between standard and actual costs and are computed for materials, labor, and overhead. Variance analysis involves subdividing total variances to assign responsibility for performance differences. Formulas are provided for calculating different type of variances.

Budgetory Control System and Cost Control

Budgeting and Budgetary control – Standard costing and variance analysis: Cost control and cost reduction:

Introduction to cost control – cost reduction- fields covered by cost reduction- tools and techniques for cost reduction

Standard Costing Operational Performance Measures And

A cost management system measures the costs of activities, identifies unnecessary costs, and finds ways to improve performance. It has three parts: predetermined standards of performance, actual performance measures, and comparisons of standards to actuals with corrective actions. Managers focus on significant cost variances to determine their causes and reduce problems. Standards can be set through historical analysis, task analysis, or a combined approach. Direct material and labor variances are calculated to measure differences between actual and standard quantities and prices used and costs.

Management accounting overhead variance

This document discusses the calculation and analysis of variances in overhead costs. It begins with an introduction to variance analysis and classification of variances as favorable or unfavorable. It then describes the different types of overhead variances including variable overhead variances, fixed overhead variances, and combined overhead variances. Specific formulas are provided for calculating the variable overhead cost variance, variable overhead expenditure variance, fixed overhead cost variance, and other overhead variances. An example is also shown to illustrate the calculation of a variable overhead expenditure variance.

Ca chap 13 standard costing&variance analysis(2)

This document discusses standard costing and variance analysis techniques. Standard costing involves setting predetermined standard costs that products should attain under given conditions. Variances measure the difference between actual and standard costs/results and can be classified in various ways, including functionally, based on measurement, results, and controllability. Key variances include material, labor, variable and fixed overhead variances. Standard costing is used for cost control, pricing, performance evaluation, and management objectives.

Standard Costing

Definition of standard cost, target costing, kaizen costing and some mathematical problem with requirements.

Variance Formulae

Consolidated Variance Formula sheet which you easily understand and learn all the variance formula like, Material Labor OR FOH.

Standard costs and variance analysis

Standard costs are developed using formulas, supplier lists, or time studies and compared to actual costs to calculate variances which should be investigated if significant, with variances for direct materials including price, quantity, mix and yield and variances for direct labor including rate, efficiency, mix, yield and idle time.

Mbaptscv ijuly2009 s

This document contains 10 questions related to standard costing and calculation of material and labor variances. The questions provide standard and actual costs for materials and labor along with production quantities. Sample solutions are provided that calculate variances for material yield, mix, usage, price and cost as well as labor efficiency, mix, usage, price and cost. Calculations are set up in a standard variance formula format comparing standard planned quantities and costs to actual quantities and costs.

Financial%20&%20 management%20accounting%20 %20chapter%2022%20(standard%20cos...

This document provides an overview of standard costing and variance analysis. It defines standard costs as realistic estimates of costs used to set performance targets. Standard costs are developed for direct materials, direct labor, and manufacturing overhead. Variance analysis compares standard costs to actual costs to identify differences known as variances. Managers use variance analysis to control costs by investigating significant variances and taking corrective actions. The document demonstrates how to calculate variances for direct materials costs.

Standard costing

Standard costs are predetermined costs that are used for planning, control, and performance evaluation. Actual costs are compared to standard costs to calculate variances. This document provides an example of calculating variances for material, labor, overhead and other expenses based on standard and actual data for a company. It determines cost, revenue, and profit variances and reconciles the actual profit to the standard profit through a variance analysis. The variances are then analyzed to identify reasons for differences in order to take corrective actions and improve operations.

Standard Costing Day2

The document discusses standard costing, which is a management accounting technique used to analyze variances. It outlines the steps in standard costing as setting standard costs, studying actual costs, comparing actuals to standards, analyzing variances, fixing responsibilities, and taking corrective action. The document also compares budgetary control to standard costing, noting their similarities like basing them on standards, and differences like standard costing focusing more on root causes of variances. It defines types of standards and provides examples of calculating material, labor, and overhead variances.

standard costing & variances analysis

The document discusses standard costing and variance analysis in manufacturing. It defines different types of production costs like direct material, direct labor, indirect costs. It explains how to calculate variances for material, labor, and overhead costs based on standard and actual quantities, prices, and hours. Variances indicate whether the difference between standard and actual costs is favorable or adverse. The document provides formulas to calculate variances for material usage, price, labor rate and efficiency, variable and fixed overhead rates and expenditures.

