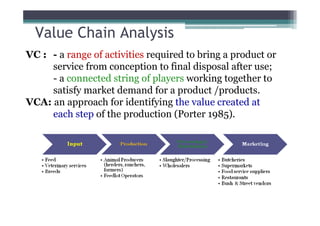

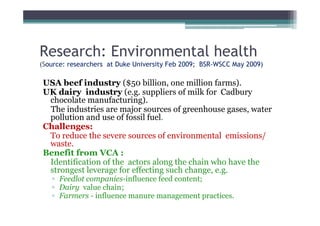

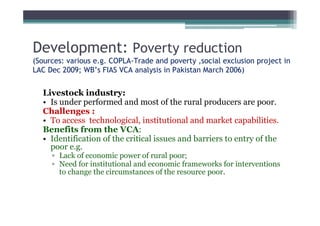

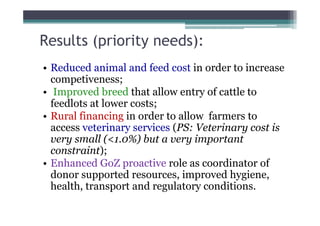

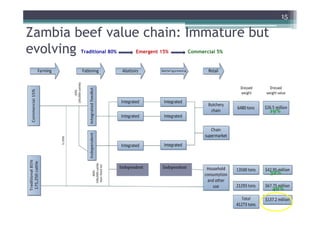

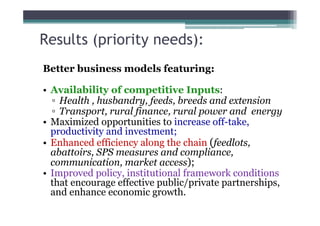

The document discusses the application of value chain analysis (VCA) in the livestock development sector, particularly highlighting its objectives of increasing profitability, improving competitiveness, and reducing rural poverty. It presents examples of practical benefits from VCA, including insights into the Zambian beef industry, challenges faced by rural producers, and the need for a supportive policy framework. Ultimately, the document emphasizes VCA as a valuable analytical tool that can benefit both commercial and traditional livestock systems while addressing environmental and livelihood concerns.