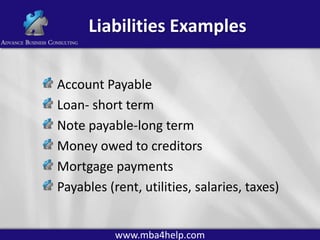

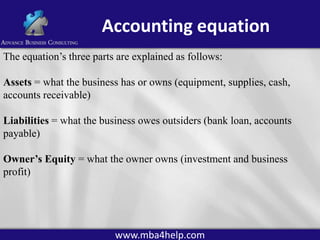

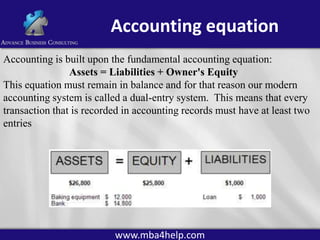

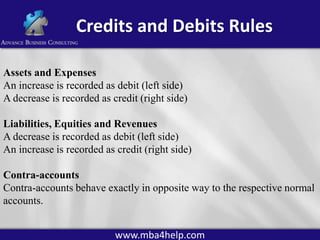

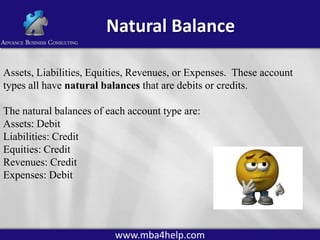

The document provides an overview of accounting principles, defining accounting as the art of recording and analyzing financial transactions to communicate relevant information to stakeholders. It distinguishes between accrual and cash accounting methods, explains the accounting equation (assets = liabilities + owner's equity), and outlines the roles of internal and external users of accounting. Additionally, it covers concepts of debits and credits, the natural balances of account types, and the overall accounting cycle.