Variance Analysis

The document discusses material and labor cost variances. It provides examples to show how to calculate material cost variance (MCV), which is the difference between total standard material costs and total actual material costs. MCV can be further broken down into material price variance and material usage variance. The document similarly discusses how to calculate labor cost variance (LCV) and how it can be further broken down. It also discusses how material usage variance and labor efficiency variance can each be broken down into mix and yield sub variances.

Standard costing presentation

Standard costing is a technique that involves setting predetermined standards for costs and comparing them to actual costs. Standards are set for materials, labor, overhead and sales prices/margins. Variances between standards and actuals are analyzed to identify reasons for differences and take corrective actions. It helps management evaluate performance, control costs, set budgets and motivate staff. Some key advantages include cost control, delegation, efficiency improvements, and anticipating future costs and profits. Limitations include requiring technical skills and difficulty separating controllable vs. uncontrollable variances.

Standard Costing

Standard costing involves establishing standard costs, comparing them to actual costs, and analyzing variances. It provides several benefits including aiding management, measuring efficiency, and promoting cost consciousness. Variance analysis examines differences between standard and actual material and labor costs. Material variances include material cost, price, usage, mix, and yield variances. Labor variances include labor cost, rate, efficiency, mix, and yield variances.

Standard Costing & Variances

Standard costing is a system that uses predetermined costs to evaluate actual costs and operational performance. It sets standards for direct materials, direct labor, and factory overheads and calculates variances between actual and standard costs. Variance analysis identifies reasons for differences from standards and helps improve operations, reduce costs through error corrections, and deploy resources effectively. Standard costing provides rules and guidelines for production, allows performance comparisons, and assists with budgeting, financial reporting, and cost management to increase efficiency and productivity. However, setting accurate standards is technical and not easy, and meeting standards should not be the only target.

What's hot (20)

Standard Costing Operational Performance Measures And

Standard Costing Operational Performance Measures And

Financial%20&%20 management%20accounting%20 %20chapter%2022%20(standard%20cos...

Financial%20&%20 management%20accounting%20 %20chapter%2022%20(standard%20cos...

Similar to Amresh management accounting

Bca i fma u 4.4 varience analysis

This document discusses various types of cost and sales variances that can occur in standard costing. It defines direct material, direct labor, and overhead variances, explaining how to calculate variances for material price and usage, labor rate and efficiency, and fixed and variable overhead costs. Sales variances are also covered, including calculations for price, volume, mix, and quantity variances based on both turnover and profit. Formulas are provided for computing each variance.

Mca i fma u 4.4 varience analysis

This document discusses various types of cost and sales variances that can occur in standard costing. It defines direct material, direct labor, and overhead variances, explaining how to calculate variances for material price and usage, labor rate and efficiency, and fixed and variable overhead costs. Sales variances are also covered, distinguishing between variances calculated based on turnover versus profit, and how price, volume, mix, and quantity variances are derived in each case. Formulas are provided for computing each variance.

Standard costing and variances

Standard costing is a technique that uses predetermined costs and revenues to measure variances from actual costs and analyze their causes to improve efficiency. It involves setting standard costs for materials, labor, and overhead, measuring actual costs, comparing actuals to standards, and taking corrective action. Variances in standard costing include material cost, price, usage, mix, and yield variances as well as labor cost, rate, efficiency, and idle time variances. The goal is to eliminate waste and inefficiencies through variance analysis.

Standard costing summary

1. The document discusses various types of standard costing variances for materials, labor, and overhead. It provides formulas to calculate 22 different variances including material cost, price, quantity, and mix variances as well as labor cost, rate, efficiency, and mix variances.

2. Overhead variances covered include variable and fixed overhead cost, expenditure, efficiency, volume, capacity, revised capacity, and calendar variances. Formulas use standard and actual quantities, prices, rates, and overhead amounts to calculate the variances.

3. Short summaries are provided for each variance along with reconciliation formulas showing the relationships between different variances.

3901853 standard-costing

Standard costs are predetermined unit costs used to measure performance. They are set by management and involve input from those responsible for costs and quantities. Standards distinguish budgets, which are total amounts, from standards, which are unit amounts. Variances are calculated by comparing actual costs to standard costs and are analyzed and reported to facilitate management decision making.

