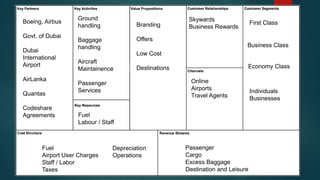

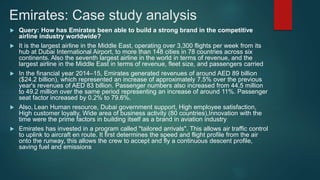

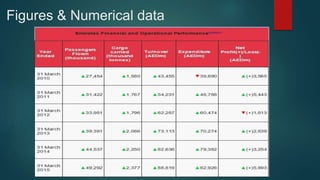

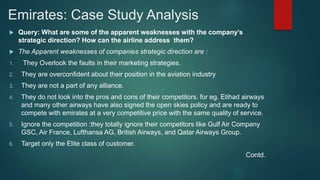

This document provides an overview of Emirates airline, including key details about its founding, headquarters, fleet size, destinations served, and ownership structure. It also summarizes some of Emirates' strategic partnerships and business activities. Charts are presented showing Emirates' sources of revenue and costs. The document then analyzes Emirates' success in building a strong global brand, including factors like government support, employee satisfaction, and innovation. Potential weaknesses in Emirates' strategic direction are discussed, along with how the airline could address issues like overlooking faults in marketing and being overconfident in its industry position. The impact of declining fuel prices on Emirates' future strategy is also considered.