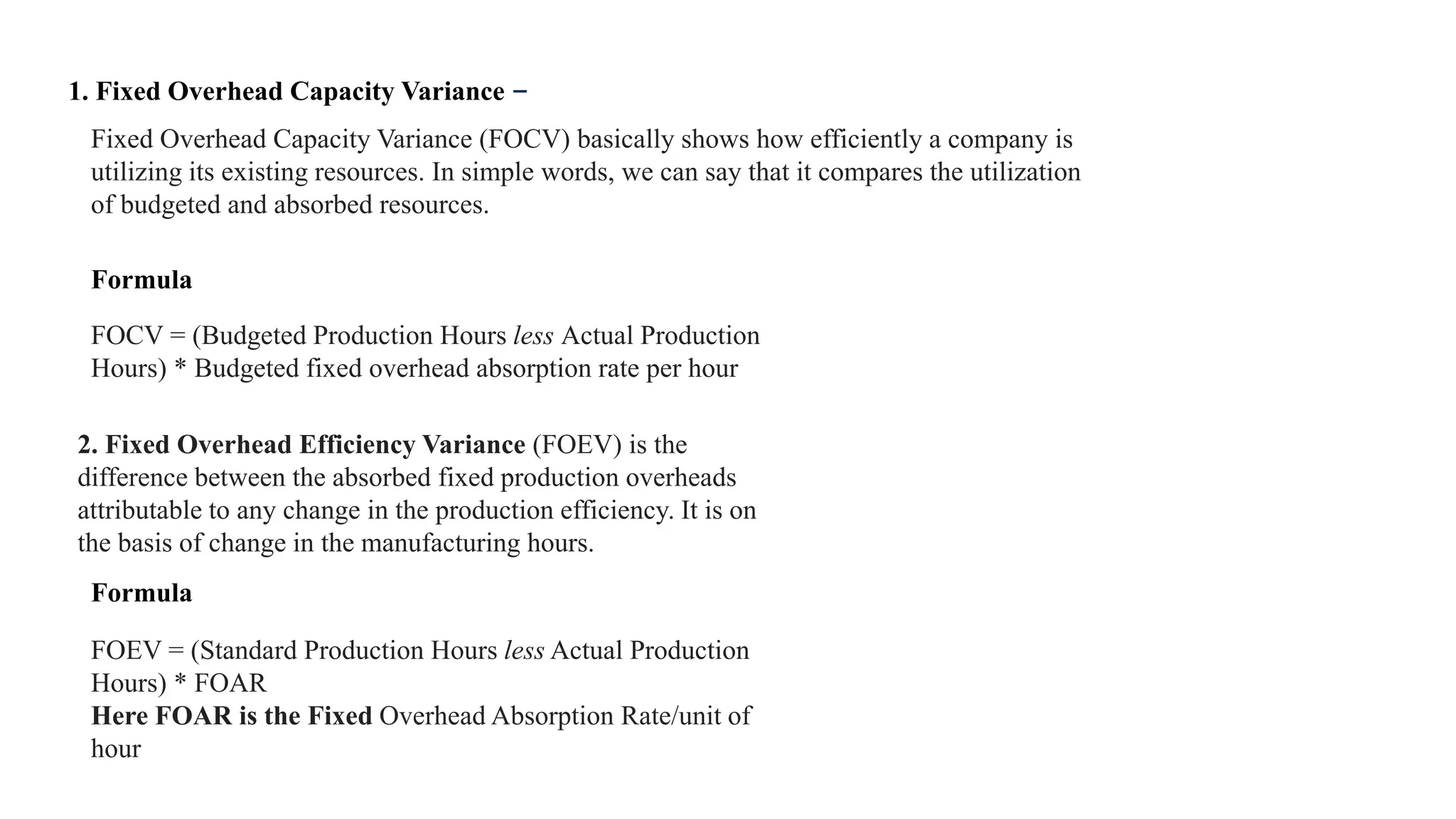

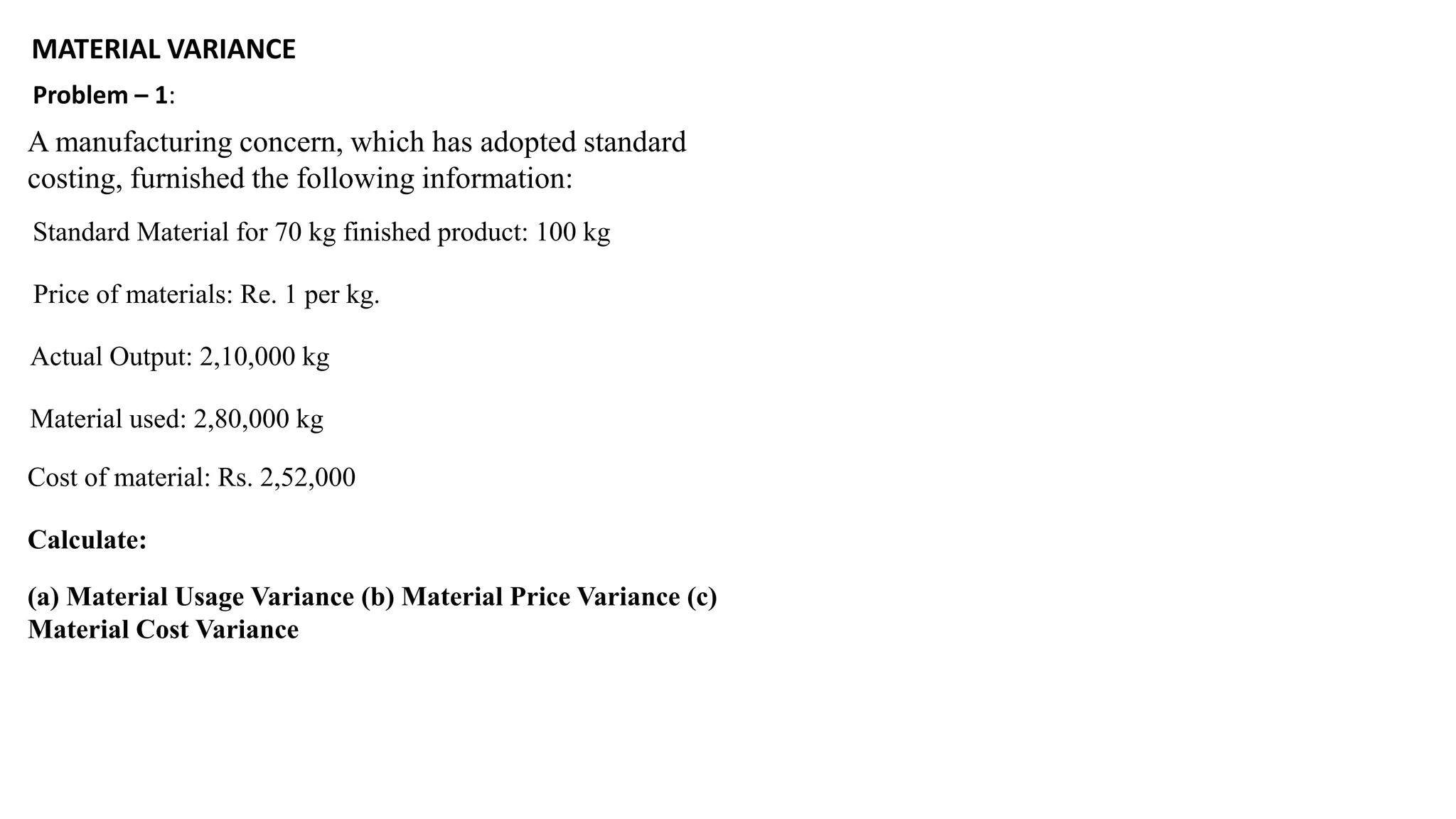

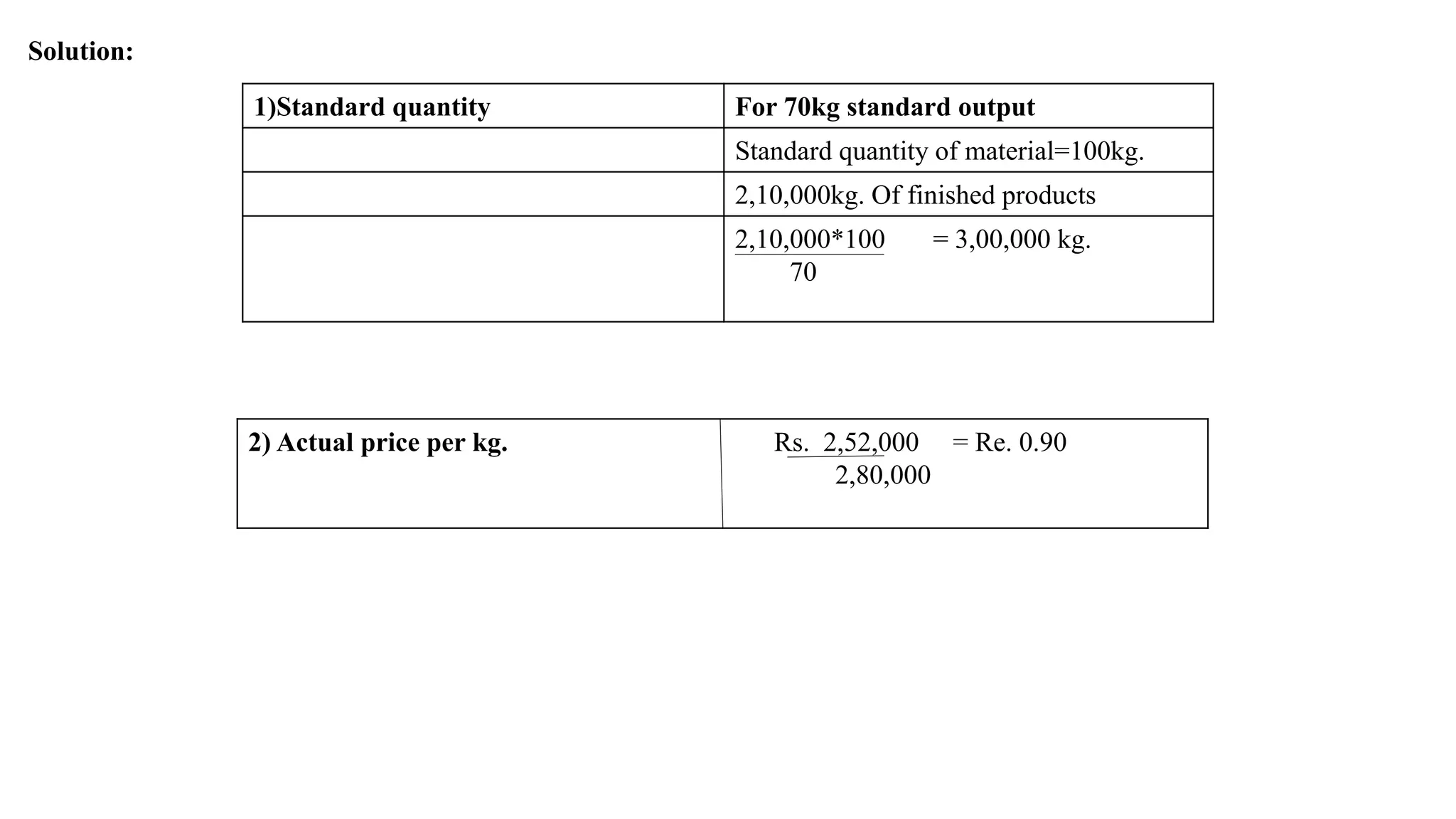

