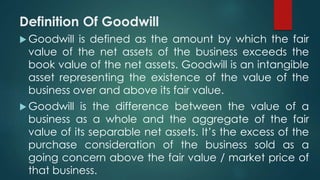

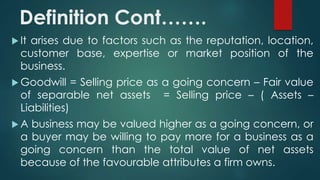

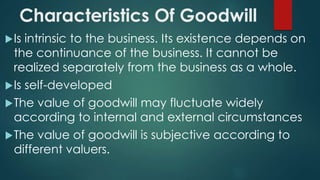

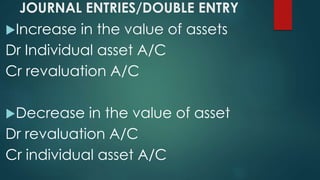

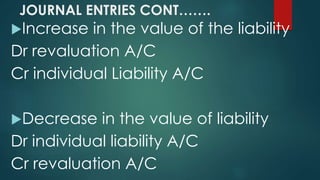

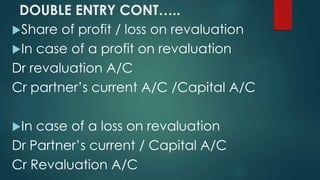

The document provides a comprehensive overview of goodwill in accounting, defining it as the excess of a business's fair value over its net assets and outlining its intrinsic, subjective nature. It discusses factors influencing goodwill, such as management efficiency, customer base, and market position, as well as distinguishing between purchased and non-purchased goodwill. Additionally, the document addresses methods for accounting for goodwill and the implications of revaluation of assets and liabilities in the context of partnerships.