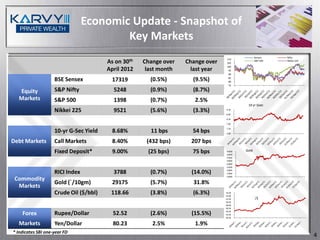

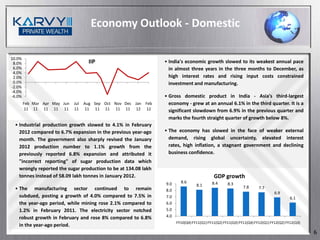

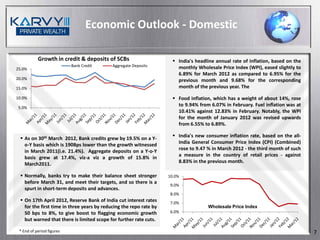

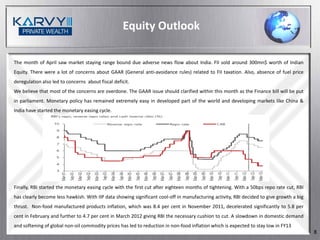

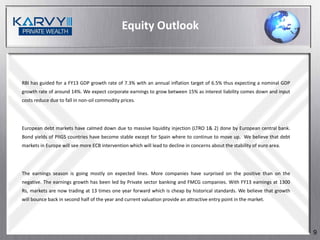

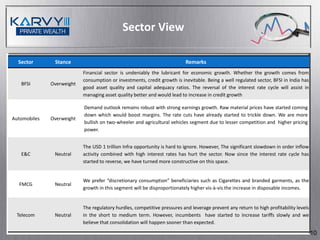

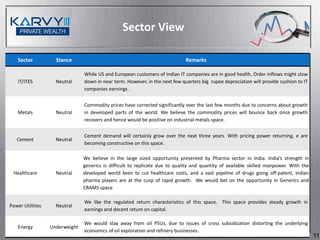

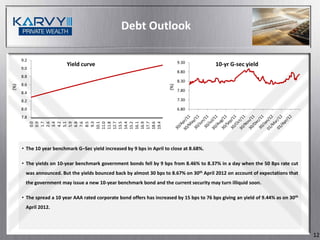

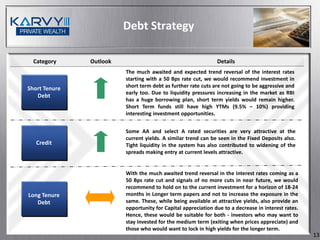

The document provides an economic and market outlook update for May 2012. It notes that while short term triggers were confusing, the medium term outlook has predictably improved in India and globally. It expects the recent interest rate cut by the RBI to eventually reduce lending rates and boost growth. The document recommends a combination of strategic long term investing and tactical shifts between broad market and stock specific investments. It provides sector views, noting positives for banking, autos, and metals while remaining neutral on telecom, IT and cement.