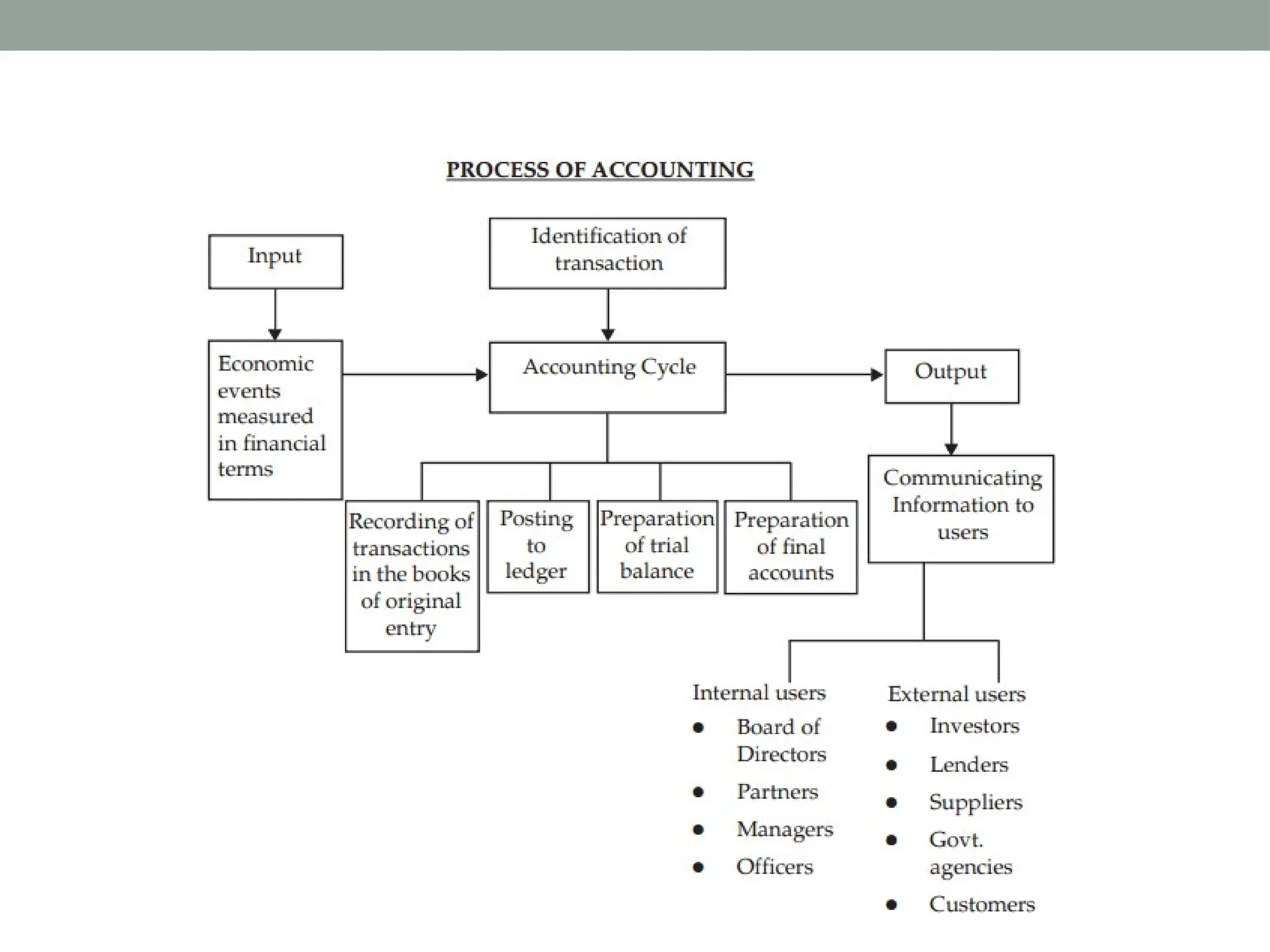

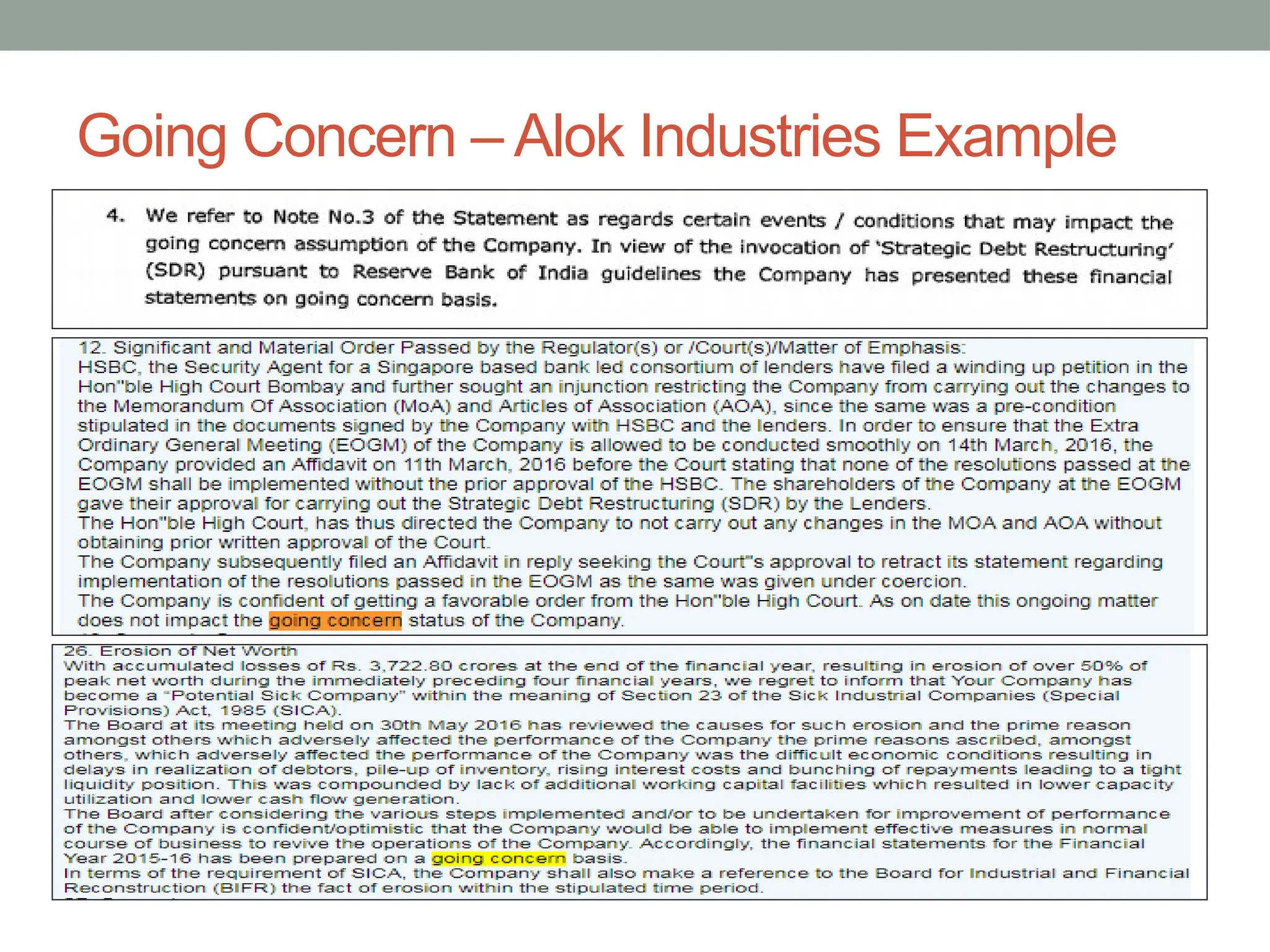

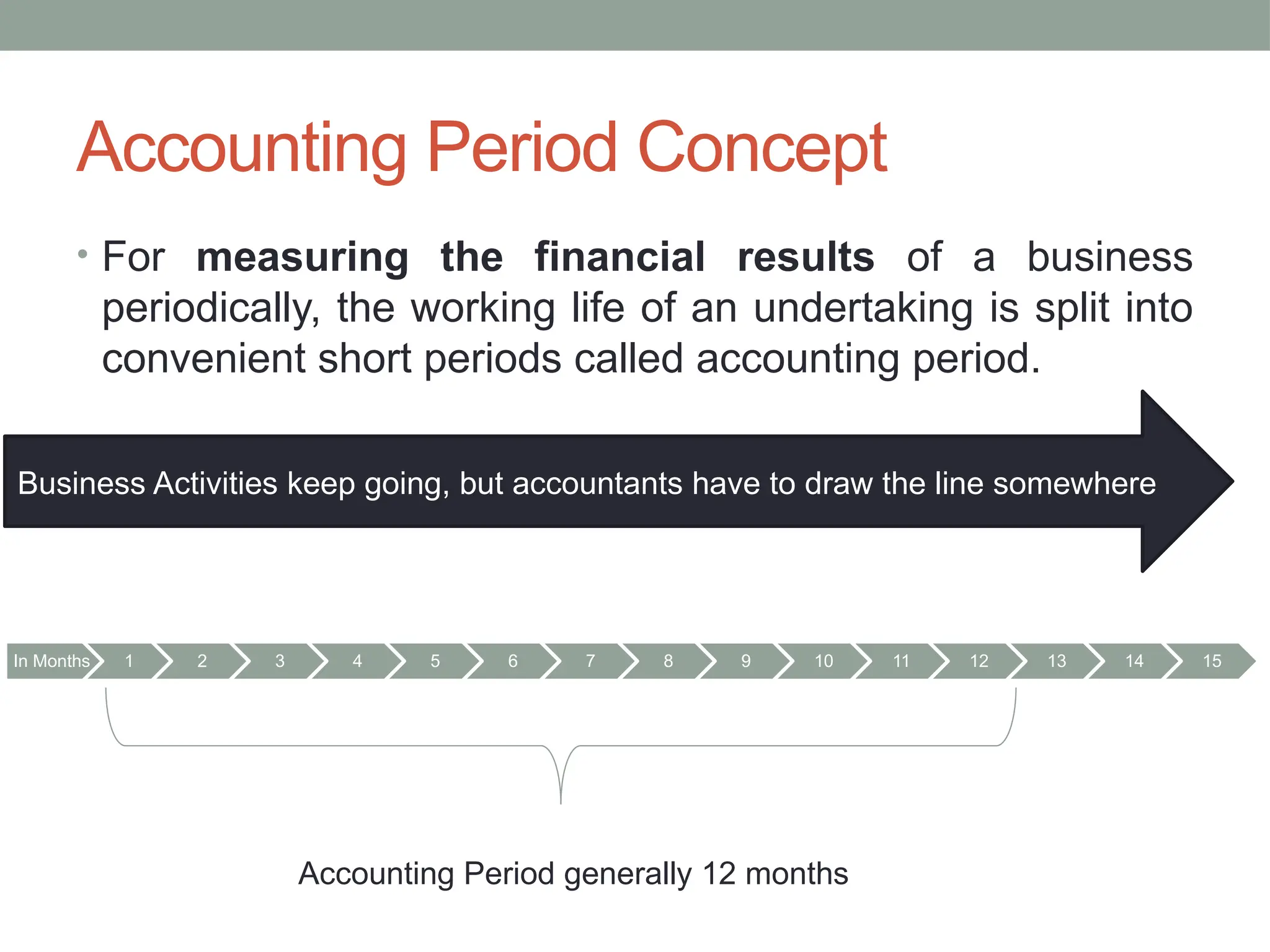

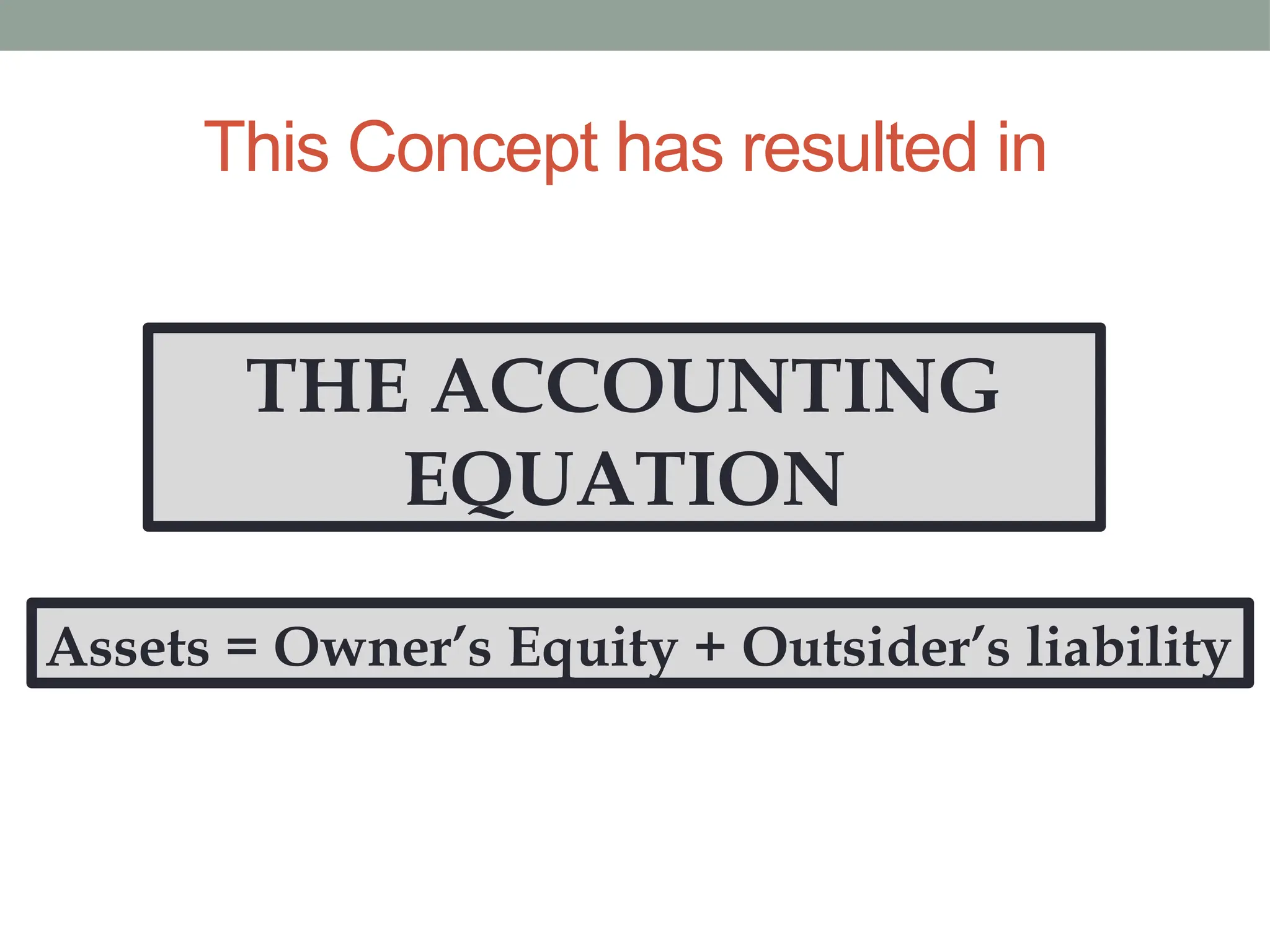