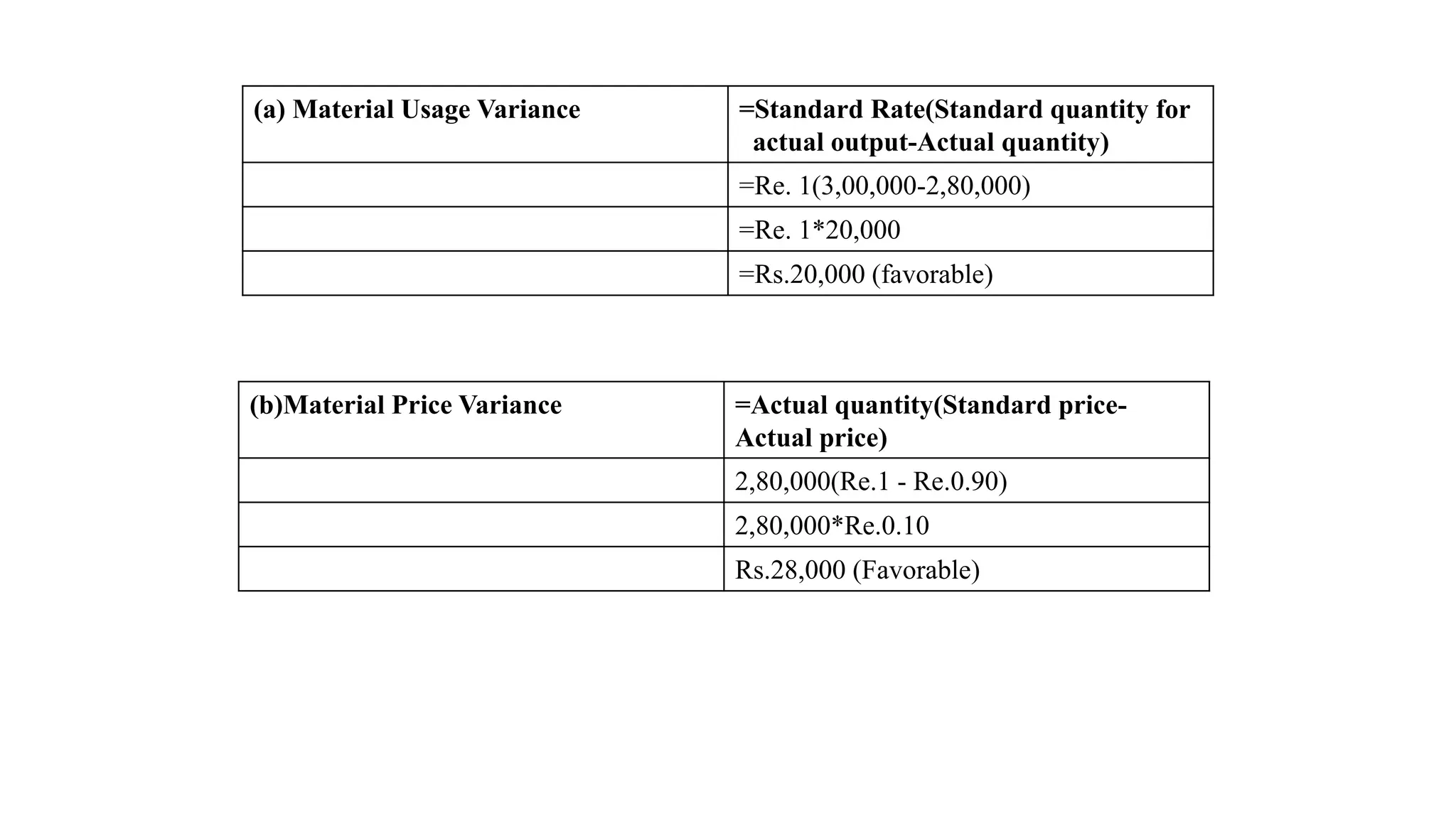

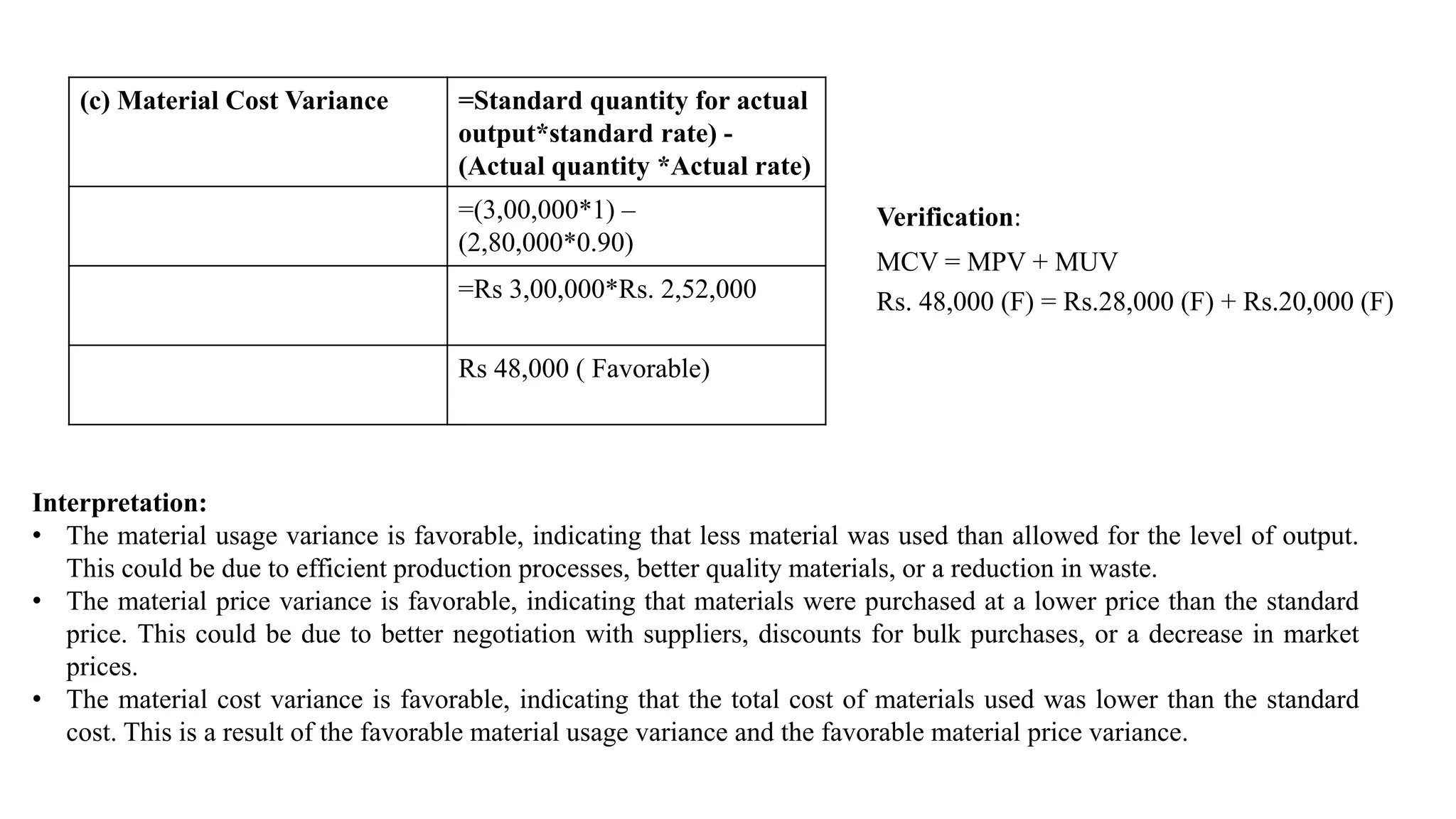

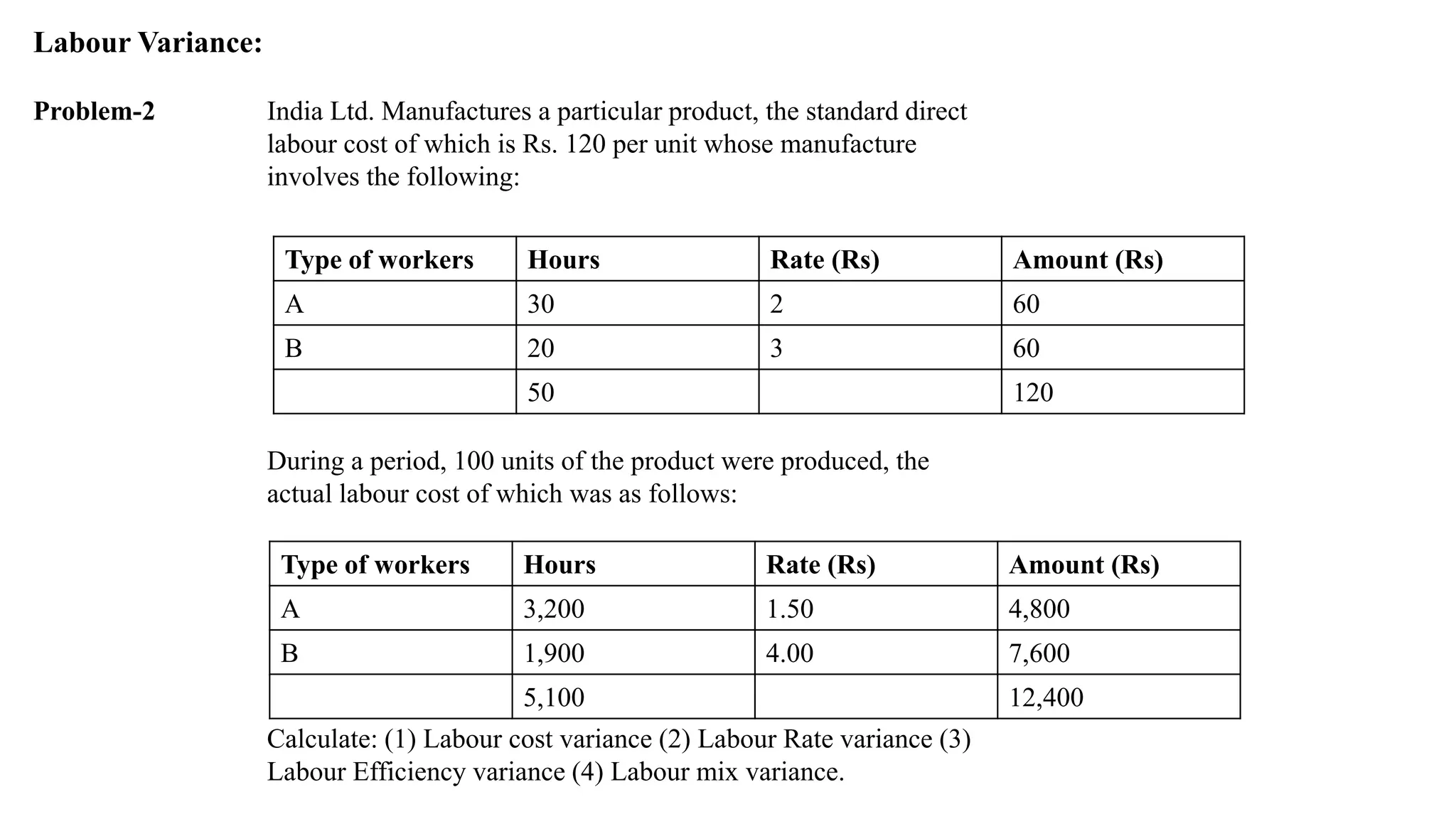

