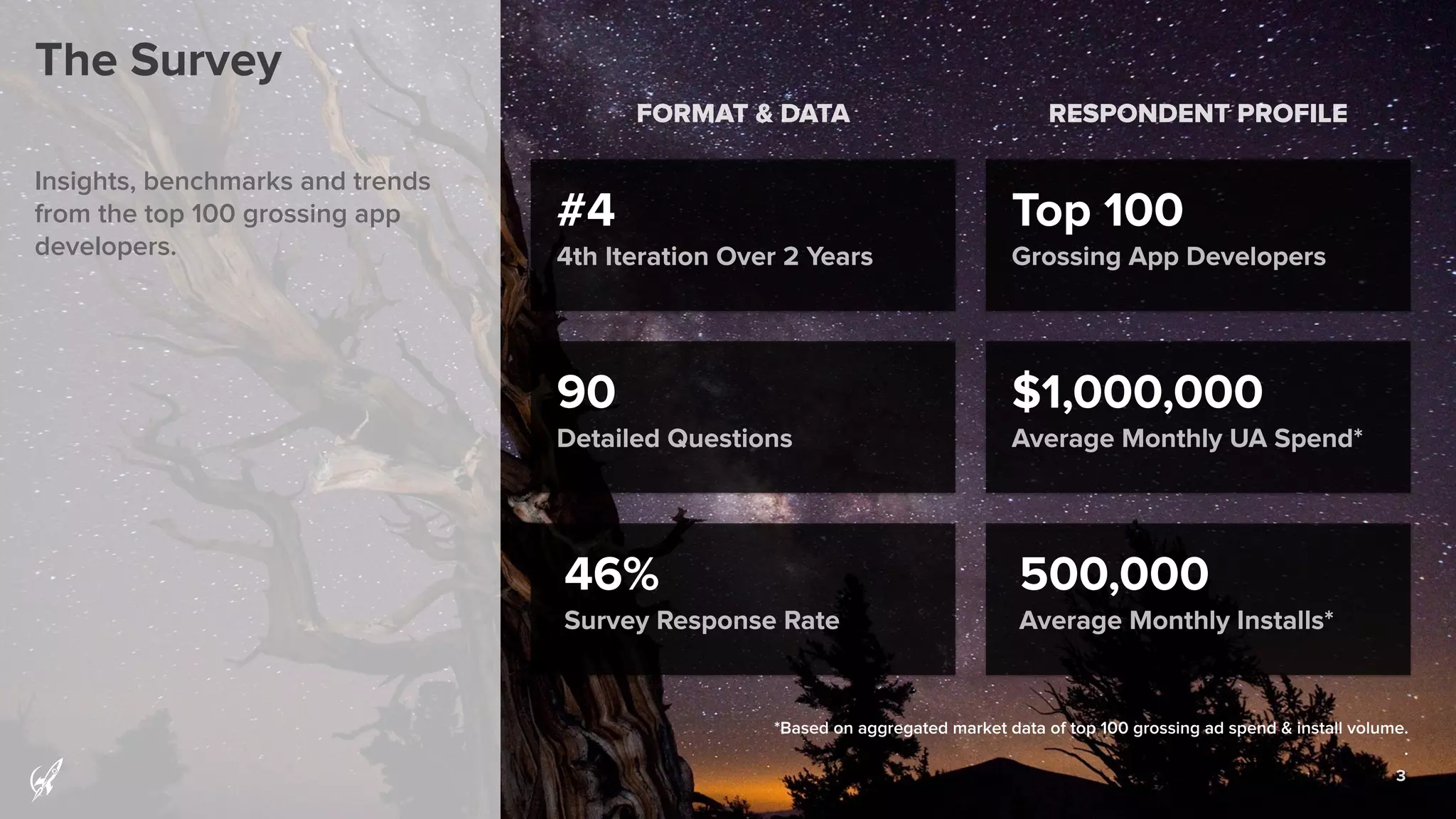

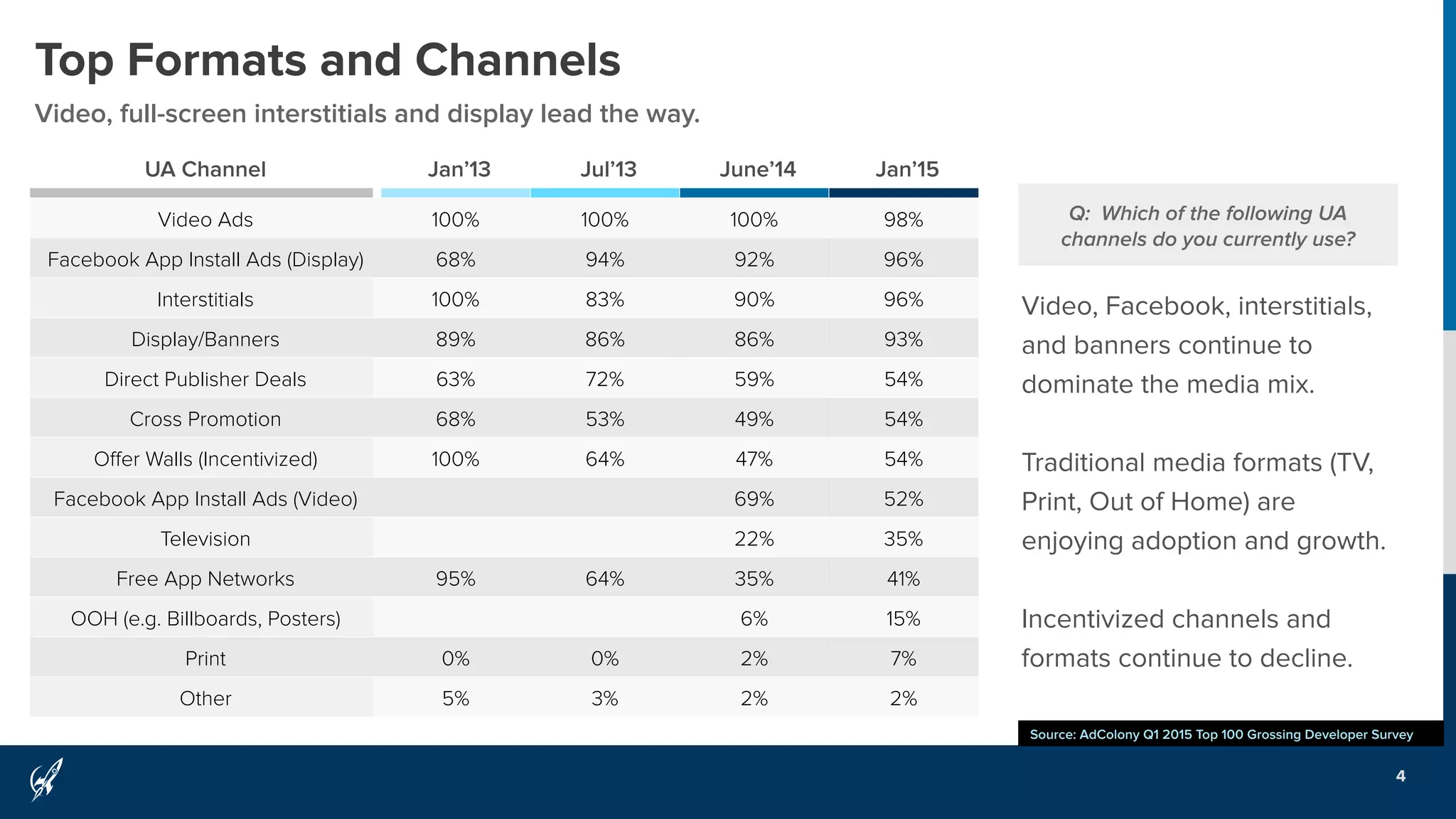

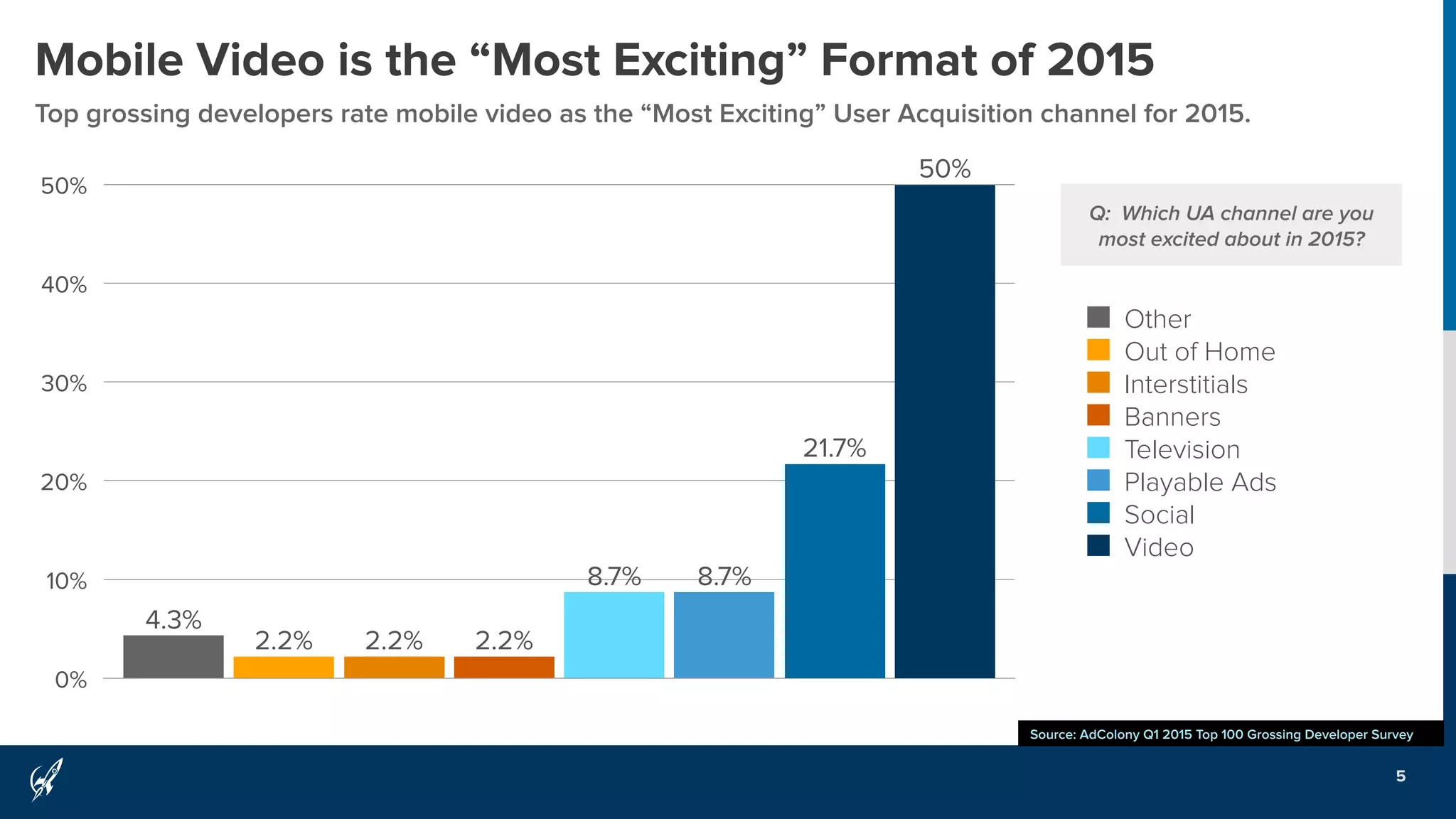