Variance Analysis

Variance analysis compares actual performance to budgets to identify deviations. There are different types of variances including material, labor, and overhead variances. Material variances measure differences in price and quantity used versus standard. Labor variances include rate, efficiency, idle time, mix, and yield. Overhead variances measure differences in variable and fixed overhead expenditures and volumes versus standards. The goal is to control costs by investigating variances and their causes.

Managerial Accounting Project.pptx

This document presents a managerial accounting project on standard costs and variances. It defines standard costs and variances, and explains how to calculate variances for direct materials, direct labor, and variable manufacturing overhead. Variances identify areas for cost reduction and efficiency improvements. The document outlines the calculation methods and significance of price and quantity variances for direct materials, rate and efficiency variances for direct labor, and rate and efficiency variances for variable manufacturing overhead. Responsibilities for variances and limitations of standard costing are also discussed.

Standard Costs Variance Analysis and its impact on Managerial Accounting

This document covers standard costs and variance analysis in managerial accounting. It defines standard costs and how they are developed, and explains how to calculate variances for direct materials, direct labor, and manufacturing overhead. Variances indicate differences between actual and standard costs, and are investigated to identify potential problems. Favorable variances are not always good, and process improvements can lead to unfavorable variances. The document provides examples of calculating variances and their financial impact.

Standard-Costing-Variance-Analysis.ppt

This document provides definitions and explanations of standard costing and variance analysis. It defines standard costs as predetermined costs based on estimates for materials, labor, and overhead. Standard costing involves establishing standard costs and measuring actual costs against standards to analyze variances and improve efficiency. Variance analysis involves separating total variances into constituent parts and explaining the reasons for variances. The document then discusses different types of variances, including material, labor, and overhead variances. It provides examples of how to calculate various variances using standard and actual data.

181572.pdf

This document discusses standard costing and variance analysis. It defines standard costing as predetermined costs based on technical estimates for materials, labor, and overhead under normal production conditions. Variances measure the difference between actual and standard costs and can be classified by function, measurement, result, and controllability. Common variances include material, labor, and overhead variances such as price, usage, efficiency, and rate variances. Standard costing is used for cost control, performance evaluation, pricing decisions, and management by objectives.

Projecto variance

The document discusses analyzing and reporting variances from standards. It defines a variance as the difference between an actual result and the corresponding budgeted amount. It describes two types of variances: favorable variances which increase operating income relative to the budget, and unfavorable variances which decrease operating income relative to the budget. The document also discusses static budget variances, flexible budget variances, sales volume variances, and how variances are computed.

Standard costing setting standards and analysis of variance

This document discusses standard costing and variance analysis. It defines standard costs as predetermined costs for manufacturing a unit based on expected materials, labor hours, and plant capacity usage. Standard costs are used for budgeting, controlling costs, promoting cost reduction, and inventory valuation. The document then describes how to set physical, materials, labor, and overhead standards. It explains different types of variances for materials, labor, and overhead costs to analyze deviations from standards and measure performance. Methods like two variance, three variance, and four variance are presented for overhead variance analysis.

Understanding SAP production order variance

This document discusses production order variance and standard costs as a way to evaluate performance and increase efficiency. It explains that setting standards and measuring variances from those standards allows companies to identify areas for improvement. The document then provides details on calculating different types of variances, including direct material, direct labor, and manufacturing overhead variances. It describes separating the total variance for each into a price and quantity component to help analyze the sources of unfavorable or favorable variances.

aaa aaa variance analysis.ppt

Variance analysis is used to identify and explain differences between planned and actual outcomes. A variance is the difference between an actual amount and a budgeted or planned amount. Variances can be categorized based on the type of cost (e.g. material, labor), whether they are controllable or uncontrollable, if they are favorable or unfavorable, their nature as basic or sub-variances, and more. Variance analysis helps management identify reasons for deviations and take corrective actions to improve performance and control costs.

Variance Formulae

Consolidated Variance Formulae to easy to learn and understand.

All Variance like Material labor & FOH is mention in the sheet.

STANDARD COSTING & VARIANCE ANALYSIS (4).pptx

a complete analysis on standard costing & variance analysis.