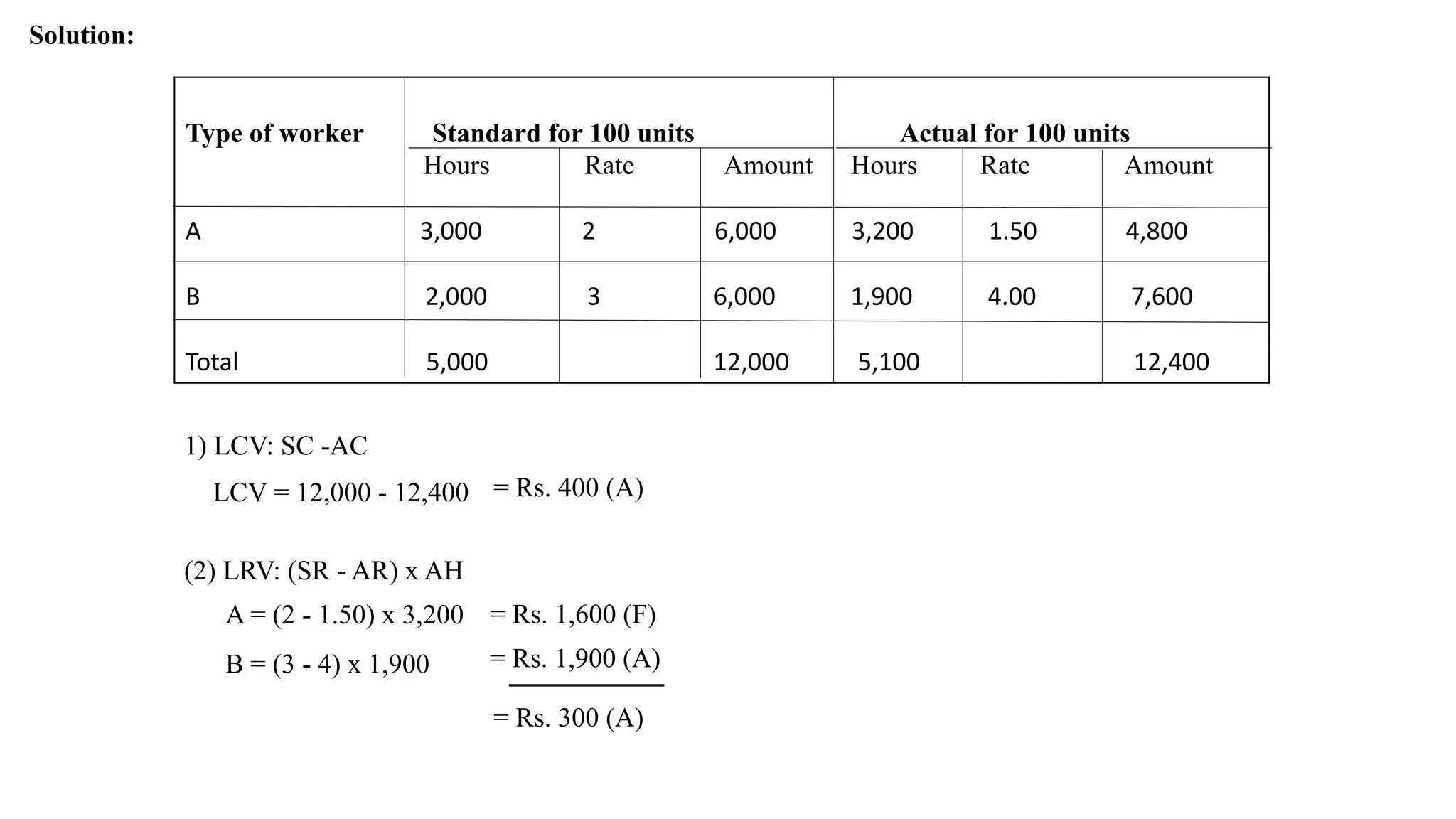

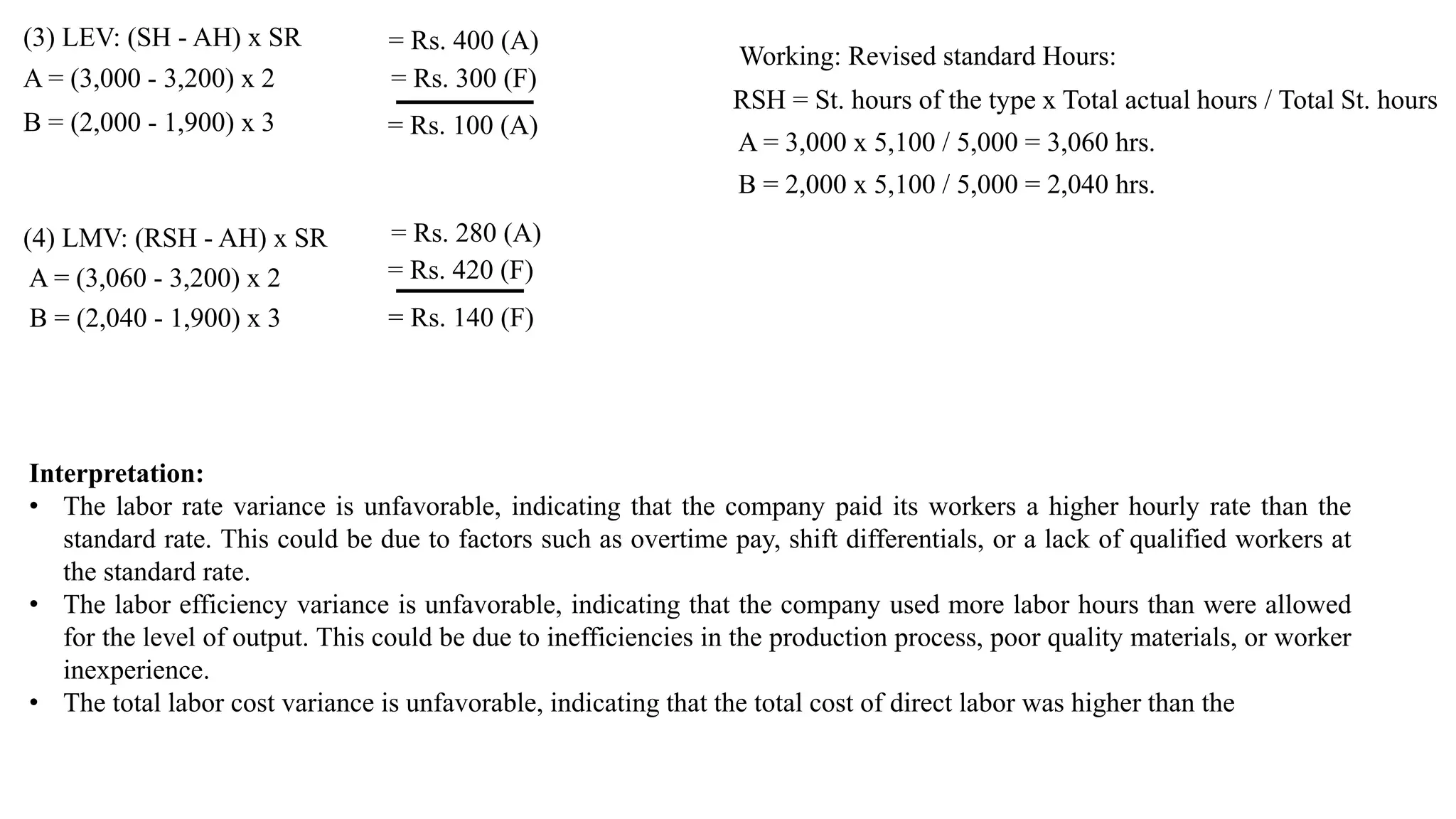