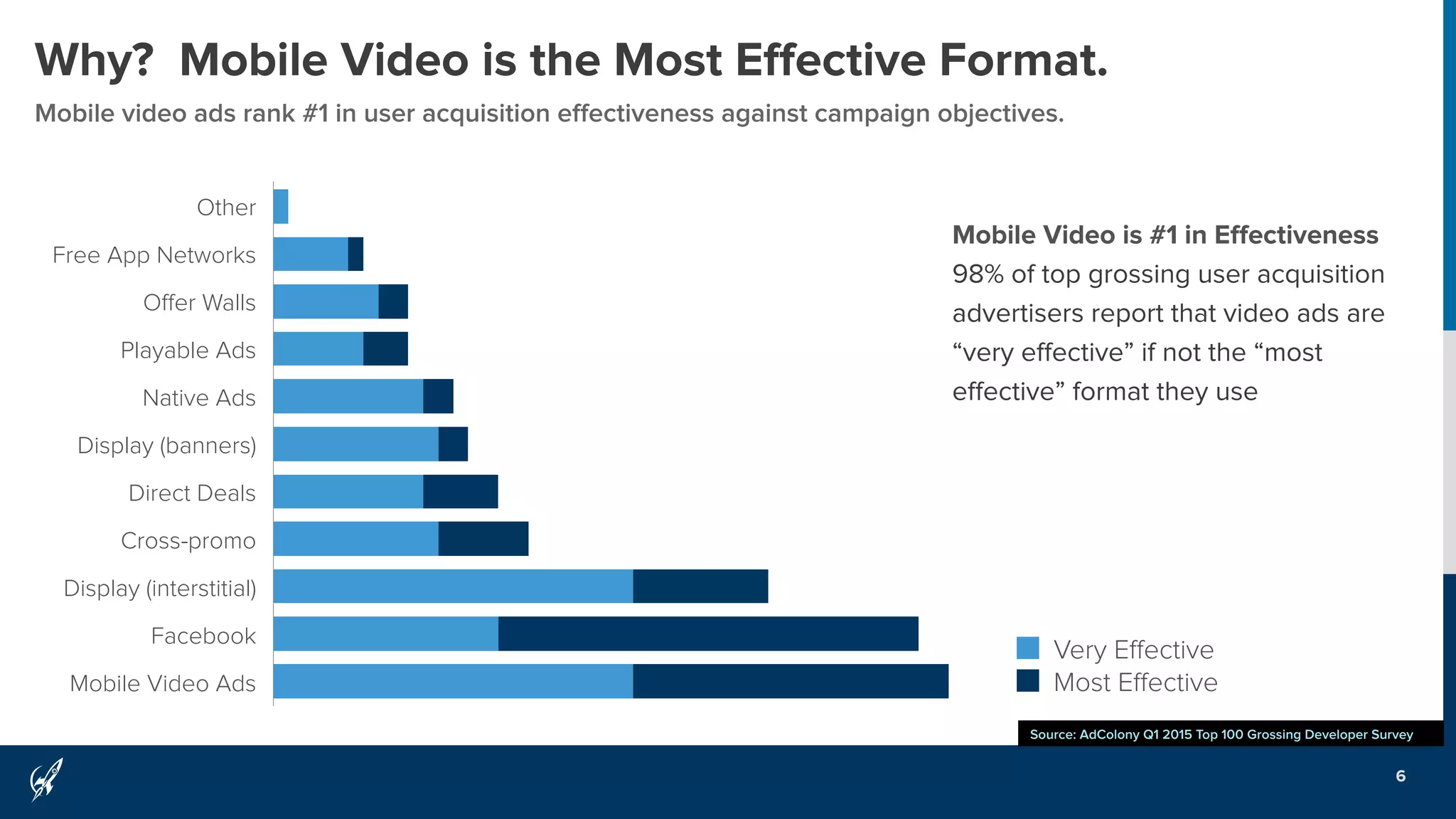

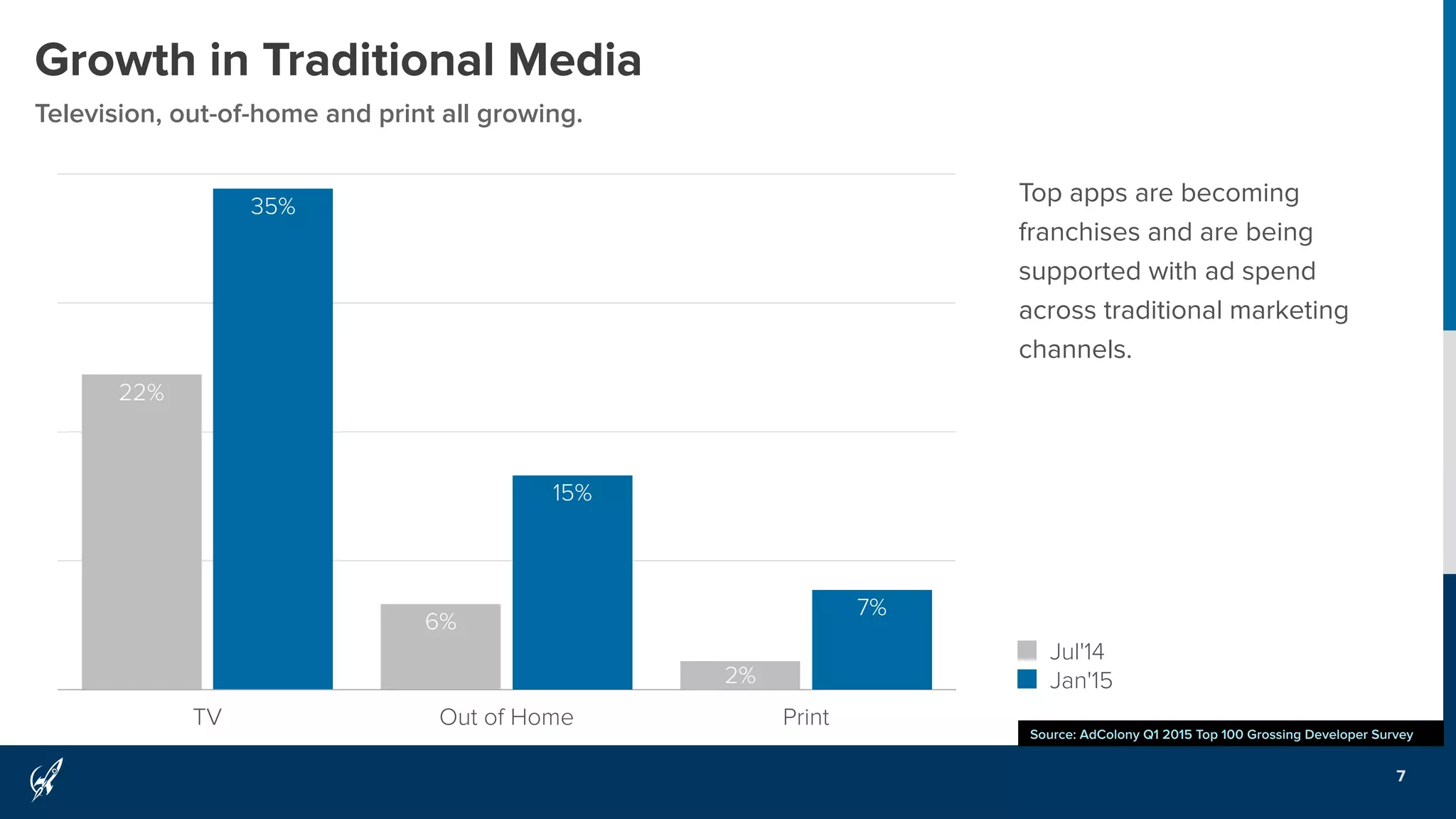