Advancedcostaccounting 140417192903-phpapp02

Standard costing refers to expected costs under anticipated conditions and allows for comparison of standard versus actual costs. Differences between standard and actual costs are referred to as variances, which should be investigated if significant. Standard cost is the cost of a single unit while budgeted cost is the total cost of budgeted units. Target costing determines the allowable cost to earn a required profit, while kaizen costing continually reduces costs after design and production. Cost variances measure differences between planned and actual costs. Material, labor, and variable overhead variances compare standard and actual costs for these items.

Standard costing

Standard costing is a technique that uses predetermined standards for costs and revenues to control performance through variance analysis. Standards are established for inputs and outputs and are used to assess performance, control costs, motivate staff, and provide guidance to improve performance. Variances measure the difference between actual and standard costs and revenues and are classified into material, labor, overhead, and sales categories to identify reasons for non-standard performance. Material variances include price, usage, mix, and yield components.

Standard costing

Standard costing is a technique that uses predetermined standards for costs and revenues to control performance through variance analysis. Standards are established for inputs and outputs and are used to assess performance, control costs, motivate staff, and provide guidance to improve performance. Variances measure the difference between actual and standard costs and revenues and are classified into material, labor, overhead, and sales categories to identify reasons for non-standard performance. Material variances include price, usage, mix, and yield components.

Standard Costing

This document discusses standard costing and variance analysis. It explains that standard costs are budgeted costs for manufacturing a unit or providing a service. Standards are set for material, labor, and overhead based on specifications, time studies, and expected activity levels. Variances measure differences between actual and standard costs and can be analyzed to control costs and evaluate performance. Variance analysis compares actual inputs/costs to standard amounts allowed for the output achieved. It also notes trends toward combining labor and overhead into conversion costs and calculating mix and yield variances.

Similar to Amresh management accounting (20)

Standard Costs Variance Analysis and its impact on Managerial Accounting

Standard Costs Variance Analysis and its impact on Managerial Accounting

Standard costing setting standards and analysis of variance

Standard costing setting standards and analysis of variance

Amresh management accounting

- 2. Classification Variances are broadly classified into the following:

- 3. Material Cost Variance Material Cost Variance Material Cost Variance is the difference between the actual cost of direct materials used and standard cost of direct materials specified for the output achieved. This variance results from differences between quantities consumed and quantities of materials allowed for production and from differences between prices paid and prices predetermined. Can be computed using the formula: Material Cost Variance = (SQ x SP) – (AQ x AP)

- 4. Material Price Variance A Materials Price Variance occurs when raw materials are purchased at a price different from standard price. It is that portion of the direct materials which is due to the difference between actual price paid and standard price specified Can be computed using the formula: Material Price Variance = (Standard Price – Actual Price) x Actual Quantity This variance is unfavourable when the actual price paid exceeds the predetermined standard price. It is advisable that materials price variance should be calculated at the time of materials purchase rather than when materials are used. This is quite beneficial from the viewpoint of performance measurement and corrective action.

- 5. Materials Usage Variance The material quantity or usage variance results when actual quantities of raw materials used in production differ from standard quantities that should have been used to produce the output achieved. It is that portion of the direct materials cost variance which is due to the difference between the actual quantity used and standard quantity specified. Can be computed using the formula: Material Qty. variance = (SQ for actual output – AQ ) x Standard Price This variance is favourable when the total actual quantity of direct materials used is less than the total standard quantity allowed for the actual output.

- 6. Material Mix Variance *The material mix variance is an sub variance of materials usage variance it arises only where more than one type of materials is used for producing a product . * Increase in the proportion of cheaper materials result in favourable mix variance & vice versa Can be computed using the formula: Material Mix variance = (Revised Standard Qty. – AQ ) x Standard Price Revised Standard Quantity = x SQ

- 7. Materials Yield Variance Materials Yield Variance The material yield variance explains the remaining portion of the total materials quantity variance. It occurs when output of the final product does not match with the output that could have been obtained by using the actual inputs. It is that portion of the materials usage variance which is due to the difference between the actual yield obtained and the standard yield specified (in terms of actual inputs). Can be computed using the formula: Material Yield variance = (Standard yield or output for actual input – Actual yield or output) x Standard Cost per unit Standard Cost per unit = Total cost of standard mix of material Net standard output quantity

- 8. Labour Variances Labour Variances constitution:

- 9. Labour Cost Variance Labour Cost Variance denotes the difference between the actual Cost and standard of direct labour Can be computed using the formula: Labour Cost Variance = (SH x SR) – (AH x AR) When the actual variance.cost labour cost is more than standard cost, there will be adverse

