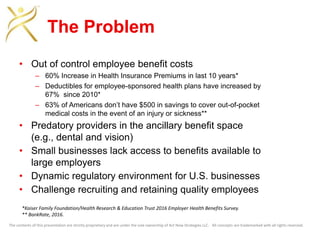

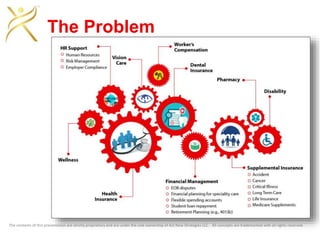

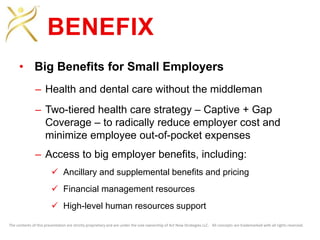

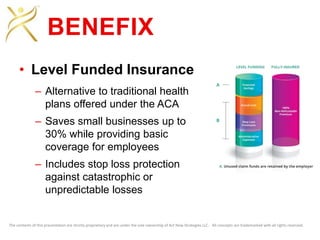

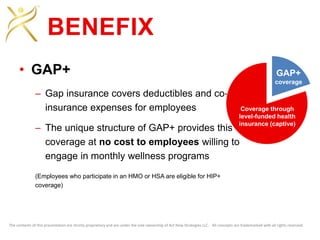

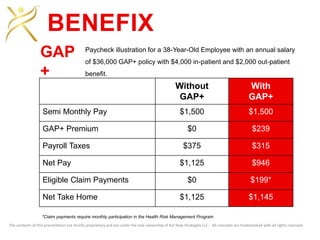

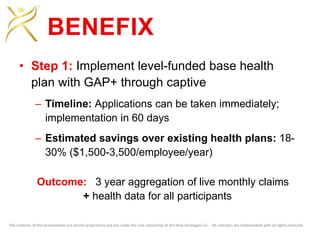

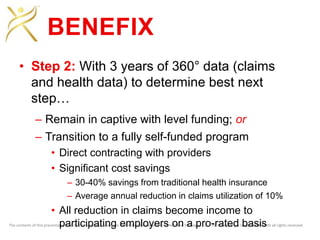

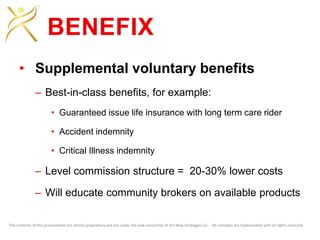

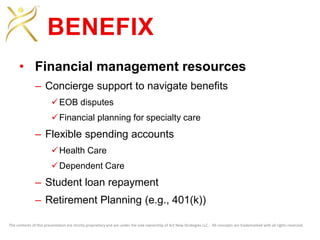

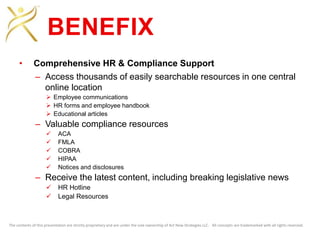

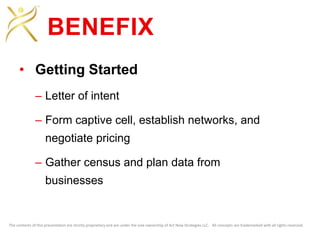

The document discusses solutions from Act Now Strategies LLC to address rising employee benefit costs for small businesses. It proposes a model called BENEFIX which establishes a captive insurance company to provide health insurance at a lower cost than commercial insurers. BENEFIX would offer a base health plan along with supplemental "GAP+" coverage for deductibles and coinsurance. Over three years of claims data collection, businesses could potentially transition to direct provider contracting and further reduce costs by 30-40% compared to traditional insurance. Additional services like financial resources, HR support, and voluntary benefits are also discussed.