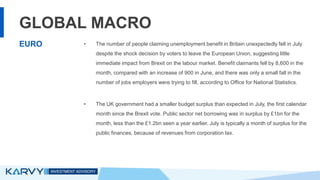

This document provides a weekly summary of economic, market, and other news from August 16-19, 2016. Some key points:

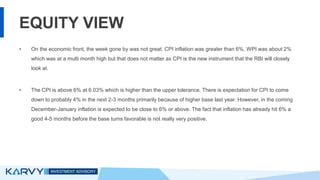

- India's CPI inflation rose above 6% in July, exceeding the central bank's tolerance limit and raising expectations of further rate hikes.

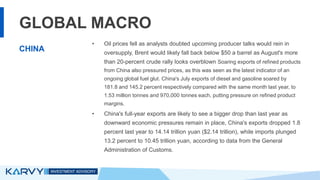

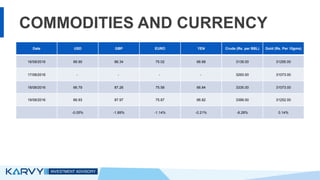

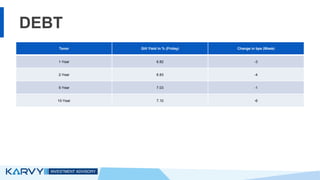

- Global government bond yields increased modestly, with the US 10-year yield rising to 1.6%, while oil prices fell on doubts that upcoming producer talks would reduce oversupply.

- Domestically, strong monsoon rains are expected to boost agricultural growth and the overall economy. Internationally, China's exports declined in 2016 and are projected to fall further due to economic pressures.