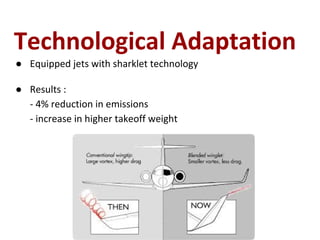

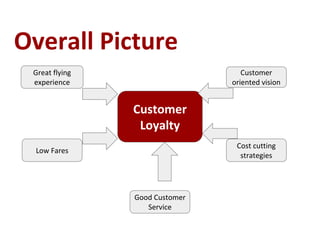

Air Arabia began as a government-owned startup in 2003 operating two leased Airbus A320 jets in the UAE. Its pricing strategy focused on offering affordable fares up to 40% lower than regular economy fares to gain market share. Through cost-cutting measures like efficient aircraft choice and fuel hedging, Air Arabia has expanded to over 100 destinations with 44 jets. It has maintained its position as the largest low-cost carrier in the Middle East through customer-oriented priorities like online booking and focus on customer loyalty. While competitors could adopt the low-cost model, Air Arabia's adaptation to challenges like fuel prices has allowed it to succeed where others may hesitate to enter the low-cost market.