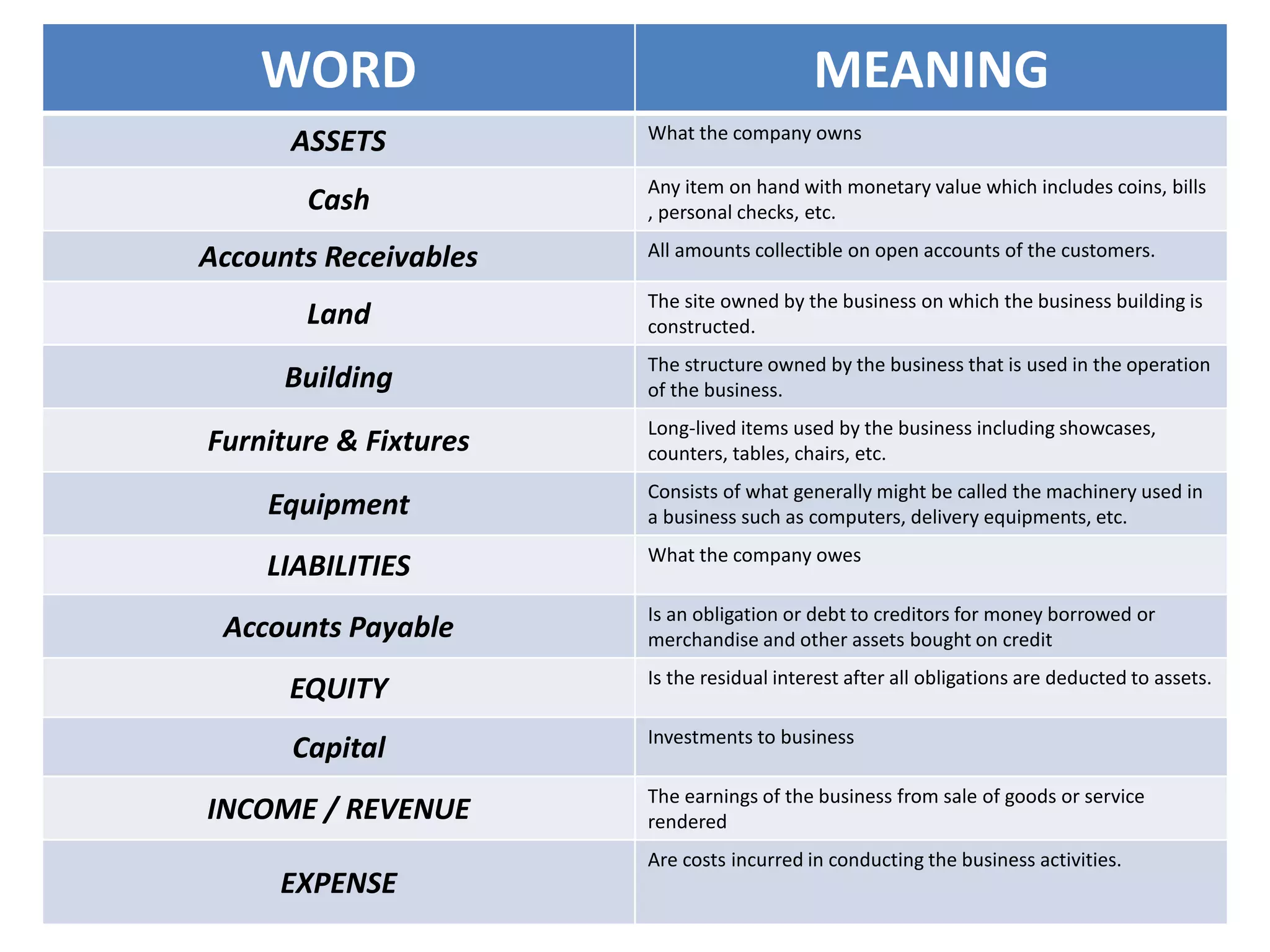

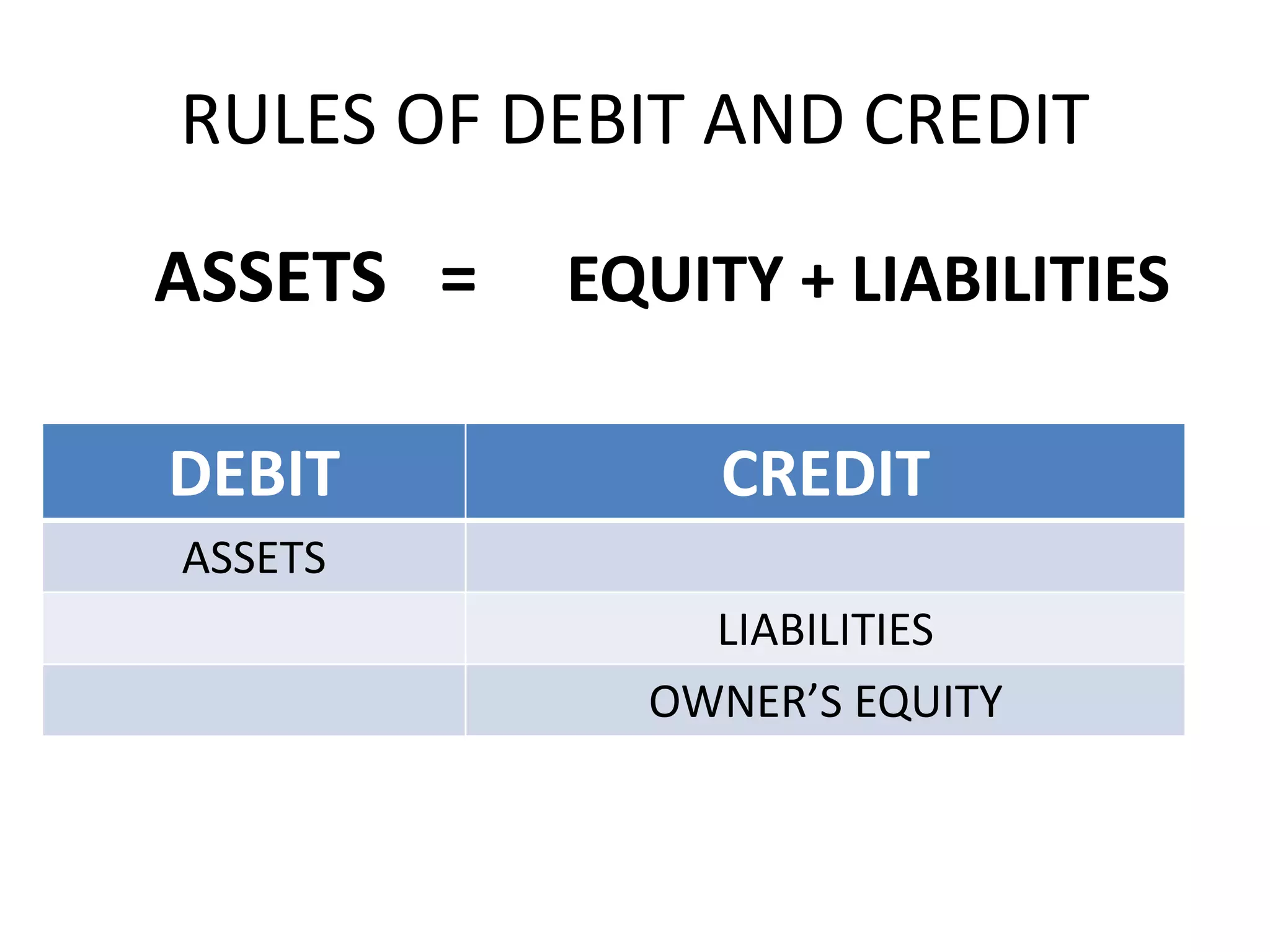

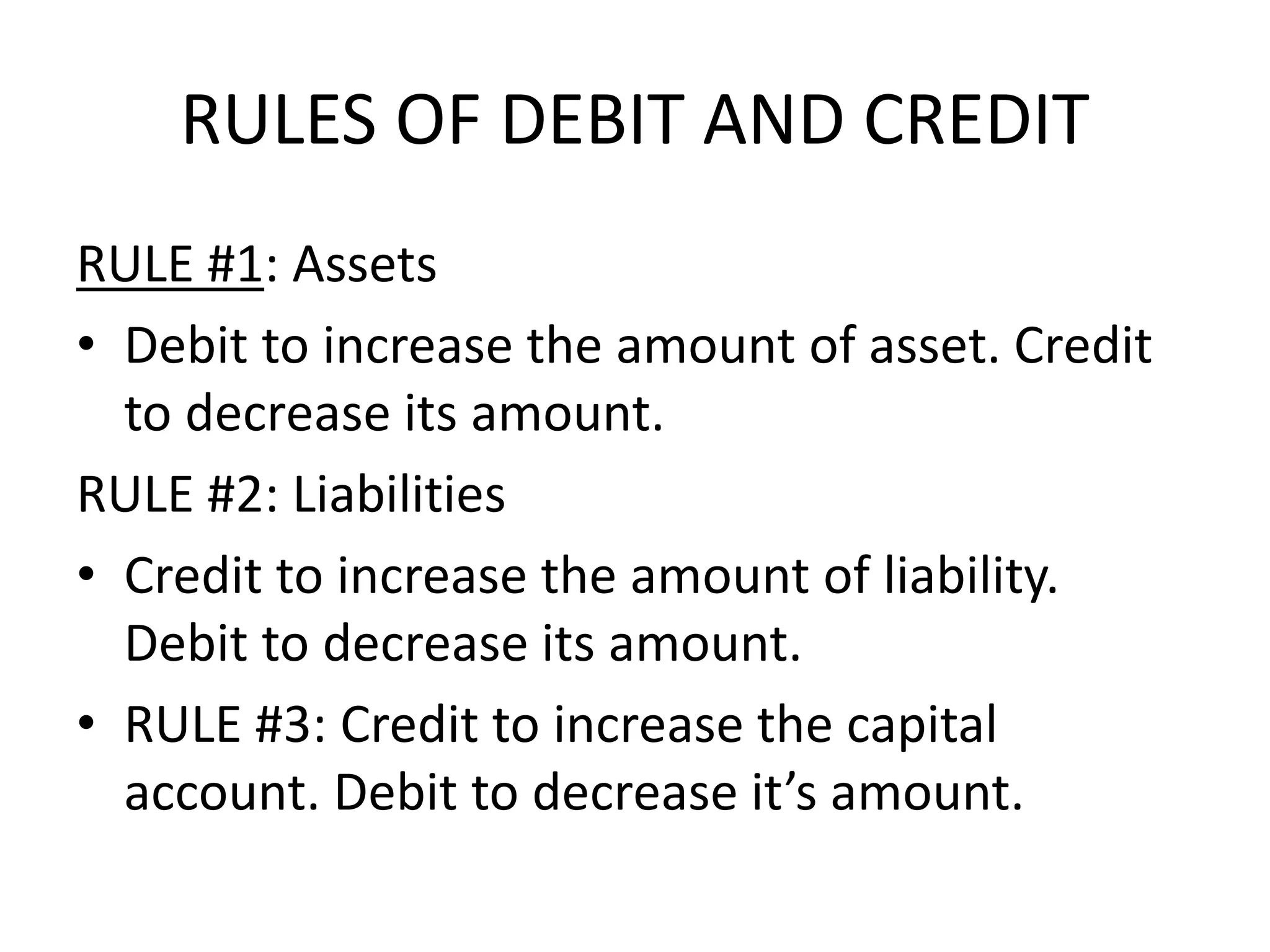

