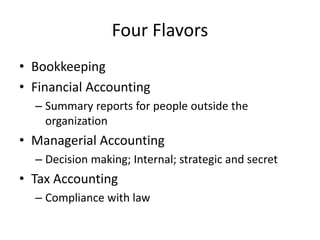

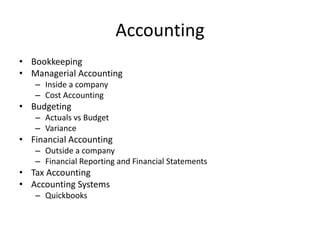

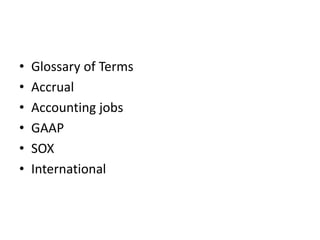

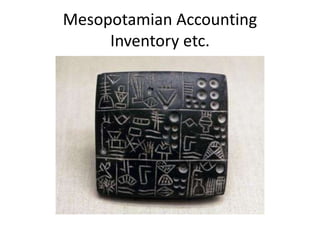

The document provides an overview of accounting as a vital business practice, detailing its components such as bookkeeping and financial statements. It highlights the evolution of accounting from manual methods to computer-based systems that enhance accessibility and accuracy. Additionally, it emphasizes the importance of cash management, budgeting, and variance analysis in operational decision-making.