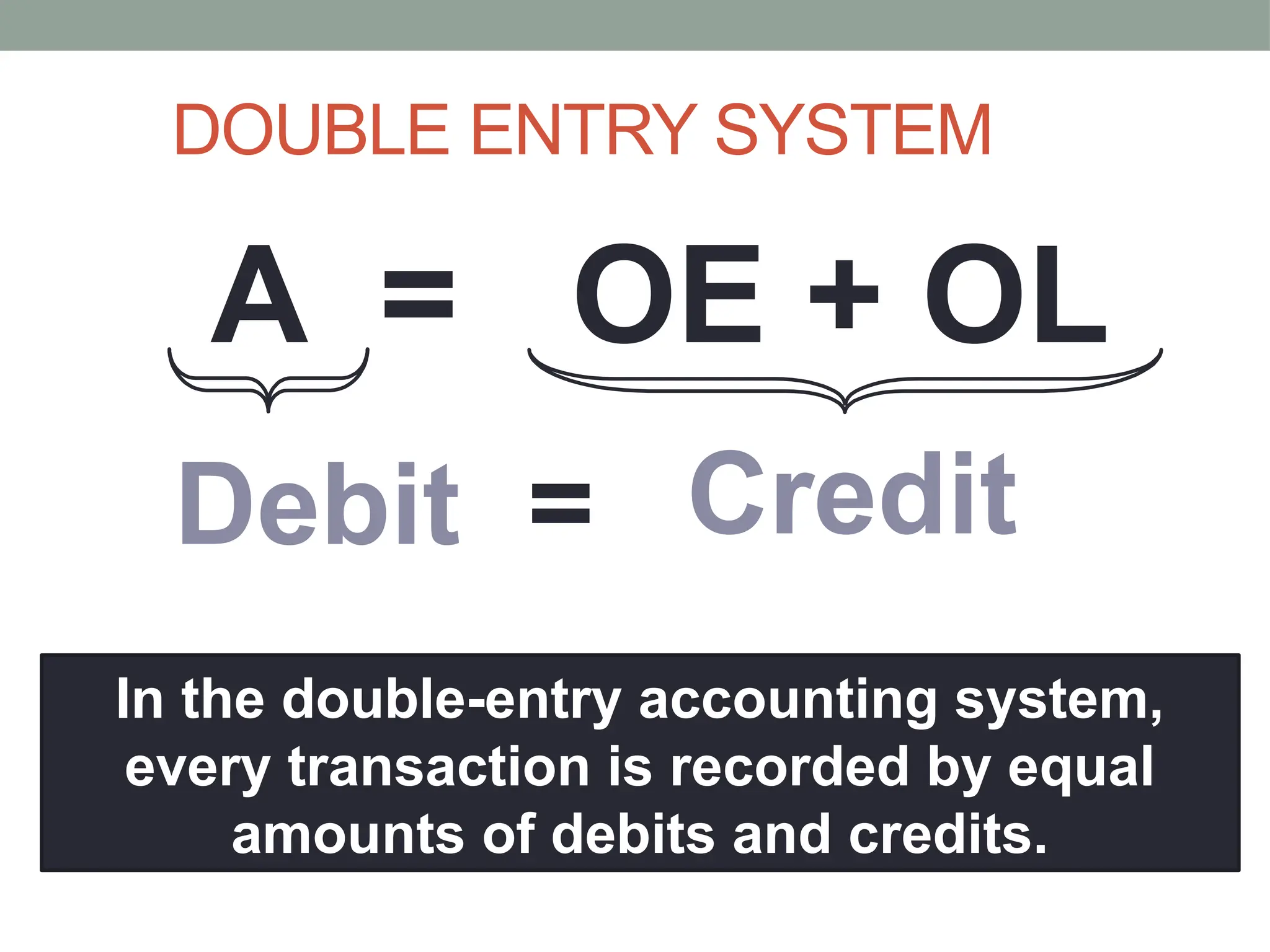

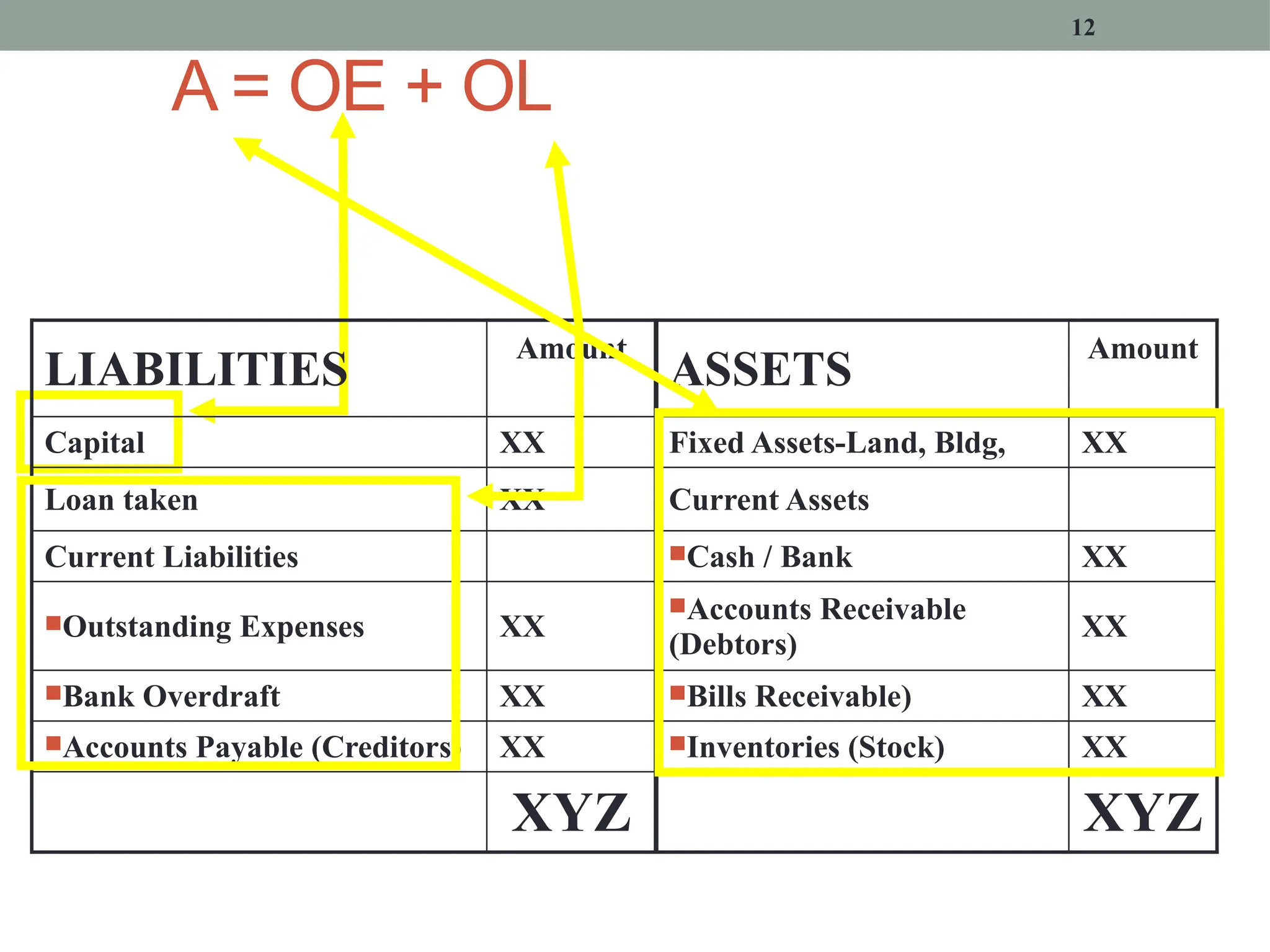

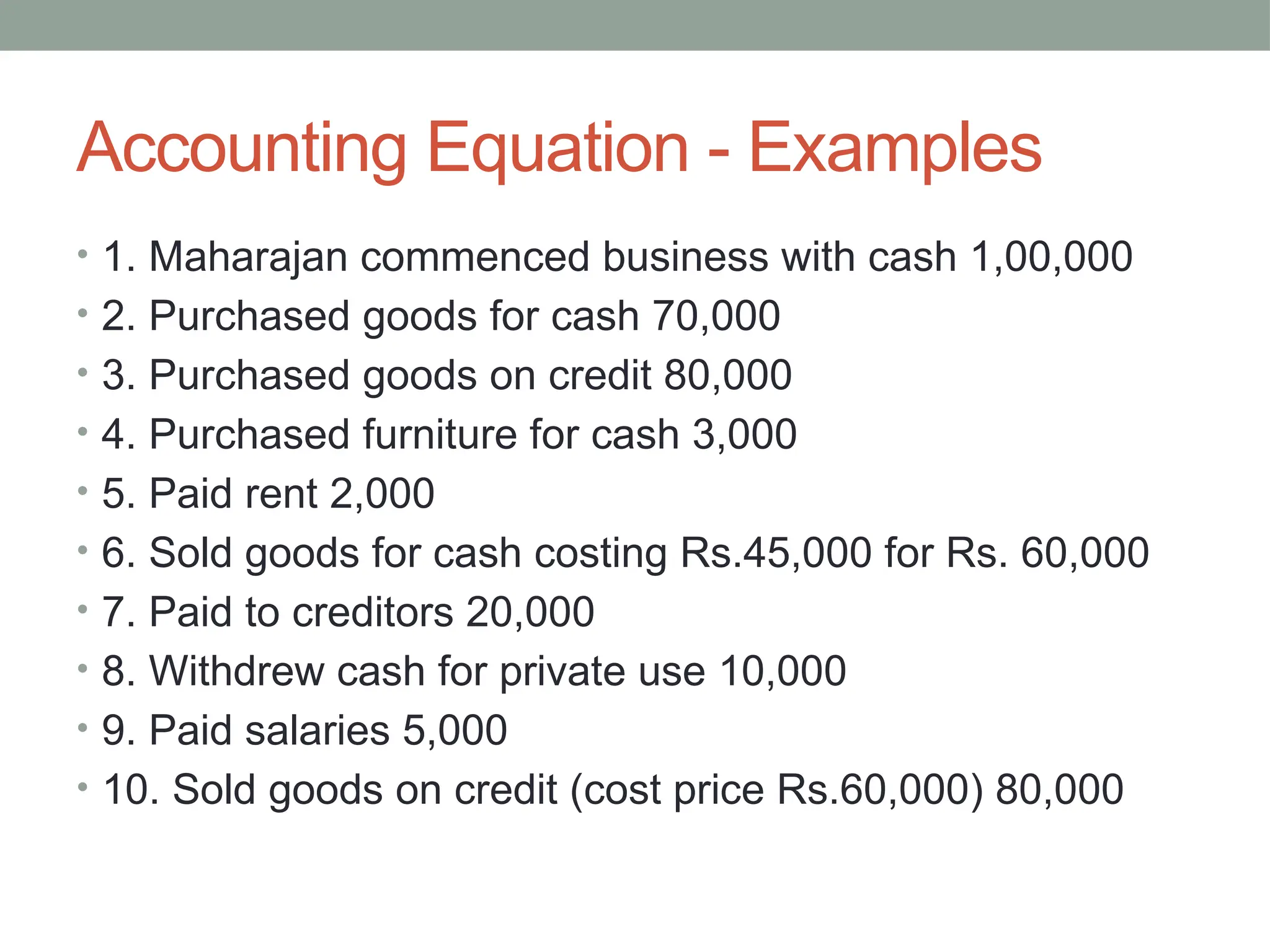