- 10. Labour Rate Variance A Labours Rate Variance is the difference between the standard labour rate specified and the actual labour rate paid. It is an uncontrollable variance as the labour rate are usually dertermined by supply & supply & demand conditions in the labour market Can be computed using the formula: Labour Rate Variance = (Standard Wage Rate – Actual Rate) x Actual Time This variance is adverse when the actual wage rate paid exceeds the predetermined standard wage rate. Reasons for labour rate variance : 1)Change in the basic wage rate . 2)Use of diferent methods of wage payment . 3)Unscheduled overtime. 4)New workers not paid full wages

- 11. Labour Efficiency Variance The Labour time or efficiency variance is the result of taking more or less time than the standard time specified for the performance of a work. It is that portion of the Labour cost variance which is due to the difference between the actual labour hour expended and standard labour hours specified. Can be computed using the formula: Labour Efficiency variance = (SH for actual output – AH ) x Standard Rate This variance is favourable when the total actual hours are less than the standard hours allowed. Reasons for LEV 1)`Using low qty materials 2)Improper working conditions .

- 12. Idle Time Variance It is a sub-variance of Wage Efficiency or Time Variance. The standard cost of actual hours of any employee may remain idle due to abnormal circumstances like strikes, lock outs, power failure etc. Standard cost of such idle time is called Idle Time Variance. It is always adverse or unfavourable. Can be computed using the formula: Idle Time variance = Idle Hours x Standard Rate per hour

- 13. Labour Mix Variance LMV arises only when more than 1 grade of workers are employed on a job , here grade refers to skilled & unskilled Can be computed using the formula: Labour Mix variance = (Revised Standard labour hours – AH ) x Standard Wage rate

- 14. Labours Yield Variance The Labour yield variance occurs when there is a difference between standard output and actual output. Can be computed using the formula: Labour Yield variance = (Standard yield or output for actual mix– Actual yield or output) x Standard labour Cost per unit

- 15. Variable OH Variances Variable Overhead Variance represents he difference between standard variable overhead (specified for actual units produced) and the actual variable overhead incurred. Can be computed using the formula: Variable OH Cost Variance = Standard Variable OH on actual production – Actual variable OH OR Variable OH Cost variance = (Actual time or standard hours for actual production x Standard variable OH Rate) – (Actual Variable OH)

- 16. Sub-division There may be two sub divisions of variable overhead variance. (i) Variable Overhead Expenditure or Budget Variance = Standard Variable Overheads for actual time – Actual variable overheads Standard variable OH for actual time = standard variable OH rate per hour x actual hours (ii) Variable OH Efficiency Variance = Standard Variable Overheads on actual production – standard variable overheads for actual time Standard or budgeted variable overhead for actual time = Standard OH Rate per hour x Actual Hours Standard variable OH on actual production = standard variable OH per unit x Actual output

- 17. Fixed OH Variances T erms to be understood before calculating OH Variances: 1. Standard OH Rate per unit or per hour or B udgeted OH Rate per unit = B udgeted Overheads B udgeted Output Units or B udgeted H ours or per hour 2. Recovered or Absorbed Overheads = Standard OH R ate per unit x Actual Output or Standard OH Rate per hour x Standard hours for actual output 3. B udgeted Overheads (for budgeted hours or budgeted output): = Standard OH rate per unit x B udgeted output units or Standard overhead rate per hour x budgeted hours. 4. Standard Overheads (for actual time or budgeted output for actual time) = Standard OH Rate per unit x Standard output for actual time or Standard OH rate per hour x actual hours Continued….

- 18. Important Terms Important Terms 5. Actual Overheads = Actual OH Rate per unit x Actual Output or Actual Rate per hours x Actual hours 6. Standard H ours for actual output = B udgeted hours Output B udgeted Output 7. Standard output for Actual T ime =B udgeted Output hours B udgeted hours x Actual x Actual

- 19. Fixed OH Cost Variance Fixed OH Cost Variance Fixed Overhead Cost Variance is the difference between standard overhead recovered or absorbed for actual output and the actual fixed overhead. Can be computed using the formula: Fixed OH Cost Variance = (Recovered or absorbed Fixed OH) – (Actual Fixed OH) OR (Actual output) x (Standard OH Rate) – (Actual OH Rate x Actual Output)

- 20. Thank you