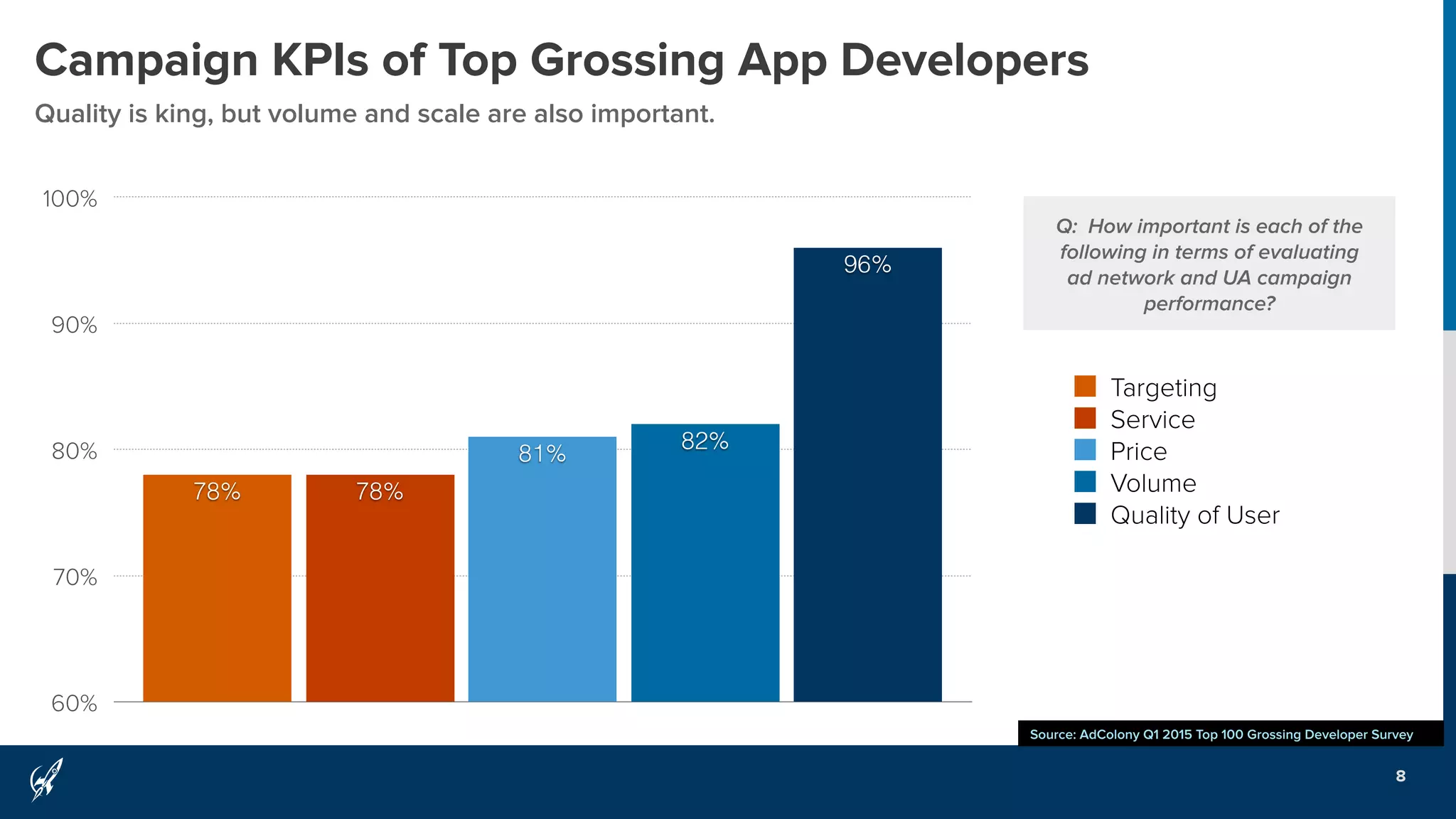

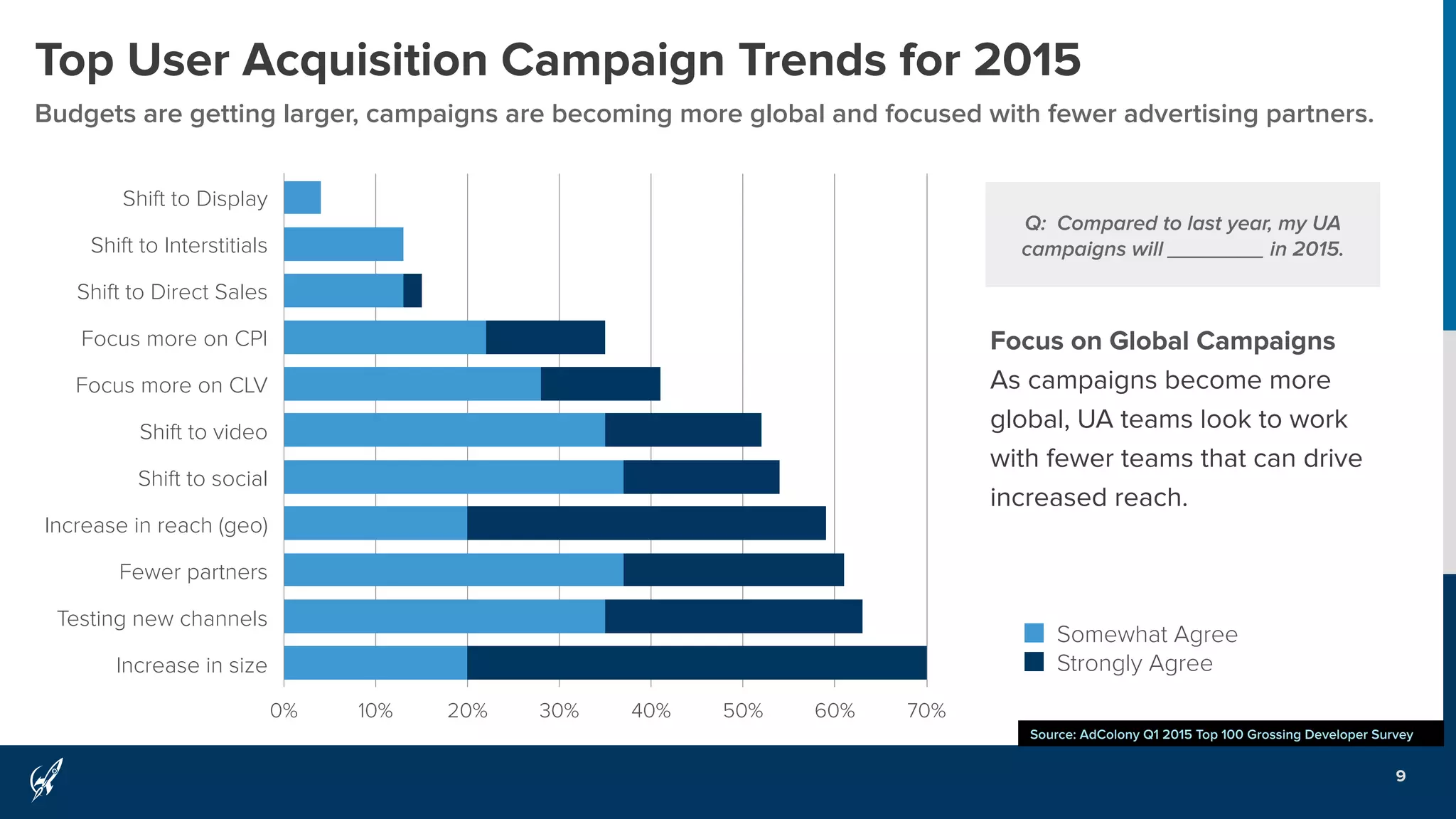

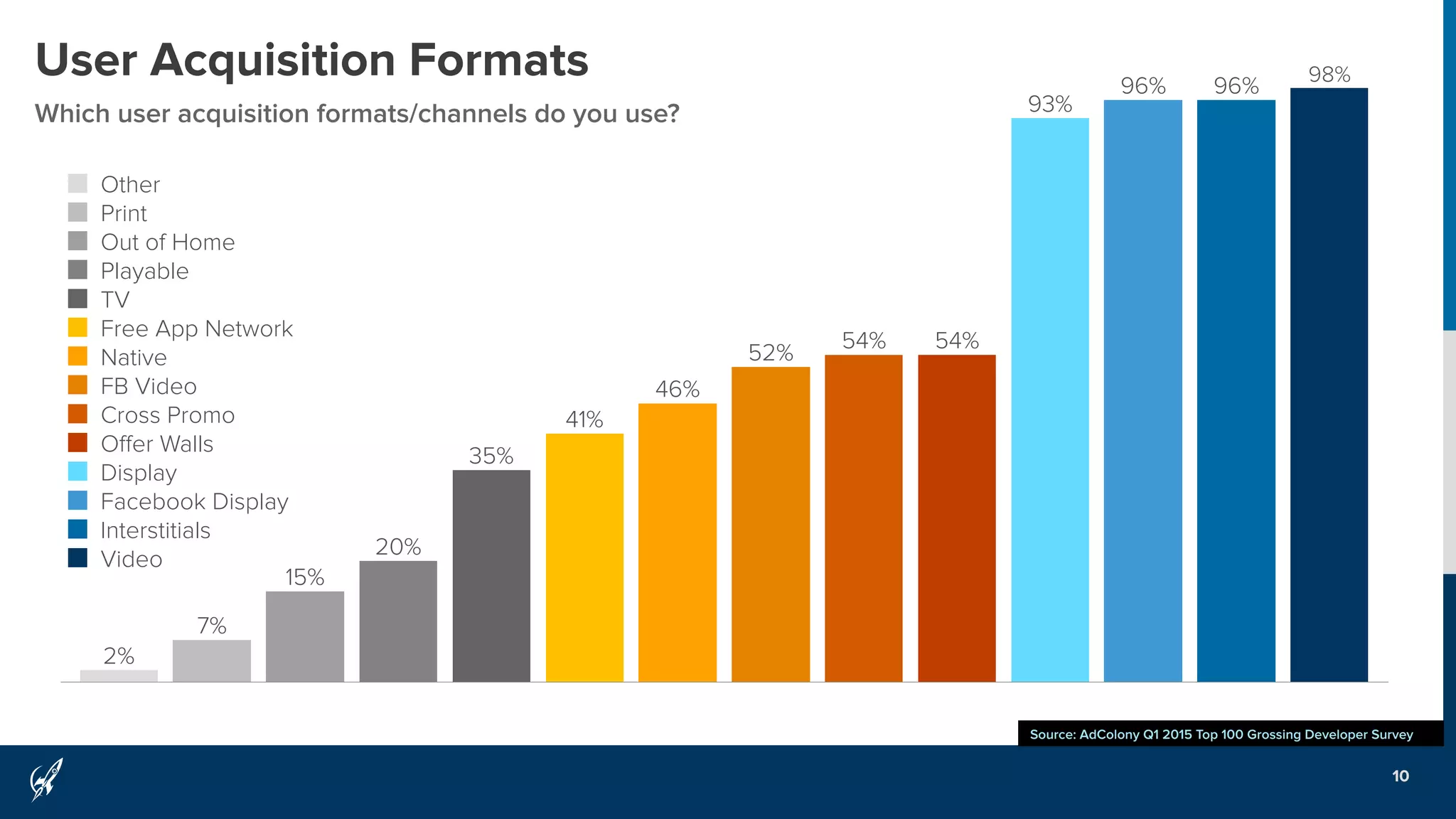