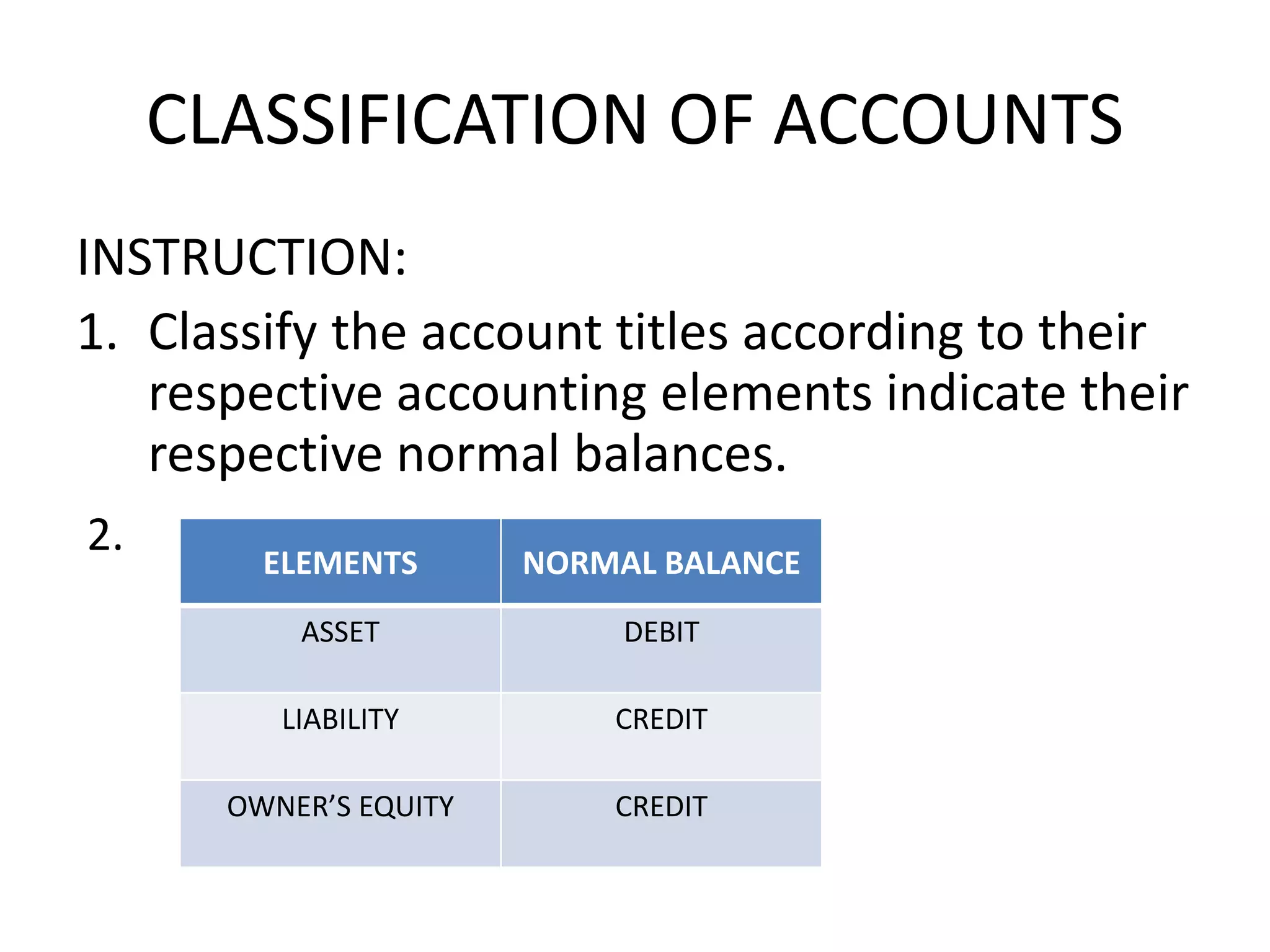

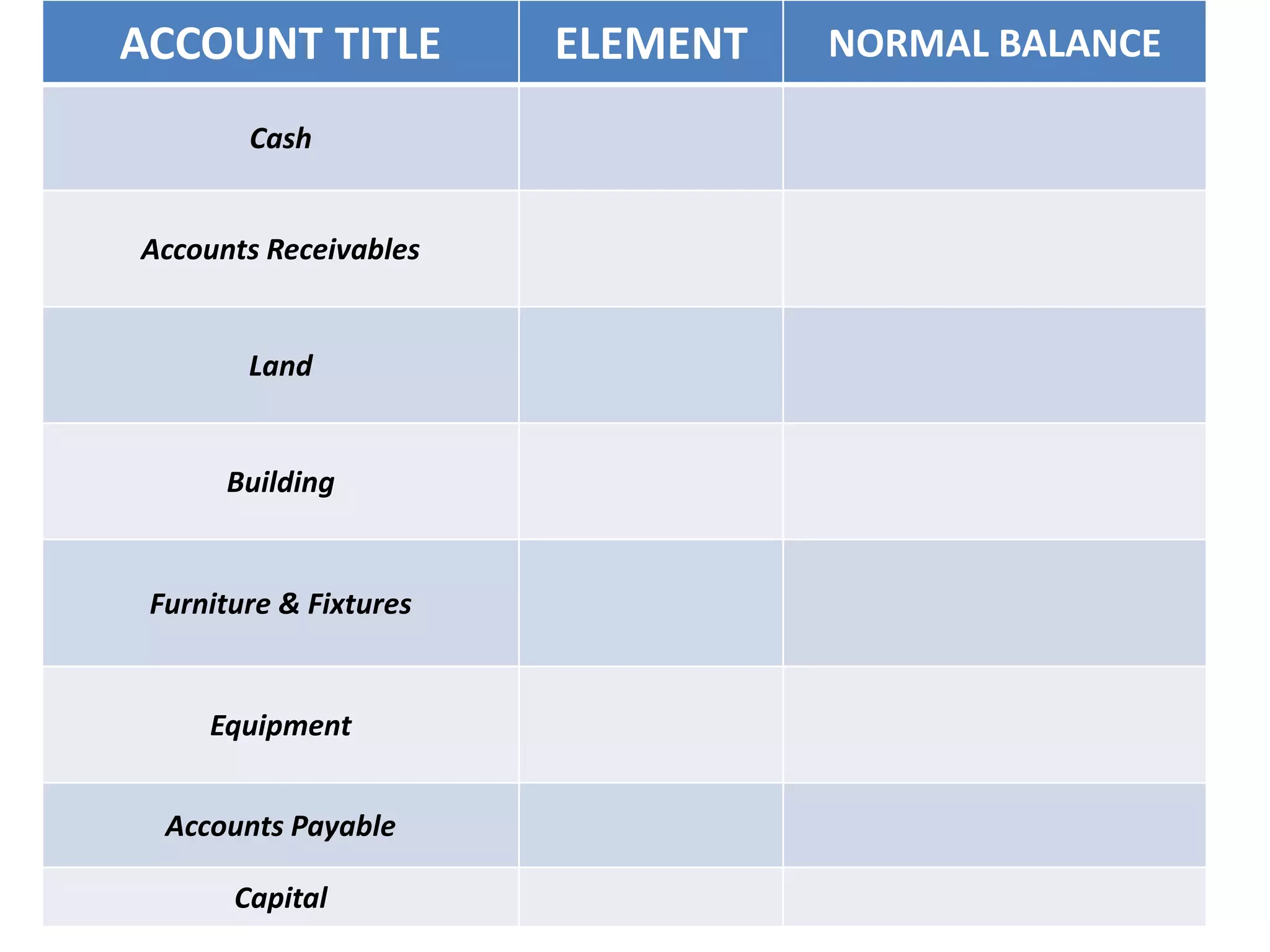

The document defines key accounting terms like assets, liabilities, equity, revenue, and expenses. It explains that assets are what a company owns, liabilities are what it owes, and equity is the residual value of assets after deducting liabilities. Accounting involves systematically recording and reporting financial transactions, while bookkeeping is the process of recording daily transactions. The accounting equation balances assets with equity and liabilities.