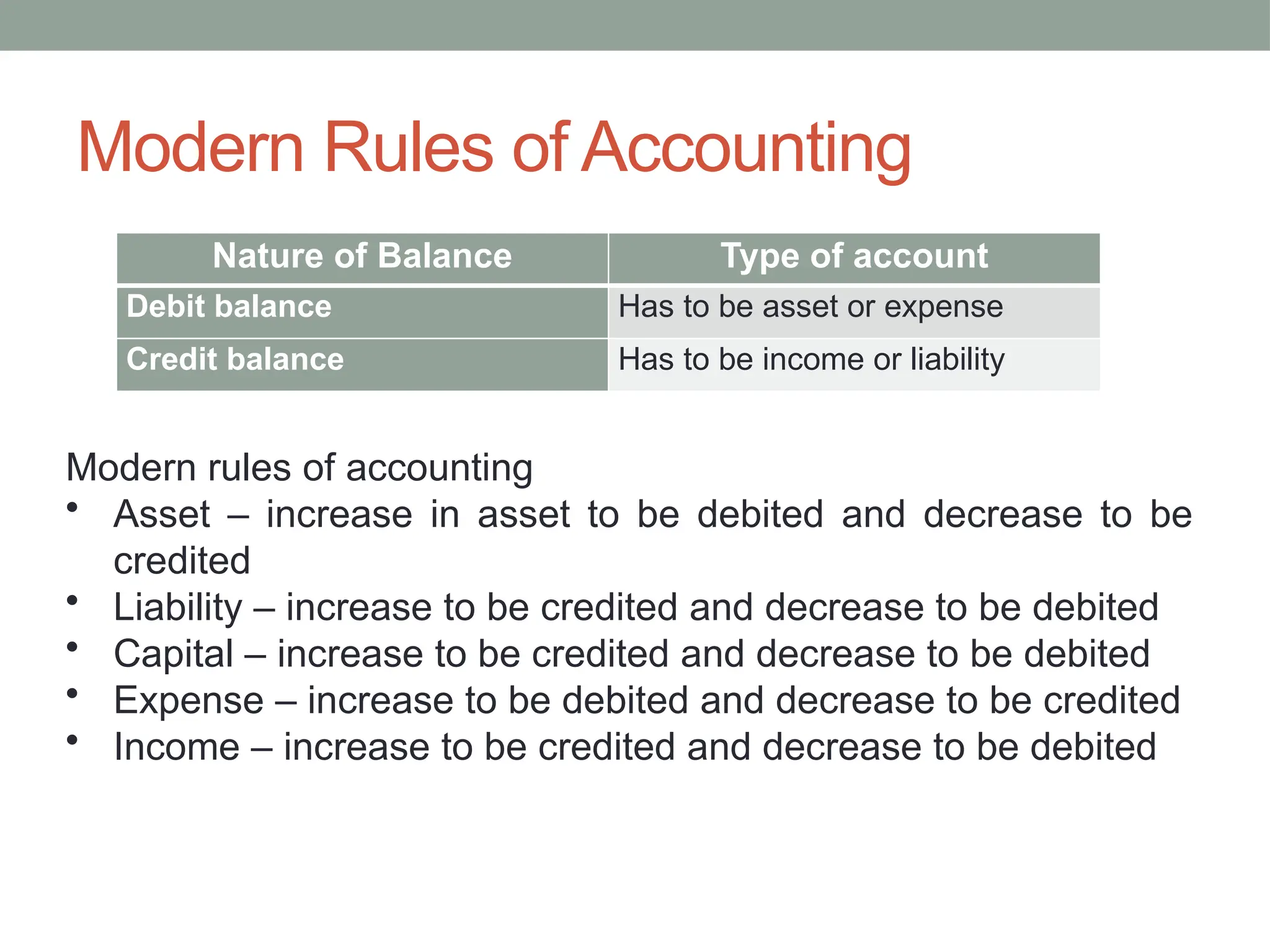

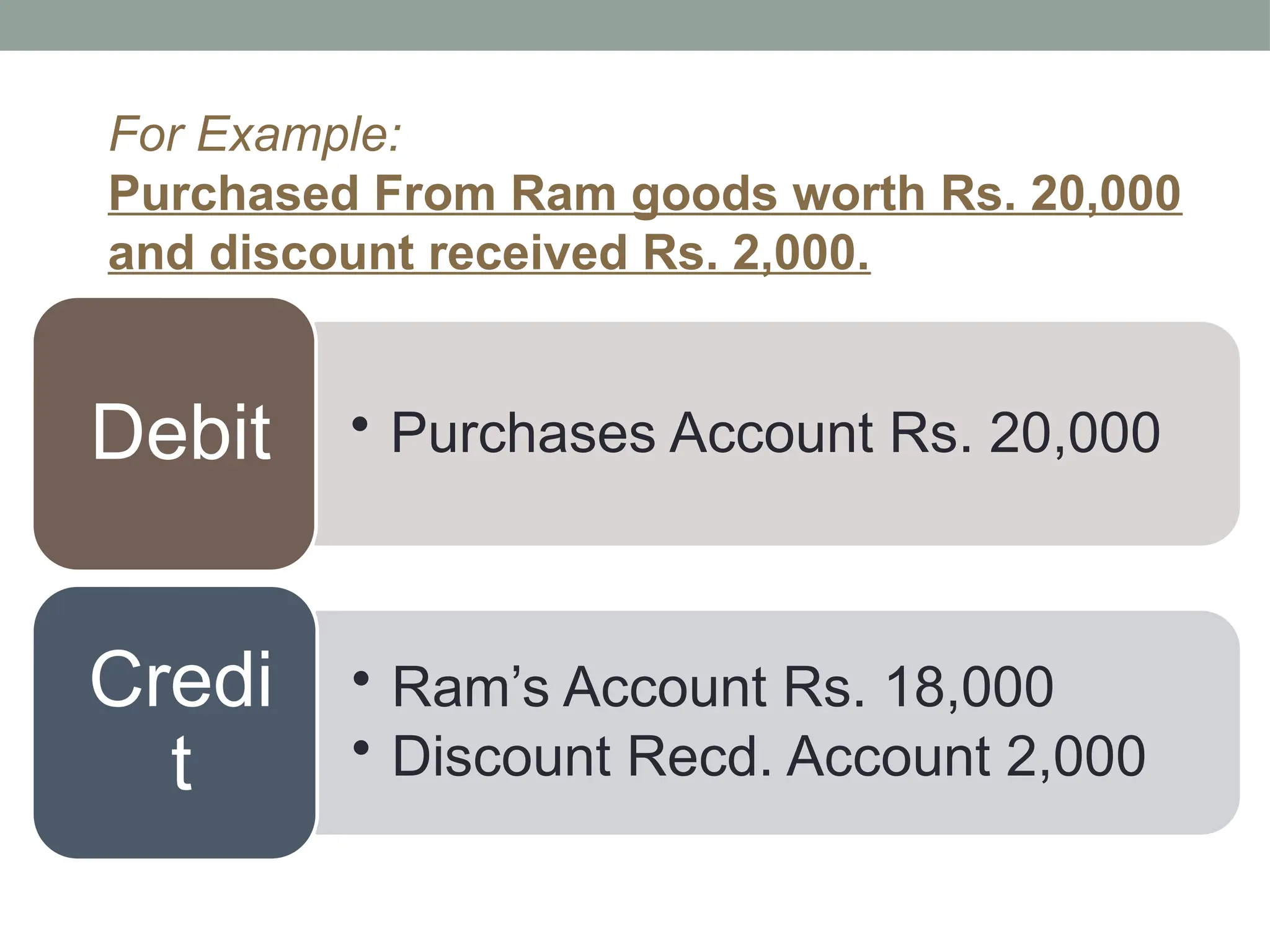

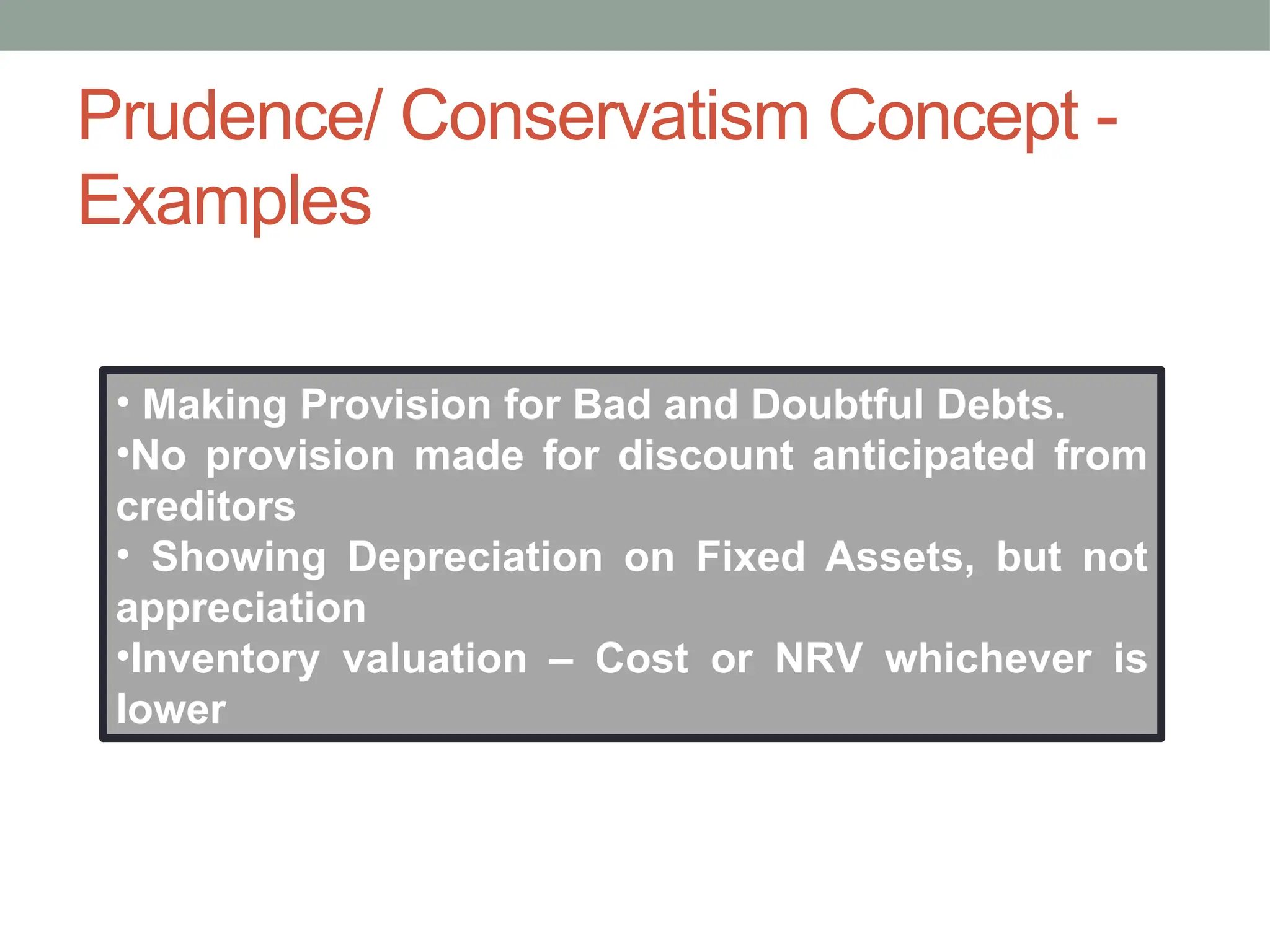

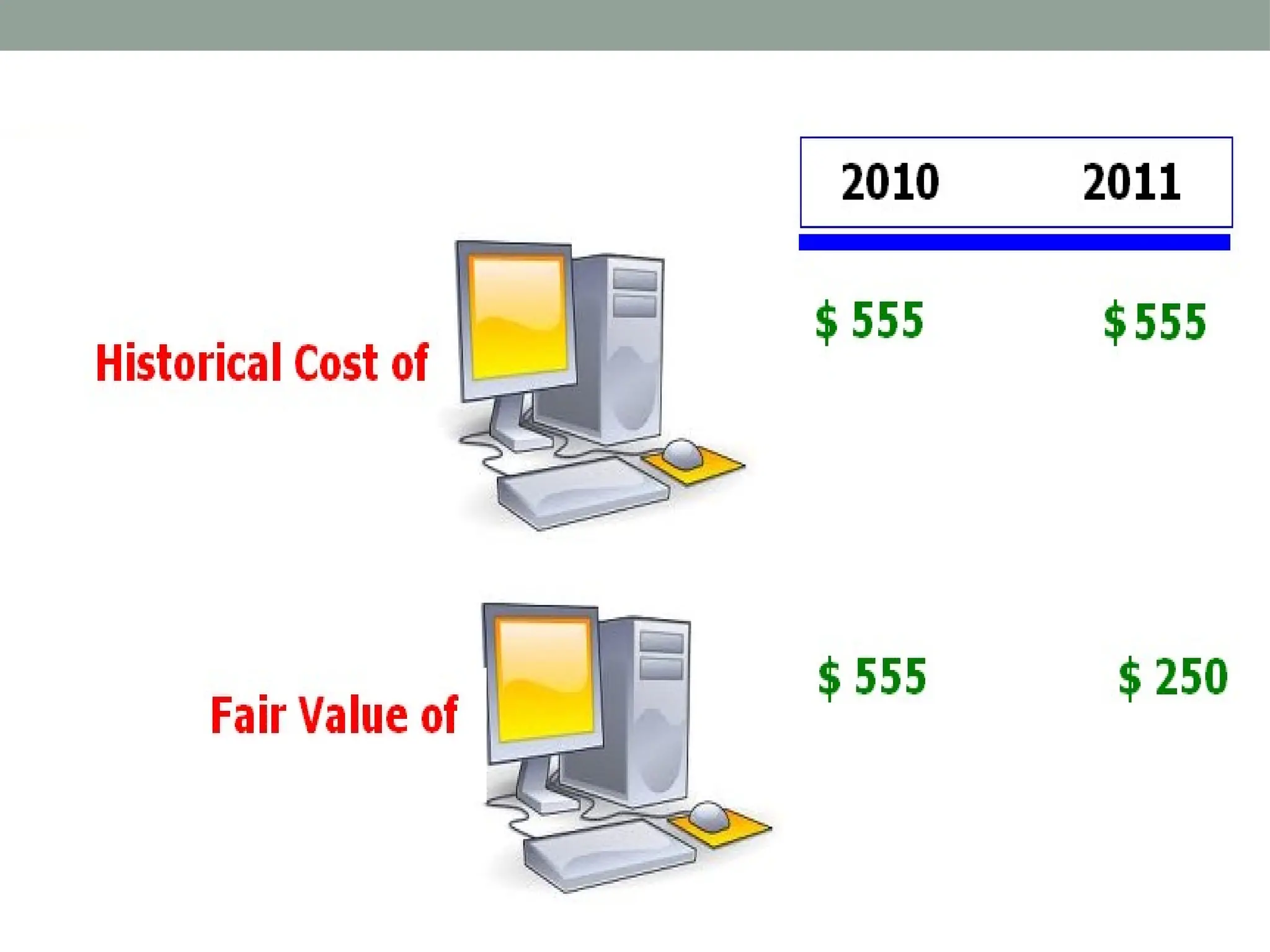

