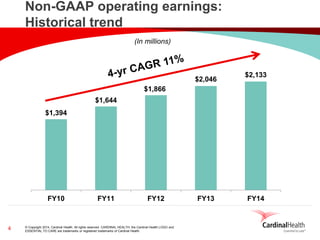

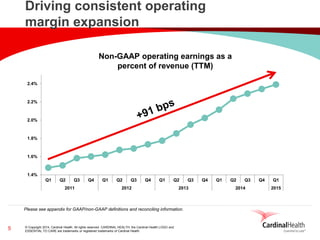

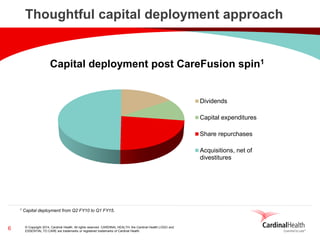

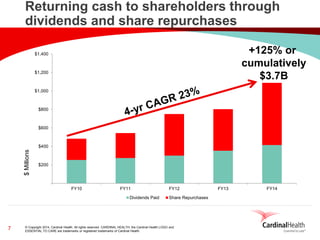

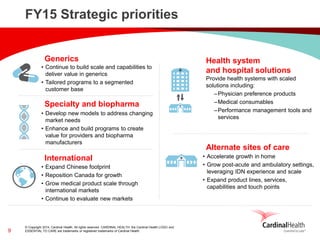

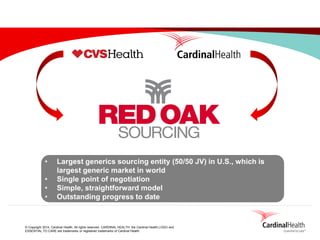

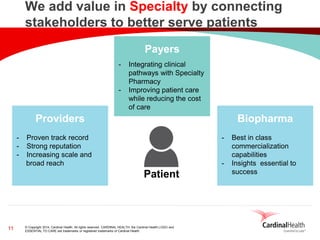

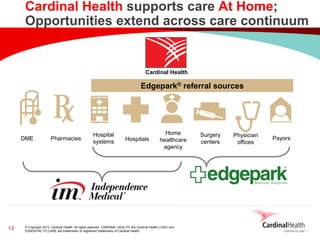

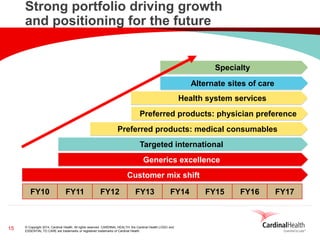

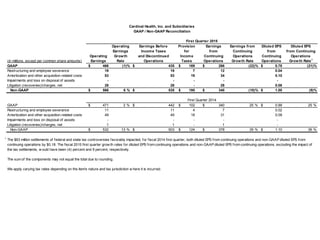

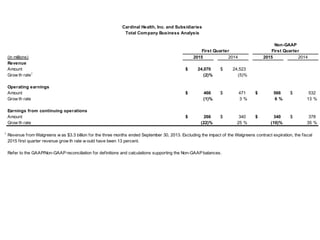

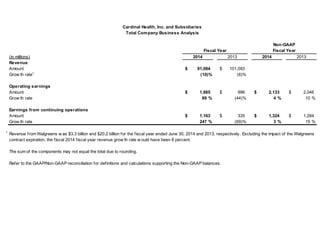

George Barrett, chairman and CEO of Cardinal Health, presented at the 2014 Credit Suisse Healthcare Conference. Cardinal Health focuses on specialty pharmaceuticals, generics, international markets, and healthcare solutions for hospitals. It has grown revenue and earnings consistently through strategic priorities like expanding in generics, specialty biopharma, China, and alternate sites of care. Cardinal Health aims to add value for customers through services and solutions that improve patient care while reducing healthcare costs.