This document provides a weekly summary of global and domestic economic news and market performance for the week of August 8-12, 2016. Some key points:

- India's wholesale and consumer price inflation increased in July driven by higher food prices. Industrial production growth slowed in the Eurozone and China.

- US retail sales were flat in July and the budget deficit declined, while China's economic growth slowed with the weakest investment growth in over 15 years.

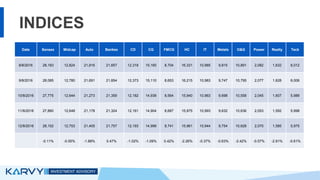

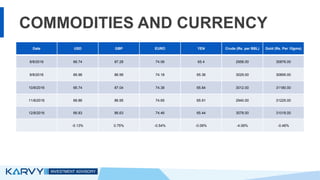

- The Indian stock market ended the week slightly lower, with the Sensex falling 0.11%. Most sectoral indices also declined over the week except for banking. Commodity prices were mixed with gold falling slightly while crude oil rose.