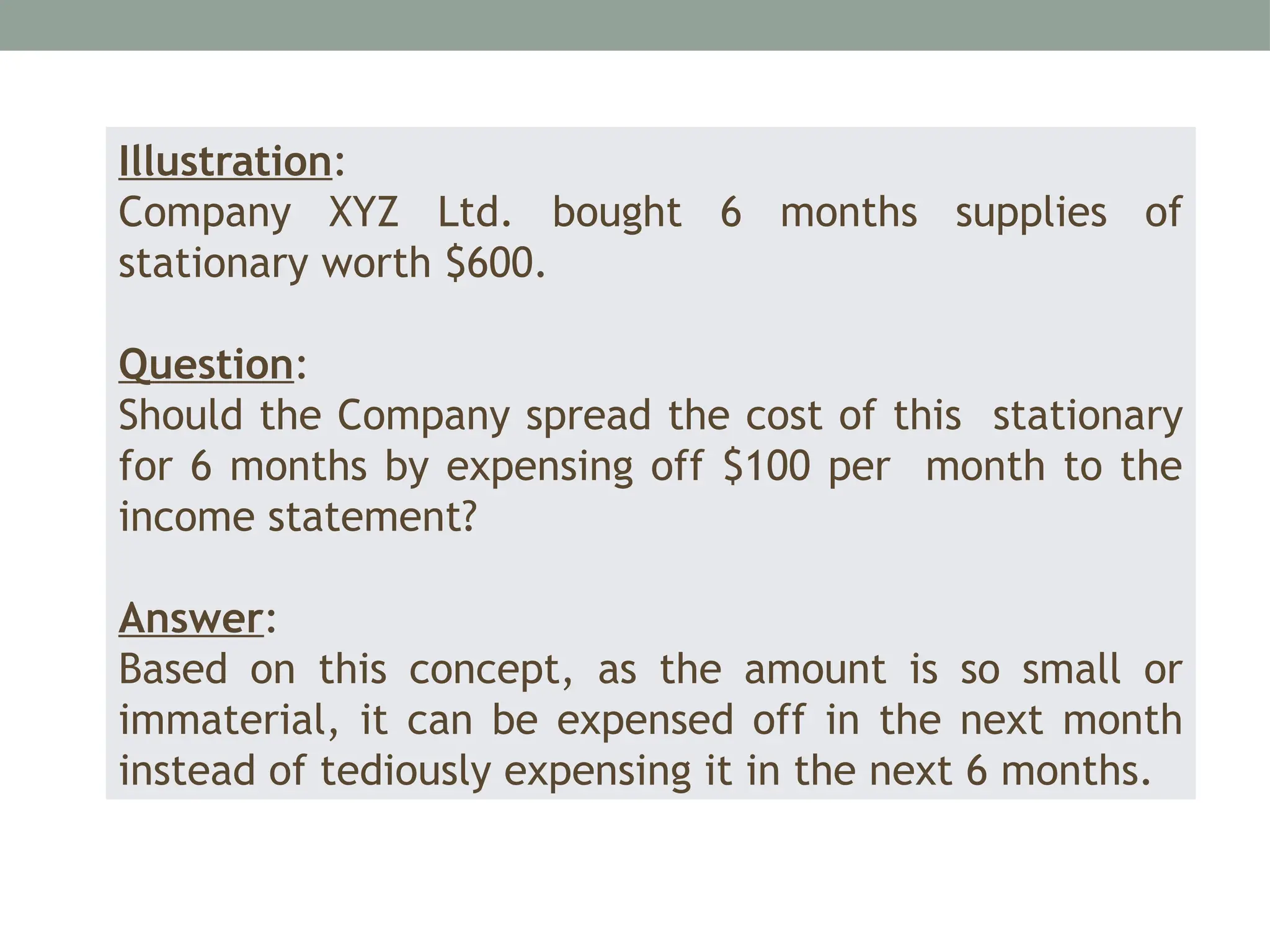

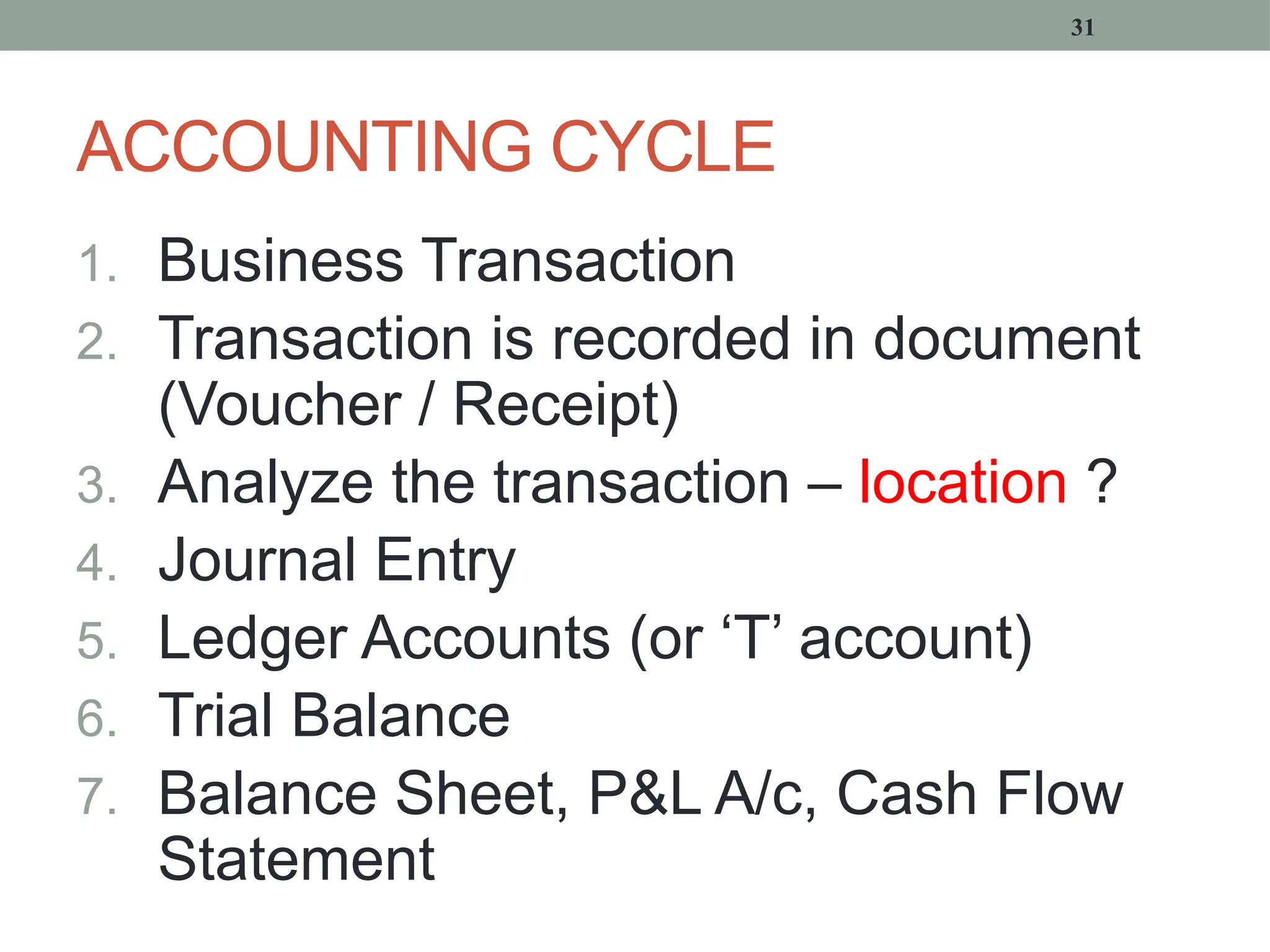

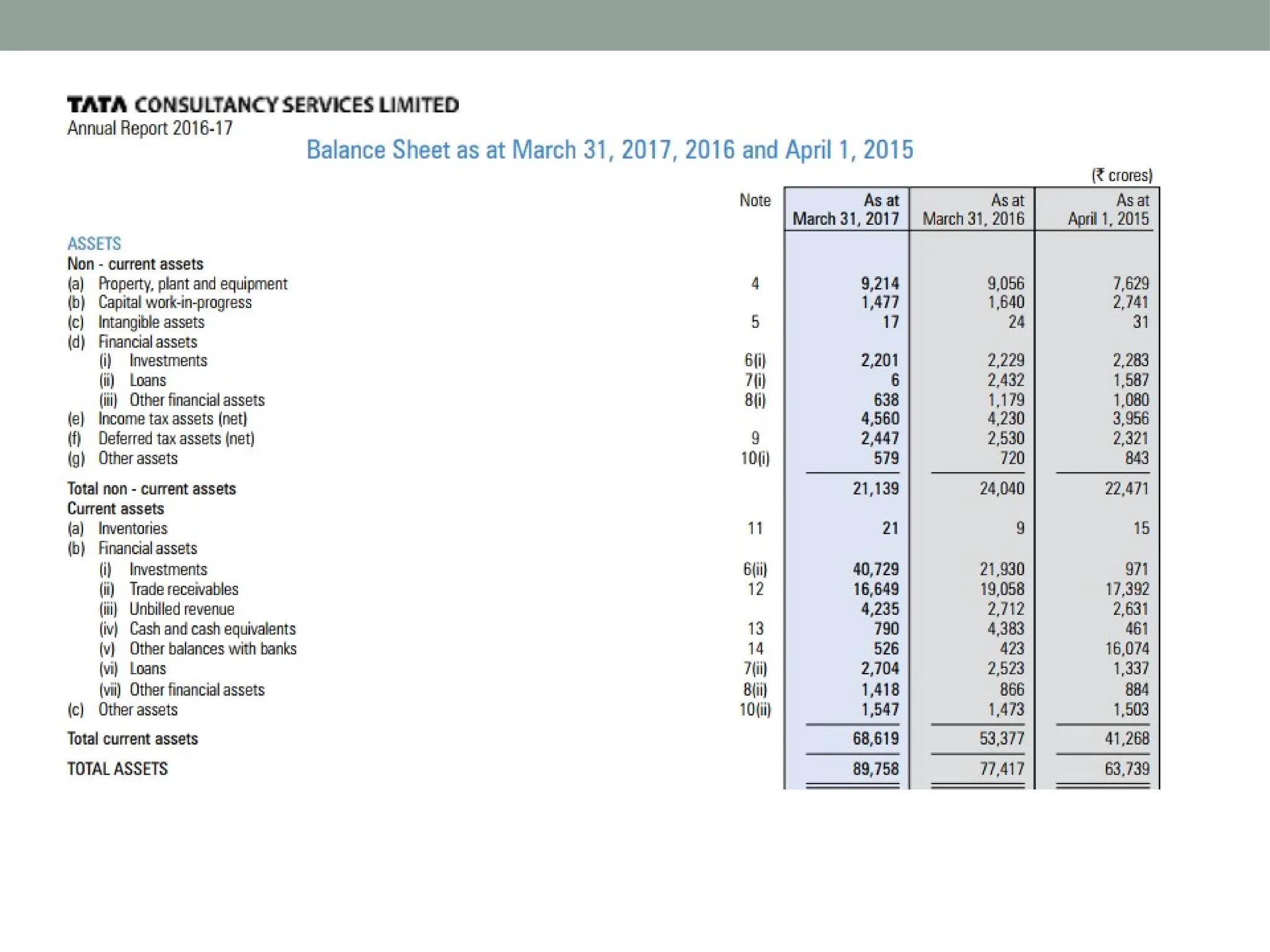