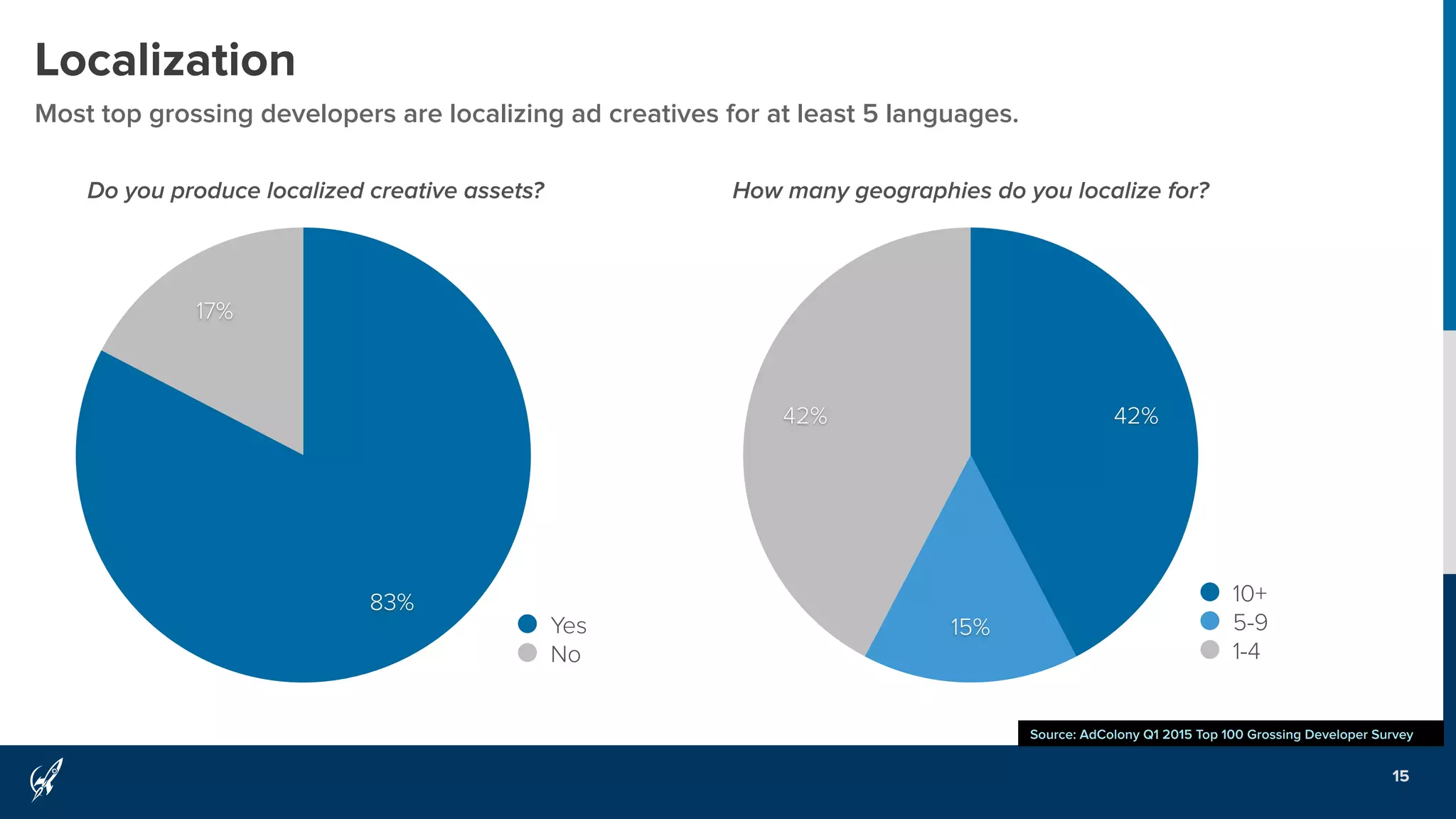

The Q1 2015 survey on user acquisition trends among the top 100 grossing app developers highlights that video ads, particularly mobile video, remain the most effective channels for user acquisition, with a majority reporting high effectiveness. The report also notes a shift towards larger budgets and global campaigns, emphasizing the importance of quality in user acquisition strategies. Additionally, it indicates a growing trend in the use of traditional media formats as part of comprehensive marketing approaches.