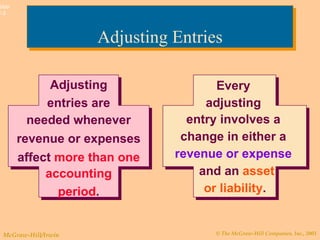

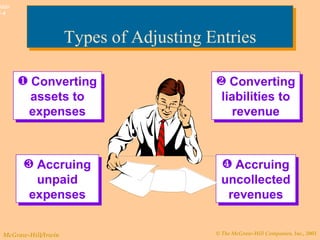

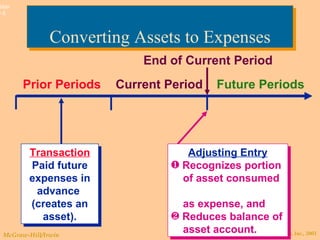

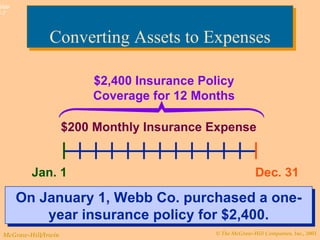

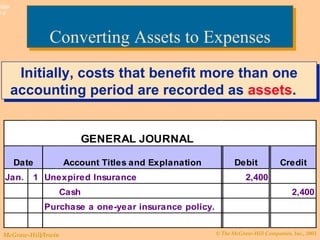

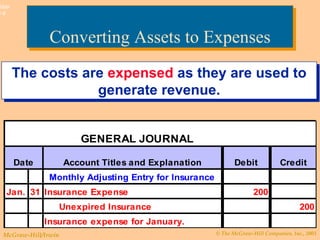

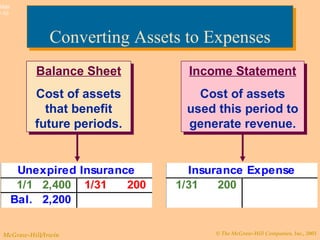

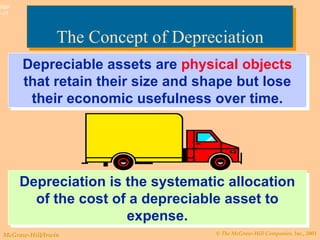

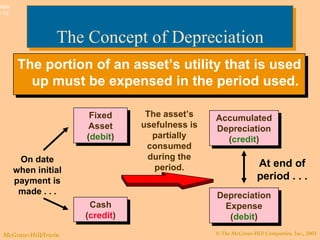

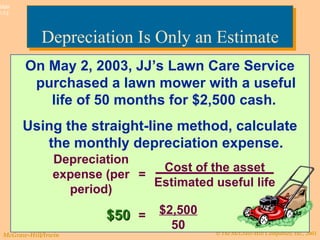

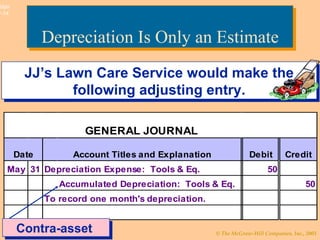

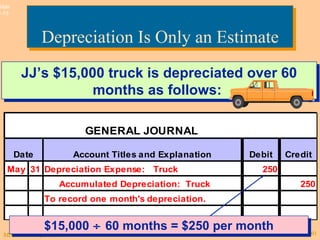

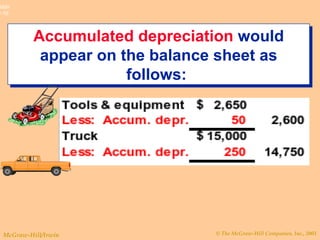

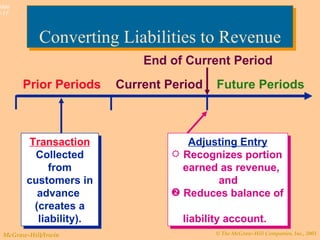

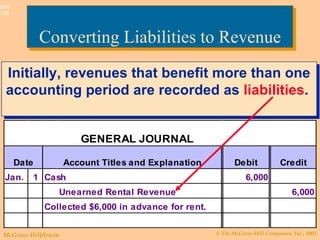

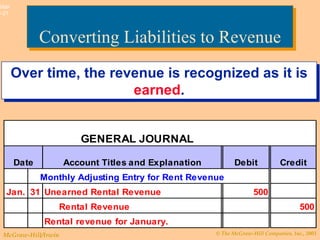

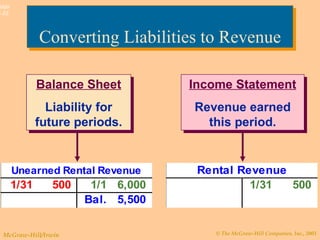

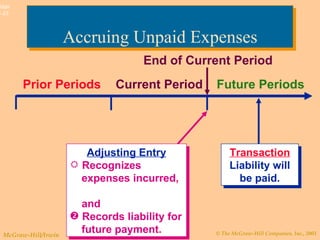

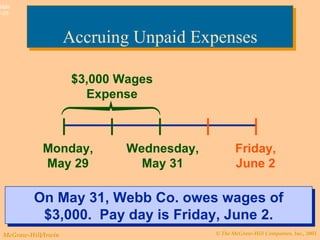

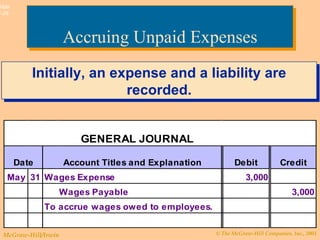

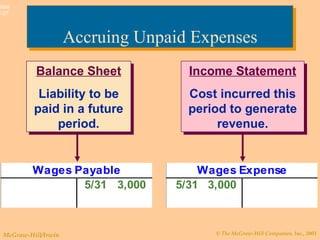

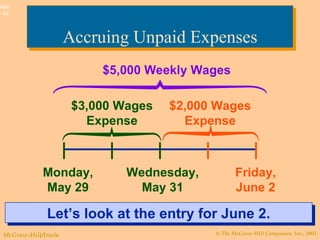

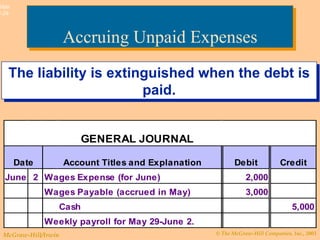

