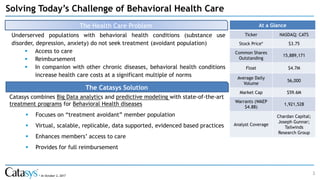

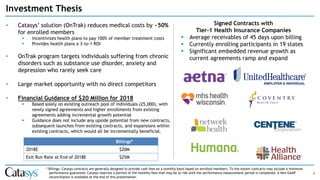

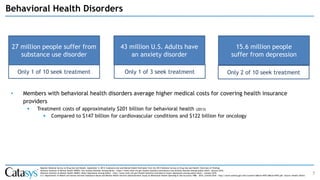

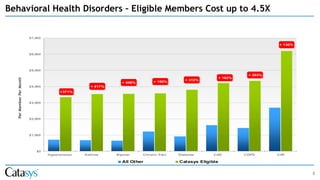

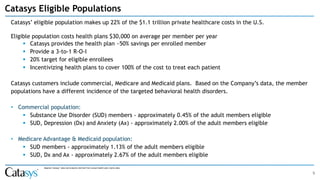

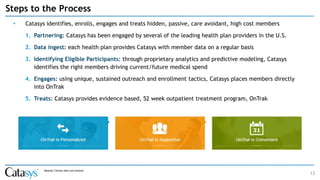

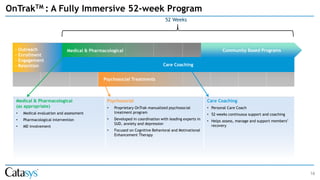

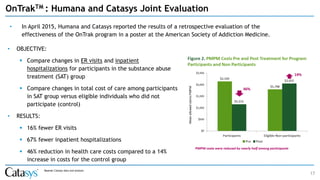

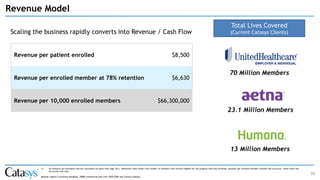

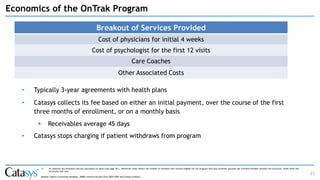

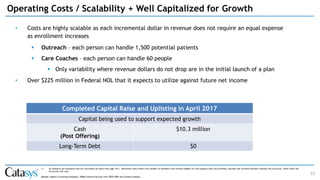

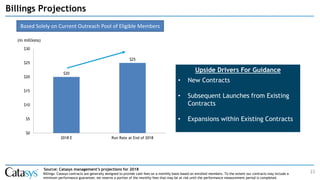

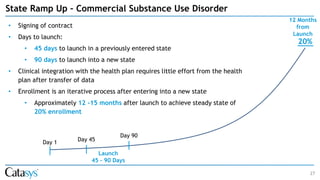

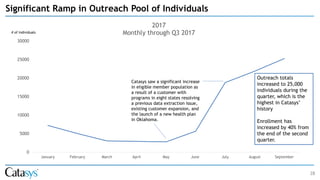

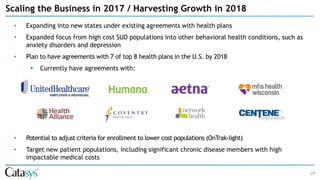

Catasys provides an integrated virtual healthcare program called OnTrak that identifies and treats behavioral health conditions like substance abuse and depression. OnTrak uses predictive analytics to identify high-cost patients with behavioral health issues who rarely seek treatment. Patients enroll in a 52-week virtual treatment program with care coaching support. Studies show OnTrak significantly reduces medical costs and healthcare utilization for enrolled members. Catasys contracts with health plans to provide OnTrak and is paid a monthly fee per enrolled member.