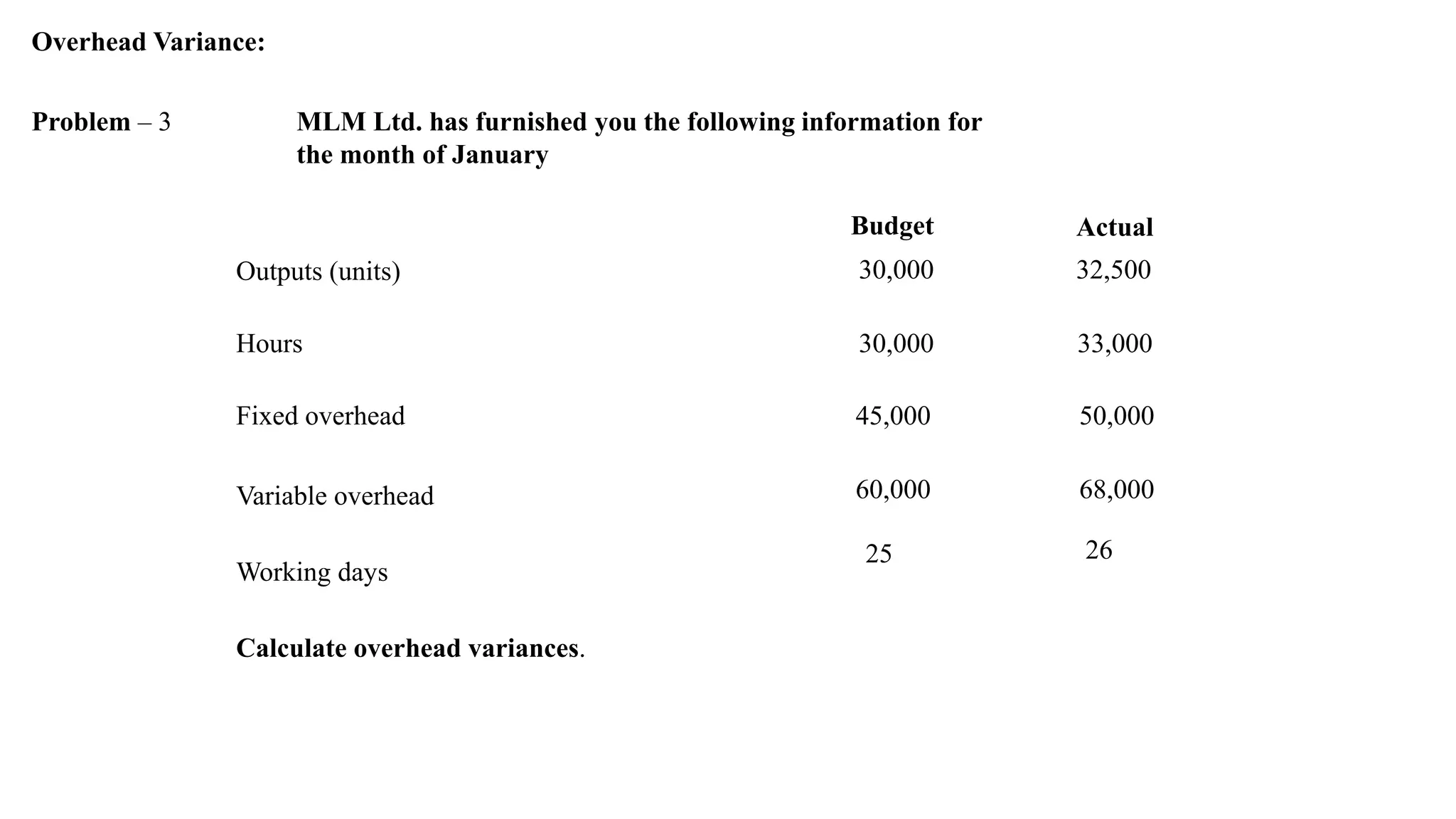

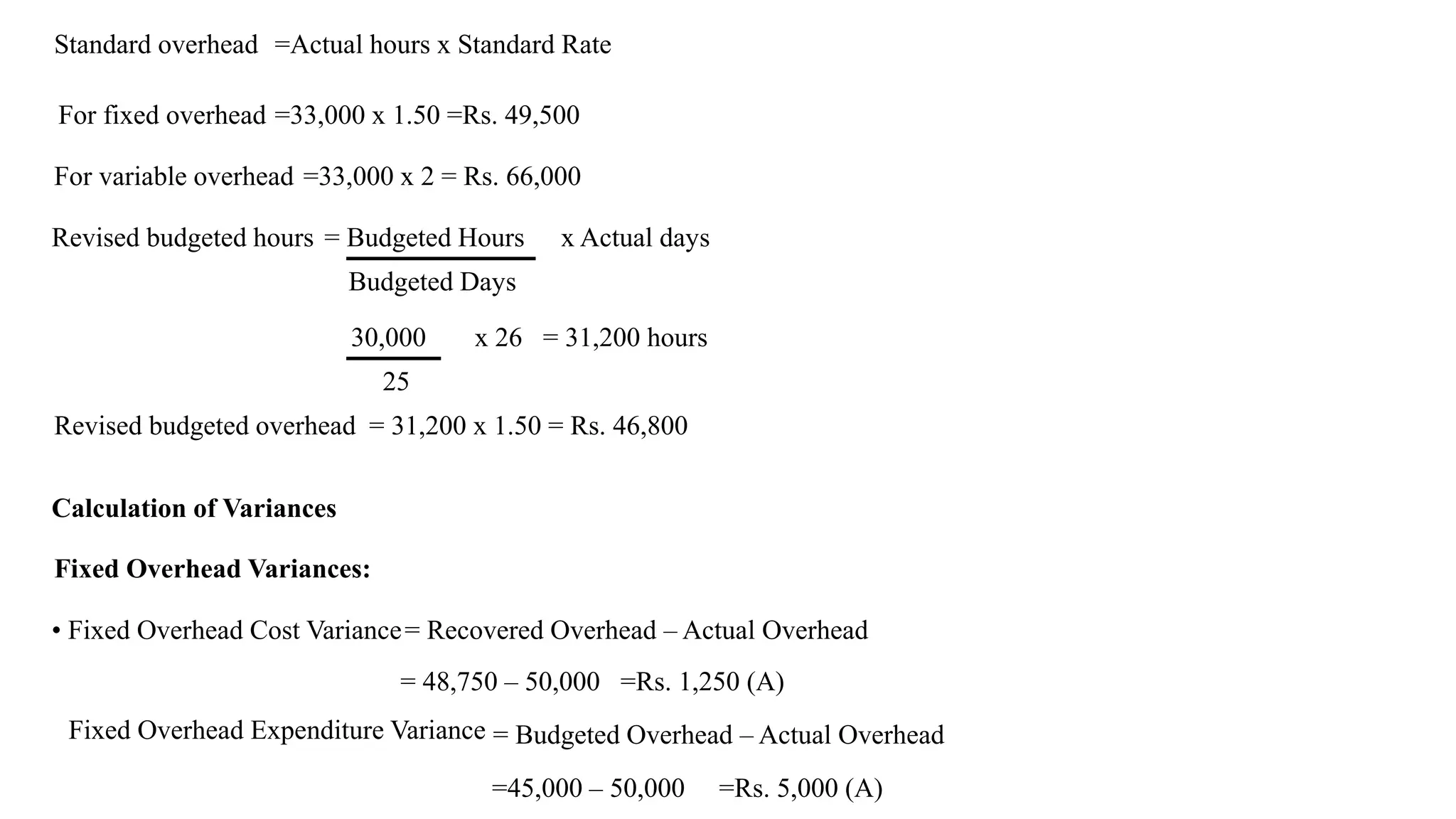

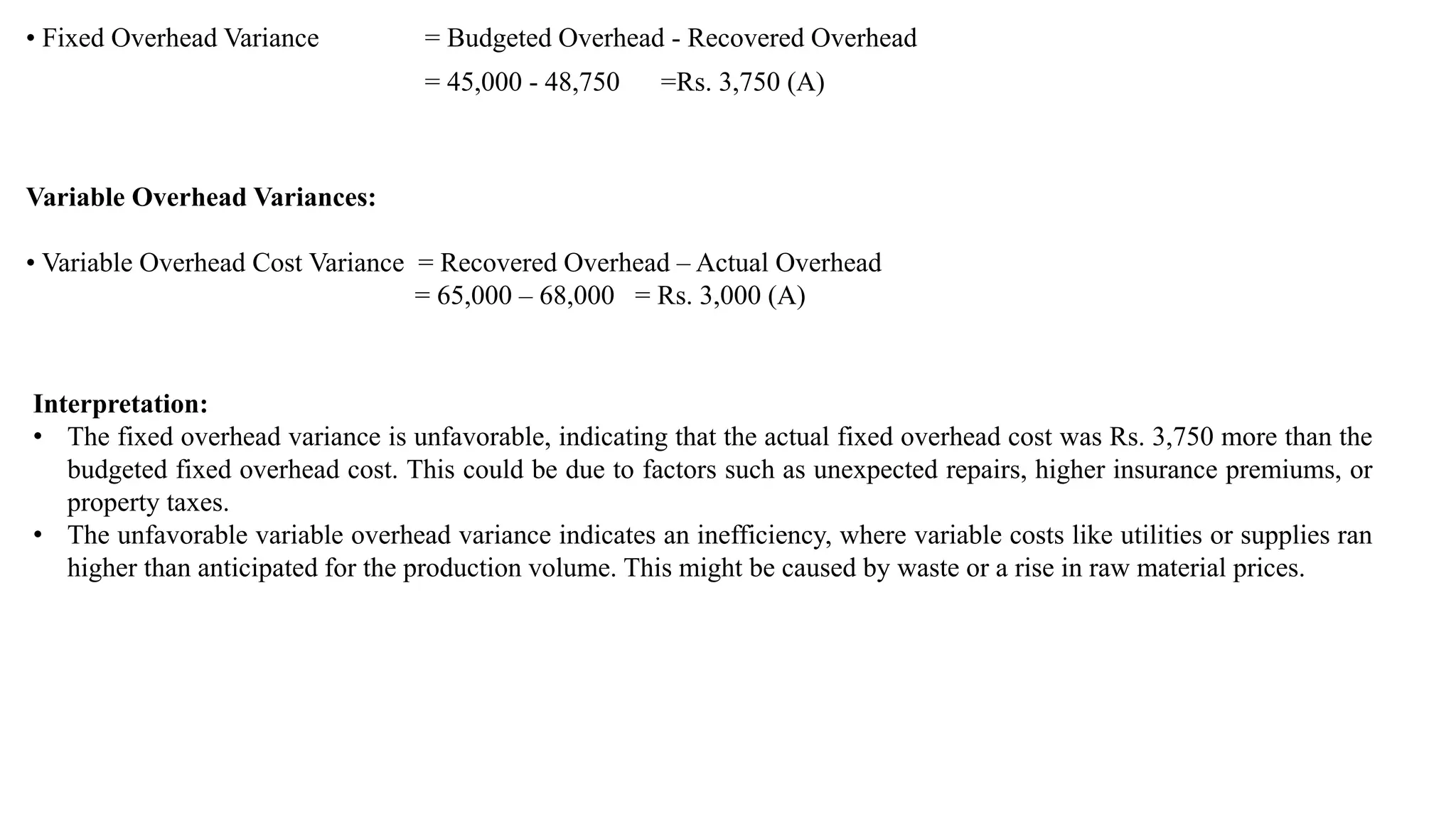

The document discusses standard costing and variance analysis, which are essential methods for estimating production expenses and assessing differences between estimated and actual costs. It details various types of variances, including overhead, expenditure, efficiency, and labor variances, providing formulas and examples for calculation. Additionally, the document interprets the results of variances to identify opportunities for improvement in manufacturing processes.