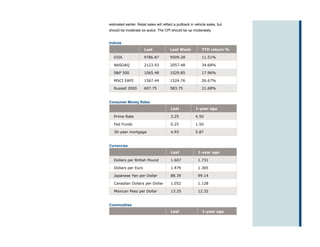

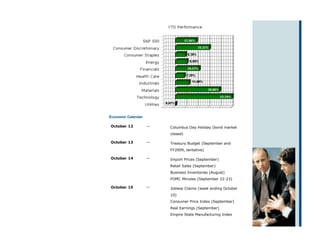

The document provides a weekly market snapshot for October 9, 2009, highlighting key economic indicators such as the ISM non-manufacturing index and the falling jobless claims, alongside concerns sparked by the Reserve Bank of Australia's interest rate hike. Retail sales and consumer price index data for September are anticipated to be influential in the upcoming economic calendar. Additionally, the document outlines various financial statistics, including market indices, interest rates, and commodity prices.