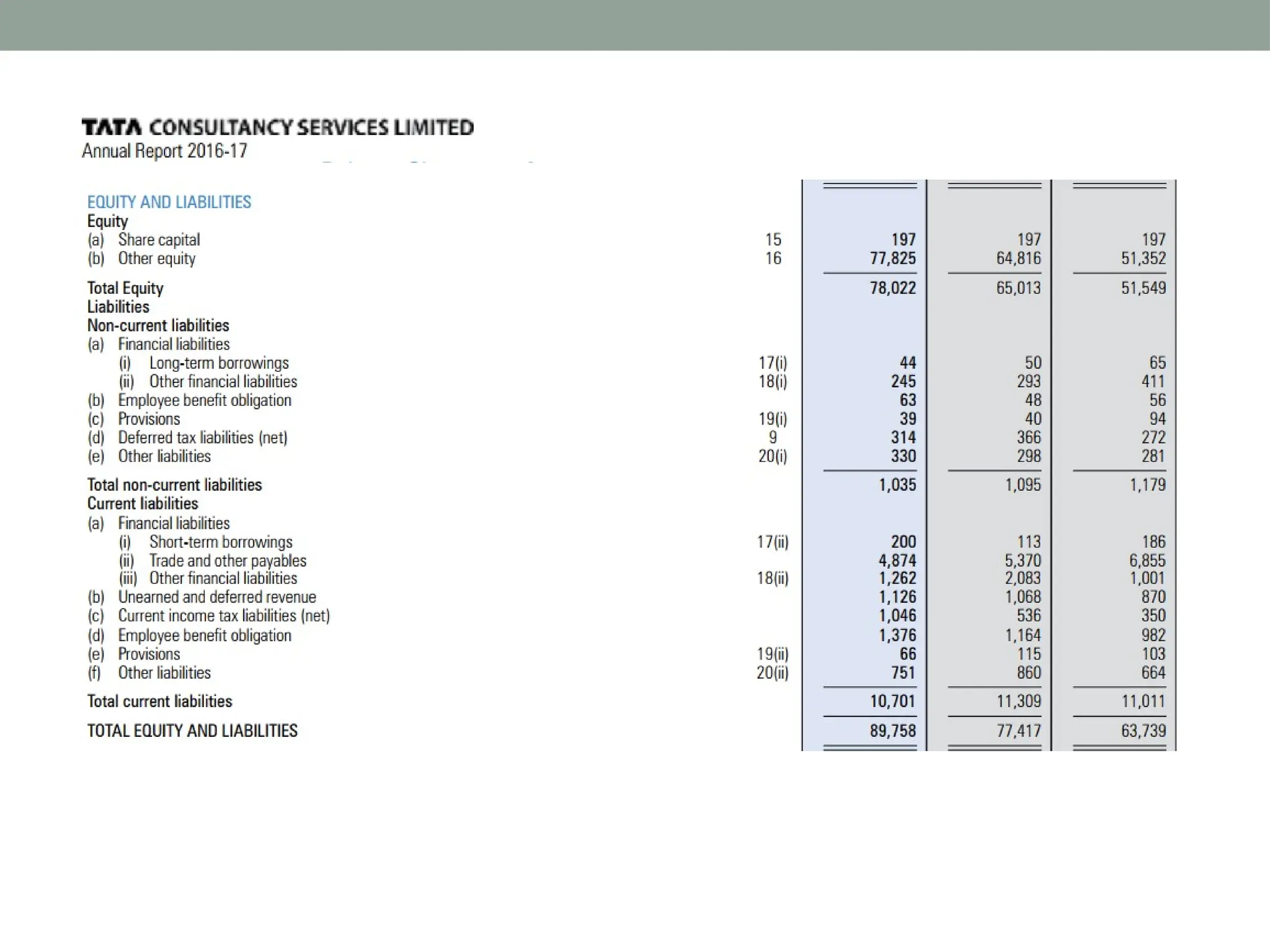

The document serves as a comprehensive review of fundamental accounting concepts and principles, including the going concern concept, accounting period concept, and the dual aspect concept, which underpins the accounting equation. It emphasizes rules for modern accounting practices, the matching principle, and conservative accounting, along with various accounting conventions such as historical cost and materiality. Additionally, the document outlines the accounting cycle from transaction recording to the preparation of financial statements.