EcoStim is an oilfield services company providing well stimulation services in the US and Argentina. The presentation highlights:

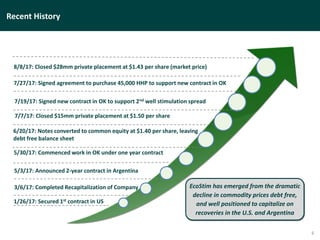

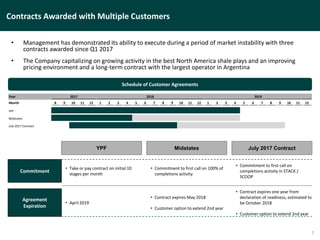

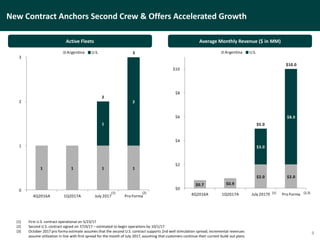

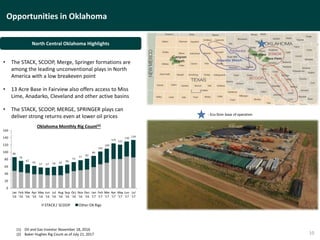

1) EcoStim has secured multiple new contracts in 2017 anchoring a second crew in the US and a long-term contract in Argentina, positioning it for accelerated growth.

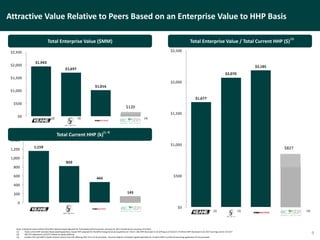

2) EcoStim trades at an attractive valuation compared to peers based on enterprise value per hydraulic horsepower.

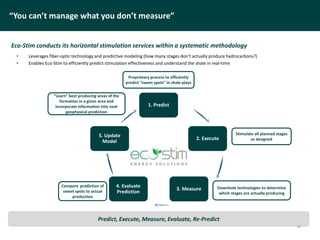

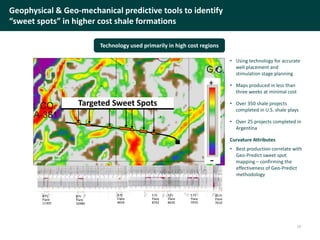

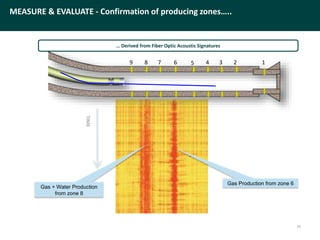

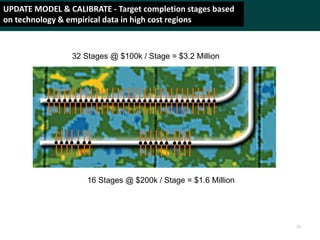

3) EcoStim utilizes proprietary downhole diagnostic and predictive technologies to more efficiently target completion stages, reducing costs for customers.