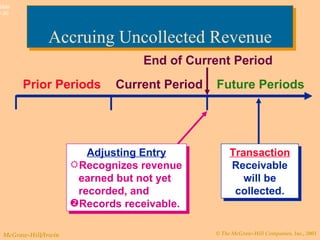

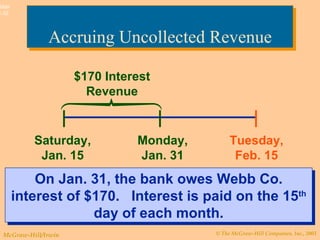

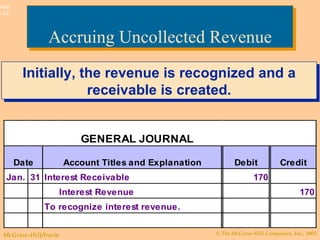

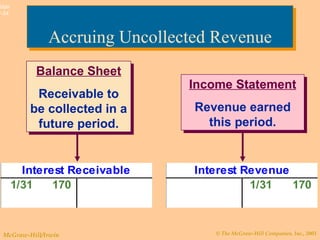

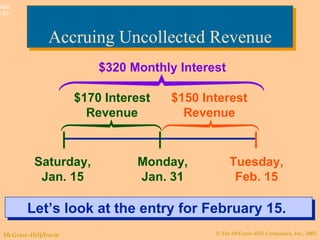

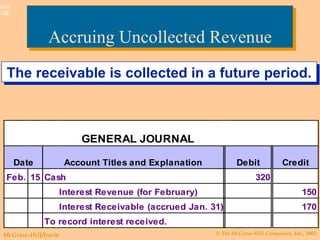

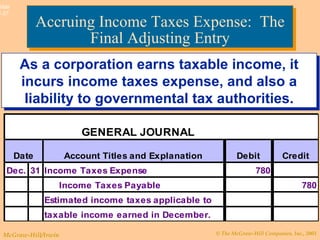

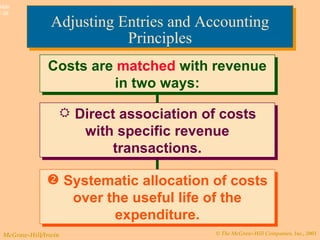

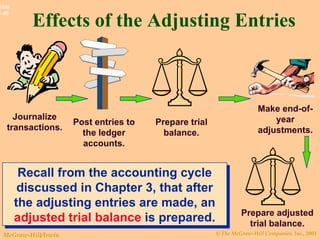

This document discusses adjusting entries made at the end of an accounting period. There are four main types of adjusting entries: 1) converting assets to expenses, such as depreciating long-term assets over time; 2) accruing unpaid expenses that have been incurred but not yet paid; 3) converting liabilities to revenue by recognizing unearned revenue over time; and 4) accruing uncollected revenues, such as recognizing earned revenue that has not yet been received. Adjusting entries ensure revenues and expenses are recorded in the appropriate periods in accordance with accrual accounting.