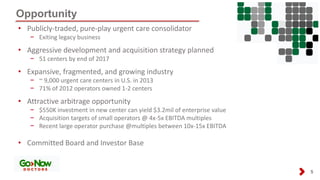

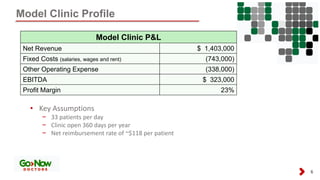

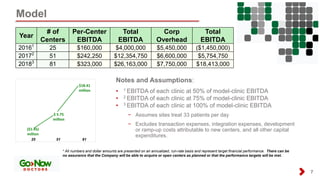

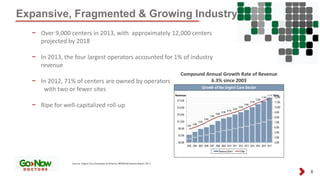

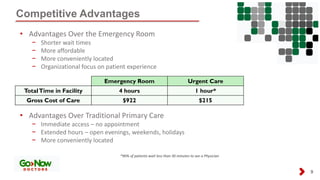

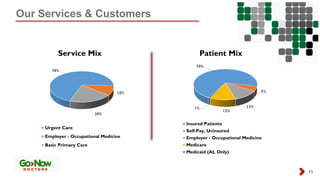

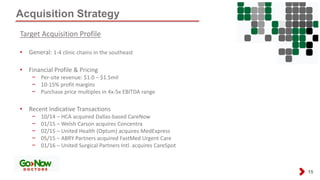

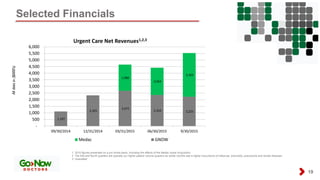

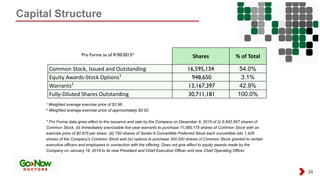

American CareSource Holdings is an owner and operator of urgent care medical centers pursuing an aggressive growth strategy through de novo clinic development and acquisitions. The company aims to have 51 centers by the end of 2017 and 81 centers by 2018. It focuses on operating conveniently located, affordable urgent care clinics in the Southeast U.S. that offer walk-in medical care without appointments. The company sees opportunities to consolidate a fragmented urgent care industry and achieve economies of scale. Its growth strategy relies on developing new clinics, acquiring competitors, and increasing revenue per existing clinic.